Gold and Silver New Record Highs on Surging Oil and Deepening Inflation

Commodities / Gold and Silver 2011 Apr 06, 2011 - 06:50 AM GMTBy: GoldCore

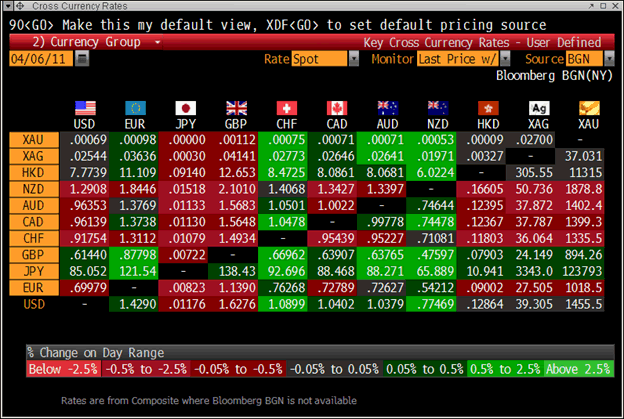

In trading in London this morning, gold reached a new record nominal high ($1,460.92/oz) and silver a new 31-year nominal high ($39.63/oz) as investors bought the precious metals to hedge deepening sovereign debt risk (in the EU but also in the US with the threat of a federal budget shutdown), geopolitical risk and deepening inflation.

In trading in London this morning, gold reached a new record nominal high ($1,460.92/oz) and silver a new 31-year nominal high ($39.63/oz) as investors bought the precious metals to hedge deepening sovereign debt risk (in the EU but also in the US with the threat of a federal budget shutdown), geopolitical risk and deepening inflation.

Brent crude reached $123.00 a barrel this morning and looks set to challenge the high seen in July 2008 of $145.49.

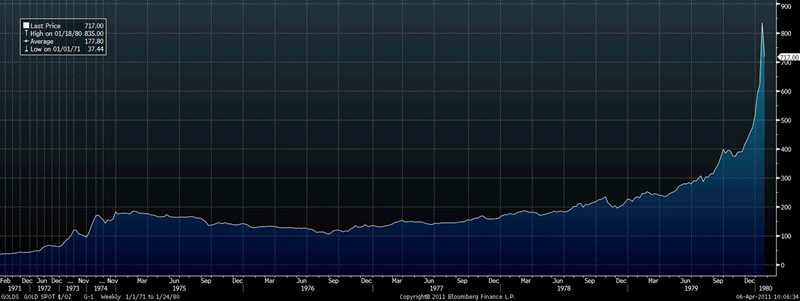

Anemic economic growth, extremely loose monetary policies, sovereign debt risk, geopolitical risk and surging oil and commodity prices is a recipe for stagflation which would see the precious metals replicate their performance of the 1970s when gold rose 24 times in value (from $35/oz to $850/oz) and silver by over 32 times (from $1.55/oz to $50/oz).

Silver over $100/oz is not as outlandish as once thought, with dealers in Hong Kong mooting that possibility. Strong demand for silver is being seen in Asia (see news).

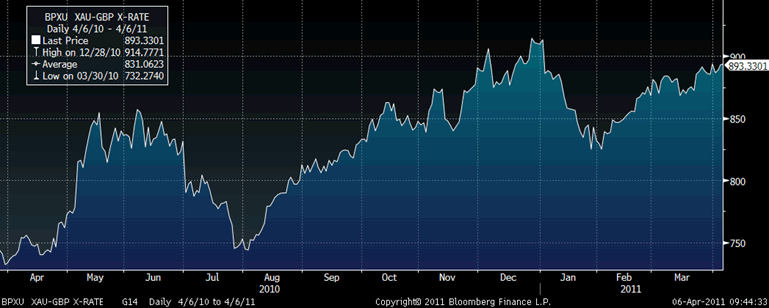

The yen and sterling have fallen today, leading to new record nominal highs in gold in yen and sterling, again targeting the £900/oz mark.

