Silver New Record High, Speculative Sentiment Remains Tame

Commodities / Gold and Silver 2011 Apr 11, 2011 - 08:46 AM GMTBy: GoldCore

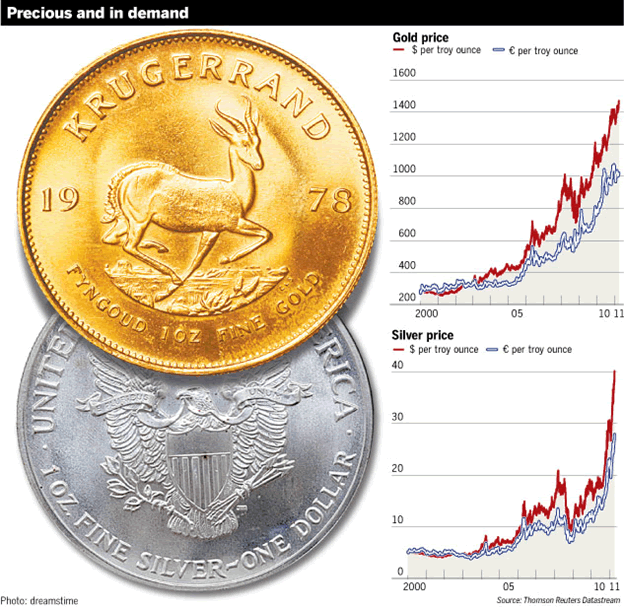

Gold and silver rose to new record nominal highs (all time and 31-year respectively) in Asian trading overnight. Both have given up earlier gains with profit taking being cited. Cash silver surged nearly 3% in Asia to $41.9525 an ounce, a new 31 year high, before trading at $41.31 an ounce.

Gold and silver rose to new record nominal highs (all time and 31-year respectively) in Asian trading overnight. Both have given up earlier gains with profit taking being cited. Cash silver surged nearly 3% in Asia to $41.9525 an ounce, a new 31 year high, before trading at $41.31 an ounce.

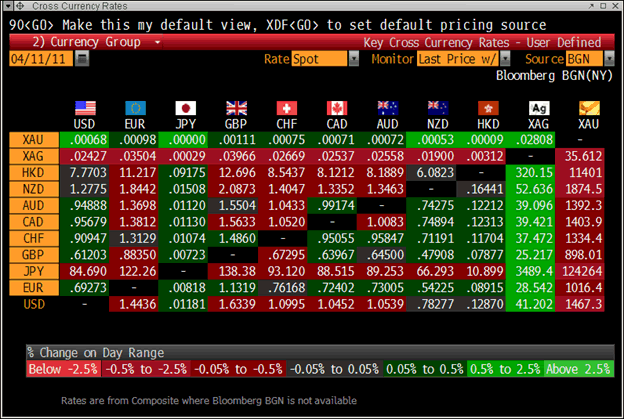

Cross-Currency Rates at 1315 GMT

Silver’s nearly 3% surge in trading in Asia may indicate that the long expected short squeeze may be underway. Bullion banks with very large concentrated short positions may be being forced to buy back their short positions - propelling silver higher.

This could shortly see silver surge over the record nominal high of $50.35/oz.

At the same time caution is merited as silver has risen nearly 10% in April so far and over 33% year to date. Speculators need to be very cautious as margin requirements may be increased again and profit taking could lead to sharp falls in price. Leveraged speculation is extremely high risk and should be avoided by investors and savers.

Those looking to buy bullion coins, bars and certificates need to focus on the long term and remember that they are buying financial insurance and not to make a profit or a return. Dollar, euro and pound cost averaging into silver is worth considering given silver’s recent sharp rise in price.

While silver is overvalued in the short term, the concentrated short positions and the strong fundamentals could propel it much higher sooner than most expect.

