Gold and Silver Reach New Record Highs

Commodities / Gold and Silver 2011 Apr 15, 2011 - 08:01 AM GMTBy: GoldCore

Gold and silver have reached new all-time and 31-year record highs in trading in London this morning. Silver is particularly strong and the euro particularly weak on sovereign debt contagion concerns.

Gold and silver have reached new all-time and 31-year record highs in trading in London this morning. Silver is particularly strong and the euro particularly weak on sovereign debt contagion concerns.

Inflation and sovereign debt fears are leading to continued safe haven demand. It is as important as ever to note that the record highs are nominal highs and inflation adjusted gold and silver remain a long way from their respective highs of $2,400/oz and $140/oz in 1980. These inflation adjusted highs remain viable long term price targets.

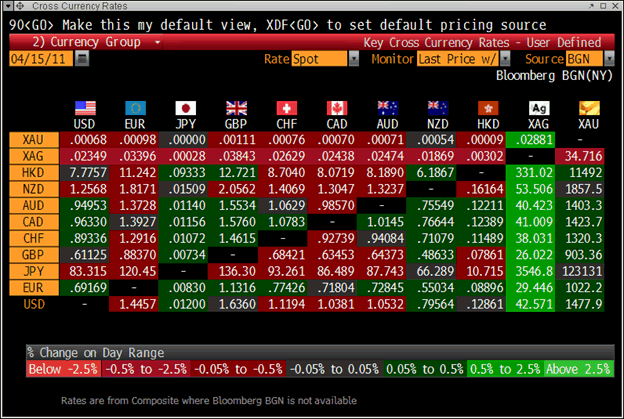

Cross Currency Rates at 1200

Precious metal prices at record highs are symptomatic of the degree of macroeconomic and geopolitical risk in the world today. These risks do not look like dissipating anytime soon, which will likely lead to higher precious metal prices.

$1,500/oz and $50/oz remain short term targets. Resistance levels have been breached and thus these psychological price points will likely now be tested. Trading and timing markets remains high risk but astute hedge funds and other traders will continue to “make the trend their friend’.

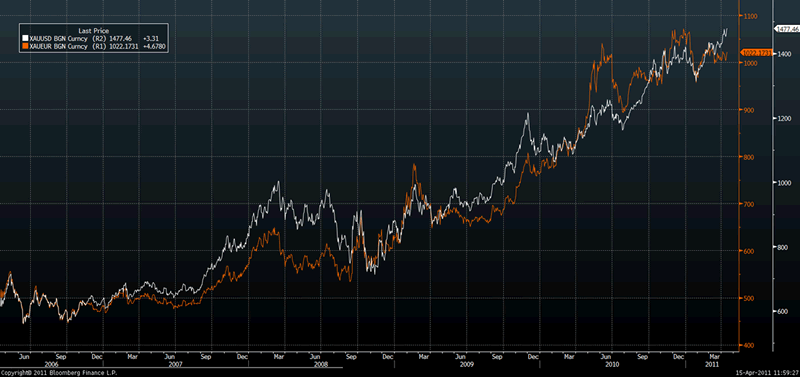

Gold in USD and Gold in EUR – 5-Year (Daily)

The risk of contagion in the Eurozone and internationally remains real. Already seriously indebted taxpayers in many western countries are set to struggle with the massive liabilities incurred from bailing out western banks.

This is leading to the possibility of even more quantitative easing, a massive increase in money supply and currency debasement on a scale not seen since our modern monetary system came into existence when Nixon announced that the US would no longer convert US dollars to gold and the world entered the era of fiat paper currencies not backed by precious metals.

The record highs were greeted with little coverage and no fanfare. What little coverage there is, remains almost exclusively in the specialist financial press (such as the FT, WSJ, Reuters and Bloomberg). Very occasional treatment in the non-specialist financial press remains superficial and negative (see news).

The negative treatment of gold and silver is in marked contrast to the treatment of more high risk individual equities, and equities in general. Bearish sentiment abounds and we have seen a lot of profit taking this week. These are tell signs and contrarian signals that gold and silver are far from the bubbles that some have been claiming for a time.