Gold and silver’s record highs were barely reported in the non-financial press and the majority of the investing public will not be aware of the record nominal highs. This is a continuing indication that suggests that the precious metals are far from the mania bubble phase when the investment public greedily buys precious metals believing them to be risk free guarantees of getting rich (as was believed about tech stocks and property).

Inflation has taken hold in much of the developing world and is now taking hold in developed world markets. Despite very significant price increases in vital commodities, particularly the essentials of food and energy, there remains much denial about the threat of inflation and stagflation.

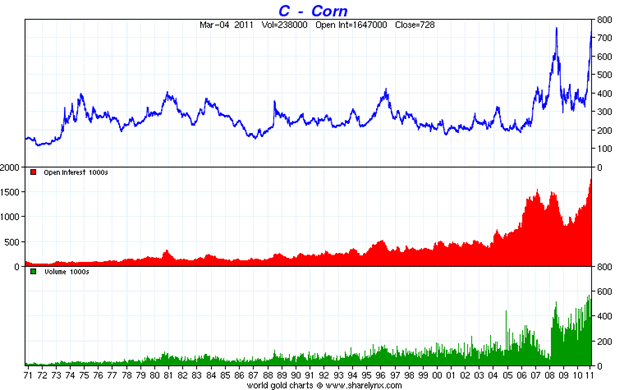

Energy prices have surged so far in 2011 with Brent crude up 28.6%, NYMEX crude up 16%, gasoline up 26% and heating oil up 25%. Agricultural commodities have also seen sharp rises. Corn is up 20% to a new record nominal high and cotton has surged 50%. These gains have been seen in just over 3 months.

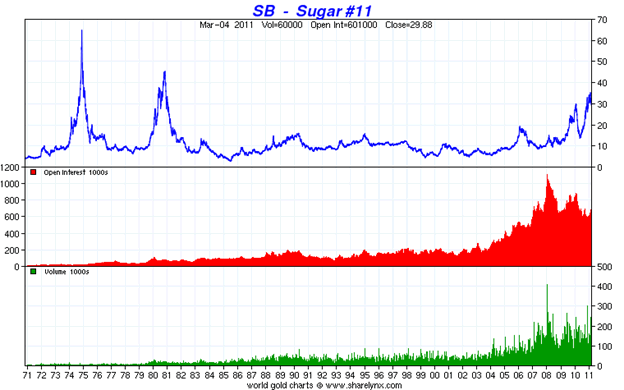

While nearly all commodities have seen sharp gains, most remain well below inflation adjusted highs of the last 40 years, and many are not far above their record nominal highs of the 1970s (see charts below).

Rising interest rates will be bullish for gold and silver. This is especially the case because interest rates may rise in order to combat inflation, and there are real concerns about all major paper currencies.

It is only towards the end of the interest rate tightening cycle, when savers are rewarded with a positive real interest rate, and savers are confident about their cash deposits in banks, that gold and silver would ‘peak’.

Marginal increases in interest rates from unprecedented record lows by the ECB, the People’s Bank of China and the Federal Reserve will not lead to falling gold and silver prices - contrary to some misinformed opinion.

Gold

Gold is trading at $1,460.45/oz, €1,021.17/oz and £895.77/oz.

Silver

Silver is trading at $39.55/oz, €27.66/oz and £24.27/oz.

Platinum Group Metals

Platinum is trading at $1,802.50/oz, palladium at $789/oz and rhodium at $2,350/oz.

News

(Reuters) -- Gold firms near record, silver strikes 31-year peak

Gold firmed on Wednesday and held near a lifetime high hit in the previous session as lingering worries about inflation and tensions in the Arab World offset China's latest move to raise interest rates.

Silver hit another 31-year peak as the metal attracted interest from investors looking for a cheaper alternative to gold and also a hedge against inflation.

