Euro Falls against Gold and Particularly Silver as Greek 10-Year Yield Surges Over 13.2%

Commodities / Gold and Silver 2011 Apr 14, 2011 - 08:39 AM GMTBy: GoldCore

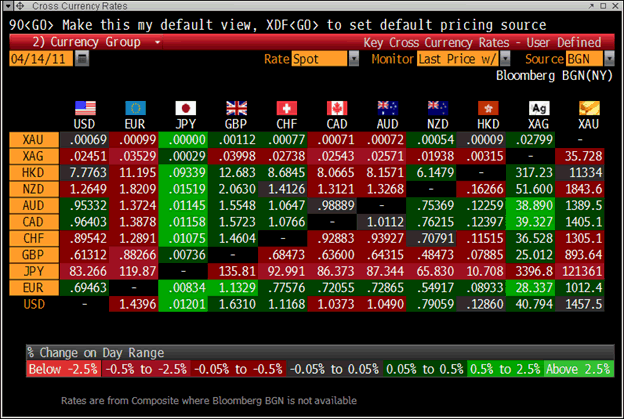

Gold is tentatively higher against the euro but mixed against other currencies, while silver is higher again in most currencies. Both probed upward this morning and are exhibiting signs that they may push higher prior to a much anticipated correction.

Gold is tentatively higher against the euro but mixed against other currencies, while silver is higher again in most currencies. Both probed upward this morning and are exhibiting signs that they may push higher prior to a much anticipated correction.

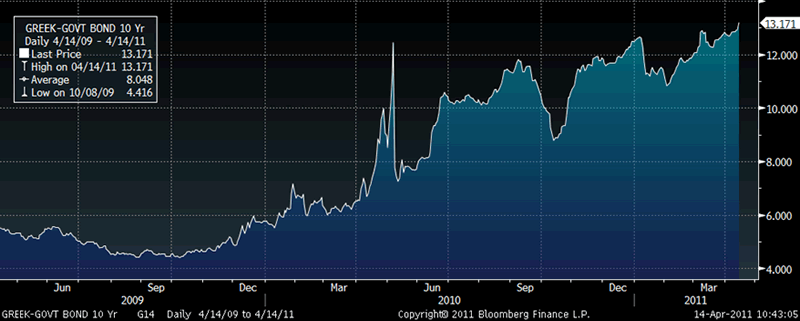

The Greek 10-year yield has just surged over 13.2% and this is leading to falls in the euro and risk aversion with equities, commodities and oil falling.

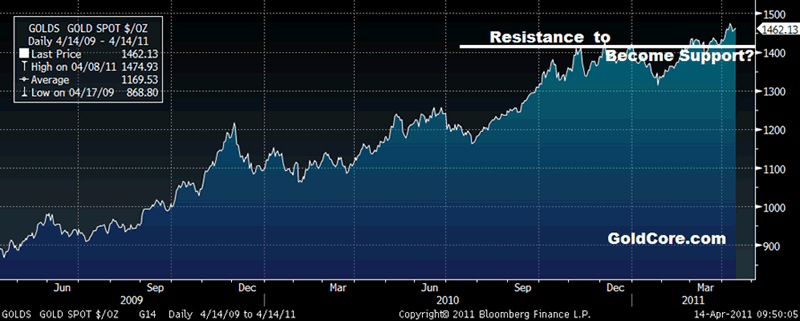

Both gold and silver are less than 2% from their record nominal highs seen Monday (gold all time and silver 31-year) and are remaining firm due to concerns about the US dollar, the euro and sovereign debt issues in Europe.

While markets are not focusing on geopolitical risk in Africa and the Middle East and the Japanese natural and nuclear disasters, these problems remain and will lead to continuing safe haven demand.

Resistance in gold is at Monday’s record nominal high at $1,478.20/oz and the psychological level of $1,500/oz.

