Stock Monday Mayhem, Panic Selling Has Set In!

Stock-Markets / Stock Markets 2011 Apr 18, 2011 - 02:24 PM GMTBy: Chris_Vermeulen

In overnight and pre-market trading the US Dollar posted a strong rally which in turn caused a sharp selloff in the equities market. The market is currently down 1.6 – 2.3% depending on the index traders are following.

In overnight and pre-market trading the US Dollar posted a strong rally which in turn caused a sharp selloff in the equities market. The market is currently down 1.6 – 2.3% depending on the index traders are following.

Here is what I see on the charts going forward a few days.

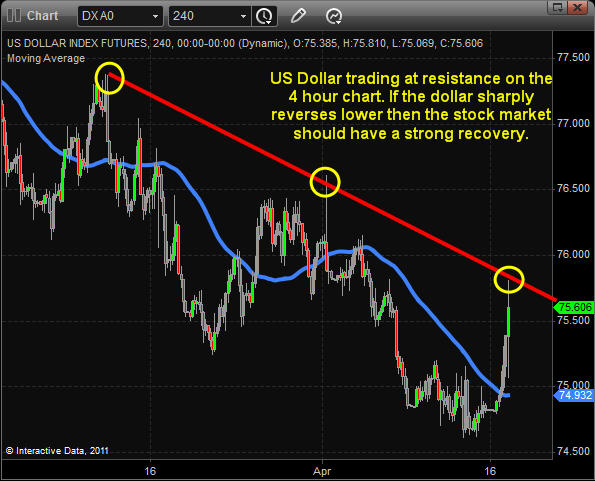

Dollar Index – 4 Hour Chart

The Dollar is trading at a resistance level which has in the past triggered strong moves lower. If we get a move lower on the dollar from here then I expect a strong recovery in the equities market and likely higher commodity prices also. If the US Dollar breaks out and rallies above this point then we could see a much further collapse in stocks and commodities.

The falling dollar has also helped to boost crude oil prices the past couple months. One of my trading buddies J.W. Jones at OptionsTradingSignals.com pocketed a nice 86% gain on a USO cash secured put based on the credit sold. Also the weak dollar has his GLD options trade up over 50% already and it has just begun. Jones is an options expert and always seems to find a way to pull money out of the market month after month…

SPY Daily Chart

The daily chart shows a large gap down putting the market in a short term oversold condition. Typically we see the market bounce back up or gap higher the following day. In some cases similar to today the market actually bottoms. So those long the SP500 I feel have a good change of recouping some of today’s decline by waiting for the kneejerk reaction bounce in the next 24-48 hours.

Market Sentiment – Panic Selling At Extremes

Today we are seeing panic selling at levels not seen since the market bottom in March. The green indicator spikes on the chart show very high levels of traders/investors dumping stocks in fear of a collapse. Today’s negative headline news has sparked mass fear and when levels like this are reached you should think of holding long positions for another 1-2 session to see if we get that bounce or market bottom.

Monday Mass Selling Conclusion:

Today’s sharp drop in equities could be an excellent low risk opportunity to add or take a long position here because most of the downside fear for the short term has been eliminated today.

That being said the trend appears to be down on the SP500 now so at this time I am looking to sell into a rally if we get one today, tomorrow or Wednesday.

If you would like to get more of my daily analysis to join my newsletter at www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.