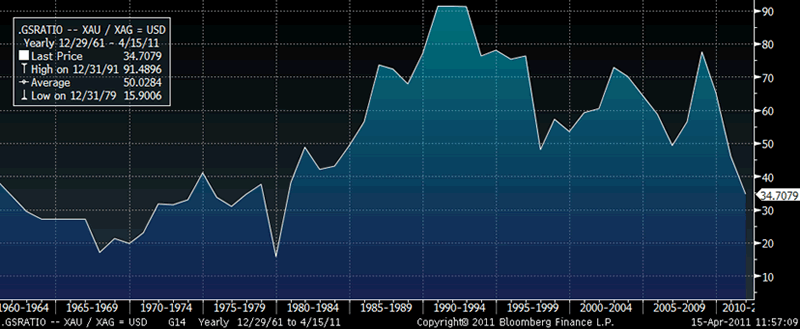

Gold/Silver Ratio 1960 - 2011 (Yearly)

Risk appetite remains high. Predicting future price movement of securities, a trading mentality and speculation remains rife. This comes at the expense of a real evaluation of risk and educating the public about the importance of real diversification and holding quality assets passively in a low risk and low cost way.

Gold

Gold is trading at $1,477.64/oz, €1,022.94/oz and £903.64/oz.

Silver

Silver is trading at $42.50/oz, €29.42/oz and £25.99/oz.

Platinum Group Metals

Platinum is trading at $1,783.50/oz, palladium at $763/oz and rhodium at $2,300/oz.

News

(Dow Jones) -- Gold, Silver Hit New Records; Others Tad Down

Spot gold and silver hit fresh records in Asian trade Friday, but platinum and palladium were marginally lower as further inflationary pressures emerged in China and concerns over the health of the euro zone lingered.

At 0655 GMT, spot gold was down 50 cents from its late New York level at $1,475.30 a troy ounce, having touched an all-time record of $1,479.44 around midnight GMT, while silver gained 15 cents to $42.33, 10 cents below a record $42.43 hit around 2200 GMT.

Regional markets were mostly lower, a data from China showed that both GDP growth in the first quarter and March consumer price inflation came in above expectations.

Inflation is seen as a key risk for China's booming economy, and the People's Bank of China has sharply tightened monetary policy in recent months to avert the risk of out-of-control price rises.

"Someone please cool this economy down now," Standard Chartered said in a note. "We maintain our call of only one more policy rate hike in the second quarter, but we highlight the risk that there could be two more hikes.

Precious metals are frequently a beneficiary of inflation fears, although they have had a mixed performance as an inflation hedge since most currencies gave up their historic links to gold or silver.

Chinese demand for gold in particular has boomed in recent years. J.P. Morgan's China equities and commodities managing director, Jing Ulrich, said Friday that Beijing's attempts to moderate the country's housing boom could be driving the "mass affluent" toward gold.

"Chinese demand for gold jewelry increased 13.5% [on year] in 2010, while demand for bars & coins rose 70.5%," she said in a note. "Most market participants expect that China's gold demand could grow at a still-stronger pace in 2011."

Silver's booming price has seen it move well beyond traditional ratios with gold. An ounce of gold has usually been worth at least 60 oz of silver in recent years, but an ounce of gold currently buys only around 34.7 oz of silver.

A trader for a European broker in Hong Kong said that silver could continue to outrun the yellow metal, since it was exposed to both industrial and booming investment demand.

"I think silver can continue to go a lot higher and continue to outpace gold. There's no downside limit to the gold-silver ratio. I think it could go a lot lower," he said.

(Bloomberg) -- Gold Trading Climbed 5% in March, Silver Gained 3.2%, LBMA Says

Gold trading rose 5 percent to an average of 19 million ounces a day in March, the London Bullion Market Association said today in an e-mailed statement. Silver trading increased 3.2 percent to an average of 145.7 million ounces a day, the LBMA said.

(Bloomberg) -- China’s March Gold Output Surges 35% to 57.6 Tons; Silver Gains

China’s March gold output gained 35 percent from the same time last year to 57.6 metric tons, according to a statement from the statistics bureau today. Silver output increased 34 percent to 1,052.6 tons, it said.

(Bloomberg) -- Coeur D’Alene Says Bolivia Silver Mine in Production ‘as Usual’

Coeur D’Alene Mines Corp. said silver production at its San Bartolome mine in Bolivia is under way “as usual” and there is no expropriation of its property rights in the country.

Tony Ebersole, a spokesman for the company, commented today in an e-mailed reponse to questions from Bloomberg News. Bolivian state-owned mining company Comibol may rescind contracts with companies including Coeur D’Alene, La Paz-based newspaper La Razon reported yesterday.