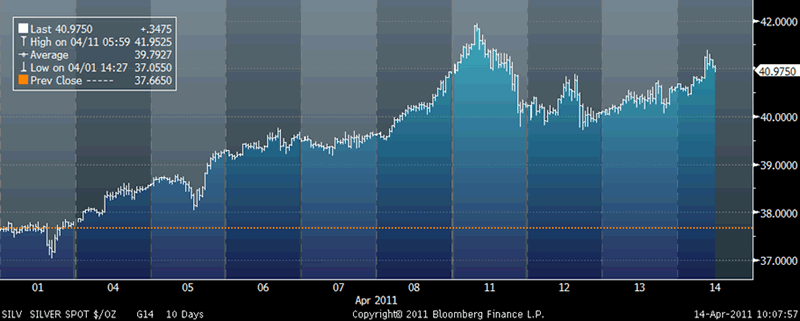

Silver’s resistance is at Monday’s multiyear nominal high at $41.95/oz. In normal circumstances profit taking would be expected near $42/oz but this is anything but a normal market due to the existence of massive concentrated short positions being investigated by the CFTC.

A short squeeze may be underway with longs buying all dips in order to punish the shorts and force them to buy back their short positions thereby propelling the price much higher.

The dollar’s fall suggests that markets are skeptical of Obama’s latest budget proposal to cut $4 trillion off the massive US budget deficit. The US fiscal situation continues to deteriorate week on week and month on month which could potentially lead to sharp falls in the dollar in the coming weeks.

Eurozone debt markets are under pressure again this morning with Greek 10-year bonds surging to a lifetime record high of 13.2%. Greece appears to be heading towards sovereign default despite the usual denials. Greece’s debt has become unsustainable, only a year after it was granted the biggest bailout in history. Debt levels in Ireland, Portugal and Spain also look increasingly unsustainable.

GFMS’ prediction of gold rising to $1,600/oz and an average price of $1,455/oz in 2011 (today’s current price) was reported in much of the financial press but as usual ignored by most of the non-specialist financial media.

GFMS are bullish on gold in 2011 and into 2012 particularly due to investment and monetary demand. This demand looks set to continue and they identify rising inflation and US sovereign debt risk as a threat with America's AAA status more likely than not to be questioned in H2 2011.

GFMS say that global mining supply has increased primarily due to another significant jump in Chinese gold production - up 8% to 350.9 tonnes from 324 tonnes.

The increase in Chinese gold production in recent years has been very large, to the degree, that some analysts have questioned their production figures. Mine supply from other major producers continues to be flat or fall as seen in South Africa and Russia production figures.

Gold

Gold is trading at $1,455.40/oz, €1,011.40/oz and £891.68/oz.

Silver

Silver is trading at $40.61/oz, €27.87/oz and £24.89/oz.

Platinum Group Metals

Platinum is trading at $1,766.50/oz, palladium at $757/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- Portuguese, Greek Bonds Fall as Dollar Weakens, Silver Rallies

Bonds of Europe’s most-indebted nations fell, driving Portuguese and Greek yields to records, on concern countries will reschedule debt. The Dollar Index sank to a 16-month low, silver rose and European stocks retreated.

Portugal’s five-year yields climbed to 10.43 percent as of 10:20 a.m. in London, while the Greek 10-year yield rose above 13 percent for the first time since at least 1998. Credit swaps on Greece signaled a 60 percent chance of a default within five years. The Dollar Index slid 0.3 percent, and the yen gained against its 16 major peers. Silver jumped 1.2 percent and copper lost 0.5 percent. The Stoxx Europe 600 Index sank 0.3 percent and Standard & Poor’s 500 Index futures declined 0.2 percent.

Bondholders may see a 50 percent to 70 percent “haircut” on their Greek securities if the nation restructures its debt, said Moritz Kraemer, head of S&P’s European debt evaluation team. Inflation accelerated in the U.S. and China, Bloomberg surveys of economists showed before reports tomorrow. Singapore said it will allow a stronger currency to curb inflation, and the European Central Bank’s Axel Weber said higher interest rates may be needed if economic forecasts are met.

“That Greece may have no other alternative but to restructure in order to get itself back on the sustainable debt path is probably the worst kept secret,” said Greg Venizelos, a credit strategist at BNP Paribas SA in London.