Spot gold added $2.13 an ounce to $1,452.63 by 0350 -- not far from a record of $1,456.85 hit on Tuesday on rallies in corn and oil prices and a downgrade in Portugal's credit rating that highlighted euro zone debt worries. "Gold is still looking to hit another record. Tensions in the Middle East and North Africa are not solved yet. Secondly, there are new uncertainties in the euro zone. These all will benefit gold," said Ronald Leung, director of Lee Cheong Gold Dealer in Hong Kong.

"The only thing is that the increase in Chinese interest rates will be a negative factor for a little while."

The world's largest gold-backed exchange-traded fund, SPDR Gold Trust, said its holdings inched up to 1,212.745 tonnes by April 5 from 1,211.229 tonnes on March 31.

Spot gold may hover around $1,452 per ounce for one trading session before climbing toward $1,477, according to Wang Tao, who is a Reuters market analyst for commodities and energy technicals.

U.S. gold futures for June rose $1.5 an ounce to $1,454.0 an ounce.

China's central bank raised interest rates on Tuesday for the fourth time since October, underlining Beijing's determination to clamp down on inflation.

The increase comes before an expected rate hike by the European Central Bank on Thursday -- first since the global financial crisis, showing how inflation is rising to the top of the global policy agenda.

China's interest rates hike often triggers fears of a slowdown in the country's demand for commodities, including gold and industrial metals, but London copper futures firmed on Wednesday and ignored Beijing's latest move.

The 25 basis point rise announced by Beijing was viewed as just the latest step in a tightening cycle which has been going on for some time and was expected to continue.

Investors will still focus on the unrest in the Middle East and North Africa, which has also spurred buying in silver and pushed up oil prices.

The head of Libya's rebel army has condemned NATO for its slow chain of command in ordering air strikes to protect civilians, saying the alliance was "letting the people of Misrata die every day.

Spot silver rose to $39.41 an ounce, its highest level since early 1980, extending Tuesday's gains.

"There's buying in silver but we don't really know whether it's coming from China or anywhere else. We can say silver is cheaper to buy compared to gold," said a dealer in Hong Kong.

"Silver will go up to $40 and it could rise to $100 in the next few years."

Other dealers said India showed some interest in silver during the wedding season, when parents give jewelry, mostly gold, to their daughters.

In other markets, the yen fell as the Bank of Japan began a meeting on Wednesday that may signal its readiness to further loosen monetary policy to support the earthquake-hit economy while Asian stocks were muted after an interest rate rise in China.

(Bloomberg) -- Gold Climbs to Record for Second Day; Silver at 31-Year Peak

Gold gained to a record for a second day in London and New York as investors bought the metal on concern interest-rate increases will curb global growth and as the dollar slumped against the euro. Silver advanced to a 31- year high.

The euro rallied to a more-than 14-month high versus the greenback before the European Central Bank meets tomorrow to decide on interest rates. China raised rates yesterday for the fourth time since mid-October to restrain increasing consumer prices.

“Investors are certainly hopeful, but confidence is lagging” that the global economic recovery can remain on track, Chris Weafer, Moscow-based chief strategist at UralSib Financial Corp., said in an e-mail. Economic data yesterday was “marginally disappointing and China’s latest interest rate rise did nothing to calm nerves,” Weafer said, after U.S. service industries grew less than forecast in March.

Gold for immediate-delivery rose as much as $3.35, or 0.2 percent, to an all-time high of $1,459.07 an ounce, and was little changed at $1,455.82 an ounce by 10:09 a.m. in London. Gold for June delivery in New York rose 0.3 percent to $1,456.50 an ounce after reaching a record $1,460.20 earlier today.

The dollar declined as much as 0.6 percent against the euro before tomorrow’s meeting of the ECB, which will increase its main interest rate by 25 basis points to 1.25 percent, according to a Bloomberg survey of economists.

