Corporate Earnings Projections, Stock Market Support, and Resistance

Stock-Markets / Stock Markets 2011 Apr 11, 2011 - 09:09 AM GMTBy: Chris_Ciovacco

Earnings season kicks off in full force today with Alcoa Inc. (AA), the biggest U.S. aluminum producer, scheduled to announce first-quarter earnings after the market close today. Alcoa is the first member of the Dow Jones Industrial Average to report.

Earnings season kicks off in full force today with Alcoa Inc. (AA), the biggest U.S. aluminum producer, scheduled to announce first-quarter earnings after the market close today. Alcoa is the first member of the Dow Jones Industrial Average to report.

While it may not feel that way on Main Street and in the housing sector, earnings at public companies are healthy. According to Bloomberg:

- Corporate profits probably rose to a record last quarter.

- Earnings for Standard & Poor’s 500 Index companies probably gained 12 percent in the three months ended March 31, from a year earlier, according to analysts’ estimates.

- Profits of Stoxx Europe 600 Index companies likely increased 21 percent.

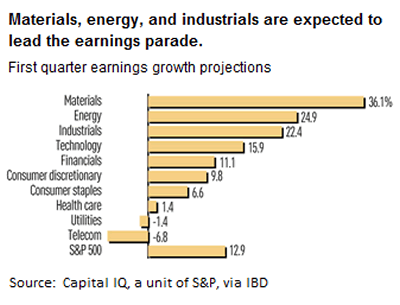

We mentioned back on March 21 that materials, energy, and industrials were well positioned. Not surprisingly, they are projected to report strong earnings growth (see below). We continue to have a tentative bullish outlook. We still like mid-caps.

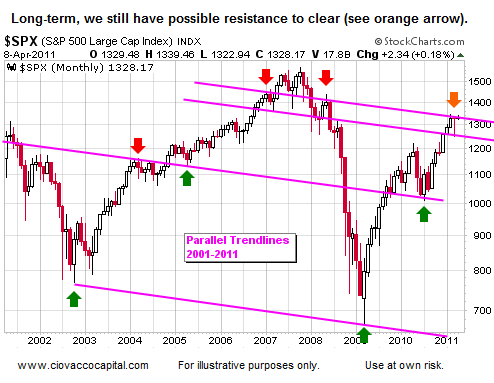

The markets have been treading water waiting for earnings – stocks have stalled near a logical point (see below).

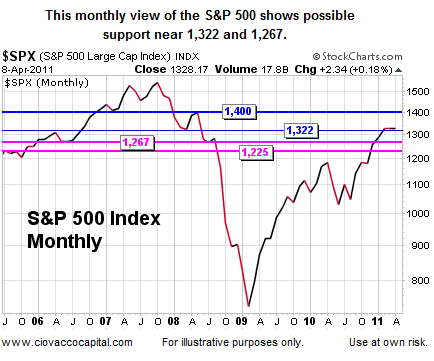

Stocks have also held at a logical point near the thin blue line below (monthly chart).

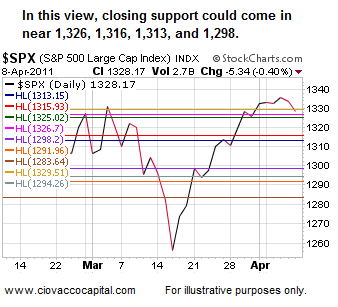

Buyers have been less enthusiastic in recent sessions and momentum has slowed considerably in the short-term. If we pull back, the next areas of basic support are shown below.

A little more noisy view of the S&P 500 shows three key areas to watch on the downside. We would tend to exercise some patience as long as the levels shown below hold.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.