Gold May Fall Short-term on ECB Rate Rise, But Rising Interest Rates are Bullish

Commodities / Gold and Silver 2011 Apr 07, 2011 - 08:52 AM GMTBy: GoldCore

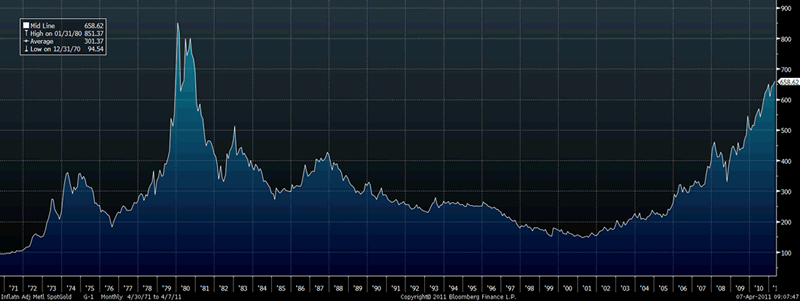

Gold’s two consecutive days of nominal record highs have seen some profit taking as oil is flat, the dollar is marginally higher and the euro has fallen. The ECB’s 0.25 % interest rate hike may lead to further profit taking today but rising interest rates in an increasingly inflationary environment will be positive for gold as it was from 1965 to 1981 (see charts below).

Gold’s two consecutive days of nominal record highs have seen some profit taking as oil is flat, the dollar is marginally higher and the euro has fallen. The ECB’s 0.25 % interest rate hike may lead to further profit taking today but rising interest rates in an increasingly inflationary environment will be positive for gold as it was from 1965 to 1981 (see charts below).

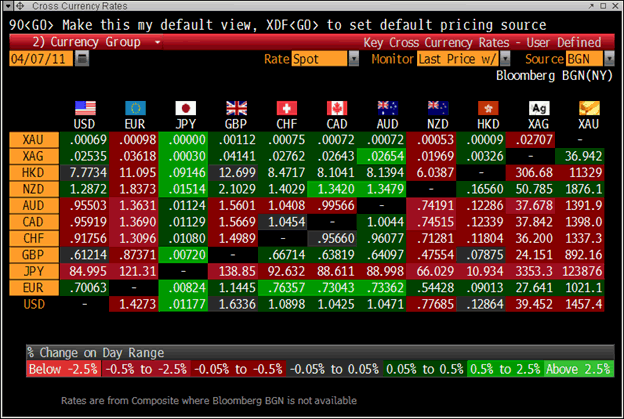

Cross-Currency Table at 1130 GMT

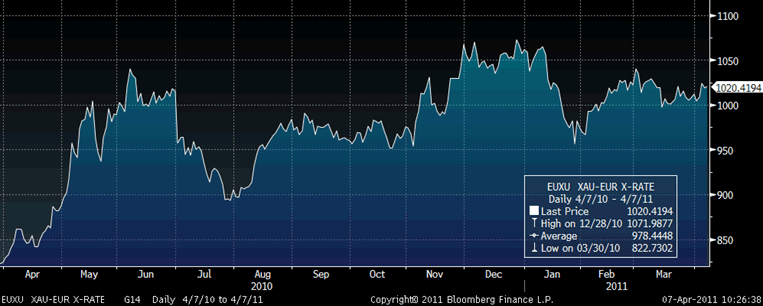

Gold in euros – 1 Year (Daily)

It is only when real interest rates turn positive (nominal interest rates are again above the nominal rate of inflation) that gold and silver’s secular bull markets may be challenged. Inflation in the eurozone is 2.6%. Today’s interest rate rise will leave eurozone interest rates at 1.25% well below the 2.6% rate of inflation meaning that savers continue to lose out due to very low yielding deposits.

US 10 Year Government Bond – 1965 to 2011

Similarly in the US, the cost of consumer goods and services has climbed 2.1% (as measured by the CPI) over the past year while Ben Bernanke has kept interest rates at 0% for over two years now.

These inflation numbers are official government statistics and are subject to hedonic and other peculiar statistical adjustments which underestimate the real rate of inflation as being experienced by the public who are feeling the pinch from rising food, energy, insurance, healthcare and other costs.

Gold Adjusted for Inflation (Urban Consumers Price Index)

Negative real interest rates will likely lead to precious metal prices continuing to rise or rather very low yielding fiat currencies falling in value versus non yielding finite gold. Rising interest rates are bullish for gold also as they may see the primary asset classes of equities, bonds and property come under pressure again.

