Whiff of Decelerating Trend in Second Tier U.S. Economic Reports

Economics / US Economy Apr 22, 2011 - 03:13 AM GMTBy: Asha_Bangalore

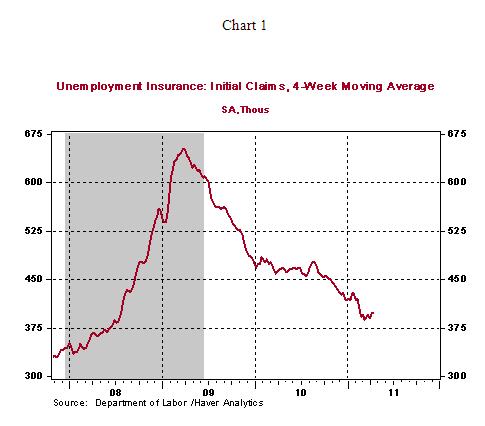

The March employment report, including a 8.8% unemployment rate and a gain of 230,000 private sector jobs, set a bullish tone early in the month, but today's reports are sending a different message. Initial jobless claims fell 13,000 to 403,000 during the week ended April 16. The four-week moving average at 399,000 has moved up 391,000 posted four weeks ago.

The March employment report, including a 8.8% unemployment rate and a gain of 230,000 private sector jobs, set a bullish tone early in the month, but today's reports are sending a different message. Initial jobless claims fell 13,000 to 403,000 during the week ended April 16. The four-week moving average at 399,000 has moved up 391,000 posted four weeks ago.

The Department of Labor indicated that last week's tally was affected by seasonal factors associated with the first month of a new quarter. Additional weekly readings will be necessary to assess if this is a seasonal factor event or a fundamental issue. Continuing claims, which lag initial jobless claims by one week, fell 7,000 to 3.695 million. Unemployment insurance claims under special programs fell roughly 70,000.

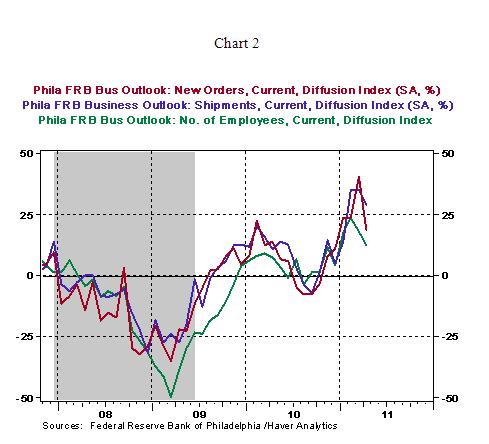

In other news, the Federal Reserve Bank of Philadelphia's factory survey of April shows a growing factory sector but at a slower pace compared with the March. The new orders index dropped to 18.8 in April from 40.3 in March; indexes tracking shipping (29.1 vs. 34.9 in March), and employment (12.3 vs. 18.2 in March) also declined.

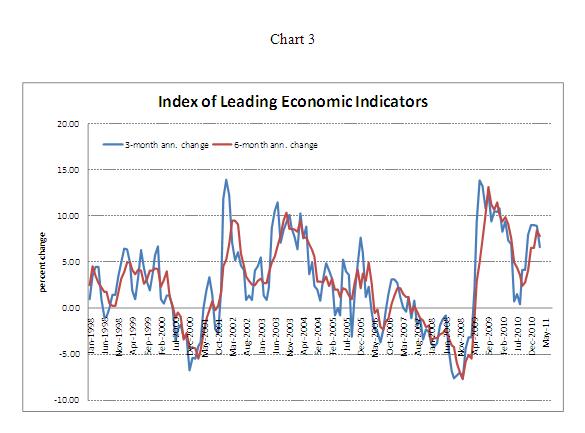

The Conference Board's Index of Leading Economic Indicators (LEI), published today, rose 0.4% in March after a 1.0% jump in February. The index has risen at an annual rate of 6.6% in the three months ended March after a 9.0% increase in the three-months ended December.

A similar decelerating trend is visible in computations over six-month and 12-month periods. In March, six of the ten components of the LEI advanced -- interest rate spread, building permits, the index of supplier deliveries, average weekly manufacturing hours, average weekly initial jobless claims and manufacturers' new orders for consumer goods. Consumer expectations, real money stock, stock prices and orders of non-defense capital goods were the declining components. The economic reports published this morning contain elements of a decelerating pace of economic activity.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.