Amaranth Collateral Damage in 78 Trillion Dollar J.P. Morgan Chase Derivatives Book

Commodities / Market Manipulation Apr 19, 2011 - 09:20 AM GMTBy: Rob_Kirby

The purpose of this paper is to illuminate the real purpose of the obscene size of derivatives books amongst the world’s largest financial institutions. Derivatives in strategic markets are controlled by governments through proxy banks and agencies using these instruments. By sheer volume, the trading in paper “tails” wag the physical “dogs”. When market volatility negatively impacts these large institutions they are given a pass by regulators and accounting protocols in the interest of national security and preservation of the status quo. Moreover, this ensures the perpetuation of U.S. Dollar hegemonic power. The following accounts outline how these instruments are used to project this power.

The purpose of this paper is to illuminate the real purpose of the obscene size of derivatives books amongst the world’s largest financial institutions. Derivatives in strategic markets are controlled by governments through proxy banks and agencies using these instruments. By sheer volume, the trading in paper “tails” wag the physical “dogs”. When market volatility negatively impacts these large institutions they are given a pass by regulators and accounting protocols in the interest of national security and preservation of the status quo. Moreover, this ensures the perpetuation of U.S. Dollar hegemonic power. The following accounts outline how these instruments are used to project this power.

Amaranth Advisors LLC went bankrupt in Oct. 2006. By mid 2007 the Committee of Homeland Security and Government Affairs released a document containing a detailed investigation of the Amaranth scandal entitled “Excessive Speculation in the Natural Gas Markets.” Amaranth, hedge fund, was launched in 2000 as a multi-strategy hedge fund, but had by 2005-2006 generated over 80% of their profits from energy trading.

Market circumstances surrounding Amaranth indicated that they were predominantly long natural gas. This is not surprising since “very easy money policies” by the Federal Reserve, a hot housing market along with rapidly industrializing Asian economies had created steadily increasing demand – and a bullish environment - for commodities in general and energy inputs in particular.

Juxtaposed against this inflationary backdrop, the U.S. Federal Reserve, the Bureau of Labor Statistics, and the U.S. Treasury ALL consistently fudged [lied about] economic data, always overstating economic growth and employment data and perpetually understating the effects of inflation. This has been well documented by John Williams of www.shadowstats.com.

Amaranth became a high profile entity employing leverage to push prices of a high profile strategic commodity like natural gas higher. This put Amaranth at odds with the 2 % inflation “kool-aide” illusion that the Fed and U.S. regulators were [and still are] trying to falsely sell the American people. In 2008, Ludwig Chincarini CFA, Ph.D, penned a paper chronicling Amaranth’s collapse titled, Lessons from the Collapse of Amaranth Advisors L.L.C. linked here. The report gave details regarding Amaranth’s management style and risk management practices as well as chronologically detailing the last days of the hedge fund.

Through the research provided to us by Ludwig Chincarini CFA, Ph.D., we get an accurate picture of Amaranth’s methodology for managing risk as follows:

“The Chief Risk Officer of Amaranth had a goal of building a robust risk management system. Amaranth was unusual in terms of risk management in that it had a risk manager for each trading book that would sit with the risk takers on the trading desk. This was believed to be more effective at understanding and managing risk. Most of these risk officers had advanced degrees. The risk group produced daily position and profit and loss (P&L) information, greek sensitivites (i.e. delta, gamma, vega, and rho), leverage reports, concentrations, premium at risk, and industry exposures. The daily risk report also contained the following:

1. Daily value-at-risk (VaR) and Stress reports. The VaR contained various confidence levels, including one standard deviation (SD) at 68% and 4 SD at 99.99% over a 20 day period. The stress reports included scenarios of increasing credit spreads by 50%, contracting volatility by 30% over one month and 15% for three months, 7% for six months, and 3% for twelve months, interest rate changes of 1.1 times the current yield curve. Each strategy was stressed separately, although they intended to build a more general stress test that would consolidate all positions.

2. All long and short positions were broken down. In particular, the risk report listed the top 5 and top 10 long and short positions.

3. A liquidity report that contained positions and their respective volumes for each strategy was used to constrain the size of each strategy. The risk managers also calculated expected losses for the individual positions. The firm had no formal stop-losses or concentration limits. Amaranth took several steps to ensure adequate liquidity for their positions. These steps are listed on the more detailed version of this section on the FMA website.”

