Sugar Set to Blast Off! - Where Technology and Hot Commodities Meet!

Commodities / Ethanol Nov 14, 2007 - 12:28 PM GMT Sean Brodrick writes: I was recently in New Orleans and man, that place is coming back strong! Good thing, since NOLA is one of America's most important cities. It's the busiest port system in the world by gross tonnage, and has shaped our country's music, food, architecture and economic history.

Sean Brodrick writes: I was recently in New Orleans and man, that place is coming back strong! Good thing, since NOLA is one of America's most important cities. It's the busiest port system in the world by gross tonnage, and has shaped our country's music, food, architecture and economic history.

The city also has a very strong connection to technological innovations and two hot commodities — cotton and sugar. The story perfectly illustrates the close relationship between new techniques and natural resource demand.

It's an especially important lesson for today's investors since sugar is currently undergoing yet another renaissance brought on by technological innovation. More on that in a moment. Let's start with ...

Eli Whitney's Cotton-Pickin' Mind And a Revolutionary Device

|

| Eli Whitney's gin made cotton an instant cash crop ... |

My wife is a distant relative of Eli Whitney, the man credited with inventing the cotton gin. Whitney, at times a schoolteacher, adventurer, brilliant inventor and failed businessman, said he invented the cotton gin after watching a cat attempting to pull a chicken through a fence. All the darned cat got was a paw full of feathers, but it gave Whitney an idea to improve the method of seeding cotton.

Whitney's invention, a wooden drum stuck with hooks, pulled the cotton fibers through a mesh. The cotton seeds would not fit through the mesh and fell outside. Whitney patented his gin in 1793, and the device kicked cotton production into overdrive.

See, the American South had been growing cotton since before the Revolutionary War — mostly in the East. But taking the seeds out of cotton by hand is a very labor intensive process. That kept cotton from becoming a hit like tobacco, indigo and rice. Whitney's invention solved the problem, and cotton became a big cash crop nearly overnight.

After the War of 1812 ended, cotton cultivation soared. Settlers moved to prairie lands of central Alabama and the rich alluvial lands along the Mississippi and Red rivers, where cotton became king. When Texas was annexed, even more cotton was planted.

|

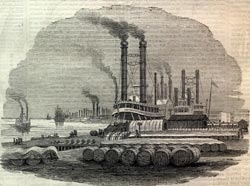

| Soon enough, New Orleans became a hub of cotton trading. |

All the lands that drained into the Mississippi basin sent their cotton through New Orleans. While around the same time, other inventions were streaming profits into the city ...

Granulated Sugar Becomes a Very Sweet Business Indeed

Europeans were using sugar long before New Orleans came along. In fact, sugar was behind 90% of the battles going on in the Caribbean. What, ye thought it was gold, matey? Narrrr!

But four decades after Jesuit priests first brought sugarcane into south Louisiana in 1751, Etienne de Bore produced the first successful sugar crop in Louisiana. He sold it for $12,000 ... Louisiana started growing a lot of sugar ... and like cotton, it all got shipped through New Orleans.

In 1812, the steamer New Orleans — the first steamboat that ever floated on the Mississippi — carried a load of sugar from New Orleans to Pittsburg.

|

| Sugar became another major commodity being shipped out of NOLA ... |

You wouldn't have recognized sugar of that time period. It came in blocks shaped like cones and loaves. Pieces were broken off with special iron sugar-cutters shaped something like very large heavy pliers with sharp blades attached to the cutting sides. These cutters had to be strong and tough, because the loaves weighed as much as 35 pounds, and could be as big as three feet high and 14 inches in diameter at the base.

Then, in 1830, the vacuum pan was invented, and with it the practice of refining sugar. The process was perfected by an inventor named Norbert Rillieux — the son of a slave and a French engineer.

Previously, sugar was refined by heating cane juice in a series of open kettles and pans called the "Jamaica Train," where slaves poured juice from container to container with long-handled ladles. The work was hard, hot and dangerous. Rillieux's invention saved time, lives ... and money.

|

| Thanks to Norbert Rillieux's sugar refining process, sweet profits started rolling in. |

The same thing that happened with cotton, happened with sugar — production costs dropped. Meanwhile, sugar refineries sprang up around New Orleans.

People discovered that if you dried refined sugar enough, it granulated. Problem is, the process took as long as 60 to 70 days. By 1866, a new invention — the first centrifugal sugar refining machine — cut that time to about 70 hours. And by 1902, The New York Times reported excitedly that a new process could cut the time to 60 to 70 minutes!

With each leap in technology, sugar became cheaper. More and more of it was grown in Louisiana. New Orleans got busier and busier.

The world's biggest sugar refinery (for its day) was built in New Orleans in 1919. It was 14 stories high, and employed a thousand workers. Sixteen years later, Tulane University hosted the first Sugar Bowl.

These days, the Sugar Bowl is held at the Superdome, and half the sugar cane in the U.S. is still grown in Louisiana!

Moreover ...

Sugar Prices Look Ready to Blast Higher From Yet Another Turn in Technology!

Almost all of the sugar sold in the U.S. goes for three times the price the rest of the world pays. Critics say the U.S. government allows the domestic sugar industry to maintain a monopoly.

I can see why they'd say that — during the 2004 elections, both parties received $3.1 million in contributions from the sugar industry. That was money well spent since Congress voted for a $1.4-billion subsidy.

Then again, prices will probably only go higher from here. So far, sugar hasn't taken off like other agricultural commodities such as wheat, corn, soybeans and cotton. But we'll see how well supply keeps up with demand now that sugar is being used more and more ... for fuel.

This year, Brazil should become energy independent, partly because of its domestic oil production, and partly because it makes more and more ethanol from sugar. A whopping 70% of the cars in Brazil are "flex-fuel" — meaning they can run on gasoline, ethanol or a mix of the two.

Brazil is exporting sugar-cane based ethanol, though it's not coming to the U.S. yet. Still, down the road, your car may run on sugar as well. Last year, Brazil exported 684 million gallons of ethanol, more than 10 times the amount it exported in 2000.

Will the U.S. make ethanol from its own sugarcane? After all, New Orleans is already a hub of the energy industry and as I just told you, lots of sugar comes from Louisiana.

It's hard to say. After all, sugar isn't the only crop with a lobby, and the corn lobby will do its best to keep corn as the U.S.'s top source of ethanol production.

But either way, sugar-cane based ethanol is here to stay, and it should greatly increase demand for the sweetest of commodities. So if you want to invest in it, there are at two ways to do that ...

#1. The Market Vectors Global Alternative Energy ETF (GEX) has returned 40% over the past six months, has an expense ratio of 0.65, and invests in a broad spectrum of alternative energy plays.

#2. Petroleo Brasiliero (PBR) is Brazil's big energy company, and it does a lot with sugar-cane based ethanol. It plans to export 2.5 billion gallons of ethanol by 2010 and is even building an ethanol pipeline!

Now, only you can decide if either of these investments fits into your portfolio. But what I find most fascinating about investing in sugar-based ethanol is that it's very much like going back in time and having a shot at Eli Whitney's cotton gin or Norbert Rillieux's sugar refining process.

And as history shows, the combination of new technology and hot commodities can be a recipe for major success!

Yours for trading profits,

Sean

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.