Investors Unaware of Significance of Currency Market Events, No Faith and Credit

Stock-Markets / Financial Markets 2011 Apr 14, 2011 - 01:37 PM GMTBy: Anthony_J_Stills

"I know that most men, including those at ease with problems of the greatest complexity, can seldom accept even the simplest and most obvious truth if it be such as would oblige them to admit the falsity of conclusions which they have delighted in explaining to colleagues, which they have proudly taught to others, and which they have woven, thread by thread, into the fabric of their lives." ~ Tolstoy

"I know that most men, including those at ease with problems of the greatest complexity, can seldom accept even the simplest and most obvious truth if it be such as would oblige them to admit the falsity of conclusions which they have delighted in explaining to colleagues, which they have proudly taught to others, and which they have woven, thread by thread, into the fabric of their lives." ~ Tolstoy

A lot of investors do not realize the significance of what is going on in the foreign exchange markets and that is because they don't realize the importance of a currency. Most people think of their government as some distant, faceless entity that has always been there and will always be there, and that is especially true in the United States. The US has enjoyed a "special status" for six decades because many viewed it as the world's moral compass and installed the greenback as the world's reserve currency. Those living in the US view the dollar as something that has always been around and will always be around and they prefer to believe that the government will somehow "work things out".

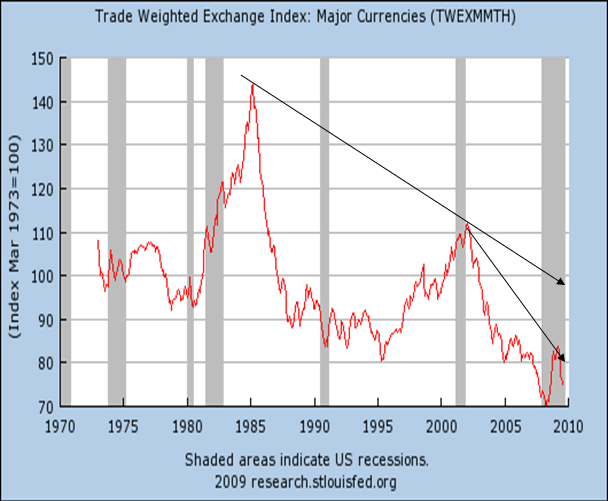

The truth of the matter is almost always different from the outward appearance, and that holds true with the US dollar as well. The US dollar is actually nothing more and nothing less than the common stock in a country, and the value of the currency will rise and fall according to the people's perception as to how that country is being run. With that thought in mind, take a look at this chart:

This is an historical chart of the US Dollar Index, the US dollar as valued against a basket of other currencies, and it has been on the decline since 1985! What's more that decline is increasing in speed and approaching the all-time low. So strip away all the rhetoric coming out of Washington and Wall Street and you can see that confidence in the US to do the right thing is all but a fading memory.

History shows us that a country is only as strong as its currency and once the currency begins to go down that slippery slope to fiat oblivion, the country is sure to follow:

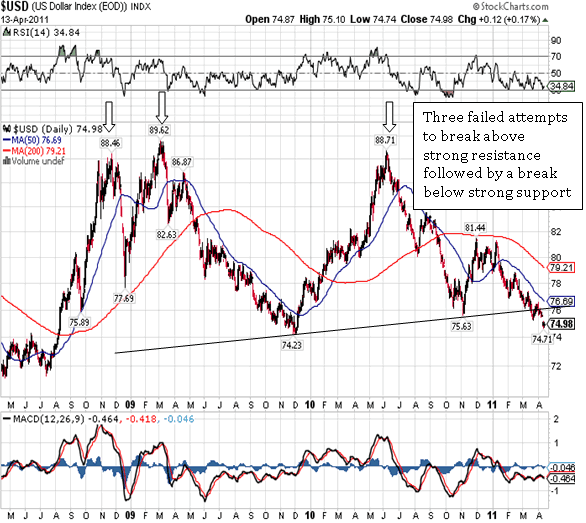

The realization that the United States is an empire in decline set in after three failed attempts to push through strong Fibonacci resistance at 89.97, a process that took two years to play out. An exclamation point was put after that realization when the greenback recently fell and stayed below a trend line connecting the last two major lows. Now the only thing standing between the dollar and its all-time low at 70.70 is modest Fibonacci support at 73.06 and it won't stem the tide for very long.