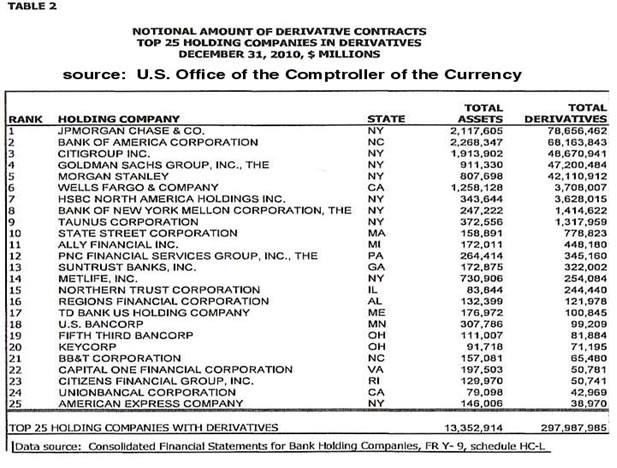

In fact, the risk aversion procedures taken by Amaranth don’t really seem much different than the mandated risk management procedures practiced by J.P. Morgan, B of A, Citibank, Goldman Sachs and Morgan Stanley – ALL with derivatives books measuring from 42.1 to 78.6 Trillion at Dec. 31/10. Here’s how the U.S. Office of the Comptroller of the Currency [OCC] states these behemoths manage their risk [pg. 8]:

“Banks control market risk in trading operations primarily by establishing limits against potential losses. Value at Risk (VaR) is a statistical measure that banks use to quantify the maximum expected loss, over a specified horizon and at a certain confidence level, in normal markets. It is important to emphasize that VaR is not the maximum potential loss; it provides a loss estimate at a specified confidence level. A VaR of $50 million at 99% confidence measured over one trading day, for example, indicates that a trading loss of greater than $50 million in the next day on that portfolio should occur only once in every 100 trading days under normal market conditions. Since VaR does not measure the maximum potential loss, banks stress test trading portfolios to assess the potential for loss beyond the VaR measure. Banks and supervisors have been working to expand the use of stress analyses to complement the VaR risk measurement process that is typically used when assessing a bank’s exposure to market risk……..[more]”

And here is what OCC reports as VaR for these selected banks [pg. 9]:

The tables above show that J.P. Morgue had a 78.6 Trillion Dollar derivatives book [446 dollars in bets for every one dollar in equity] and estimates that the most they could expect to lose in any given day is $ 71 million. [Note: Amaranth, with an approximate 20 Billion Dollar Derivatives book – lost an average of $ 420 million for 14 days straight for total losses of approximately 6 billion at the beginning of Sept. 06].

As a housekeeping note: Years ago, circa 1998, J.P. Morgue’s management deemed their proprietary measure of assessing risk [VaR] so “brilliant” they “spun it off” in a separate company called RiskMetrics.

“JP Morgan [had] developed a methodology for calculating VaR for simple portfolios (i.e. portfolios that do not include any significant options components) called RiskMetrics. The success of RiskMetrics has been so great that Morgan has spun off the RiskMetrics group as a separate company.

RiskMetrics forecasts the volatility of financial instruments and their various correlations. It is this calculation that enables us to calculate the VaR in a simple fashion. Volatility comes into play because if the underlying markets are volatile, investments of a given size are more likely to lose money than they would if markets were less volatile.”

RiskMetrics was successfully marketed to some of the most astute, successful risk managers in ALL THE LAND such as:

Bear Stearns Global Clearing Services and RiskMetrics Group to Offer Risk Management, Portfolio Analysis and Investment Planning Solution to Independent Investment Advisors.

Publication Date: 25-JAN-06

Article Excerpt

NEW YORK -- Bear, Stearns Securities Corp. and RiskMetrics Group announced today they have entered into an agreement to offer RiskMetrics Group's WealthBench(TM) technology platform to independent investment advisors and family offices via the Bear Stearns WealthSET(SM) wealth management solution. Investment advisor clients of Global Clearing Services are now able to access WealthSET's institutional quality risk analytics, investment planning, asset allocation and proposal generation capabilities.

And

Lehman's prime brokerage to offer clients RiskMetrics tools online

Published online only

Author: Gallagher Polyn

Source: Risk magazine | 13 Dec 2002

Lehman Brothers' global prime brokerage unit will offer RiskMetrics' RiskManager tool to hedge funds, fund of funds and investors via its website, LehmanLive. The RiskManager service features value-at-risk, stress testing and 'what-if' scenario generation.

