World Stock Markets Uptrending

Stock-Markets / Stock Markets 2011 Apr 09, 2011 - 02:36 PM GMTBy: Tony_Caldaro

A very interesting week from a worldwide perspective. All the foreign markets we follow: Asia +1.4%, Europe +0.8%, the Commodity equity group +0.7% and the DJ World +0.9%, were all higher on the week. But the US ended mixed to negative: SPX/DOW mixed and the NDX/NAZ -0.6%. Economic reports for the week were sparse but mostly positive. On the downside ISM services and the M-1 multiplier. On the upside consumer credit rose, along with the WLEI, excess reserves and the monetary base, wholesale inventories remained positive and jobless claims declined. Bond yields are now uptrending again, Crude soared 5.1%, Gold gained 3.2% and the USD is making new lows. Next week we have the FED’s Beige book, the CPI/PPI and Options expiration.

A very interesting week from a worldwide perspective. All the foreign markets we follow: Asia +1.4%, Europe +0.8%, the Commodity equity group +0.7% and the DJ World +0.9%, were all higher on the week. But the US ended mixed to negative: SPX/DOW mixed and the NDX/NAZ -0.6%. Economic reports for the week were sparse but mostly positive. On the downside ISM services and the M-1 multiplier. On the upside consumer credit rose, along with the WLEI, excess reserves and the monetary base, wholesale inventories remained positive and jobless claims declined. Bond yields are now uptrending again, Crude soared 5.1%, Gold gained 3.2% and the USD is making new lows. Next week we have the FED’s Beige book, the CPI/PPI and Options expiration.

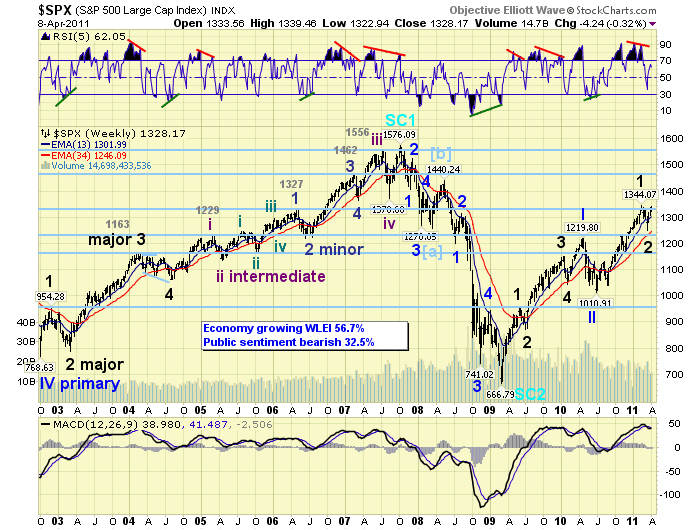

LONG TERM: bull market

The bull market of March 2009 continues. Counting from the SPX 667 low we’re expecting a Cycle wave [1] bull market lasting about three years. Cycle wave bull markets consist of five Primary waves. The first two of these Primary waves have already completed: Primary wave I at SPX 1220 in Apr10, and Primary wave II SPX 1011 in July10. Primary I consisted of five Major waves and Primary II consisted of three Major waves.

The five Major waves of Primary I have been labeled as follows: Major 1 SPX 956 Jun09, Major 2 SPX 869 Jly09, Major 3 SPX 1150 Jan10, Major 4 SPX 1045 Feb10 and Major 5 SPX 1220 Apr10. The three Major waves of Primary II were not labeled because they did not create any trend changes.

Counting from the Primary II low at SPX 1011 in Jly10 we have the first two Major waves of Primary III completed. Major 1 completed at SPX 1344 in Feb11, Major 2 completed at SPX 1249 in Mar11, and now Major wave three is currently underway. We’re projecting the Major wave 3 uptrend will last three months, end in Jun11, and carry the SPX to between 1440 and 1462. Then a Major wave 4 will correct the market back to SPX 1363 by Jly11, before an uptrending Major wave 5 will complete Primary wave III around SPX 1550 in Oct11. After that a sharp correction for Primary IV to be followed by an uptrending Primary V will complete the bull market in early 2012. For the details: http://caldaro.wordpress.com/2011/04/04/spx-bull-mkt-projection-update/.

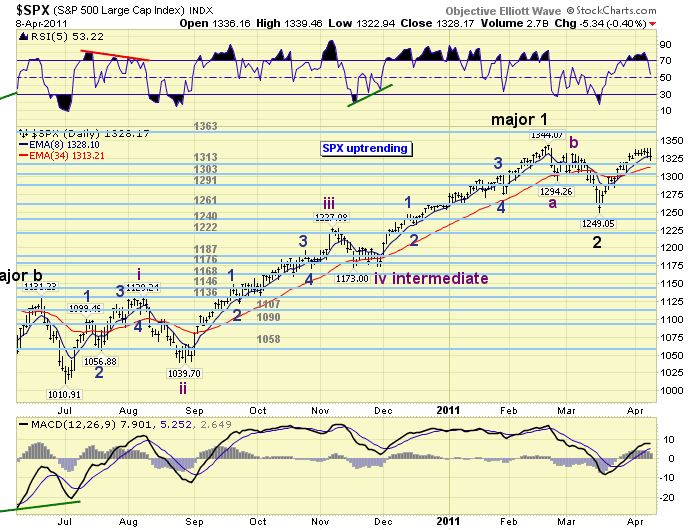

MEDIUM TERM: uptrend high SPX 1339

After a slightly extended, seven month, uptrend Major wave 1 topped in Feb11 and then the downtrending Major 2 corrected, for the anticipated one month, into Mar11. Now we are in a confirmed Major wave 3 uptrend that should unfold in five Intermediate waves. All the Major wave uptrends of this bull market have unfolded in five Intermediate waves.

