U.S. Jobless Downtrend Remains in Place

Economics / Unemployment Apr 08, 2011 - 04:13 AM GMTBy: Asha_Bangalore

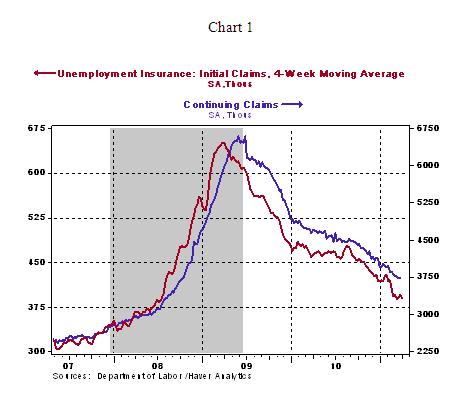

Initial jobless claims fell 10,000 to 382,000 during the week ended April 2, which puts the 4-week moving average at 389,500. Continuing claims, which lag initial jobless fell 9,000 to 3.723 million. The good news is that the downward trend of jobless claims is maintained. The number of claimants under the special programs fell for the week ended March 19 declined roughly 90,000. Going forward a larger drop would be necessary to be consistent with the strength seen in private sector payrolls in February and March.

Initial jobless claims fell 10,000 to 382,000 during the week ended April 2, which puts the 4-week moving average at 389,500. Continuing claims, which lag initial jobless fell 9,000 to 3.723 million. The good news is that the downward trend of jobless claims is maintained. The number of claimants under the special programs fell for the week ended March 19 declined roughly 90,000. Going forward a larger drop would be necessary to be consistent with the strength seen in private sector payrolls in February and March.

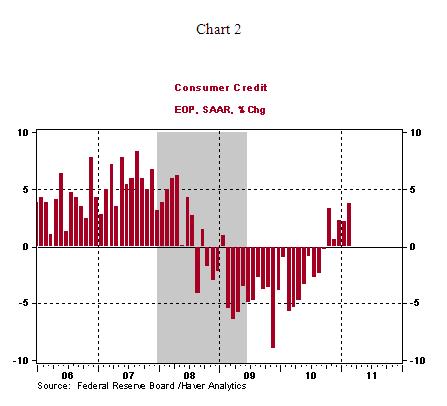

Consumer Credit Posts Fifth Monthly Gain

Households are gradually increasing their liabilities in the last few months. After posting declines each month in the February 2009-September 2010, consumer credit grew in the each of the five months ended February (see Chart 2). This bodes positively for consumer spending and growth in the economy.

ECB Raises Policy Rate as Expected, Here is a Chart to Consider

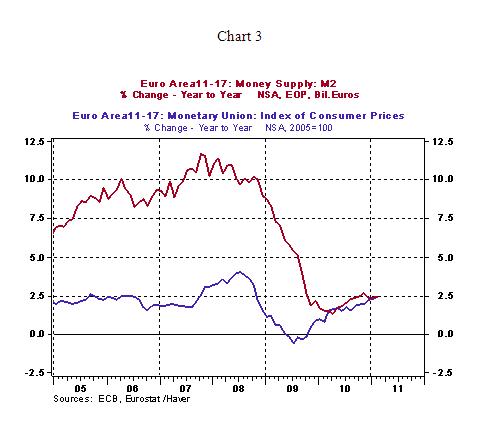

The European Central Bank (ECB) raised the policy rate 25bps to 1.25% today. Unlike the Bank of England which chose to leave the policy rate unchanged at 0.50%, the ECB took a special stand against inflation and tightened monetary policy. Chairman Bernanke indicated that he sees the recent gain in energy and other commodity prices as "transitory" and the Fed is ready to take action if there are meaningful spillovers seen in prices of other goods and services. We can write at length about the different paths the Fed and ECB are taking. The long and short of it is that the ECB faces a two-speed economy with the Germany and France operating at different pace compared with the economic woes of Ireland, Greece, Portugal, and Spain, but the focus seems to be on inflation.

Quite recently, the ECB raised the policy rate in July 2008 to 4.25% from 4.00%, only to reverse it as the economic crisis took a severe turn in October 2008. Although, the situation has improved, the economic fundamentals of the region strongly suggest that this is probably a one-off event much like in 2008. President Trichet, the head of the ECB, noted that it is not the beginning of a string of hikes. Chart 3 indicates that when the ECB raised the policy rate for a short while in 2008, money supply was growing at a more rapid clip than today. This is another piece of evidence that the ECB's inflation fear is probably an exaggerated concern, for now.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.