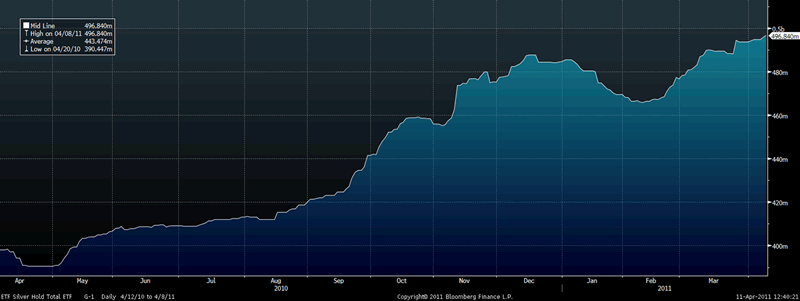

Total Silver ETF Holdings

Continuing talk of speculative fever or frenzy is hyperbole. Bullion dealers internationally are busy. However, it is important to note that buying has not increased massively and is around levels seen after the collapse of Bear Stearns and Lehman Brothers and at the higher of the first phase of the sovereign debt crisis. Some dealers have been talking up sales in an effort to raise profile.

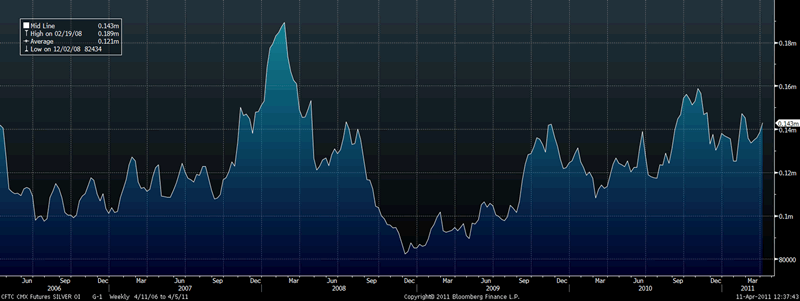

Proof of the lack of animal spirits in the silver market is seen in the data which shows that speculative sentiment on the COMEX (as seen in the Commitment of Traders/ COT data - see chart below) is subdued. While the total silver ETF holdings increased to a record, they are not far above the levels seen in December 2010 (see chart above).

Importantly, even at $41.30/oz the dollar value of the total silver ETF holdings remains very small at just over $20.5 billion.

To put that number in perspective, today bankers put a prospective value of around $60 billion on Glencore, one of the world’s largest commodity trading companies. BP has set up a fund worth $20 billion to cover legal claims from the oil spill disaster.

Apple (AAPL) has an enormous market capitalisation of $311.43 billion and Google $186 billion suggesting that the real frenzy and bubble may again be in the tech sector and on the Nasdaq.

The global forex market turnover averages some $3.9 trillion per day. The NYSE's turnover is $35 billion per day and the US Treasuries turnover is $400 billion per day

Allocations to silver are tiny and silver remains the preserve of a very small amount of investors internationally.

This is slowly changing but investment demand for silver is increasing from a near zero-base and is miniscule compared to allocations in equity, bond and derivative markets.

CFTC CEI Silver Total Open Interest/Futures - 5-Year Daily

The macroeconomic and geopolitical fundamentals remain very bullish with many unresolved issues in the world - including in the Middle East and Africa, the Japanese natural and nuclear disasters and sovereign debt risk in the EU and the US.

While a US federal shutdown was averted, the problems experienced are an indication that the US is not immune to the sovereign debt problems being seen in the eurozone.

The economic aftershocks of the natural disaster and subsequent nuclear disaster continue to reverberate. A growing appreciation of the risks posed by ‘black swans’ is leading to financial insurance and safe haven demand for gold and silver.

Gold

Gold is trading at $1,467.57/oz, €1,017.31/oz and £897.32/oz.

Silver

Silver is trading at $41.13/oz, €28.51/oz and £25.15/oz.

Platinum Group Metals

Platinum is trading at $1,796.50/oz, palladium at $790/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- UBS Increases One-Month Gold Forecast to $1,500 an Ounce

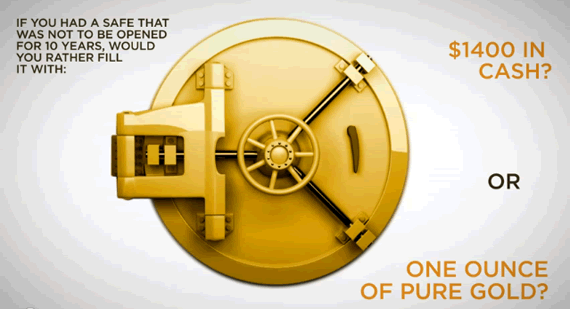

UBS AG raised its one-month gold forecast to $1,500 an ounce, from $1,450, analyst Edel Tully said today in an e-mailed report to clients. The bank maintained its three-month forecast for gold at $1,400.