The safe haven, inflation hedging, liquidity and diversification benefits of gold have never been more needed by the investment and savings public.

Gold’s Two Consecutive Days of Nominal Record Highs Ignored by Non-Financial Media

Despite this need for gold as a safe haven and diversification to protect from inflation and negative real interest rates, most of the non-financial media has ignored and barely reported gold’s record nominal highs in recent days, despite the incredibly uncertain geopolitical and macroeconomic conditions facing people internationally.

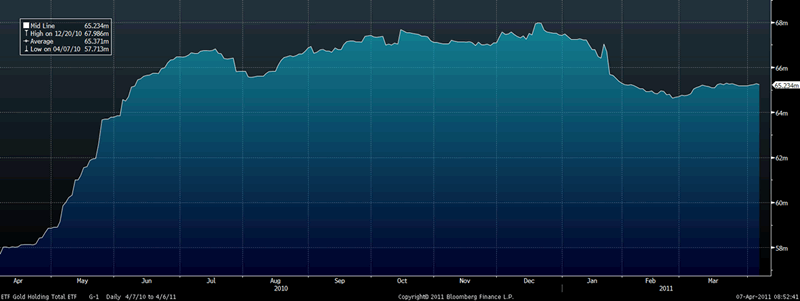

Total Known Gold ETF Holdings

In the same way that sections of the media ignored and downplayed the risk posed by debt, derivatives and property bubbles prior to the subprime debt crisis and bursting of various property bubbles, so today the monetary and macroeconomic risks and the risks posed by inflation to the public and our economies are being downplayed and largely ignored.

What little coverage there is of gold, it continues to often be slightly biased with negative terminology such as “gold hits new peak”, “gold peaked today”, “investors piled into gold”, “investors flock to gold” and “speculators hoard gold”. All of which are factually inaccurate and misleading.

Headlines regarding “gold peaking” have abounded since gold rose above $700/oz. Given our inability to forecast the future movement of any asset it is always best not to predict if something has ‘peaked’ - especially in a headline.

Also, many journalists continue to fail to report the important fact that the record highs are nominal highs and that adjusted for the significant inflation of the last 31 years, gold remains well below its inflation adjusted high of $2,400/oz.

The primary indicators of investment demand for gold - the Commitment of Traders (COT) data and Total Gold ETF Holdings continue to clearly show that little or no one is “piling into” gold – not even the speculators.

It is interesting that such negative terminology is rarely used with regard to equities and bonds – especially as bonds are likely the largest bubble in the world today.

When the non-financial press cover gold, they often quote bankers, stock brokers, CFD providers and other financial service providers warning about gold and suggesting gold is a bubble and is risky. It is interesting that these same individuals never advised their clients to own gold but now they believe they are experts on the gold market and can advise people not to buy or to sell.

Instead of urging diversification, they give simplistic reasons as to why gold may or “will fall”. Diversification is what they should have been advising for years and their clients would be in a far better position if they had.

Since gold rose above $800/oz in 2007 there have been umpteen definitive statements that gold was in a “speculative” bubble and would fall. If I had an ounce of gold for every time I have heard such “experts” warn regarding gold being a bubble, I would be as rich as Croesus.

To be fair, it is likely that part of the reason for the very limited coverage and somewhat negative treatment of gold is that some journalists and editors genuinely believe that gold is a speculative bubble. They may be being cautious after the experience of recent bubbles when much of the media failed to warn regarding, and indeed cheer led, recent equity and property bubbles.

They are right to be cautious in this regard. At the same time, they have a duty to report all of the facts in a non biased manner and to offer a plurality of opinion regarding all markets – including the gold market. Focusing on any one asset class and ignoring others is a failure to report the markets.

Lack of knowledge regarding financial markets, investments and savings is detrimental to the wealth of individuals, families and nations. In the coming years many will look back at the lack of and biased coverage of the gold market and wonder as to how it could have been so biased and myopic.

Gold

Gold is trading at $1,457.87/oz, €1,021.49/oz and £894.34/oz.

Silver

Silver is trading at $39.47/oz, €27.65/oz and £24.21/oz.

Platinum Group Metals

Platinum is trading at $1,783.00/oz, palladium at $778/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- Gold 2012 Forecast Raised to $1,650 From $1,200 by Standard Chartered

Gold will average $1,650 an ounce next year, compared with a previous forecast of $1,200, Standard Chartered Bank said in a report today.

