US October Retail Sales Growth Slows Whilst PPI Inflation Shows Small Rise

Economics / US Economy Nov 15, 2007 - 10:46 AM GMTBy: Paul_L_Kasriel

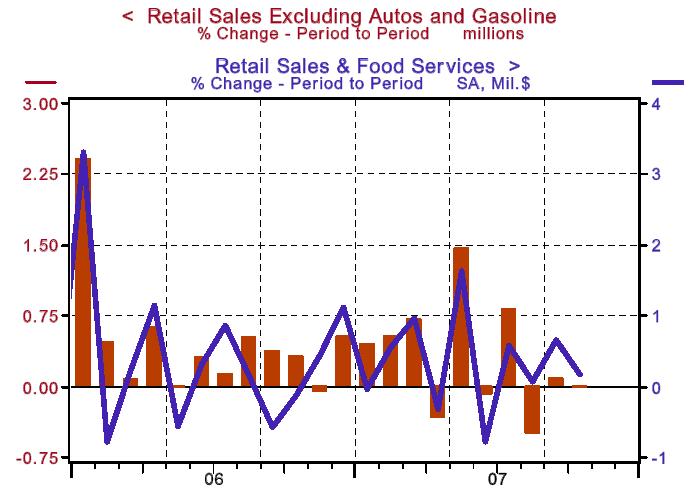

Retail sales rose 0.2% in October, following a revised 0.7% gain in the prior month. Excluding autos and gasoline , retails sales edged up 0.1% during October after a 0.2% increase in the prior month. The component of retail sales which excludes autos, gas , and building materials, often used to gauge underlying strength of consumer spending, held steady in October following a 0.2% gain in the prior month. The August reading (-0.4% now vs. 0.0 original estimate) of this measure shows a downward revision, which points to a downward revision of consumer spending in the third quarter. Each of these measures sends a convincing message of soft retail sales.

Retail sales rose 0.2% in October, following a revised 0.7% gain in the prior month. Excluding autos and gasoline , retails sales edged up 0.1% during October after a 0.2% increase in the prior month. The component of retail sales which excludes autos, gas , and building materials, often used to gauge underlying strength of consumer spending, held steady in October following a 0.2% gain in the prior month. The August reading (-0.4% now vs. 0.0 original estimate) of this measure shows a downward revision, which points to a downward revision of consumer spending in the third quarter. Each of these measures sends a convincing message of soft retail sales.

Chart 1

From the details of the report, auto sales rose 0.2%, gasoline purchases moved up 0.8%, food sales increased 0.4%, and sales of building materials advanced 0.6%. The jump in building materials purchases is suspect given the weakness in the housing market. The drop in furniture (-0.1%) and general merchandise (-0.9%) and the lackluster reading of apparel sales (0.1%) were the pockets of weakness. The quarterly trajectory appears extremely weak (see table below) implying that consumer spending is most likely to be barely positive in the fourth quarter vs. a 3.0% increase in the third quarter.

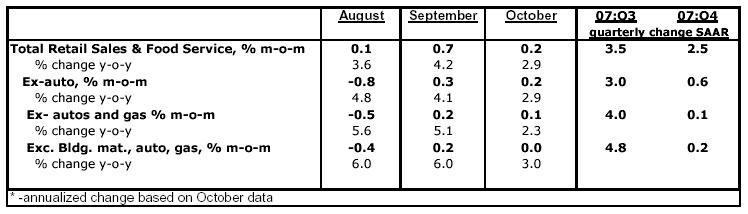

Retail Sales – October 2007

Wholesale Core Prices Show Small Upward Trend

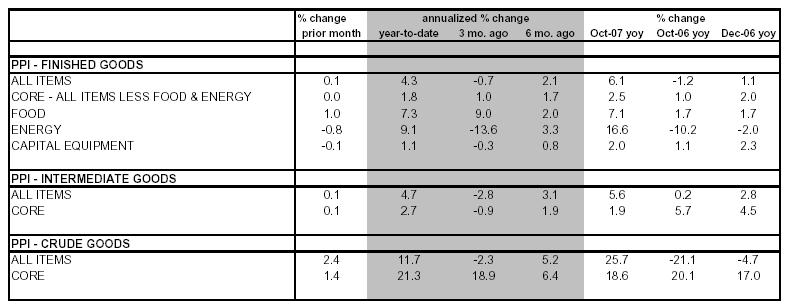

The Producer Price Index (PPI) for Finished Goods moved up 0.1% in October compared with a 1.1% jump in September. The 1.0% increase in food prices after a 1.5% gain in September was the largest increase among the various components of the wholesale price index. The energy price index fell 0.8% after a sharp 4.1% gain in September. Based on quotes for November, the energy price index should once again post a large increase. In the twelve months ended October, the PPI for finished goods has risen 6.1%, reflecting a 16.6% gain in energy prices and a 7.1% increase in the food price index.

Producer Price Index – October 2007

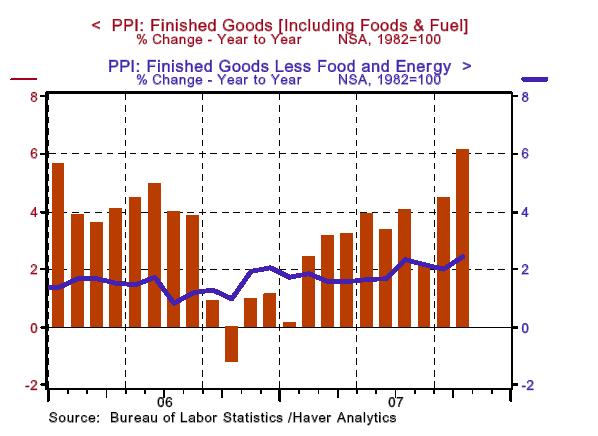

Excluding food and energy, the core PPI held steady in October, putting the year-to-year increase at 2.5%. On a year-to-year basis, the core PPI of finished goods has moved up from a low of 1.6% in April 2007. Higher prices for passenger cars (+1.0%), cigarettes (+0.9%), civilian aircraft (+0.5%), household furniture (+0.3%), and book publishing (+0.5%) were offset by price decreases for light motor trucks (-2.7%), computers (-1.3%), newspapers (-1.1%), alcoholic beverages (-0.30%), and communication and related equipment (-0.1%).

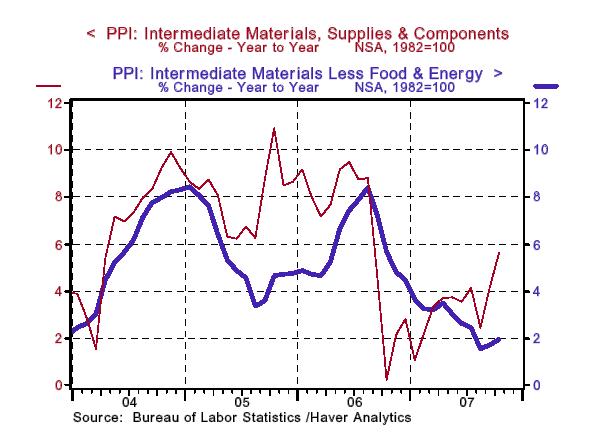

Chart 2

Pipeline price pressures appear to be mild at the intermediate stage. The overall intermediate goods price index climbed up 0.1% in October. The intermediate goods prices index excluding food and energy edged up 0.1%, taking the year-to-year increase to 1.93% in October, following a low of 1.56% in August. The crude goods price index increased 2.4% and the core crude good price index was up 1.4%.

Chart 3

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.