Gold Tops $1,500 in Flight to Quality

Commodities / Gold and Silver 2011 Apr 21, 2011 - 05:46 AM GMTBy: Mike_Shedlock

The New York Times reports Gold Tops $1,500 an Ounce in 'Flight to Quality'

The New York Times reports Gold Tops $1,500 an Ounce in 'Flight to Quality'

The list of factors that have supported the price of precious metals in recent weeks is long. It includes worries about the sustainability of European debt levels — and whether countries like Greece will soon default; the threat of a possible downgrade of U.S. credit ratings amid an impasse over raising the debt limit and dealing with the budget deficit; the weaker dollar; rising inflation in many parts of the world and continued unrest in North Africa and the Middle East, which has pushed up oil prices.

“We’re seeing a perfect storm for gold and silver prices,” said Robin Bhar, a senior metals analyst in London for the French bank Crédit Agricole.

“Gold is sometimes a currency, sometimes a commodity and sometimes a store of value,” analysts at Merrill Lynch wrote recently. “As purchasing power of workers in emerging markets increases, we see demand for gold as a commodity increasing over the next few years,” the Merrill Lynch report said. Orderly Move Higher

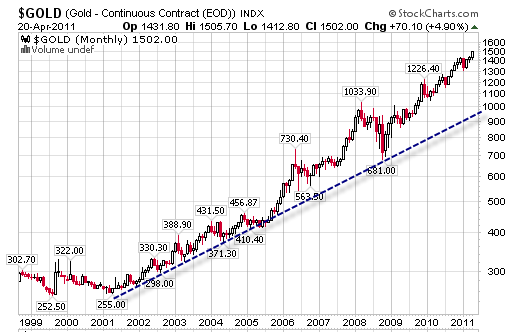

Unlike other commodities that have skyrocketed and crashed, the climb in gold has been very orderly. It is the only commodity whose long-term trendline is long and unbroken.

Gold could take a substantial hit, just as it did in 2008 and still keep its long-term trendline intact. Why is that?

The answer is currency debasement. A few charts from Interactive Map: Paul Ryan vs. Obama Budget Details; Path of Destruction will show what I mean.

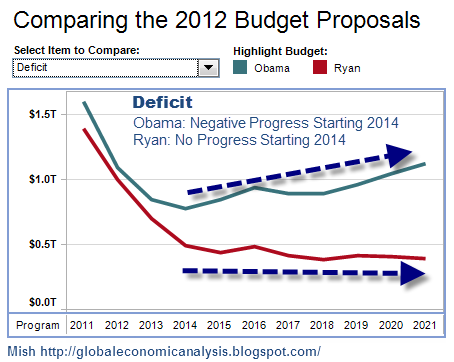

Deficit: Obama vs. Paul Ryan

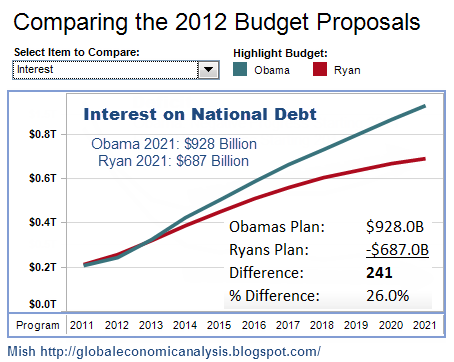

Interest on the National Debt: Obama vs. Paul Ryan

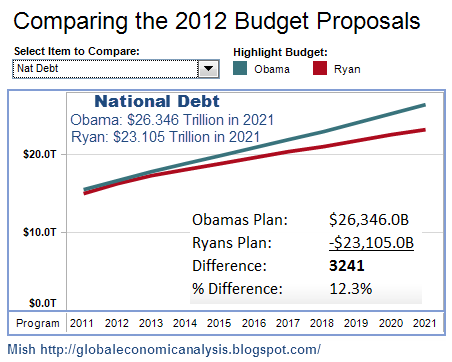

National Debt: Obama vs. Paul Ryan

National Debt is going to soar in 10 years from $15 trillion to $23-26 trillion if either Obama's or Ryan's plan is enacted.

That is currency debasement on a scale never seen before in the US. However, it is not just the US. The UK is a financial basket case and in Europe there is a sovereign debt crisis.

In China, credit is expanding at 20-30% a year. Indeed, China is printing money faster than the US. Thus, the idea the Yuan is undervalued is questionable to say the least.

For further discussion regarding China and the Yuan, please see Is the Yuan Undervalued?

So, why shouldn't gold be rising? If anything, the surprise should be how orderly the rise has been given massive currency debasement everywhere you look.

Gold is Money

Merrill Lynch analysts wrote “Gold is sometimes a currency, sometimes a commodity and sometimes a store of value.”

Those Merrill Lynch analysts make a number of mistakes.

The fact of the matter is gold is always a currency and always a commodity. I make the case "Gold is Money" in two posts.

Money is Always a Commodity

Please consider a few re-ordered sentences from Murray Rothbard's classic text What Has Government Done to Our Money?

Money is a commodity used as a medium of exchange.

Like all commodities, it has an existing stock, it faces demands by people to buy and hold it. Like all commodities, its “price” in terms of other goods is determined by the interaction of its total supply, or stock, and the total demand by people to buy and hold it. People “buy” money by selling their goods and services for it, just as they “sell” money when they buy goods and services.

Money is not an abstract unit of account. It is not a useless token only good for exchanging. It is not a “claim on society”. It is not a guarantee of a fixed price level. It is simply a commodity.

What Is The Proper Supply Of Money?

Continuing from the book ...

Now we may ask: what is the supply of money in society and how is that supply used? In particular, we may raise the perennial question, how much money “do we need”?The above online book found on mises.org is a great read. It is also free. It should be required reading for all members of Congress. Please meet with your legislative representative and get them to read the book.

Must the money supply be regulated by some sort of “criterion,” or can it be left alone to the free market?

All sorts of criteria have been put forward: that money should move in accordance with population, with the “volume of trade,” with the “amounts of goods produced,” so as to keep the “price level” constant, etc.

But money differs from other commodities in one essential fact. And grasping this difference furnishes a key to understanding monetary matters.

When the supply of any other good increases, this increase confers a social benefit; it is a matter for general rejoicing. More consumer goods mean a higher standard of living for the public; more capital goods mean sustained and increased living standards in the future.

[Yet] an increase in money supply, unlike other goods, [does not] confer a social benefit. The public at large is not made richer. Whereas new consumer or capital goods add to standards of living, new money only raises prices—i.e., dilutes its own purchasing power. The reason for this puzzle is that money is only useful for its exchange value.

[Thus] we come to the startling truth that it doesn’t matter what the supply of money is. Any supply will do as well as any other supply. The free market will simply adjust by changing the purchasing power, or effectiveness of the gold-unit [monetary-unit].

The key point above is that money is a commodity. Yet unlike other commodities, an increase in money supply confers no overall economic benefit. Over time, money simply buys less and less.

Those three sentences and one look at the budget charts above nicely explain the rise in gold.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.