Demographics, Energy and The End Game: Exponential Functions

Politics / Demographics Apr 28, 2011 - 02:55 AM GMTBy: DK_Matai

If the Middle East conflicts continue to escalate could oil touch $150-$200 per barrel in the months ahead? What are the consequences of this development for both the East and the West? Let us not forget that the Middle East turmoil was primarily triggered by high food prices, inflation and youth unemployment. As the turmoil in the Middle East escalates, continuously bumping the price of energy upwards, this is having a further knock-on effect on the price of other natural resources as well as food.

If the Middle East conflicts continue to escalate could oil touch $150-$200 per barrel in the months ahead? What are the consequences of this development for both the East and the West? Let us not forget that the Middle East turmoil was primarily triggered by high food prices, inflation and youth unemployment. As the turmoil in the Middle East escalates, continuously bumping the price of energy upwards, this is having a further knock-on effect on the price of other natural resources as well as food.

Given the backdrop of recovery from massive financial turmoil less than a year ago, the fragility of the global economic environment is such that growth trajectories are likely to falter if the price of oil heads towards the $150-$200 per barrel bracket. This is no longer an extremely low probability high impact event but more like a medium to high probability high impact event that could take place in the months ahead. Why? What runs common between Tunisia, Egypt, Libya, Yemen, Syria, Bahrain and other Middle East countries experiencing various flavours of the Jasmine revolution and civil conflict?

Why are Saudi Arabia, Iran, Kuwait, Qatar and other oil producing emirates of the UAE in a similar position? The answer lies in the demographic youth bulge, which manifests itself amongst both Sunni and Shia peoples, and it represents a high proportion of the collective population in the Middle East which is below the age of 20. What is the main concern in the West about the Middle East tinder box? The price of energy. When all is said and done, the key question which senior executives ask the ATCA 5000 is the following: What is the end game?

Exponential Growth

The Exponential Function

When we examine the asymmetric threats facing humanity in the short to medium term, it becomes clear that major challenges -- whether local, national or international -- are all tied together by the exponential function! A lack of appreciation for what exponential increase really means leads our society to be disastrously sluggish in acting on critical issues. Believe it or not, our great survival struggle -- manifest via demographics, energy and the end game -- is about understanding the practical meaning and effects of the exponential function. The complexity which is created by the exponential function over time can lead to extremely high probability high impact events that began a long time ago like a small dot or speck of dust and have been dismissed as low probability events in corporate board rooms and government cabinet offices.

What is the Exponential Function?

Simply put, the exponential function means growing like this: 1, 2, 4, 8, 16 and 32. Doubling, doubling again and then doubling again and again. Everyone surely understands that? Yes, at a theoretical level, and No, at a practical level!

For example: suppose one agrees to eat one almond on the first day of the month, two almonds on the second, four almonds on the third, eight almonds on the fourth, and keeps doubling them every day. How long can one keep going? How long will a pound of almonds last? The first pound of almonds will be gone on the ninth day as one eats the remaining half of the pound. On the tenth day, one will eat a whole new pound of almonds. By the fifteenth day, one will be expected to eat 32 pounds of almonds! One will have to eat roughly one's own weight in almonds by the 17th day! On the 21st day the total will have risen to one ton, roughly the weight of a car; and by the end of the month, assuming a 30-day month, it will be 500 tons, or the weight of a ship! Welcome to the cumulative impact of the exponential function which is visible in demographics, energy, other natural resources and the end game.

Impact on Demographics

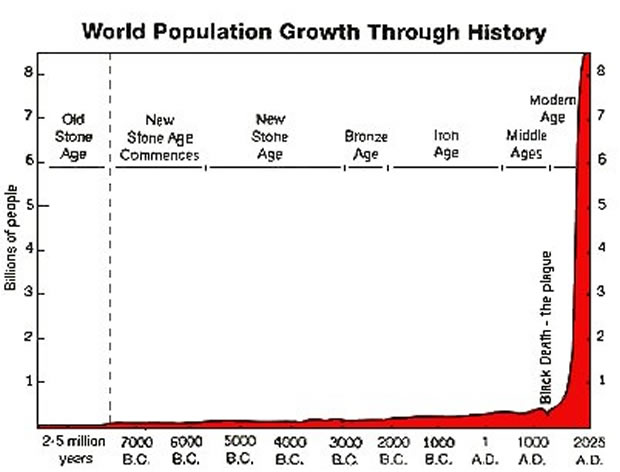

The human population of Earth reached 1 billion in 1804, 2 billion in 1927, 3 billion in 1959, 4 billion in 1974, 5 billion in late 1986 and 6 billion in late 1999. We are presently on the cusp of 7 billion. At this level of population we are consuming around 2 planets worth of resources even though more than 1 billion live in abject poverty. Mexico, with a population of 107 million and a doubling time of 70 years, will, if it keeps that up, grow to 214 million in seven decades. That's nothing compared to Kenya, which has a doubling time of 26 years. If Kenya goes on growing at its present rate, in 70 years there will be roughly three Kenyans for every one alive today!