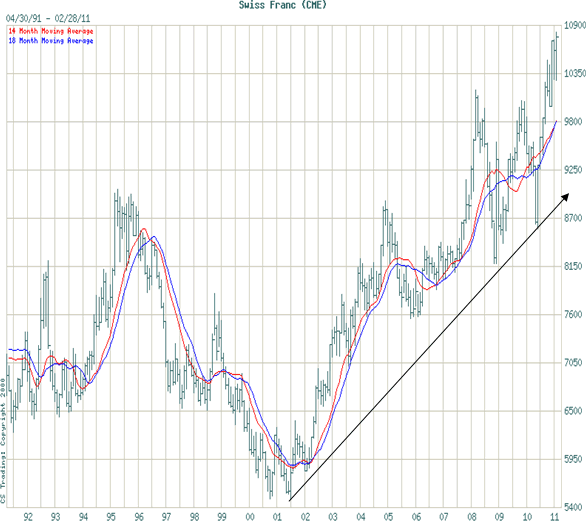

The depth of the problem can be measured by looking at where the money is flowing too. We know investor capital is moving out of the dollar but we need to you the other half of the puzzle. It isn't going into the Yen and it is buying Euros slowly and without any great conviction. Instead it is moving into the Swiss Franc:

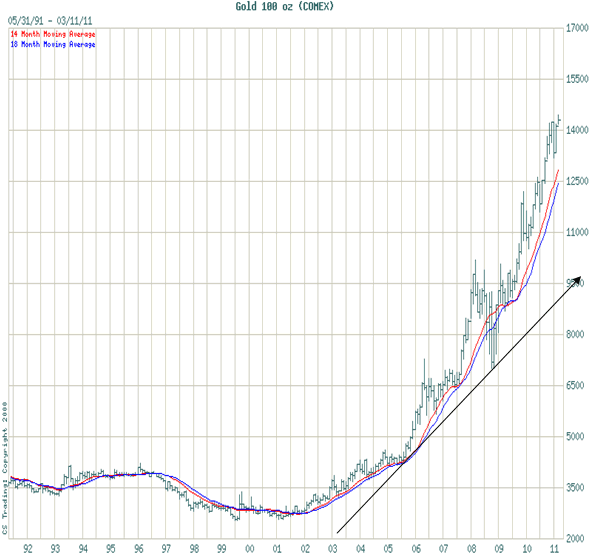

and it is moving into gold:

Strangely enough both of these moves began around the year 2000 and both of these moves have been relentless and with little or no interest on the part of the general public.

The move into the Franc and gold has been the quietest bull market in history and the little commentary I read and hear is almost always negative. What's more the move out of the dollar is unrecognized by the Fed and the Department of the Treasury who insist that the US has a "strong dollar policy". They are either very stupid or they are liars, and it's such a big lie that Joseph Goebbels must be smiling in his tomb.

I'm not going to go into all the reasons why the government would lie, it would all be subjective anyway, but I will say that the lie is designed to keep Americans in the dark. The government does not want you to know that you have alternatives to the dollar, it doesn't want you to know that the debt will never be paid, and it doesn't want you to know that your standard of living is about to suffer a significant reduction. That's why Fed Chairman Bernanke can go on record as saying that the American people do not have a need to know. If they knew the truth the American people would march on Washington and some of these politicians would suffer a fate similar to Mussolini. The messages from gold and the Swiss Franc are very clear for anyone willing to look at a chart. The problems are serious, they are here under our nose, and if swift action is not taken they will destroy the American way of life.

Anthony J Stills Steve Betts

as@theablespeculator.com sb@theablespeculator.com

© 2011 Copyright Anthony J. Stills - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.