The extra yield investors demand to hold Portuguese 10-year bonds instead of benchmark German bunds widened to a euro-era record 545 basis points, with the Greek-German spread increased 15 basis points. Yields on Spanish 10-year debt jumped eight basis points, with Irish yields nine basis points higher. The yield on the bund slipped two basis points.

Yen, Pound

The yen strengthened 0.5 percent versus the euro and 0.7 percent against the dollar. The pound advanced 0.4 percent against the dollar and appreciated 0.2 percent versus the euro as a Nationwide Building Society report showed U.K. consumer confidence rose in March from a record low as Britons grew more optimistic about the outlook for the economy and spending.

Three stocks fell for every two that gained in the Stoxx 600. Banca Popolare di Milano Scarl lost 1.9 percent, leading a decline in banks, as two people familiar with the situation said Italy’s oldest cooperative lender will consider a rights offer after the central bank asked it to boost capital. Reckitt Benckiser Group Plc plunged 7.5 percent after saying Chief Executive Officer Bart Becht will step down.

Jobless Claims

The decline in S&P 500 futures indicated the U.S. equity gauge will fall for the fifth time in six days. Reports today may show the number of people filing first-time claims for unemployment insurance was little changed at 380,000 last week while producer prices increased 1 percent in March, according to Bloomberg surveys of economists.

China’s Shanghai Composite Index dropped 0.3 percent before government reports tomorrow that may show inflation accelerated at the fastest pace since July 2008 and economic growth slowed, according to Bloomberg surveys of economists.

Russia’s Micex Index retreated 0.9 percent as mining companies including OAO GMK Norilsk Nickel sank on lower copper and nickel prices. Copper fell for a fourth day, the longest losing streak since February, and nickel slipped for a third day in London.

Silver climbed to $41.125 an ounce, near the 31-year high of $41.9525 on April 11, and gold jumped 0.4 percent to $1,462.75 an ounce. Crude oil increased 0.2 percent to $107.34 a barrel.

(Bloomberg) -- HSBC Asset Management Increases Gold Holdings to 6% From 3%

HSBC Global Asset Management said it increased its gold holdings to 6 percent from 3 percent at the beginning of this quarter.

Gold priced at $2,600 an ounce is a “reasonable fair value target,” HSBC’s Charles Morris, head of the company’s Absolute Return fund, said in a report.

(Bloomberg) -- Russia’s Gold Production Beats South Africa’s Output, GFMS Says

Russia overtook South Africa as the fourth-biggest gold producer last year even as output declined, said researcher GFMS Ltd. China’s production gained.

Russia’s mine supply declined to 203.4 metric tons from 205.2 tons in 2009, the London-based researcher said in a report published today. Output from South Africa, now the fifth-biggest producer, slipped to 203.3 tons from 219.8 tons, GFMS said.

Mine supply from China, the biggest producer, increased to 350.9 tons from 324 tons, GFMS said. Australia was second- largest at 260.9 tons followed by the U.S. with an output of 233.9 tons, the researcher said.

(Bloomberg) -- South African February Gold Production Fell 2.3% From Year Ago

South African gold production fell 2.3 percent in February from a year earlier, Jean-Pierre Terblanche, a spokesman for Statistics South Africa, said by phone from Pretoria today.

(FT) -- Indian investors take a shine to silver

Indian investors, long known for their enthusiasm for gold, are ditching bullion for silver as they expect it to generate higher returns than the yellow metal, the country’s main industry body said.

The Bombay Bullion Association’s head said that investors were buying more silver than ever, underpinning prices in India that are already at record highs.

“The type of demand for silver that we have experienced in the last few months has never been seen before,” Prithviraj Kothari, president of the BBA, said. “Demand has gone up 25 per cent compared to a year ago as people are going crazy for silver because they think it will give them better returns than gold.”

In 2010 India consumed about 2,800 tonnes of silver, this year’s consumption is expected to rise to 4,000 tonnes, according to the BBA. Silver prices in Mumbai, India’s main trading hub for precious metals, hit an all-time high of Rs60,125 a kilogram ($1,364) on Friday, more than double year-ago levels. Global silver prices rose to more than $40 a troy ounce for the first time since 1980 at the end of last week.

