Perfect Storm for Gold and Silver

Commodities / Gold and Silver 2011 Apr 08, 2011 - 07:31 AM GMTBy: GoldCore

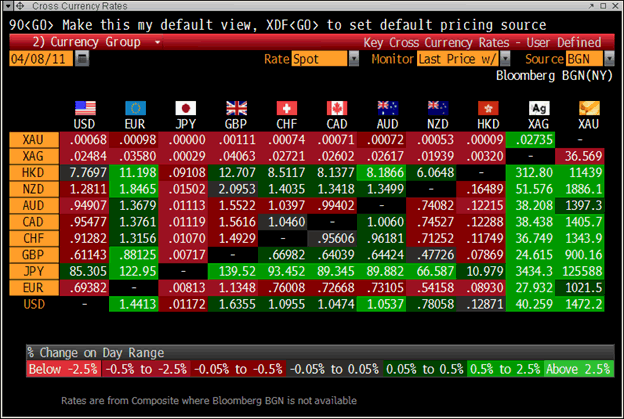

Gold and silver reached new record all time and 31-year highs respectively again yesterday and this morning - both nominal highs. Silver has surged to a new 31-year nominal high of $40.28/oz and may now target next resistance at $50/oz - the 1980 nominal high.

Gold and silver reached new record all time and 31-year highs respectively again yesterday and this morning - both nominal highs. Silver has surged to a new 31-year nominal high of $40.28/oz and may now target next resistance at $50/oz - the 1980 nominal high.

Gold is now targeting $1,500/oz after just reaching new nominal highs at $1473/oz. Gold is higher in all currencies this week but especially the beleaguered yen which has fallen 4% against gold in the week so far.

The gold and silver markets are experiencing a perfect storm due to the heightened level of geopolitical and macroeconomic risk.

Debt concerns in the eurozone and in the US (possible government shutdown), surging oil prices due to geopolitical risk in the Middle East and Africa, deepening inflation and the Black Swan risk of natural disasters (another Japanese earthquake has led to problems at a second nuclear plant - Onagawa) is leading to continued safe haven demand from a minority of astute buyers.

These include high net worth individuals, hedge funds, pension funds and central banks.

“Speculative froth” remains subdued as seen in the COT and ETF holdings data.

The vast majority of the public in the western world do not know how much an ounce of gold or silver bullion is. A small minority knows how to invest in or buy bullion, and an even smaller minority have any allocation to gold, let alone silver.

The majority of the western public’s only experience with regard to gold and silver is with dodgy “cash for gold” merchants who have lured millions of people to sell the family gold and silver (jewellery) in exchange for quickly depreciating euros, pounds and dollars.

In the years to come, people will be shocked by the ignorance of the western “cash for gold” phenomenon - while those in the Middle East, China, India and Asia continue to buy gold and silver as timeless stores of value rather than as an “investment” to be timed and bought and sold for commercial gain and profit.

The majority of the western media continues to completely ignore and not report the precious metal markets - especially silver.

Even in the face of surging oil and food prices and deepening inflation, and after consecutive days of record nominal high prices, most media in the UK and Ireland barely reported the news - let alone analysed it for the benefit of their readers.

The notion that silver is a bubble continues to be propagated by many. Indeed, the Financial Times reports that ‘Silver set to reach $50 before plunging in value, study says.’ The study is by GFMS who have been at best lukewarm on silver for a number of years.

Silver’s gains have been sharp but the fundamentals remain very sound due to a very limited supply and a very substantial increase in investment and industrial demand, especially in China and the rest of Asia.

The GFMS World Silver Survey released yesterday shows that investment demand increased by 47% in 2010 and industrial demand is very robust.

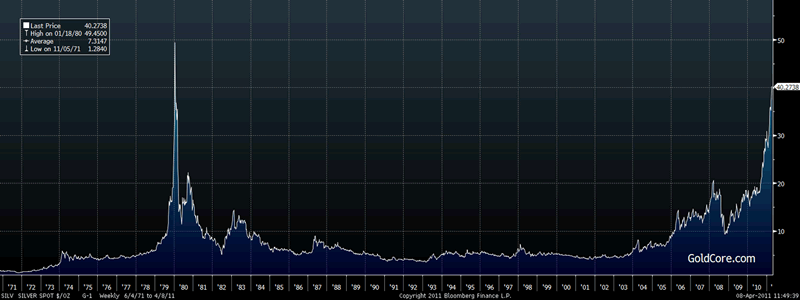

Silver’s nominal high of $50/oz is looking like it will be seen sooner rather than later, given the degree of demand and momentum. Any sell off will likely be short but sharp prior to a resumption of silver’s secular bull market and silver’s inflation adjusted high of $150/oz remains a long term price target.

The long term silver chart above shows how silver rose from $1.28/oz to $49.45/oz (on a weekly basis) from 1971 to 1980 or a rise of 38 times. Given that the conditions today are far more bullish than they were in the 1970s silver may replicate this performance.

