Growth and Inflation Equals Growthflation

Economics / US Economy Apr 28, 2011 - 04:46 AM GMTBy: John_Hampson

It's an awkward term, but its what we've got: growth AND inflation. And the US Fed yesterday made it clear they will continue to support both.

It's an awkward term, but its what we've got: growth AND inflation. And the US Fed yesterday made it clear they will continue to support both.

Growthflation makes for big nominal gains in stocks and commodities, even if less in real terms, and that means little incentive on the short side. Eventually we will see excessive inflation and overtightening kill growth, but right now we see strong leading indicators together with a continued policy of stimulus from the Fed (QE2 into the end of June, reinvestment of maturing securities for a few months after that, and most likely rates on hold until 2012), a recipe for more growth and more inflation. Essentially the Fed is keen to bring back those 7 million lost jobs (employment being the notorious laggard) and continues to talk down inflation.

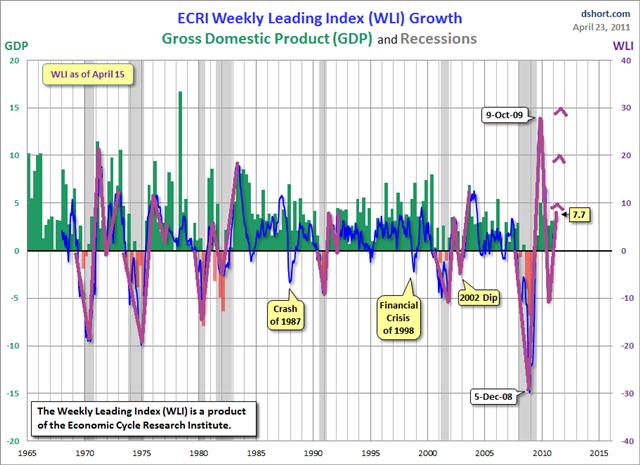

ECRI leading indicators have made a dynamic W pattern consistent with previous recessions and recoveries, as highlighted below. Based on those historic rhymes, we could be heading for supercharged WLI, as high as 10, 20 or even 30. Fed policy is supportive.

Underlying Source: Dshort/ECRI

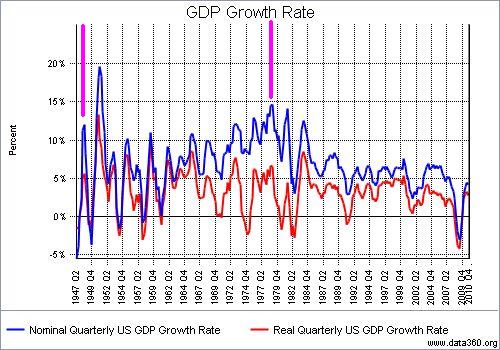

The chart below shows nominal US GDP growth and real US GDP growth since 1947. I have highlighted the two growthflation peaks that preceded the last two secular commodities peaks. In both instances inflation had the effect of doubling the growth rate. Between now and 2013 (the next secular commodities peak and inflationary peak by solar cycles) we should be heading for a similar growthflationary peak, with strong underlying growth doubled by strong inflation to make a significant nominal peak. Fed policy, again, is supportive.

Underlying Source: data360.org

We remain some way under inflation levels reached at the 2008 peak. With history as our guide, official CPI inflation should reach over 4%, and Shadowstats real inflation could be headed for a peak of 15% by 2013.

Source: Shadowstats.com

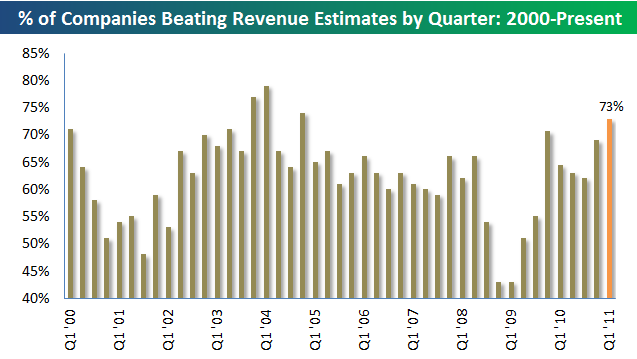

US earnings so far this season show the sales growth needed to compensate for higher input prices, again supportive of growthflation:

Source: Bespoke Investment

The Bloomberg Financial Conditions Index, which comprises money market indicators, bond market indicators and equity market indicators, continues to strengthen:

Source: Bloomberg

Although GDP forecasts have been reduced recently, on the grounds of higher commodity costs, the above compliation suggests growth may surprise to the upside - and inflation too - as we accelerate to a growthflationary peak.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation.

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.