Currently the market has been rallying for a bit over three weeks from the Major 2 SPX 1249 low. The initial rally was quite sharp and quick, but the market has quieted down a bit since entering April. We’re counting this initial rally as part/all of Intermediate wave one. Our preferred count suggests Minor wave 1 ended at SPX 1301, Minor 2 at SPX 1284, Minor 3 at SPX 1339 and Minor 4 is underway now. As long as the current pullback holds the OEW 1313 pivot range this count will remain the focus. Actually we have been looking for a pullback into the mid-low 1320′s for Minor wave 4, and the SPX hit 1323 on friday. Nevertheless, the uptrend will continue higher into June 2011.

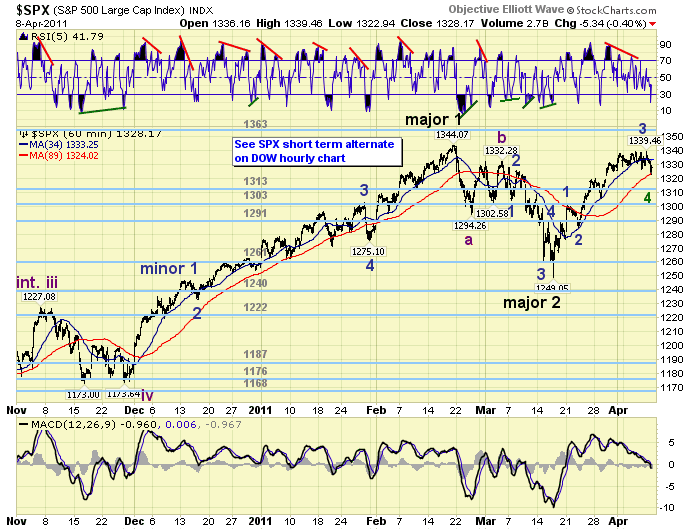

SHORT TERM

Support for the SPX remains at 1313 and then 1303, with resistance at 1363 and then 1372. Short term momentum hit oversold friday afternoon and then bounced. Should the market hold friday’s low, or make a slightly lower low monday/tuesday, we’ll mark that low Minor wave 4 and expect Minor wave 5 to take the bull market to new highs, (possibly 1363), to conclude Intermediate wave one.

Should this pullback continue to breakdown and decline below the OEW 1313 pivot range. We would have to adjust the count to Intermediate wave one ending at SPX 1339 and Intermediate wave two underway. Support for Intermediate two under this scenario woulds be the OEW 1291 pivot range. The early part of the week should provide the answer. Best to your trading!

FOREIGN MARKETS

Asian markets were all higher on the week for a net gain of 1.4%. All Asian indices are in confirmed uptrends except Japan’s NIKK.

European markets were all higher on the week as well for a gain of 0.8%. Only England’s FTSE and Spain’s IBEX are in confirmed uptrends.

The Commodity equity group were mixed on the week for a net gain of 0.7%. All three indices, however, are in confirmed uptrends.

The uptrending DJ World index gained 0.9% on the week.

COMMODITIES

Bonds (-0.5%) have been heading lower again as a downtrend has been recently confirmed. 10YR yields have risen from 3.14% to 3.57% since stocks started uptrending.

Crude still uptrending, and soaring this week +5.1%, hit new bull market highs at $114. With $111 exceeded we now raise our uptrend target to $121: Int. v = 1.618 Int. iii.

Gold uptrending, and surging to new all time highs at $1475, gained 3.2% on the week. Silver crossed $40 for the first time in 30+ years. Expecting much more out of Gold and Silver before this uptrend ends.

The downtrending USD made new yearly lows as it dropped 1.1% on the week. Just three major supports left before the USD breaks to new lows: 74.23, 71.31 and then 70.70.

NEXT WEEK

A busy week kicks off on tuesday with the Trade/Budget deficits and Import/Export prices. Then on wednesday we have Retail sales, Business inventories and the FED’s Beige book. On thursday, the weekly Jobless claims and the PPI. Then on friday the CPI, the NY FED, Industrial production, Consumer sentiment and Options expiration. As for the FED a somewhat busy week as well. Monday we have a speech from FED vice chair Yellen in NYC at 12:15. On tuesday Senate testimony from FED governor Tarullo. Then on thursday a speech from FED governor Duke in Wash, DC. Best to your week!

CHARTS: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID1606987

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.