Were silver to replicate the 1970s performance it would have to rise from a low of $4.10/oz in 2001 to over $150/oz – which, as it happens, is the all important inflation adjusted high.

Whether silver will plunge or not at some stage is irrelevant if one is buying for diversification, safe haven and store of value reasons. When silver reached $10, $15 and $20 an ounce, there were similar warnings which may have dissuaded some of the public from buying for the long term and diversifying.

Rather than attempting to predict the future price movement of markets, the western public would be better served by acting like their Eastern counterparts and buying bullion for long term financial insurance and store of value reasons rather than speculation and making short term returns.

Diversification and wealth preservation are fundamental in these uncertain times.

Max Keiser’s “Silver Liberation Army”

An increasingly important phenomenon in the silver market is that of the “Silver Liberation Army” which appears to be going viral. Former Wall Street broker and current broadcaster and journalist Max Keiser wants to put silver in the hands of the people in the belief that it will stop banking corruption and allow people to take back some of the wealth that has been transferred to bankers.

This is leading to a small but growing minority of hard money advocates and others unhappy with government and banking corruption and abuses to buy silver coins in volume and through the use of viral messages, video etc encouraging the rest of the public to do the same.

The Million Ounce March is a campaign started by Keiser to encourage the public to protect themselves against inflation by purchasing silver. Money printing leading to inflation, hyperinflation and destruction of fiat currencies has been seen throughout history and Keiser rightly believes that silver will protect people from this and other risks posed by the financial system dominated by Wall Street banks.

Gold

Gold is trading at $1,470.70/oz, €1,020.54/oz and £898.63/oz.

Silver

Silver is trading at $40.23/oz, €27.92/oz and £24.58/oz.

Platinum Group Metals

Platinum is trading at $1,811.00/oz, palladium at $795/oz and rhodium at $2,350/oz.

News

(FT) -- Inflation concerns drive silver above $40

Silver is the focus of a buoyant commodity complex after the grey metal hit $40 an ounce for the first time since 1980 as traders ride the “bullion-as-inflation-hedge” bandwagon.

The same strategy has also on Friday driven gold to a fresh record of $1,469 an ounce, with investors pouring funds into precious-metal exchange-traded funds.

The SPDR Gold Trust, the world’s biggest gold-backed ETF, said its holdings of the yellow metal had risen to 1,217 tonnes, the most since mid-March, while the iShares Silver Trust’s holdings hit a record high of 11,193 tonnes, according to Reuters.

Silver is up 65 cents to $40.16 an ounce, advancing 30 per cent in 2011, while gold is up 0.8 per cent to $1,468 an ounce.

The latest burst of bullion buying seems to be predicated on oil’s surge to its highest levels since August 2008. Worries about supply from Libya and Nigeria, ahead of elections in the large West African exporter, have pushed Brent crude above $124 a barrel, feeding input cost inflation fears.

(Bloomberg) -- Silver 2011 Price Forecast Raised 20% at Morgan Stanley

Morgan Stanley raised its silver price forecast for 2011 by 20 percent to $31.39 an ounce, according to a report e-mailed today.

(FT) -- Silver set to reach $50 before plunging in value, study says

The silver market is likely to continue its spectacular ascent and to touch a record high at more than $50 a troy ounce this year – but could then crash back to earth, according to new forecasts by GFMS, a leading precious metals consultancy.

The grey precious metal has soared 121 per cent during the past 12 months to touch a 31-year peak of $39.73 this week as investors, disillusioned at the actions of central banks and governments, bought it as an alternative to paper currencies.

“In the short term, things have moved spectacularly fast because of the amount of money from investors,” said Philip Klapwijk, executive chairman of GFMS. “I think $50 will probably be taken out this year.”

However, Mr Klapwijk warned the market could suffer a steep correction if investors were to withdraw their funds because without their buying, the supply of silver would be expected to exceed demand. “When you see prices moving up so fast you have to be careful. There’s no convincing economic reason for why this is happening. It is still a market with a very large surplus,” he said.

Investors ploughed $5.6bn into the $21bn-a-year silver market in 2010, according to statistics published on Thursday by GFMS in its annual report on the silver market published by the Silver Institute, a mining industry group. Mr Klapwijk forecasted investment in silver would rise by about 50 per cent in dollar terms to hit $8bn this year. A surge to more than $50 an ounce would see silver surpass its peak of 1980, when the billionaire Hunt brothers notoriously attempted to corner the market. In its report, GFMS said that there had been “a major move into the silver market by a number of hedge funds”.

Mr Klapwijk said one possible trigger for a correction in the silver price could be a decision by some investors to cash in: “I can’t help but think that if we hit $50 we could see a significant correction driven by profit-taking.”

Non-investment consumption of silver is rising sharply, with industrial usage up 20.7 per cent last year, but supplies are also increasing.

Total supply increased by 14.6 per cent last year, driven largely by a dramatic swing by producers to start a fresh wave of hedging, or selling their output forward at fixed prices, a trend which has continued in the first quarter of this year.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.