The Coming Junior Gold and Silver Stock Eruption

Commodities / Gold and Silver 2011 Apr 26, 2011 - 03:29 AM GMTBy: Q1_Publishing

The junior market is on the verge of blowing up like a “Coke geyser.”

The junior market is on the verge of blowing up like a “Coke geyser.”

If you’re not one of the 13 million views of what happens when Mentos are dropped into a bottle of Diet Coke, you should know it creates an eruption of foam reaching as high as 20 feet.

That’s exactly what the junior market is set to do soon.

Could it Get Any Better?

The junior market hasn’t performed as well as should be expected over the last few months.

There are, as always, the few special situations that have done very well.

The overall market, however, has lagged significantly while the fundamentals say it should be setting new highs along with gold, silver and oil. But it hasn’t.

The table below breaks down the return of various assets since the start of the year:

This should be “Prime Time” for junior stocks that are often so highly leveraged to the prices of the gold, silver, and oil. But junior stocks have performed more poorly than almost any other related asset.

There are a number of factors one could easily point to for this lag. The Japan earthquake and financial fallout devastated junior stocks. Mr. Market believes gold and silver have run too far, too fast. Overall economic sentiment has taken a turn for the worse.

But they’re all wrong. The TSX Venture Index has fully recovered from the post-Japan sell-off. Gold and silver prices are still well below their inflation-adjusted historical highs and low for the current (and widely expected) negative real interest rates. Economic sentiment has never fully recovered from 2008.

The real reason for the lagging performance, I believe is much simpler. And it’s creating a great and predictable opportunity.

History Repeats

Every year the TSX Venture goes through a similar seasonal cycle.

For example, last year the TSX Venture Index fell 19% between March and July. Meanwhile, gold, silver, and oil fell 3%, 2%, and 8% respectively over the same time period.

The current lag in the TSX Venture Index happens every spring and it has a simple explanation - financings.

Junior resource companies issue new shares year round, but most deals are completed in the late fall and winter. November through February is the peak financing period.

The trend hasn’t changed this year either. The only real difference is that the total value of financing deals completed was much higher.

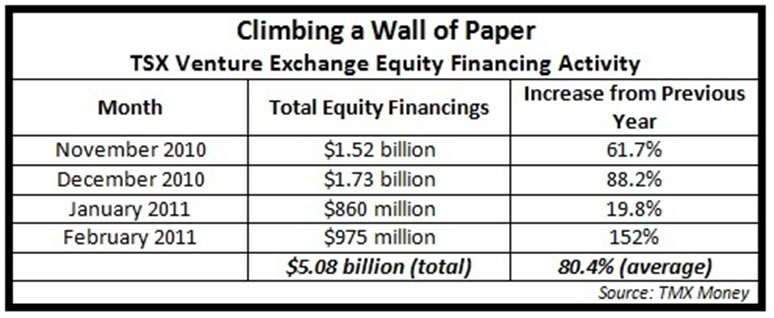

The table below shows how TSX Venture financings between November and February increased by 80% compared to the same period the year before:

The massive amount of financings (most with four month hold periods) is the most critical drag on the overall TSX Venture market.

With more than $5 billion worth of stock (that’s excluding an increase in value of shares and value of attached warrants) coming free trading, there’s a lot to soak up. After all, the total market value of the TSX Venture market is about $80 billion. So a $5 billion wall creates a big hurdle.

What’s happening right now is the financial equivalent of dropping Mentos into a bottle of Diet Coke and putting a cap on it. The cap is going to hold for a while, but it’s going to explode higher and faster when it does. That’s why we’re seeing this as buying season for juniors.

A Catalyst for Change

There are multiple catalysts to blow the lid off of the junior market.

There are major new discoveries being made every at the rate of once or twice per year.

Drilling season in the Yukon is about to get started and if another discovery is made, there’s going to be some big speculative premiums on almost all Yukon-focused junior gold companies.

Also, as time goes by, there will be less shares coming on the market. TSX Venture financing deals peaked last December. Those are just coming free trading now. January and February were lighter activity months and have left a smaller wall. In the end, all of these deals will be unlocked by July anyways. It’s just a matter of time.

Any way you look at it, the junior market is poised to explode over the next few months and finish the year incredibly strongly if gold and silver prices hold together.

Even if they don’t correct too hard (imagine $1450 gold and $40 silver), conditions would be exceptionally positive for junior resource stocks to do well.

Remember, oil, gold, and silver prices fell between 2% and 8% during the same period last year while the TSX Venture fell 19%.

Currently the inverse is about to happen – only an order of magnitude larger. Gold, silver, and oil prices are up significantly between 9% and 50%. But the TSX Venture index is actually down despite the most optimal conditions.

Everything is in place for a big jump in junior resource stocks and conditions will likely continue to be in the coming months (more reasons why available here). There may be an inclination to sell in May and go away, but the seasonal nature of the junior market is making it a much better time to be a buyer.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2011 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.