The dollar’s level “is definitely one of the forces behind” gains in gold, Eugen Weinberg, an analyst at Commerzbank AG in Frankfurt, said today by e-mail.

Libya Conflict

Demand for precious metals strengthened over the past week as investors sought a shelter to protect their wealth against the conflict in Libya, the nuclear crisis in Japan and European sovereign debt concerns. Moody’s downgraded Portugal’s long-term government bond ratings by one level to Baa1 from A3, and said it’s considering another reduction.

“The reality of accelerating inflation in China is indeed positive for gold,” UBS analyst Edel Tully said in a report. Gold may extend gains toward $1,465.71 an ounce after breaking through the “psychological” level of $1,450, Tully wrote. Federal Reserve Chairman Ben S. Bernanke this week said inflation must be watched “extremely closely,” spurring bets that interest rates may be raised sooner than analysts expected.

Spot silver was little changed at $39.3075 an ounce after earlier today climbing to $39.5013, the highest level since February 1980. An ounce of gold bought as little as 36.86 ounces of silver in London today, the lowest level since September 1983, data compiled by Bloomberg show. Gold has jumped 28 percent in the past year, and silver more than doubled.

ETP Holdings Gain

Gold held in exchange-traded products rose 1.51 metric tons to 2,030.27 tons yesterday, data compiled by Bloomberg from 10 providers show. Holdings reached a record 2,114.6 tons in

December. Silver ETP assets were unchanged at 15,395.52 tons, data from four providers show. Palladium for immediate delivery was little changed at $788.25 an ounce, while spot platinum was 0.1 percent higher at $1,795.75 an ounce.

(Bloomberg) -- Gold Climbs to Record in ‘Flight to Safety’ as Silver Reaches 31-Year Peak

Gold climbed to a record for a second day as the sovereign-debt crisis in Europe deepened after Moody’s Investors Service cut Portugal’s credit rating and higher grain and oil prices worsened the inflation outlook.

Immediate-delivery bullion increased 0.2 percent to an all- time high of $1,459.07 an ounce and traded at $1,457.47 an ounce at 3:53 p.m. in Singapore. Gold for June delivery in New York rose 0.5 percent to a record $1,460.2 an ounce and traded at $1,458.2 yesterday. Cash silver climbed to $39.5013 an ounce, the highest level since 1980, before trading at $39.385.

“Investors continue to exhibit symptoms of flight to safety,” Shiyang Wang, analyst with Barclays Capital, wrote in a note to clients. Gold and silver gained as oil “forged ahead with its upward trajectory while ongoing geopolitical concerns and European sovereign-debt issues remained.”

Demand for precious metals strengthened as investors sought a shelter to protect their wealth against the conflict in Libya and the nuclear crisis in Japan. Moody’s downgraded Portugal’s long-term government bond ratings by one level to Baa1 from A3, and said it’s considering another reduction.

Federal Reserve Chairman Ben S. Bernanke this week said inflation must be watched “extremely closely,” spurring bets that interest rates may be raised sooner than analysts expected. The European Central Bank signaled it’s ready to raise borrowing costs this week. Yesterday, China raised rates for the fourth time since mid-October to restrain increasing consumer prices.

Gold-Silver Ratio

The gold-to-silver ratio continued its descent as the white metal climbed to its most expensive level versus bullion since 1983. An ounce of gold bought 36.99 ounces of silver today, compared with an average of 62 in the past 10 years.

“It still has the 33.83/31.58 area in sight,” Axel Rudolph, technical analyst with Commerzbank AG, wrote in a report yesterday. “It may take several weeks, if not months, for this to be reached.”

Gold has jumped 28 percent in the past year, and silver more than doubled. Gold remains an attractive investment even at record prices, fueled in part by the Federal Reserve’s $600 billion of Treasuries purchases through June, according to Bianco Research LLC in Chicago.

“I think the path of least resistance for gold is higher,” said James Bianco, the firm’s president, told Bloomberg Television yesterday.