The shares fell $2.45, or 7.3 percent, to $31.31 as of 1:53 p.m. in New York trading. Earlier they dropped as much as 9.7 percent, the biggest intraday decline since May 20, 2010.

(Bloomberg) -- U.S. Mint Says 2011 American Eagle Gold Coin Available April 21

The U.S. Mint will start taking orders for the 2011 American Eagle Gold Proof Coins on April 21, it said in a notice on its website. The coins will come in four sizes ranging from one ounce to a 10th of an ounce, the U.S. Mint said today.

(Bloomberg) -- Belarusian Central Bank Drops Sales of Precious Metals in Rubles

Belarus’s central bank stopped setting prices in rubles for its sales of gold, silver and platinum to companies, individuals and banks, offering the precious metals in dollars, according to the regulator’s website. The bank is continuing to accept rubles on its purchases of precious metals.

(Bloomberg) -- U.K. Royal Mint Gold Output Slips 18%, Silver Output Gains

The U.K.’s Royal Mint, established in the 13th century, said first-quarter gold-coin production slipped 18 percent from the previous three months.

The mint used 28,939 ounces of gold, compared with 35,113 ounces in the fourth quarter of 2010, according to data obtained by Bloomberg News under a Freedom of Information Act request.

Gold advanced to a record $1,478.18 an ounce on April 11 as investors sought to protect their wealth amid concerns inflation will accelerate and as governments debase paper currencies.

The metal for immediate delivery averaged about $1,388 in the first quarter from $1,370 in the prior three months. Gold was at $1,467.07 an ounce by 4:14 p.m. in London. It has risen for 10 straight years, the longest run since at least 1920.

The U.K. mint used 208,468 ounces of silver in the first quarter, up 22 percent on the 170,251 ounces in the prior three months. Silver averaged $31.97 an ounce in the first quarter.

The mint moved to Llantrisant in Wales from London’s Tower Hill in 1968. It makes coins including the 22-carat 2011 U.K. Sovereign Proof, weighing 7.99 grams (0.26 ounce) and costing 375 pounds ($611), the state agency’s website shows.

A 22-carat coin has a 91.6 percent gold content, according to the World Gold Council.

(Bloomberg) -- Royal Canadian Mint Added to LBMA’s Silver Good Delivery List

The Royal Canadian Mint’s refinery was added to the London Bullion Market Association’s “good delivery list” for silver, effective today. The Mint has been on the LBMA’s gold list since about 1919, the LBMA said in a statement today.

(Bloomberg) -- Silver Speculators ‘Gunning’ for 1980 Record: Chart of the Day

Silver prices that doubled in the past year may be headed to a record above $50 an ounce on signs that higher trading costs have failed to deter new buyers, said Matt Zeman, a strategist at Kingsview Financial in Chicago.

The CHART OF THE DAY shows that holdings of New York futures by small speculators doubled since March 2010, even as their minimum deposit, or margin, for a 5,000-ounce contract jumped 74 percent to $8,700. Silver touched $42.21 yesterday, the highest since 1980, the year prices reached a record $50.35 as the Hunt Brothers helped corner the market.

“People are gunning for $50,” said Zeman, who correctly predicted a January slump in gold prices. “The margins aren’t discouraging buying yet. People are still very willing to pony up the money.”

Silver futures for May delivery rose yesterday by $1.427, or 3.5 percent, to close at $41.664 on the Comex in New York, bringing the cost of one contract to $208,320. The metal surged 84 percent last year, second only to cotton among the 19 commodities tracked by the Thomson Reuters/Jefferies CRB Index.

Margins for small speculators, who have less cash available to finance trading than do hedge funds and large investors, may have to rise another 15 percent to $10,000 before “you’re going to see buying interest dry up,” Zeman said. “That’s getting very expensive for a lot of small traders and small speculators.”

For silver’s rally to continue, it must attract new buyers, Zeman said. Prices generally drop on the day that margins are raised because small speculators must put up more money to trade or are forced to sell their positions to cover the margins.

Silver fell 0.9 percent on March 25, the last time margins were raised, halting a five-day rally to $38.18. At the time, the price was the highest in 31 years.

(Irish Times) -– Proinsias O’Mahony: Silver Linings

Oil is not the only commodity that may be ripe for profit-taking. Silver has risen by over 30 per cent in 2011 and more than doubled over the last 12 months.

