Global Monetary Policy Tightening

Interest-Rates / Central Banks Apr 24, 2011 - 11:53 AM GMTBy: Submissions

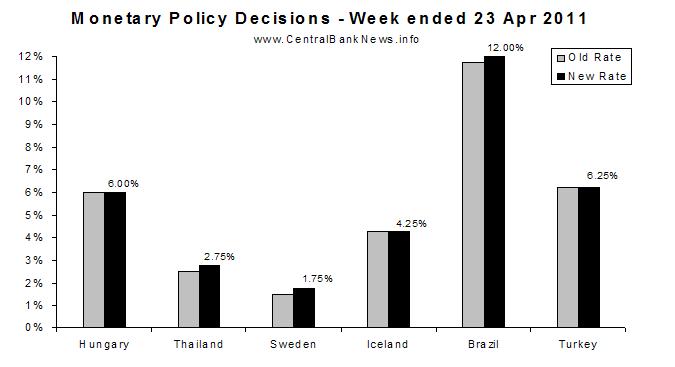

centralbanknews writes: Global monetary policy tightening continued through the past week. Central Banks that increased interest rates included those of: Thailand +25bps to 2.75%, Sweden +25bps to 1.75%, and Brazil +25bps to 12.00%. Meanwhile those that opted to hold interest rates unchanged were: Hungary at 6.00%, Iceland at 4.25%, and Turkey at 6.25%. Aside from interest rate changes the week also saw another 50 basis point increase in China's required reserve ratio, bringing the average ratio for large banks to 20.50%, and the Central Bank of Turkey increased two of its reserve ratios by 100bps. Elsewhere the Belarusian central bank instituted a secondary currency market, taking a step in the direction of a freely floating currency.

The theme was predominantly emerging market monetary policy tightening, however the Swedish Central Bank's move echoed the commencement of monetary policy tightening by the European Central Bank. Thus as noted previously we are now transitioning into an interesting, if not risky, phase of global monetary policy tightening as the reality of rising prices (beyond headline inflation) begins to have a broader impact. But while countries like Brazil, China, and Thailand took moves to tighten policy on concerns of economic overheating, there still remains weak spots around the globe.

This was illustrated by the situation in Belarus where a credit crunch and currency crisis are taking their toll on the former Soviet state, forcing it to consider options in terms of a possible bailout from Russia. Aside from that the usual policy risks will start to become more serious and pressing, for instance China's policy tightening brings its required reserves to new highs. Large emerging market economies like China and Brazil will need to tread carefully along the line of controlling inflation and tackling overheating risks on the one hand, while balancing that against the risk of forcing their economies into a hard landing on the other hand.

Next week features a few key developed economy monetary policy decisions. First up, the US Federal Open Market Committee meets to review policy (which is expected to be little changed); and interestingly, Federal Reserve Chairman Ben Bernanke will conduct his inaugural post-meeting press conference. The Reserve Bank of New Zealand will also review interest rates and is expected to keep the official cash rate on hold at 2.50%. The Bank of Japan is also scheduled to review its policy settings later in the week, with the target rate expected to be held at 0.10%.

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/04/monetary-policy-week-in-review-23-april.html

© 2010 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.