U.S. Core Inflation Remains Contained, FOMC Policy Stance is Safe

Economics / Inflation Apr 30, 2011 - 08:55 AM GMTBy: Asha_Bangalore

Personal consumption expenditures rose 0.2% in March after an upwardly revised 0.5% jump in February. A 0.4% increase in outlays of services and a 0.1% jump in purchases of durables lifted consumer spending, with a 0.3% drop in expenditures of non-durables were a partial offset. Real consumer spending is projected to advance by 3.0% during the second quarter after a 2.7% gain in the first quarter.

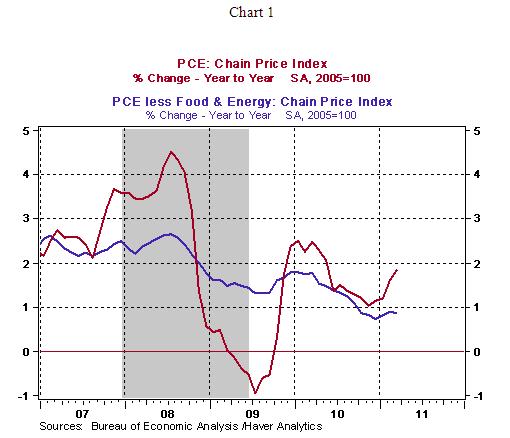

The personal consumption expenditure price index moved up 0.4% in March, putting the year-to-year gain at 1.8. The core personal consumption expenditure price index, which excludes food and energy, rose 0.1% in March, and translates into a 0.88% year-to-year increase. The core personal consumption expenditure price index bottomed out in December 2010 (0.73%). The FOMC predicts the core personal expenditure price index to range between 1.3% and 1.6% in 2011. The forecast is below the "unofficial" target of 2.0% as is the current reading. These benign readings support the current easy monetary policy stance of the Fed. Chairman Bernanke's press conference was largely about inflation and what the Fed can/will do about it. Bernanke indicated that higher prices for commodities are a transitory event and that it would matter if it made its way into core prices.

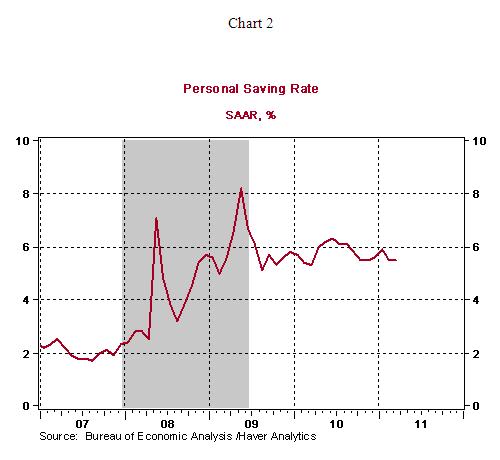

Personal income moved up 0.5% in March, after a 0.4% gain in the prior month. The personal saving rate held steady at 5.5% in March.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

CLAYTON TOM R.Ph

01 May 11, 12:19 |

Government Statistics??????

Sasha.. Please go to shadowstatistics.com Govt. stats are rigged . You know that. Clay Tom |