Having exceeded $40 this week, it’s looking pricey. One ounce of gold now buys about 36 ounces of silver, compared to an average of 62 over the last 10 years. This is the first time since 1983 that the gold-silver ratio has dipped below 40-1. Bulls note that the ratio was higher still in 1980, when silver hit its all-time high of $50.35. However, that was a freak event.

Prices rose eight-fold inside a year after the billionaire Hunt brothers attempted to corner the market by buying up to one-third of the world’s supply.

A change in the exchange’s leverage rules resulted in a price crash, with the brothers losing most of their fortune and eventually being banned from commodity trading.

Silver may yet go higher, of course, but it’s seldom looked so expensive.

Editor's Note: This analysis like many looks at silver purely in terms of price and the recent price increase and in terms of trading and “taking profits”. It fails to consider the all important factor of physical supply (dwindling) and demand (industrial and investment increasing significantly from a low base).

The Hunt Brothers cornering the market was responsible for silver going parabolic in late 1979. However inflation in the 1960s and an oil crisis and stagflation in the 1970s led to safe haven demand and drove silver from $0.91 in 1961 to $1.29/oz in 1967 to $10/oz in the summer of 1979 prior to going parabolic in the final months of 1979.

Also, the article fails to acknowledge that the gold silver ratio throughout most of the 19th Century and throughout most of history was from 12 to 15 to 1.

The opinion is based on assumptions regarding past performance and is thus superficial at best. A little knowledge is a dangerous thing. It also fails to have a historical perspective which is vitally important in these times.

Timing markets and speculation remains high risk and investors would be well advised to continue to own a range of quality assets with allocations to gold and silver. Asset diversification and wealth preservation through ownership of precious metals in the safest way possible has never been more important.

(Dow Jones Marketwatch)-- Gold investing: what to do and how to do it

Investors can still make a lot of money in the gold market — or prevent losing it, if they do their homework before they wade through a sea of investment choices.

Gold has been in a volatile trading environment, to say the least, with prices repeatedly climbing to new heights since 2008, only to lose big chunks of those gains in a single day. Deciding what to do with gold and how to do it has been a challenge even for seasoned investors.

After all, gold investment choices come in many different forms: bars, coins, jewelry, futures and options contracts, exchange-traded funds and gold mining shares.

‘The good news for gold and silver is the ‘mother’ of all bull markets has further to go. The bad news is the opportunity to double or triple one’s money is behind us.’

Peter Grandich, The Grandich Letter

“The good news for gold and silver is the ‘mother’ of all bull markets has further to go,” said Peter Grandich, editor of The Grandich Letter. “The bad news is the opportunity to double or triple one’s money is behind us.”

So what’s an investor to do?

For one thing, don’t rush to sell. If you’re thinking of cashing out, carefully consider your options and have a good reason before you do, say most experts.

“While gold and silver have been relatively volatile in recent weeks, they have remained solid long-term uptrends,” said Brien Lundin, editor of Gold Newsletter. “These uptrends are based on fundamental economic and monetary issues — primarily too much currency floating around the world, the continuance of accommodative monetary policies, and governmental debt concerns so large that they cannot be addressed without higher levels of inflation to eat away at their values.”

That all means the long-term picture looks bullish for both gold and silver, “although the wiggly lines that make up the bigger uptrend will provide better times to buy and sell the metals,” he said.

He wouldn’t recommend that investors sell their core holdings in the metals. He advises investors to “hold some gold and silver bullion as financial ‘insurance’ — a core holding that they shouldn’t trade.”

Getting gold, alternatives into 401(k)

Most 401(k) investors don't have access to gold, commodities and other alternative investments, according to John Ameriks, principal at mutual-fund giant Vanguard Group. Still, he says employees can push for these options. Jonathan Burton reports.

That seems to be great advice, given the mostly upbeat outlook for higher gold prices.

Gold has reached record levels, but it “remains a long way from its real inflation-adjusted high of $2,400 an ounce seen 31 years ago,” said Mark O’Byrne, executive director at international bullion dealer GoldCore. And “whether gold will fall or not, at some stage, is irrelevant if one is buying for portfolio diversification, safe haven and store of value reasons.”

Big decision

So the best way to make the right decision to buy, sell or hold gold is to first fully understand investment goals.

Are you looking at gold as a short- or long-term investment and why?

“Sell out completely if you believe that gold is in a bubble and any slowdown in worldwide economic growth will cause commodity prices, including gold, to tumble as inflationary expectations come down,” said Robert Barone, a partner and portfolio manager at Ancora West Advisors in Reno, Nev. Or “stay completely in (or even add to your holdings) if you believe that the U.S. dollar will continue to get weaker due to inflationary economic policies.”

