Stocks Stealth Bull Market Still Dragging Stocks Higher

Stock-Markets / Stock Markets 2011 Apr 25, 2011 - 12:02 PM GMTBy: Money_Morning

Jon D. Markman writes:

The bull market in stocks may be getting long in the tooth, but it's still intact. That was evidenced by strong earnings and rising valuations last week.

Jon D. Markman writes:

The bull market in stocks may be getting long in the tooth, but it's still intact. That was evidenced by strong earnings and rising valuations last week.

Stocks finished an uplifting week on Wall Street on Thursday by gapping higher after earnings reports from industrial heavyweights as diverse as Apple Inc. (Nasdaq: AAPL) and Honeywell (HON) showed that companies have used the slowdown in the economy to become more efficient -- earning incrementally more income on incrementally less revenue.

For the week, the Dow Jones Industrial Average rose 1.8%, the Standard & Poor's 500 Index rose 1.7%, the Nasdaq Composite Index rose 2.2%, overseas developed-market large caps rose 1.9%, emerging market large caps rose 2.2% and U.S. small-caps rose 2.2%. Our favorite slice of the capitalization/style pie, mid-cap stocks, as measured by the iShares S&P MidCap 400 Growth ETF (NYSE: IJK), fared best with a 2.6% gain.

Overseas standouts included the Market Vectors Indonesia Index (NYSE: IDX), up 4.1% for the week; the Global X InterBolsa FTSE Colombia20 (NYSE: GXG), up 3%; the iShares MSCI South Korea Index Fund (NYSE: EWY), up 4%; and the iShares MSCI All Peru Capped Index Fund (NYSE: EPU), up 3%.

Breadth favored advancers, 2-1, and the number of new highs rose to 630, vs. 65 new lows. Some of the stand-outs among the S&P 100 hitting new highs were Autozone Inc. (NYSE: AZO), AT&T Inc.(NYSE: T), Baxter International Inc. (NYSE: BAX), The Boeing Co. (NYSE: BA), Cigna Corp. (NYSE: CI), The Dow Chemical Co. (NYSE: DOW) and EMC Corp. (NYSE: EMC).

That is a very diverse list of new highs -- tech, telecom, aerospace, chemicals, healthcare, insurance -- which shows the advance is still broad. Another sign of strength is the success of quiet, medium-sized companies that are grinding out earnings growth in an environment that is still tough.

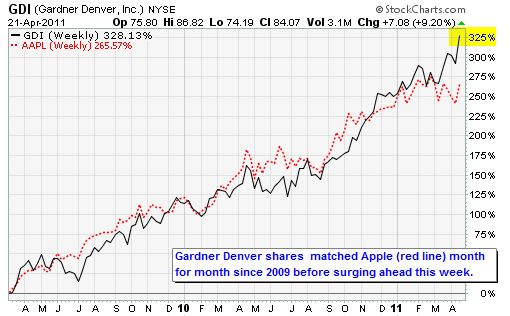

One of those this week was Gardner Denver Inc. (NYSE: GDI), a mini industrial conglomerate that I have recommended several times in the past three months. It is one of the unsung heroes of the industrial manufacturing world, producing machinery, compressors, rotary screws, water-jetting systems and other products used in the petrochemical, oil drilling and paper manufacturing industries.

Gardner Denver is never going to get the headlines of an Apple, but it is one of those mid-cap growth stocks that you just have to admire. Shares have risen 325% in the past two years, as you can see above, to the point where it rocks a $4.9 billion market cap. Just for fun, I plotted GDI's return over that time against Apple and discovered that it coincidentally traded very much in synch with the tech giant since early 2009 before surging ahead to an all-time high on Thursday.

GDI reported earnings per share rose 85% year-over-year in the first quarter on a 26% increase in revenue. Its backlog of business also rose 47% from the same quarter in 2010, and executives upped guidance for the rest of the calendar year.

What's important to understand about a GDI is that it is not growing by acquisition, but rather in a more well rooted, sustainable way.

"I am very pleased with the record-breaking financial results achieved by the company in the first quarter, reflecting strong organic growth in our end markets and solid execution by our employees worldwide, supported by the principles of the Gardner Denver Way," said Barry L. Pennypacker, the company's chief executive officer.

If you can muscle past the corporate-speak, the comment that the company had achieved organic growth is key. He is saying that GDI achieved the results not through financial engineering or share buybacks, but by just creating and selling products its customers wanted.