Observations

- most of the huge derivatives players take a similar standardized approach to evaluating and assessing risk

- Despite relative uniformity in risk management models among derivatives risk managers we see a disproportionate number of smaller, relatively better capitalized players fail while larger relatively under-capitalized bemoths continue to make windfall gains and flourish.

- There appears to be a double standard being practiced by the CFTC regarding position limits between the largest derivatives players [like J.P. Morgue] and smaller ones [like Amaranth]. Issues of concentration [commodities laws] are enforced on smaller players and ignored on the preferred players. This preferential treatment extends to this day as the CFTC continues to “look the other way” while J.P. Morgan and HSBC increasingly dominate the short open interest in COMEX silver – even as reported shortages of physical metal continue to crop up at national mints around the world.

Perhaps some of you might be wondering how J.P. Morgue et al really do it? How they can take such HUGE, LEVERAGED risk and seemingly NEVER lose? Well, here’s a clue: back in early 2006, Business Week reported,

President George W. Bush has bestowed on his intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006,

What that means folks, is: “if J.P. Morgan is deemed to be acting in the name of National Security or the National Interest – THEY [and presumably others] CAN “LEGALLY” BE EXCUSED FROM ACCOUNTING.

The reality is that derivatives trading is risky. Major players in the derivatives trade ALL, more or less, use the same risk management practices. The key difference[s] between J.P. Morgan et al and interlopers - hedge funds - who come-and-go is that the banks who act for the Federal Reserve have the backing of the Great Guttenberg and they are not subject to regulatory oversight or accounting.

These key banks have created ridiculously larger and disproportionate derivatives edifices in key strategic areas of interest rates [bonds], energy and precious metals where the sheer volume of paper trade overwhelms and assigns false pricing to the underlying physical trade – ie. the tail wags the dog. Control of the pricing in these strategic instruments works hand-in-hand with global U.S. hegemonic strategy of dollar price settlements in key strategic commodities and the perpetuation of supremacy of the Dollar as the world’s reserve currency.

It’s in this context that we begin our examination of the Amaranth kill shot.

Review of the Amaranth Kill Shot Sequence

The black text below in “quotes” was excerpted from Ludwig Chincarini CFA, Ph.D, Lessons from the Collapse of Amaranth Advisors L.L.C. linked here [pg. 17].

The chart below chronicles the milestones – beginning with the entrance of J.P. Morgue into the Nat. Gas futures trading arena at the turn of 1995/96. It should be noted that the Nat. Gas price movement that led to Amaranth’s demise has been described by some very qualified professionals as being a 5 or possibly even as high as a 9 standard deviation event where the fund lost an average of $420 million per day for the first 14 trading days of September, totaling a final loss of around $6 billion.

According to Dr. Jim Willie PhD. [Statistics] a 5 standard deviation event has a one in 1.74 million chances of happening. Willie told me 9 standard deviation events do not happen in nature.

This appended passage is a play-by-play of Amaranth’s final days where virtually all of their equity was vaporized in a matter of 14 days. Chincarini documents how the CFTC took issues of concentration on the NYMEX seriously, when it suited them to do so, as it pertained to Nat. Gas and Amaranth. Rob Kirby comments in blue:

Excerpt begins:

“Of particular note was an August 8, 2006 complaint by NYMEX officials that Amaranth’s position in the September 2006 contract (near-month contract) was too high at 44% of the open interest on NYMEX. … Amaranth reduced this short position by the day’s close by 5,379 contracts (see the change in NYMEX contracts from the close of August 7 to the close of August 8), but they also increased their similar exposure short position on ICE by 7,778 contracts.

Thus, ironically, the request by NYMEX to reduce Amaranth’s positions led Amaranth to actually increase their overall September 2006 position. At the same time, they also increased their exposure to the October 2006 contract; a contract that is a close substitute to the September 2006 contract. In particular, they had increased their October 2006 position in NYMEX natural gas futures by 7,655 contracts and their equivalent position on ICE October 2006 contracts by 4,984.”