“If you aren’t sure, take some off the table,” he said. “Sometimes, it is a good idea to take your investment out (or reduce it) and ‘play’ with the house’s money,” and you can do that by selling part of your holdings outright, setting stops underneath the current market price or using options.

That gradual approach may be a good choice.

If you’re not so confident over where gold prices will head next, you can “average in,” said Edmond Bugos, director of mining finance at Strategic Metals Research & Capital.

If you want to buy $100,000 worth of gold, but think gold prices are too high and aren’t sure prices will come down, you can buy $20,000 today, $20,000 in a week and $20,000 in another week and so on, he explained.

“This lowers your risk a little ... and can get you a good average price,” he said. So “averaging in” is “a good way to get your feet wet if you don’t have the patience to wait out the dips and corrections.”

Selling with confidence

But some investors will feel they have no choice other than to sell their gold for some quick, much-needed cash.

“If you need cash, now is the time to take gold off the table,” said Tom O’Brien, chief executive officer of investor educational services provider TFNN.com.

If you do decide to sell, getting a fair price won’t be easy.

“It is imperative that the investor do their homework when selling gold,” said O’Brien, who’s also editor of The Gold Report. “If the investor owns an ETF, or gold company ... they will get fair market value.”

Gold ETFs include the SPDR Gold Trust (CONSOLIDATED:GLD) , ETFS Gold Trust (CONSOLIDATED:SGOL) and iShares Comex Gold Trust (CONSOLIDATED:IAU) . Year to date, all three have gained nearly 4%, close to the rise seen in gold futures prices for the period.

John O’Donnell, chief knowledge officer at the Online Trading Academy, referred to ETFs as “safe,” but said he’d prefer to own coins rather than gold mining shares. “Gold is money. A mine is a business [that] can suffer operating losses.”

Indeed, there’s a lot besides the actual price of gold that may move the stock price for gold mining companies, said Ancora’s Barone, including the company’s financial condition, debt levels, the quality of its management and existing mines, its exploration outlook, environmental issues and taxes.

Year to date, Barrick Gold (NYSE:ABX) , the world’s largest gold producer, has seen its shares climb about 0.5% compared with a nearly 4% rise in gold futures (COMMODITIES:GCM11) .

The real thing

When it comes to physical representations of gold, selling and buying become trickier.

Selling an ETF is as simple as calling a broker. But “a little more research may be warranted if you have a coin,” said Mike Savage, a chartered financial consultant and founder of Savage Financial Group in East Stroudsburg, Pa. “There are many different values for the same coin based on the condition and scarcity of the coin. While buying and selling coins, the person with the most knowledge will usually win the negotiation.”

A coin dealer has overhead and needs to make a profit, according to Barone, so investors would need to “pay anywhere from a 3% to a 20% (or more) premium to buy and suffer a similar discount when selling.”

David Beahm, a vice president at precious-metals retailer Blanchard & Co., says gold and silver bullion coins are “sold for only a small margin above the spot price.”

Some dealers, however, advertise new bullion products as numismatic investments — in other words, they have special value to collectors — and so charge a much higher premium than is typically charged for a bullion product, he said.

“The reality is that these new mint products should have a value that correlates close to their precious metal content.” Read more about gold investment basics.

Melt value

Meanwhile, with gold prices at historic highs, consumers are starting to look at their old jewelry as a source of cash.

Cash4Gold, an Okinawa, Fla.-based mail-in refinery that buys precious metals directly from consumers, has become a popular, sometimes criticized, means for consumers to monetize unwanted jewelry.

A company spokesperson said Cash4Gold “bases its offers to consumers on daily gold prices, the quality of gold being offered and the quantity,” and consumers have 12 days from the date on the check to accept its offer or request their items back, promptly returned, insured and free of charge. Read more about selling jewelry.

Gold Newsletter’s Lundin said consumers should not be tempted to simply cash the check they get from mail-in services, but take their time and “check with a number of local dealers” to get the best price.

When it comes to selling that old jewelry for its gold, TFNN.com’s O’Brien said the client should be getting about 80% of the melt value.

“The majority of dealers give way below that level because the public just doesn’t understand what they have is valuable,” he said. But “a very small amount of gold is worth big dollars. It doesn’t matter what shape it’s in.”

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.