(Bloomberg) -- Russian Currency, Gold Reserves Advance $500 Million in Week

Russia’s foreign currency and gold reserves rose $500 million in the week to April 1 to $504.5 billion, the central bank said on its website.

(Bloomberg) -- Vietnam Banks Reduce Rates on Gold Deposits, Tuoi Tre Reports

Some Vietnamese banks have reduced interest rates on gold deposits as the central bank has restricted gold lending, Tuoi Tre newspaper said, citing banks. Vietnam Export-Import Commercial Joint-Stock Bank cut rates to as low as 0.2 percent for deposits with terms of six months or longer. Viet A Commercial Joint-Stock Bank also decreased rates to as low as 0.5 percent for six-month deposits.

(Bloomberg) -- Gold Declines as Rally to Record, Interest Rate Rise Spur Sales

Gold declined on speculation that investors are locking in gains after the price rose to a record earlier, and as central bank efforts to combat inflation curbed demand for precious metals.

Immediate-delivery bullion fell 0.4 percent to $1,454.35 an ounce at 2:25 p.m. in Singapore. The price gained to a record $1,462.35 earlier. Gold for June delivery in New York decreased 0.2 percent to $1,455.30 an ounce after reaching an all-time high of $1,463.70 yesterday.

“Some traders are taking profits after the recent rally to record prices,” said Park Jong Beom, Seoul-based trader with Tongyang Futures Co. “Policies to raise interest rates are also weighing on sentiment a bit.”

China raised interest rates this week for the fourth time since mid-October before a report that may show consumer prices climbed last month at the fastest pace since 2008. Federal Reserve Chairman Ben Bernanke this week said inflation must be watched “extremely closely.” Minutes from the Fed’s March 15 meeting, released yesterday, show dissent on maintaining programs intended to stimulate growth.

The U.S. has kept its benchmark interest rate at a record low since December 2008. Rising interest rates tend to increase the cost of holding non-interest-bearing commodities.

Gold climbed to a record this week as fighting in Libya, Japan’s nuclear crisis and concerns about European debt boosted demand for the metal as a protector of wealth. Bullion is up 2.4 percent this year, after jumping 30 percent in 2010 as investors sought sanctuary from currency debasement and accelerating inflation.

‘Still Favorable’

Gold will average $1,650 an ounce next year, compared with a previous forecast of $1,200 an ounce, Standard Chartered Bank said in a report today.

“The current climate is still favorable for precious metals,” Eugen Weinberg, head of commodity research with Commerzbank AG, wrote in a note to clients. “Continued unrest in North Africa and in the Arab world and the debt crisis in eurozone peripherals are fuelling price speculation.”

The U.S. and Italy are each considering arming Libyan opposition forces to speed the ouster of Muammar Qaddafi, according to an official involved in closed-door talks between Secretary of State Hillary Clinton and Italian Foreign Minister Franco Frattini in Washington today. In Japan, workers at the damaged Fukushima Dai-Ichi nuclear plant are pumping nitrogen into a reactor to prevent a possible explosion.

Portugal will seek a bailout from the European Union after the nation’s political crisis helped push borrowing costs to record levels and forced it to become the third euro-region country to need rescuing.

Cash silver fell 0.7 percent to $39.29 an ounce after climbing to a 31-year peak of $39.7625 an ounce yesterday. Palladium for immediate delivery lost 1.3 percent to $776.25 an ounce, while platinum shed 0.7 percent to $1,780.50 an ounce.

(Irish Independent) -- Oil and gold surge ahead of likely hike in ECB rates

Oil, gold and other commodities surged yesterday ahead of an expected rise in European Central Bank rates today.

Oil price futures to be settled in May surged to a 30-month high of $122.49, with gold hitting an all-time high of $1,459 an ounce.

The euro jumped to a 14-month high, due to a decline in the dollar, as markets bet that the 23 members of the ECB governing council would push through a 0.25pc rise in the base rate to 1.25pc.

This is expected to be just the first in a string of rises in the coming months.

Investors bought commodities and the euro because they feel the interest rate rise will depress international growth. They also think the ECB rate rise will not have its intended effect of dampening inflation in the 17-member eurozone.

A string of economists and investment banks lined up to condemn the expected rate rise as a policy blunder, for Ireland, Portugal and Greece.

A study by giant Swiss bank Credit Suisse concluded that interest rates in Ireland, Portugal and Spain should fall rather than rise.