Apple is the same kind of company in that it has achieved its incredible growth through home-grown innovation and smart marketing, not by buying competitors and bolting on their growth. This is notable because it is repeatable, and executives are not constantly distracted by flirting with and courting other companies and then forcing these war brides into their corporate culture.

Compare this approach with the mess that Google Inc. (Nasdaq: GOOG) and Cisco Systems Inc. (Nasdaq: CSCO) have created for their long-suffering shareholders by constantly blowing money on bad acquisitions in their unsuccessful pursuit of growth at any cost.

Slow and Steady

I recently saw some interesting stats from a speech by David Stockman, the former Reagan budget director, breaking down U.S. income levels and debt. He noted that America now has more student loan debt than credit card debt, totaling more than $1 trillion. Unless incomes pick up -- and right now they are going the wrong direction -- the losses on those student loans will be massive and may represent the next round of trouble in the credit crisis.

Stockman noted that about 64 million Americans earn about $50,000 annually working in manufacturing, real estate, finance. The next level down is what he called health, education, services industries where the typical income is about $30,000.

Then there is a growing underclass of part-time workers who earn about $19,000 annually. They are below the poverty level, cannot save, and cannot support a family. Many of the people in this category are young adults with those massive student loans.

So keep these stats in mind as we observe a few troubles facing consumers at this time. The main constraint: Retail gasoline rose six cents last week even though crude oil prices came down because of the constraints on refined products created by the Japanese quake and tsunami.

Higher gasoline prices are running into restrained wages and leading to declining "real" wages. Over the past five months, real weekly wages are down at a 4% annualized pace. This is what is cooling the economy. Here are the bullet points to mull, according to one top Wall Street economics research team:

•Unemployment claims have stopped declining, meaning fewer people are finding work.

•Weekly surveys of corporate results are hooking down.

•The First Call earnings revision index has hooked down.

•Steel production is down a bit.

•the ECRI Leading Weekly Index has slowed its climb to a crawl.

•Long Beach container imports declined sharply in March.

So those are the negatives, and part of the reason that many large companies are surprising The Street with lower-than-expected results. Now let me show you a few positives:

•Real retail sales probably rose 3% annualized in the first quarter, compared with estimates of 1.8%. Despite the rise in gasoline prices, the consumer-focused fund SPDR S&P Retail ETF (NYSE: XRT) is up 7.8% this year.

•Industrial production, the Empire manufacturing index, and the furniture buying index were all up last week.

•The Federal Funds rate has been zero for 29 months, junk bond yields are near a record low and the Bloomberg financial conditions index is near a recent high.

•Credit conditions are improving, with all kinds of commercial and industrial loans, auto loans and mortgages easier to get and showing improvements in financing.

•The credit card delinquency rate improved in March.

•Both Federal Reserve Chairman Ben S. Bernanke and U.S. President Barack Obama are focused on achieving above-trend growth this year and next year, and have shown their desire and ability to pull out the stops to get it.

In short, there are troubles in the world, without doubt, but bull markets always advance along the proverbial "wall of worry." Even if the major indexes hit a brick wall and stumble here at their February highs, it will take a lot -- much more than we've seen so far -- to derail the current bull cycle in equities. Don't forget that last year featured a -17% top-to-bottom decline in the market midyear, and it still ended much higher in the end.

Volume and Intensity AWOL

Markets need a big surprise to get them jazzed up, and that was supplied early in the week by Intel Corp. (Nasdaq: INTC), one of the most confounding companies on the planet. The crippled chip giant, which seems to be on the verge of recovering from a disastrous decade of missed opportunities with consumers and distrust from partners, reported record earnings and revenue and boosted guidance. Maybe it can have a second act in the coming decade.

Now the weird thing about the week was that while a lot of stocks did join Intel on the upswing, volume was weak and buying intensity was lacking.

That may sound strange to say at the end of a successful week. But when you peel back the skin of this vehicle and look at the volume, which is the equivalent of fuel, you can see that it was one more in a series of sessions in which stocks went up because holders were reluctant to sell, not because buyers were so crazed to buy.

How can that be?

Well, with all the mergers of late, and initial public offerings (IPOs) scant, there is actually a shortage of shares in the world -- so if you want some you have to pry them out of the hands of a holder who doesn't want to let them go. To persuade him, you need to offer a little more, and then a little more. The buyers have to be a tad more aggressive than the sellers, that's all.