(Bloomberg) -- IMF Says Gold Sale Windfall Profits $2.79 Billion

The International Monetary Fund said today it was considering three options for the use of $2.79 billion in gold sale windfall profits. The windfall profits “resulted from the higher-than-anticipated average gold sales price,” the IMF said in a statement in Washington.

(Bloomberg) -- IMF Has $2.79 Billion Windfall Profit on Gold Sale, Debates Use

The International Monetary Fund started discussions on how to allocate $2.79 billion of windfall profit from gold sales, considering three options.

The gold sales, which were initiated in October 2009 and ended in December 2010, generated more profit than expected because of higher than anticipated gold prices, the IMF said.

The institution agreed in September 2009 to dispose of 403.3 metric tons of bullion as part of a plan to shore up its finances and lend at reduced rates to low-income countries. More than half of the gold amount was acquired by the central banks of India, Mauritius, Sri Lanka and Bangladesh, according to past announcements.

Many executive directors on the IMF board supported using the extra profit for lending at lower rates, the IMF said. Many also backed putting it toward the fund’s precautionary balances or putting it in the endowment, where most of the profit is already going to go, it said.

(Dow Jones)-- Gold, Silver Hit New Records In Asian Trade

Base metals surged in Asian trade Monday, with gold and silver chalking up new long-term highs while platinum edged closer to its highest level since the global financial crisis.

Spot gold eked out a new record of $1,476.37 a troy ounce in the first hour of usual trade around 2200 GMT, before falling back later in the day, while silver rose 2.6% to a fresh record of $41.96/oz. Platinum and palladium also touched their highest levels in a month.

Nigel Phelan, Asia Director for ETF Securities, a provider of exchange-traded commodity funds, said that he was seeing no evidence of investor interest in precious metals flagging at current elevated prices.

Gold is at an all-time high while silver is at its highest since 1980, when the Hunt brothers caused an immense spike in prices with an attempt to corner the global market in the metal.

"The inflationary trade is definitely back on now with rates on the rise," Phelan said. The European Central Bank last week raised interest rates for the first time since it completed a round of cuts following the global financial crisis in 2009, while the People's Bank of China continued a trend of tightening monetary policy that has been in place since the start of the year.

But rising interest rates are a double-edged sword for precious metals. While they may be seen as a signal that policy makers are concerned about inflation, they also raise the cost of holding commodities and are a signal of increased expectations of economic growth. Precious metals are frequently bought as a hedge against sluggish economic performance and market volatility.

However, Phelan said investors were still enthusiastic. "There's a huge amount of money in the markets and flowing into commodities generally," he said.

In a note Friday, Barclays Capital said that holdings in gold ETFs rose by 19.9 tons Thursday, the highest daily inflow since January, while silver holdings rose to a fresh record high.

At 0630 GMT, spot gold was down $2.40 from its late New York level at $1,472.60/oz. Silver rose 66 cents to $41.59/oz, platinum dropped $3 to $1,806/oz and palladium gained $5 to $800/oz.

An annual survey of the silver market by The Silver Institute, a global industry body, last week reported that demand for jewellery and industrial uses rose by 12.8% to a 10-year high and would continue to rise this year, while mine production climbed only 2.5%.

(Bloomberg) -- Cash Silver Gains as Much as 2.5 Percent to $41.9425 An Ounce

Silver for immediate delivery advanced as much as 2.5 percent to $41.9425 an ounce in Singapore, the highest level since 1980.

(Bloomberg) -- Silver Futures in India Advance to a Record on MCX Exchange

Silver futures in India advanced as much as 1.1 percent to a record 61,128 rupees per kilogram. May-delivery futures on the Multi Commodity Exchange of India Ltd. traded at 61,025 rupees at 10:04 a.m. in Mumbai. The metal has more than doubled in the last year in India.

(Bloomberg) -- Egypt’s Trade Ministry Says Lifts Ban on Gold Exports

Egypt’s Trade Ministry lifted a ban on gold exports that was supposed to be enforced until June 30, the Cairo-based ministry said today.