India silver imports increased nearly sixfold last year, according to Bloomberg, as wholesale buyers boosted their stocks while the price of the metal was trading at half its current level. Since February imports have moderated as traders wait for a correction in the market.

Historically, silver was bought in India’s poor rural areas, which account for 70 per cent of the country’s 1.2bn population. However, since January a growing number of urban middle-class investors have also started hoarding silver. Anjani Sinha, chief executive of National Spot Exchange, said that since the start of the year it has been opening 3,000-4,000 new silver accounts every month.

Bharagava Vaidya, a precious metals trader in Mumbai, said that Indian investors started switching from gold to silver about a year ago when prices for the grey metal were particularly low relative to bullion.

“Demand spiked in an absolutely unprecedented manner,” said Mr Vaidya.

The price of the grey metal globally has been rallying since February when pro-democracy protests and social unrest throughout the Middle East that toppled regimes in Tunisia and then Egypt sent investors scrambling for havens.

But traders warned that, although India’s demand for silver was expected to remain strong in the long term, the country’s love affair with gold was far from over, especially once the festival season started next month.

Mr Vaidya said: “During the Akshaya Tritiya festival [May 6] many people will buy gold...it might be less of an investment-driven decision and more of religious one.”

For India’s Hindu-majority population, Akshaya Tritiya is a holy day during which devotees pray, fast and buy gold believing that it brings good fortune. Some dealers said that closer to Akshaya Tritya silver holders might contemplate cashing in on the extraordinary gains of the grey metal to get back into bullion.

(FT) -- Gold forecast to reach $1,600 level

The rally in gold prices has further to run, says a leading precious metals consultancy, which predicts waves of investor buying will take gold prices to as much as $1,600 a troy ounce by the end of the year.

GFMS, the London-based consultancy that compiles benchmark statistics for gold, said on Wednesday in its bi-annual “gold survey” that fears that the market was approaching a turning point were premature. “In terms of gold fundamentals, there is a strong case for arguing that the glass is, at least, ‘half full’,” it said.

Investors have become nervous that prices are nearing a peak, triggering some selling. But rising concerns about inflation, as oil and other commodities prices surge, the eurozone debt crisis and unrest in the Middle East have helped to underpin further price gains.

Gold prices hit a nominal all-time high of $1,476.21 an ounce on Monday, up 28.4 per cent over the last year. However, in real terms, adjusted by inflation, gold remains well below the peak set in 1980 of more than $2,300 an ounce.

Philip Klapwijk, GFMS chairman, said the prospects for gold remained bright and forecast an average price for 2011 of $1,455 an ounce. “Investors continue to be concerned about the outlook for inflation, with governments in general showing little appetite to tighten monetary policy significantly,” he said.

Mr Klapwijk said that mounting debt problems in the US and a stalemate to cut the budget could benefit gold later in the year and in 2012. As well as investor demand, GFMS said that consumption should hold up as official sector purchases continued and became more substantial, with solid gains in electronics countering a slight drop in jewellery demand.

The official sector, a group that includes central banks and sovereign wealth funds, bought 73 tonnes of gold on a net basis, a “remarkable change of direction for a market that has been used to absorbing substantial volumes of gold sold by central banks over the last two decades,” the consultancy said.

GFMS estimated that central banks had not been net buyers of gold since 1988. It said the official sector’s sales accounted for about 16 per cent of global supply per year from 1989 to 2009. The consultancy expected another strong year of official sector buying, potentially rising to 100 tonnes and setting a new 22-year peak.

The consultancy warned that supply was set to grow by a large amount on the back of gains from both mine production and scrap this year, tempering the bullish influence of increased demand. Mine output increased nearly 4 per cent last year to 2,689 tonnes, surpassing the production peak of 2,646 tonnes set in 2001.

“A second year of strong production confirms that, after years of falling output, mine production is now responding positively to rising gold prices,” GFMS said.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.