U.S. 2011 Q1 Real GDP Economic Growth One of the Three Smallest Gains of the Recovery

Economics / Economic Recovery Apr 29, 2011 - 04:27 AM GMTBy: Asha_Bangalore

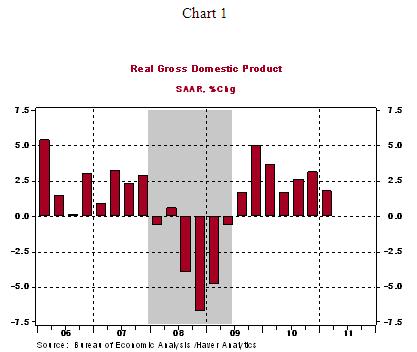

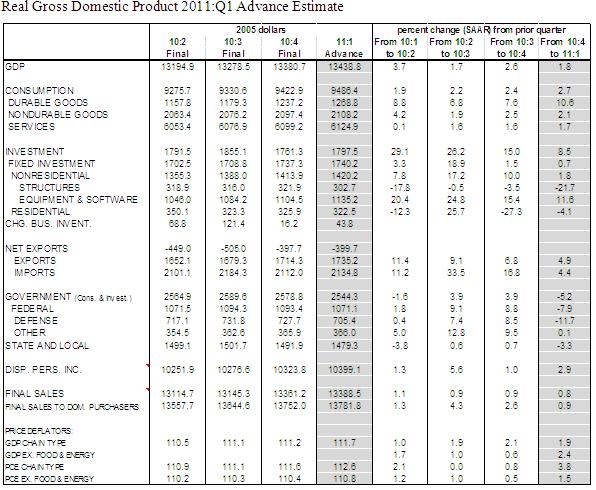

Real GDP of the U.S. economy grew at an annual rate of 1.8% in the first quarter of 2011, after a 3.1% increase in the prior quarter. Of the seven quarters of economic growth recorded in the current recovery, the first quarter's performance is one of the three readings which have been below 2.0% (see Chart 1).

Real GDP of the U.S. economy grew at an annual rate of 1.8% in the first quarter of 2011, after a 3.1% increase in the prior quarter. Of the seven quarters of economic growth recorded in the current recovery, the first quarter's performance is one of the three readings which have been below 2.0% (see Chart 1).

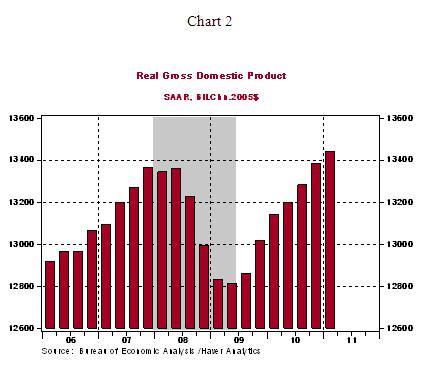

In the first quarter, consumer spending (+2.7%) and equipment and software spending (+11.6%), and exports (+4.9%) and inventories ($43.8 billion vs. $16.2 billion) made positive contributions to real GDP growth, while residential investment expenditures (-4.1%), non-residential structures (-21.8%), and government spending (-5.2%) partially offset these gains. It is noteworthy that real GDP in the first quarter crossed the peak reading in the fourth quarter of 2007 by a significant measure (see Chart 2) and the U.S. economy is most certainly on the path of expansion

Stronger growth is predicted for the second quarter of 2011 and a more moderate pace is likely in the second-half of the year, which puts the Q4-to-Q4 increase in 2011 around 2.9%. The FOMC's projections show the central tendency for real GDP growth as 3.1%-3.3% in 2011.

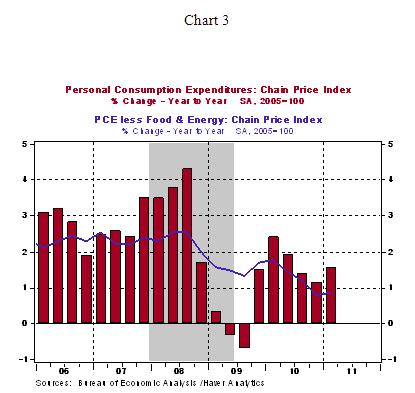

Overall inflation measures reflect higher oil and commodity prices, with the personal consumption expenditure prices index showing a 3.8% increase in the first quarter vs. a 0.8% gain in the prior month. The core personal consumption expenditure price index moved up 1.5%, the largest increase in the past five quarters. On a year-to-year basis, it has bottomed out in the fourth quarter (0.81%), with the latest year-to-year gain at 0.86% (see Chart 3). The Fed's forecast for this core inflation price index for 2011 on Q4-to-Q4 basis is 1.4% to 2.0%.

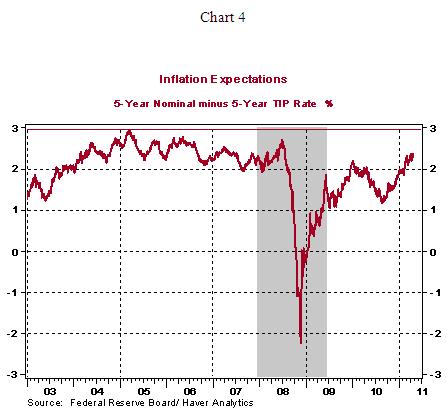

Chairman Bernanke's remarks at the press conference indicate that the Fed is focused on meeting its dual mandate of price stability and full-employment. He stressed on several occasions, during the press conference, the Fed's strong commitment to prevent a serious inflationary situation from taking hold in the economy. Bernanke zeroed in on "medium term inflation expectations" as an important trigger that would lead to tighter monetary policy even in the event of an elevated unemployment rate. The unemployment rate in March was 8.8% and the latest 5-year inflation expectations reading (derived from the difference between 5-year nominal Treasury note yield and the yield on the 5-year inflation protected security) stood at 2.37% on April 27, which has moved up from 2.09% on March 15 (the date of the last FOMC meeting) and 1.27% on August 27 when Chairman Bernanke indicated that the Fed is likely to embark on the second round of large asset purchases, referred to as QE2. The recent peak of this measure is 2.94% in March 2005 when the Fed was on a monetary policy tightening path (see Chart 4). This could be viewed as a threshold reading that would prompt considerations of a tightening of monetary policy.

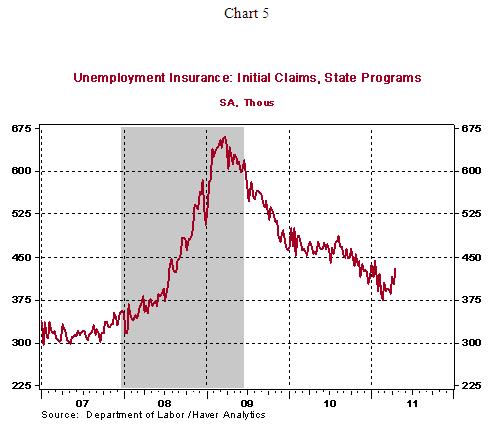

In other related news, initial jobless claims increased 20,000 to 429,000 during the week ended April 23, which is the highest since January 2011 (see Chart 5). Continuing claims, which lag initial jobless claims by one week, fell 68,000 to 3.64 million. The latest initial jobless claims reading is disappointing and raises expectations of an increase in payrolls that is less than the 216,000 gain posted in March.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.