Is Deflation Still a Threat, the Deflation Survival Guide" Gives the Answer

Economics / Deflation Apr 19, 2011 - 09:47 AM GMTBy: EWI

"Every excess causes a defect; every defect an excess. Every sweet hath its sour...The waves of the sea do not more speedily seek a level from their loftiest tossing, than the varieties of condition tend to equalize themselves."

This quote comes from Ralph Waldo Emerson's essay, "Compensation." He opens the essay with a poem which includes these two lines:

"Mountain tall and ocean deep

Trembling balance duly keep."

Do Emerson's prose and poetry actually speak to the subject of deflation? Indeed they do.

Recent decades have seen the biggest credit inflation the world has ever known. So the question is: What will "duly keep" the "balance" of so great an "excess"? Well, a deflation of the same scale.

And the depth of deflation will be in proportion to the height of the credit build-up.

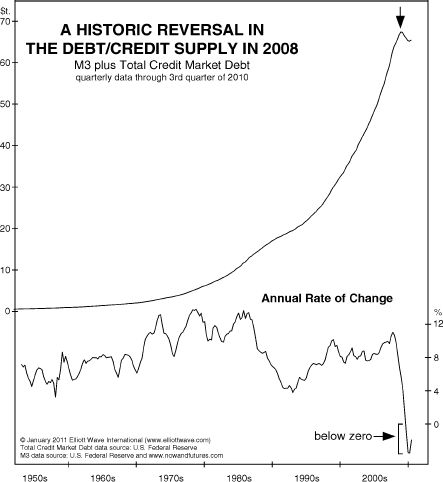

How high was the mountain of debt/credit? In 2008, it reached its zenith at $65 trillion. This chart from the January 2011 Elliott Wave Theorist shows what has happened since:

In that same issue of the Theorist, EWI's Robert Prechter observes: "This decline in overall money and credit is the first on an annual basis since 1929-1933. It is a big deal."

And the $65 trillion is a conservative number. Prechter also states:

"It does not count derivatives, which are IOU-ifs representing an estimated risk of indebtedness of $600t., or the unfunded liabilities of the federal government, which by some estimates amount to $300t."

Does history shed light on vast excesses in debt/credit and deflation? Read the excerpt below from Conquer the Crash (2nd ed.), pp. 88-90:

"Deflation requires a precondition: a major societal buildup in the extension of credit (and its flip side, the assumption of debt)... Elliott wave expert Hamilton Bolton... summarized his observations this way:

'In reading a history of major depressions in the U.S. from 1830 on, I was impressed with the following:

(a) All were set off by a deflation of excess credit. This was the one factor in common.

(b) Sometimes the excess-of-credit situation seemed to last years before the bubble broke.

(c) Some outside event, such as a major failure, brought the thing to a head, but the signs were visible many months, and in some cases years, in advance.

(d) None was ever quite like the last, so that the public was always fooled thereby.

(e) Some panics occurred under great government surpluses of revenue (1837, for instance) and some under great government deficits.

(f) Credit is credit, whether non-self-liquidating or self-liquidating.

(g) Deflation of non-self-liquidating credit usually produces the greater slumps.'"

Note that we have had more than "a major societal buildup in the extension of credit." The chart above also shows that "a deflation of excess credit" has been underway since 2008. As Hamilton Bolton said, this is the one factor all major depressions have in common.

To help plan and prepare for your financial future, we suggest that you take a FREE look at our deflation survival guide titled, "The Guide to Understanding Deflation." It's an eBook of Robert Prechter's most important recent warnings and teachings about deflation, and it's free.

To start your free read, simply sign-up to become a Club EWI member (membership is also free). Becoming a member only takes moments after you click here.

This article was syndicated by Elliott Wave International and was originally published under the headline Does Deflation Remain a Threat?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.