This does result in higher prices, but it's not the stuff of legendary, epic, amazing market advances. For that you need people who believe in the dream, and have dollar signs in their eyes, and just want to buy with every ounce of energy in their body and every gram of greed in their soul. We will probably see that eventually, but that is not what's happening now. It's all very polite and genteel.

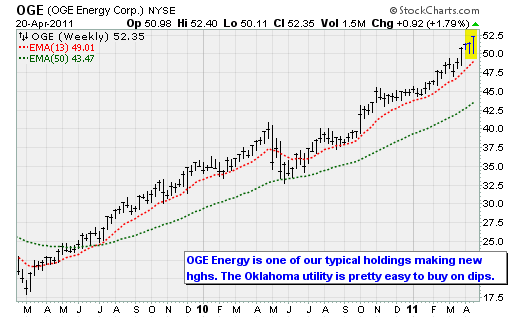

One encouraging sign was a rise in the number of new highs. That shows some leadership, which is sorely lacking. They included some portfolio positions that I have been recommended in the past two months during the recent downturn, including the utility DPL Inc. (NYSE: DPL), up 9.5% on a merger offer; Brazilian ute CPFL Energia SA (NYSE ADR: CPL); oil and gas producer EV Energy Partners LP (NYSE: EVEP); Oklahoma utility OGE Energy Corp. (NYSE: OGE) and the magnificent mutual fund for orphans, widows and capital preservationists, Vanguard Wellesley Income Mutual Fund (MUTF: VWINX).

There are many stocks on our list that are likely to join these on the all-time high list that I would still call to your attention, including Baytex Energy Corp. (NYSE: BTE), Roper Industries Inc. (NYSE: ROP), Cognizant Technologies Solutions Corp. (Nasdaq: CTSH), Rayonier Inc. (NYSE: RYN), Balchem Corp. (Nasdaq: BCPC),Whiting Petroleum(NYSE: WLL) and National-Oilwell Varco Inc. (NYSE: NOV).

The Energy Industrial Complex

Elsewhere this week, financial stocks rediscovered the bounce in their step after brokerage Morgan Stanley (NYSE: MS), asset manager BlackRock Inc.(NYSE: BLK) and credit card issuer Capital One Financial Corp. (NYSE: COF) all reported solid numbers. That's a big swath of financial services.

So did industrial powerhouse Honeywell International Inc. (NYSE: HON) -- a key member of our Industrial SPDR ETF (NYSE: XLI) fund -- which I have discussed many times as an important company because it touches so many industries, from commercial construction to cars and aerospace. HON jumped 3.4% on big volume to close at a new all-time high XLI is still a dollar under its own high, and the HON results suggest it is on its way.

Crude oil prices rose steadily over the week. That helped our many of our recommended energy complex positions, such as Oceaneering International Inc. (NYSE: OII), as well as the SPDR S&P Oil & Gas Explorers and Producers Fund (NYSE: XOP).

And, finally, I will just note that silver has gone parabolic, with a 24% gain this month that looks like an old-fashioned squeeze. There are rumors that someone has a corner on the market and is forcing shorts to come in. It's a page right out of the 1800s history books. The ghost of "Diamond Jim" Fisk lives again! (Read about the Black Friday gold panic of 1869hereor better yet, on pages 94-97 of mylast book, theAnnotated Edition of Reminiscences of a Stock Operator.)

Putting a damper on today's festivities was a report from the Federal Reserve Bank of Philadelphia for April that showed a drop in manufacturing. Initial jobless claims also disappointed with a 403,000 print, much higher than the consensus expected. Isn't it fascinating that the market sloughs off bad news like this when it is in a good mood about earnings, and the Federal Reserve is pumping money?

The Week Ahead

April 25: New Home Sales (3/11).

April 26: Existing Home Prices (2/11). Consumer Confidence (4/11).

April 27: MBA Mortgage Index (4/22/11). Durable Goods Orders (3/11). Crude Inventories (4/23/11). FOMC Meeting.

April 28: Gross Domestic Product (Q1). Initial Unemployment Claims. Pending Home Sales.

April 29: Personal Income (3/11). Personal Spending 3/11).

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source : http://moneymorning.com/2011/04/25/bull-market-still-dragging-stocks-higher/

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.