[Rob Kirby note: to say that the October 2006 contract was a Close substitute for the September 2006 contract is VERY misleading BECAUSE September was still the lead “spot” month – and Amaranth was being FORCED to roll out of their spot position – exposing a “weak hand” [like an open wound / blood in water attracts sharks]. If, instead, the “short” – undoubtedly J.P. Morgue - had been told to cover – the price would have EXPLODED UPWARD. Additionally, and more telling, the fact that Amaranth was using ICE Nat. Gas contracts as substitutes for NYMEX contracts illustrates that there *used-to-be* a high degree of correlation between Nat. Gas traded in Europe and Nat. Gas traded in North America – more on this later].

“On August 9, 2006 the NYMEX called Amaranth with continued concern about the September 2006 contract and warned that October 2006 was large as well and they should not simply reduce the September exposure by shifting contracts to the October contract. In fact, by the close of business that day, Amaranth increased their October 2006 position by 17,560 contacts and their ICE positions by 105.75. For September 2006, Amaranth did follow NYMEX instructions by reducing NYMEX natural gas positions by a further 24,310, but increased September ICE positions by 4,155.”

[Rob Kirby note: winning or losing when institutional trading often comes down to “who blinks first”. The CFTC decided that Amaranth would blink first. At this point, Amaranth’s fate was sealed – and J.P. Morgue undoubtedly knew it. A noble assist in the Amaranth Kill Shot sequence has to go another Fed / Treasury lackey institution – Goldman Sachs – who re weighted their vaunted Goldman Sachs Commodity Index (GSCI) which, at the time, had roughly 100 billion in institutional money following it.]

“On August 10, 2006 another call from NYMEX urged Amaranth to reduce the October 2006 position since it represented 63.47% of the NYMEX open interest. In response to this call, Amaranth reduced the October 2006 position by 9,216 contracts, but increased their similar October 2006 ICE position by 18,804 contracts.

By the end of this three-day session of calls from the NYMEX warning Amaranth of its position size in September and October contracts, Amaranth had actually increased their overall positions from August 7, 2007 to August 11, 2006 in those two contracts by 16,484 (a decrease in September 2006 positions by 23,143 and an increase in October positions by 39,627).”

[Rob Kirby note: commentators made much of Amaranth’s elevated risk [VaR] measures and leverage employed – 5.23 times. One should remember that the “other side” of Amaranth’s trades was principally J.P. Morgue. Morgue is the biggest hedge fund on the planet – with market cap of roughly 176 billion and a derivatives book of [at Sept. 30/06] 63.477 Trillion for leverage of 361 times. Incredibly, extreme, dizzying leverage NEVER seems to cause P & L problems for ole J.P. Morgue’s derivatives book which at one time topped 90 Trillion - EVER. In fact, at Dec. 31/10, Morgue’s derivatives book was 78.656 Trillion with market cap of 176 billion for leverage today of 446 times]. In fact, Chincarini himself conjectured [on pg. 19],

“The reconstruction of the VaR of Amaranth’s positions on August 31, 2006 was high, but cannot entirely explain Amaranth’s losses in September 2006 unless one designates the Amaranth collapse as a 5 standard deviation event.”

Others, like Hilary Till of Premia Capital Management characterized the price move that buried Amaranth as a 9 standard deviation move:

“Hilary Till of Premia Capital Management released a damage control piece assessing aspects of the Amaranth case. She assured us that the market move associated with Amaranth’s loss was a nine standard deviation event. If you don’t know what that means, it is statisticians’ speak for “it won’t happen again.”

[end] -

Interesting, in Dr. Jim Willie’s words, “a 9 standard deviation never did happen, at least not naturally.”

Ladies and gentlemen, Amaranth Advisors LLC was surgically removed from the financial landscape by the Fed / J. P. Morgue in a “joint kinetic movement”.

Amaranth Versus Long Term Capital Management [LTCM]

For those who forget, LTCM was a hedge fund founded by bond guru John Meriwether which suffered a spectacular collapse in 1998 and was subsequently bailed out by consortium of banks at the behest of the U.S. Treasury and Federal Reserve. Fed and Treasury officials argued at the time that the bailout was necessary because the collapse of LTCM posed systemic implications for the global financial system. Here’s why:

Much has been written on the Bank of Italy, LTCM and gold – like this excerpt from Embry / Hepburn back in 2004 at pg. 29:

….in September 1999, TheStreet.com quoted Nesbitt Burns gold analyst Jeff Stanley as saying on a conference call: "We've learned Long Term Capital Management is short 400 tons."74