Palladium for immediate delivery strengthened 0.3 percent to $790.75 an ounce, while spot platinum was up 0.3 percent at $1,799.55 an ounce.

(Bloomberg) -- Wing Hing Rises in Hong Kong on South African Gold Deal

Wing Hing International Holdings Ltd., a building contractor, rose the most in almost a year in Hong Kong trading after agreeing to pay as much as $580 million for South Africa’s Taung Gold Ltd.

Wing Hing gained 17 percent to 70 Hong Kong cents at 12:31 p.m. local time, the most since April 9 last year. The stock had been suspended since Jan. 31.

Taung has interests in two gold mining projects in South Africa, which may a total of about $2 billion to develop, Wing Hing said in a filing on April 4. The Hong Kong-based company will issue 10.9 billion shares to pay for the transaction.

The company is shifting its focus to gold mining, completing the purchase of an exploration license in China’s Hebei province in July.

(Bloomberg) -- Vietnam Gold Traders Want Cut in Export Tax, Lao Dong Reports

The Vietnam Gold Traders Association has asked the government for a cut in the gold export tariff to boost shipments of the metal, Lao Dong newspaper reported, citing the industry group.

The current 10 percent export tax for the metal should be cut to 0.5 percent or 0 percent because profit margins for the gold export business aren’t higher than one percent, Lao Dong said, citing the association.

(Bloomberg) -- Rand Gains to One-Year High to Yen on Gold, Rate Differential

The rand surged to its highest level in almost a year against the yen and gained against the dollar on speculation rising commodity prices will buoy Africa’s biggest economy, boosting investor appetite for rand assets.

South Africa’s currency gained as much as 1.5 percent to 12.7711 yen, the strongest level since May 4, and traded at 12.7129 yen at 10:34 a.m. in Johannesburg. The rand rose as much as 0.6 percent to 6.6798 per dollar, its highest since Jan. 5.

South Africa’s central bank may raise its key interest rate from 5.5 percent this year as economic growth and inflation accelerate, some economists say, widening the difference with near-zero rates in Japan and the U.S. The Bank of Japan will likely keep rates low to aid an economic recovery after the nation’s biggest earthquake on record.

“The yen remains under significant pressure as markets assess the damage to the economy,” John Cairns and Nema Ramkhelawan, currency strategists at Johannesburg-based Rand Merchant Bank, wrote in a research note. With gold at a record, “the bias is for gains” in the rand, they wrote.

Gold climbed to a record for a second day as the sovereign- debt crisis in Europe deepened after Moody’s Investors Service cut Portugal’s credit rating. Platinum rallied for a third day, and copper gained on expectations faster global economic growth will boost demand for industrial metals. The two commodities account for about a fifth of the nation’s export earnings.

Yield Spread

South Africa’s 13.5 percent bond maturing in September 2015 yields 721 basis points, or 7.21 percentage points more than Japanese debt of similar maturity. The spread has widened from 661 basis points on Nov. 11, according to data compiled by Bloomberg. The rand has earned a 6.7 percent return in the so-called carry trade against the yen in the past month, according to data compiled by Bloomberg.

South Africa’s Business Confidence Index reached a 30-month high yesterday on signs economic growth is accelerating. Finance Minister Pravin Gordhan said on April 1 the economy may grow faster this year than the government’s 3.4 percent estimate, spurred by rising demand for the country’s commodity exports.

“This buoyancy is likely to spill over to the consumer prices and reignite inflation expectations,” BNP Paribas SA analysts led by London-based Paul Mortimer-Lee wrote in a research note. “If this scenario materializes and inflation moves to the upper area of the target range, the Reserve Bank will likely initiate rate hikes, which will be positive for the rand.”

Government bonds gained. The 13.5 security due 2015 climbed 17 cents to 121.45 rand, cutting the yield 5 basis points to 7.69 percent.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.