The move came after the North African country’s bourse and economic and political conditions “stabilized”, Trade and Industry Minister Samir El- Sayyad said in the e-mailed statement.

(Bloomberg) -- Silver Beating Gold as World Economy Rebounds: Chart of the Day

Silver, where half of the world’s consumption is from industry, offers better returns than gold because it benefits from a rebounding global economy as well as demand for a haven, according to UBS AG.

The CHART OF THE DAY tracks assets of the two metals held in exchange-traded products, showing silver stockpiling outpaced gold since February. Silver climbed to its most expensive level versus gold since 1983 and is the second-best performer in the UBS Bloomberg CMCI Index in the past year behind cotton.

“It’s principally driven by investment,” Peter Hickson, global basic materials and commodities strategist with UBS in Hong Kong, said in an interview. “Many investors are looking for silver to test $50. Certainly, there’s an argument that the current momentum is likely to continue.”

Silver for immediate delivery has more than doubled over the past year, reaching $41.5238 an ounce today, the highest since 1980 when it climbed to a record $49.45. Cash gold gained 27 percent in the past 12 months to $1,473 an ounce as of 11:34 a.m. in Singapore after touching an all-time high of $1,478.18.

An ounce of gold bought 35.5 ounces of silver compared with an average of 62 in the past 10 years.

Holdings in exchange-traded products backed by silver climbed to 15,453.45 metric tons through April 8, the highest level since at least February 2010, according to data compiled by Bloomberg from four providers. Gold assets advanced to 2,049 tons as of April 8 from 2,028 a week earlier and compared with a record 2,114.6 tons on Dec. 20, data from 10 providers show.

Industrial applications such as electrical switches and batteries represented 50.3 percent of silver demand in 2008, compared with 40 percent five years earlier and 51 percent in 2007, according to The Silver Institute.

(Bloomberg) -- Commodities Advance for Eighth Day as Investors Seek Haven

Commodities climbed for an eighth day, the longest winning streak since November, as investors sought a haven from fighting in Libya and unrest in the Middle East, pushing gold to a record and silver to a 31-year high.

The Standard & Poor’s GSCI Spot Index of 24 commodity futures advanced as much as 0.3 percent to 762.22, the highest level since August 2008, and was at 760.47 as of 3:32 p.m. Singapore time. Crude oil, corn and lead gained to the most expensive since 2008.

“Commodities across the board are rallying, aggravating the inflation outlook,” said Chae Un Soo, a Seoul-based trader at KEB Futures Co. The S&P GSCI gauge advanced 20 percent this year, beating a 5.6 percent increase in the MSCI World Index of equities as U.S. Treasuries declined 0.6 percent.

Inflation in China, the top user of metals and energy probably accelerated to 5.2 percent in March, exceeding the government’s 2011 target of 4 percent for a third month, according to the median estimate in a Bloomberg News survey. The

National Bureau of Statistics will release the data on April 15. The People’s Bank of China raised interest rates four times and boosted banks’ reserve-requirement ratios six times since the third quarter. China’s inflation is “somewhat out of control,” investor billionaire George Soros said yesterday at a conference in Bretton Woods, New Hampshire.

The Dollar Index, which gauges the greenback’s value against six major currencies, fell 0.2 percent today, extending two weekly declines. Commodities normally move counter to the U.S. currency. The GSCI index jumped 40 percent in the past year as the dollar gauge dropped 7 percent.

Crude, Gold

Crude for May delivery gained as much as 0.6 percent to $113.46 a barrel in New York and traded at $112.46.

After almost two months of fighting, troops loyal to Muammar Qaddafi and rebels in the North African country, Africa’s largest oil exporter, have fought to a stalemate, with battles moving back and forth in a small area along the coast, and neither side able to take or hold territory for long. Qaddafi has vowed not to leave Libya, and a cease-fire that would keep him in power has been flatly rejected by rebels.

Gold for immediate delivery gained as much as 0.2 percent to $1,478.18 an ounce, the highest ever, and traded at $1,474.28. Cash silver jumped as much as 2.5 percent to $41.9525 an ounce, the highest level since 1980.

Copper, Corn

“We would view markets moving into bubble territory when prices move above $2,000 and $50 an ounce,” Xiao Fu and Adam Sieminski, analysts at Deutsche Bank AG said in a report today.