In addition, Frank Veneroso stated:

“I have received many testimonies that LTCM had extensively used gold borrowings to fund its leveraged positions, and believe it likely that the Fed removed these shorts from LTCM's books in the course of the bailout of LTCM.”75

Reg Howe also spoke of the apparent LTCM gold short position:

“Recent confidential information from a highly reliable source confirms rumors that at the time of its collapse, LTCM was short a substantial amount of gold (300 to 400 tonnes is the range most often mentioned), and that this position was covered in some type of arranged off-market transaction.”76

Crucial to the allegations of gold price manipulation is a statement Veneroso made in 2002:

We conclude from our argument based on the development of an inadvertent corner in the gold markets, from a “prison of the shorts”, that, since the Long Term Capital Management crisis in late 1998, the official sector has been managing the price of gold.77

The “prison of the shorts” cited by the renowned gold analyst is the situation that developed due to the large speculative gold short positions.

When sovereign gold is lent / leased – it is generally sold into the market to raise cash balances.

The Italians were lending / leasing their sovereign gold and investing the proceeds with LTCM. Italy was no doubt attempting to reverse their sagging fortunes with their substantial sovereign gold holdings due to the reality that their gold holdings were ONLY losing value over that time frame:

The declining gold price was effectively “screwing Italy’s chances” of QUALIFYING FOR THE EURO – by negatively impacting the value of their reserves.

This would have made the Italians HIGHLY CAPTIVE and AGREEABLE – given their predicament - to any proposal to help reverse or alleviate that REALITY.

Thinking that LTCM was infallible – owing to them having a couple of Nobel laureates on staff and also being predisposed to playing fast-and-easy with their gold accounts – Italy still wasn’t done. Next up was a gold loan / lease – arranged by your friendly neighborhood bullion banker [like Goldman Sachs]. The proceeds were invested in LTCM in the belief they would earn the ‘magical gains’ that LTCM had been delivering to their investors.

Embry / Hepburn tell us that Long Term Capital Management denied they ever traded gold. In a letter sent to attorneys for the Gold Anti-Trust Action Committee, LTCM’s attorney James G. Rickards maintained [pg. 29]:

“None of LTCM, LTCP, nor their affiliates, has ever entered into any transaction involving the purchase or sale of gold, including without limitation, spot, forwards, options, futures, loans, borrowings, repurchases, coin or bullion, long or short, physical or derivative or in any other form whatsoever.”73

While Jim Rickards may be “technically correct” that LTCM was not directly involved in trading gold or in gold price rigging – they would UNQUESTIONABLY have had direct knowledge of the genesis of the sovereign Italian funds that were invested with LTCM – because Rickards’ own bio states that he principally organized the bailout.

When LTCM failed, they had to be bailed out because a public bankruptcy would have:

A] exposed the Italian manipulation of their sovereign gold [which did aid and abet in a wider – globally coordinated - gold price suppression]

and

B] that Italy was playing “financial accounting tricks” to qualify for the Euro, i.e. the Euro might have been still-borne.

When the “gang” of investors met at the Fed’s offices in NY to discuss the bailout of LTCM – it’s been well reported that Greenspan and then Tres. Secretary Rubin laid it on the table that all LTCM investors were going to have to help bail LTCM out.

Bear Stearns realized that unsustainable “short” monkey business was involved where Gold was concerned and basically said – NOT A CHANCE WE PAY A NICKEL!!! Further details of the LTCM / Bk. of Italy / Gold connection are laid out in a subscriber only paper titled, Fine Italian Dining, archived at kribyanalytics.com.

Amaranth had no golden skeleton buried in any of its closets – therefore a public bankruptcy / dismemberment – mostly for the benefit of J.P. Morgue, who effectively got to close out their short nat. gas positions for pennies on the dollar by ‘absorbing’ Amaranth’s longs – was not only desirable, but preferred because it sent a clear message to any and all other hedge funds who might have harbored thoughts of becoming large players in such a strategic space.

You see folks, when you are printing money like a banshee and telling the world that inflation is running at 2 % - you don’t want interlopers with deep pockets – like Amaranth – bidding the price of strategic commodities like natural gas – UP.

Got physical yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2011 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

B.

24 Apr 11, 06:45 |

Still trying to Blow up JP Morgan???

You don't know their positions and exposures so you make them up. |