Impact on Energy Capacity and Consumption

Until the 1970s world oil consumption was growing at seven percent per year. That means doubling every ten years. The doubling time of anything growing exponentially is 70 divided by its annual growth rate -- 70 divided by seven percent is a ten-year doubling time. Every ten years we used as much oil as we had used in all previous history. Every ten years we had to go out and discover as much oil as we had ever discovered before -- and then, to keep going, discover twice that much in the next ten years. We didn't keep going after 1970 because we couldn't have. In 1973, there was a massive oil shock and that global economic crisis began to alter consumption behaviour. Since then, per capita oil consumption in the US -- which reached a peak in 1978 -- has fallen by 20 percent from that level. As a result, there's still plenty of oil around at present, but we've been burning it faster than we've been discovering it for 20 years now because of the arrival of China, India and other emerging countries as major consumers of oil alongside the G7 and other developed nations. It is well known that we have around a 1,000 years' worth of coal left. However, if we burn 7 percent more of it each year than the year before -- which we may well do post the Fukushima nuclear crisis in Japan and substituting coal for the disappearing oil -- it will last just 60+ years, and it will bring on global climate chaos much faster than even the worst case scenario projections.

The End Game

One doesn't get much reaction time when problems grow exponentially and come closer to the end game. This is where we have arrived now. An old French riddle illustrates the point: Suppose one owns a pond on which a water lily is growing. The lily doubles in size each day. If the lily were allowed to grow unchecked, it would completely cover the pond in 30 days, choking off other forms of life in the water. For a long time the plant is almost invisible, and so one decides not to worry about cutting it back until it covers half the pond. On what day will that be? On the twenty-ninth day! To solve the problem of a complete covering of the pond, now only one day is left!

We are emitting carbon dioxide and several other greenhouse gases in the atmosphere exponentially. We are clearing tropical rain forest at an exponential rate. The human population is growing exponentially. Human energy use, human production of synthetic products, chemicals, deserts and rubbish are growing exponentially. Many national economies are growing exponentially in terms of x percent GDP growth per annum, and we cheer them on, although a worldwide economic growth rate of, say, 3.5 percent per year means another whole industrial world is added to this one in just two decades! We can't keep it up. If all interlocutors truly understood the consequences of exponential growth, we would have no differences of opinion, no conflicts of interest, within the one world united point-of-view. This is clearly not the case at present.

Conclusion

There is a medium to high probability that the demographic youth bulge in the Middle East will cause the present turmoil to spread to some key oil producing countries at some stage in the near future. The consequences of this will be a rise in the price of oil to $150-$200 per barrel. As a result, global demand for all manner of products and services will fall dramatically as the spending power is eroded swiftly to pay for fuel and food amongst other essentials. With the prospect of negative growth looming and unemployment rising, the consequences will not be benign for nation states and their economies as well as the debt pyramid at the sovereign, corporate and individual levels of society. All these interlinked tensions will be further exacerbated by the speed, severity, synchronicity and scale of the colossal impact which high oil prices will deliver. This may cascade into regional, national and international crises and conflicts by way of an extended end game.

The key question remains: How to build the escape velocity needed to break free from the current gravitational pull of influences that limit the capacities of leadership in governments and corporations to plan for such internal and external crises and conflicts? The only immediate solution is to educate one and all on the practical relevance and power of the exponential function as it applies to demographics, energy and the end game so that conservation of resources becomes an essential mantra and modus operandi. The energy efficient will be the only ones able to survive, and only just. The human tendency is to focus on technological solutions but what may be necessary in the present context, given that the time left is so limited, is a fundamental rethink in regard to the resource-hungry lifestyles we all lead.

We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

By DK Matai

Asymmetric Threats Contingency Alliance (ATCA) & The Philanthropia

We welcome your participation in this Socratic dialogue. Please access by clicking here.

ATCA: The Asymmetric Threats Contingency Alliance is a philanthropic expert initiative founded in 2001 to resolve complex global challenges through collective Socratic dialogue and joint executive action to build a wisdom based global economy. Adhering to the doctrine of non-violence, ATCA addresses asymmetric threats and social opportunities arising from climate chaos and the environment; radical poverty and microfinance; geo-politics and energy; organised crime & extremism; advanced technologies -- bio, info, nano, robo & AI; demographic skews and resource shortages; pandemics; financial systems and systemic risk; as well as transhumanism and ethics. Present membership of ATCA is by invitation only and has over 5,000 distinguished members from over 120 countries: including 1,000 Parliamentarians; 1,500 Chairmen and CEOs of corporations; 1,000 Heads of NGOs; 750 Directors at Academic Centres of Excellence; 500 Inventors and Original thinkers; as well as 250 Editors-in-Chief of major media.

The Philanthropia, founded in 2005, brings together over 1,000 leading individual and private philanthropists, family offices, foundations, private banks, non-governmental organisations and specialist advisors to address complex global challenges such as countering climate chaos, reducing radical poverty and developing global leadership for the younger generation through the appliance of science and technology, leveraging acumen and finance, as well as encouraging collaboration with a strong commitment to ethics. Philanthropia emphasises multi-faith spiritual values: introspection, healthy living and ecology. Philanthropia Targets: Countering climate chaos and carbon neutrality; Eliminating radical poverty -- through micro-credit schemes, empowerment of women and more responsible capitalism; Leadership for the Younger Generation; and Corporate and social responsibility.

© 2011 Copyright DK Matai - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.