Copper for delivery in three months gained as much as 0.7 percent to $9,944.75 a metric ton on the London Metal Exchange. That compares with the record $10,190 on Feb. 15. Tin jumped to an all-time high of $33,600 a ton and lead gained to $2,904.

Imports of copper and products into China, the largest user, jumped 29 percent in March to 304,299 tons, climbing from a two- year low of 235,469 tons in February, according to customs data.

Shipments fell 33 percent from the same month last year. “Imports rebounded strongly from February and this adds to positive sentiment,” Wang Jingjing, an analyst at Founder Futures Co., said from Hunan. “A large part of recent gains has actually been driven by investors looking for an alternative to the U.S. dollar.”

May-delivery corn gained as much as 1.9 percent to $7.8875 per bushel on the Chicago Board of Trade, the highest price for the most-active contract since June 2008, when the grain surged to a record $7.9925.

(Bloomberg) -- Silver Traders Trim Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators decreased their net-long position in New York silver futures in the week ended April 5, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 36,785 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 354 contracts, or 1 percent, from a week earlier.

Silver futures rose this week, gaining 7.6 percent to $40.61 a troy ounce at today's close.

Miners, producers, jewelers and other commercial users were net-short 56,414 contracts, an increase of 1,119 contracts, or 2 percent, from the previous week.

Each Friday the CFTC publishes aggregate numbers for long and short positions for speculators such as hedge funds and institutional investors, as well as commercial companies that buy or sell futures to protect against price moves. Analysts and investors follow changes in speculators' positions because such transactions can reflect an expectation of a change in prices.

(Bloomberg) -- Gold to ‘Go Much Higher’ Amid Rising Inflation, Tocqueville Says

Gold prices may “go much higher” as investors seek protection against inflation and weaker currencies, said Douglas Groh, a senior research analyst at Tocqueville Asset Management LP.

“We all expect inflation, despite what the government wants us to think,” Groh said today during a presentation at a conference in New York. “Gold is a real store of value” while major currencies including the dollar and the euro lose their purchasing power over time, he said.

Tocqueville, based in New York, oversees $14 billion in assets, including $4 billion in gold investments. Gold futures touched a record $1.476.20 an ounce today on the Comex in New York.

(Bloomberg) -- Gold Traders Increase Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators increased their net-long position in New York gold futures in the week ended April 5, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 204,706 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 11,585 contracts, or 6 percent, from a week earlier. Gold futures rose this week, gaining 3.2 percent to $1,474.10 a troy ounce at today's close.

Miners, producers, jewelers and other commercial users were net-short 258,665 contracts, an increase of 17,896 contracts, or 7 percent, from the previous week.

Each Friday the CFTC publishes aggregate numbers for long and short positions for speculators such as hedge funds and institutional investors, as well as commercial companies that buy or sell futures to protect against price moves. Analysts and investors follow changes in speculators' positions because such transactions can reflect an expectation of a change in prices.

(Financial Times) --Gold and silver fever grips investors

When Jean-Claude Trichet announced a quarter-point jump in interest rates this week, gold and silver prices dipped as the European Central Bank chief emphasised his inflation-fighting focus.

But the two well-known inflation hedges were only temporarily dented by the tough talk; on Friday silver pushed above $40 a troy ounce for the first time since 1980 and gold pushed to a new all-time high in nominal terms at $1,474.19.

The metals’ rallies have clear links to rising fears about inflation. But recent predictions for silver to hit $50 and gold to breach $1,500 are based on more than just these fears.

“Both markets actually have surplus supply. Demand for both is good – particularly industrial demand for silver – but this isn’t enough to absorb all the supply,” says Suki Cooper, precious metals analyst at Barclays Capital. “That leaves the rest down to investor demand.”

Investors have indeed been piling in. Holdings of gold to back exchange-traded funds – the popular way for retail investors to gain exposure – jumped 19.9 tonnes on Thursday alone in the biggest single inflow since late January, according to Barclays. On the same day, holdings of silver jumped 42 tonnes to another record at 15,554 tonnes.

Interest itself has been triggered by a range of factors, not least geopolitical tensions. After a weak January, prices of the metals spiked higher in February when the unrest that toppled governments in Tunisia and then Egypt sent investors scrambling for havens.