However, because Germany is booming, a rate of plus-4.5pc would be more appropriate in that country, researchers said.

The findings, under what is known as the Taylor Rule, are based on a calculation of what is the most appropriate interest rate given inflation and growth.

Weak

Bloxham economist Alan McQuaid said the the weak periphery countries of Greece, Ireland, Portugal and Spain were extremely vulnerable to monetary tightening.

"Floating rate mortgages are a big issue in Ireland and Spain and tighter ECB monetary policy will do little to help already hard-pressed households.

"An even bigger problem for some peripheral states like Ireland is their weak banking sector.," he said.

Some 85pc of mortgages in Ireland are variable, compared with 15pc in Germany. Yesterday, the IMF warned about the dangers of variable rate mortgages. It said variable rates, including trackers, were usually lower than a fixed-rate loan -- at least at the beginning.

But when rates go up, the heavily borrowed become financially distressed, with consequences for the whole economy.

Variable rate loans -- whether they are trackers or standard variable loans -- are the norm in Ireland, the UK and Spain.

But elsewhere in Europe and in North America, long-term fixed rate loans are more common and so there is less disruption from interest rate hikes.

The ECB will raise its main refinancing rate by a quarter-percentage point from a record low 1pc today, according to all 57 economists surveyed by the Bloomberg news agency.

Germany's factory orders increased in February more than forecast, advancing 2.4pc after rising 3.1pc in the previous month, the Economy Ministry said. The rise will give further reason for the ECB to feel it necessary to raise rates. - Charlie Weston Personal Finance Editor

(Reuters) -- Gold slips from record; ETF holdings lowest since May

Gold ticked lower to hover below a record on Thursday ahead of an expected euro zone interest rate hike, while ETF holdings dropped to their lowest in almost a year as investors shifted some of their money into other markets.

Despite selling in the physical market, bullion was still supported by inflation concerns driven by the deadly unrest in Libya and the Middle East as well as soaring food prices. Silver barely moved after hitting a 31-year peak on Wednesday.

Spot gold eased $2.31 to $1,454.69 an ounce by 0607 GMT, after striking a record of $1,461.91 on Wednesday as the U.S. dollar slipped to a 14-month low against the euro.

Gold is far below its all-time inflation-adjusted high, estimated at almost $2,500 an ounce set in 1980 as a result of heightened geopolitical pressure and hyper inflation.

"Moms and dads are moving out, out of gold and into the equities. But our expectations for gold moving higher has more to do with inflationary concerns, I think, particularly in China," said Jonathan Barratt, managing director of Commodity Broking Services.

"Market is looking at not just oil, it's looking at food and I think that's important, particularly when corn reached a record high. Expectations are that foodstuff will continue to rise."

Spot silver hardly changed at $39.30 an ounce, within sight of a 31-year peak of $39.75 struck on Wednesday. The European Central Bank is poised to raise interest rates from a record low 1.0 percent on Thursday and more is likely to follow but, fearful of heaping more pain on the euro zone's stragglers, it will give few clues about when the next move will come. [ID:nLDE7351QH]

The euro was down a quarter point on the day at $1.4297 , having risen to $1.4350, its highest since late January 2010, on Wednesday, while Japan's benchmark Nikkei average closed up 0.1 percent at 9,590.93.

In the grains market, Chicago corn futures edged up to near record highs as thin U.S. stocks and expectations of firm Chinese demand helped purge early losses ahead of key U.S. data later this week.

"There's some profit taking at the high end. I think people are shifting money into stocks because the U.S. economy seems to be improving. I don't think the ETF is giving you better returns," said a bullion dealer in Hong Kong.

"Also I think the gold market is moving too slowly after reaching the high."

In Singapore, a centre for bullion trading in Southeast Asia, dealers noted sales of scraps from Thailand and Indonesia as holders cashed in on bullion's rise to a record.

The world's largest gold-backed exchange-traded fund, SPDR Gold Trust , said its holdings fell to 1,205.467 tonnes by April 6, their lowest level since May last year, from 1,212.745 tonnes on April 5.

U.S. gold futures for June fell $2 to $1,456.5 an ounce. Gold's volatility index dropped more than 2 percent on Wednesday, suggesting that the market was not expecting wild price movements in the future.

Brent crude dipped on Thursday after five straight days of gains on concern that rising prices will hurt demand from the world's top oil consumers the United States and China, but unrest in North Africa and the Middle East cushioned the fall.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.