During the financial crisis, investor fear manifested itself in strong demand for physical holdings. In spite of recent turmoil, there has not been the same scramble to buy physical supplies this time round.

“The fear factor is not as key right now,” says Osvaldo Canavosio, a hedge fund analyst at Man Investments in New York. “At the height of the financial crisis, in precious metals there was a bit of a panic to hold physical.”

Yet the haven buyers were out in force again on Friday, watchers said, as investors braced for a potential shutdown of the US government if last-ditch talks between Republicans and Democrats fail to reach agreement.

Retail investors are showing particular interest in silver coins in many countries, including the US. Last month the Utah state legislature passed a bill accepting US gold and silver coins as legal tender and other states are considering similar legislation in a direct rebuke to the Federal Reserve and its ultra-loose monetary policy.

“Utah has crossed the Rubicon, others are likely to follow suit,” says Daniel Brebner at Deutsche Bank.

Analysts and investors now see $1,500 gold and $50 silver as likely to be breached in the coming months, as the potential for looser monetary policy for longer in the US weighs on the dollar.

Commodities, including gold and silver, are typically priced in dollars so a weaker dollar boosts raw materials prices. The euro hit a 14-month high of $1.4443 against the dollar on Friday. Some gold bugs are even betting on a third round of quantitative easing, dubbed QE3, by the Federal Reserve, after its current scheme ends in June.

“Expectations that QE2 could be followed by QE3 are higher in the gold market than in other markets,” says Edel Tully, precious metals strategist at UBS.

This could leave gold investors setting themselves up for disappointment. “I would expect gold to march to $1,500 sooner rather than later,” says Ms Tully. “Towards the end of this quarter gold could hit a stumbling block if QE2 ends.”

An end to QE would tighten US monetary policy but it would be a small step compared with the inflationary impact of soaring oil and food prices, which have pushed real US interest rates – nominal rates minus inflation – to negative levels, analysts say.

“Gold is ultimately dependent upon real rates, which are a function of both inflation expectations and monetary policy,” says Jeffrey Currie, head of commodities research at Goldman Sachs, which forecasts gold will hit $1,625 by the end of the year. “A top in gold prices will only become apparent when the risks of sovereign default are behind us with a clear and successful exit of the stimulus we’ve seen over the last few years.”

Negative real rates are not just a US issue; the same is true in China – where demand for bullion is skyrocketing, bankers say.

“The cost of carry [the difference between interest on deposits and non-interest bearing gold] is zero,” says Walter de Wet, head of commodities research at Standard Bank. “It incentivises money to be invested in assets.”

Analysts are, however, less confident on silver, whose move higher has been so dramatic that many believe a sharp correction could soon be on the cards.

“I’m less convinced we’re going to remain so high, if only because we’re expecting a generous increase in mine supply,” says James Steel, commodities analyst at HSBC. “Short-term, we could go higher, but it’s increasingly vulnerable to a correction.”

(Bloomberg) -- Silver 2011 Price Forecast Raised 20% at Morgan Stanley

Morgan Stanley raised its silver price forecast for 2011 by 20 percent to $31.39 an ounce, according to a report e-mailed today.

(Bloomberg) -- Gold to ‘Remain Strong’ Amid Financial Turmoil, ABN Amro Says

Gold prices will “remain strong” in 2011 amid financial turmoil and geopolitical risks, said Victor van der Kwast, chief executive officer of ABN Amro’s International Diamond and Jewelry Group.

The “global economic and political landscape is giving gold a fresh shot in the arm,” van der Kwast said today during a presentation at a conference in New York. “Gold is a good investment in 2011.”

Gold prices touched a record $1.476.20 an ounce today on the Comex in New York.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Company Announcement: GoldCore Headquarters Change of Address

It is with great pleasure that I am writing to advise you that as of today, GoldCore have relocated to new headquarters - from 63 Fitzwilliam Square, Dublin 2, Ireland to 14 Fitzwilliam Square, Dublin 2, Ireland.

The move reflects the growing success of the business and the continuing expansion of our wealth management offering in Ireland and bullion services internationally.

Please note for your records our new address:

GoldCore, 14 Fitzwilliam Square, Dublin 2, Ireland.

Please not that phone numbers, fax numbers and emails remain the same:

T: +353 1 632 5010

F: +353 1 661 9664

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.