Gold and Oil Will Soar When the Saudi Monarchy Falls

Commodities / Middle East Apr 06, 2011 - 06:04 AM GMTBy: Ron_Holland

Oil at $200 plus a barrel will be the least of America’s problems when the Saudi Monarchy falls.

Oil at $200 plus a barrel will be the least of America’s problems when the Saudi Monarchy falls.

"If something happens in Saudi Arabia it (oil) will go to $200 to $300 (a barrel). I don't expect this for the time being, but who would have expected Tunisia?" ~ Former Saudi oil minister Sheikh Zaki Yamani 4/5/11

The most important question facing the United States today is whether the freedom revolutions sweeping the Middle East will impact the authoritarian regime of Saudi Arabia and the major oil producers surrounding this nation of major oil reserves? The second question is if the government is overthrown, will the new government continue the practice of pricing oil in depreciating dollars rather than consider new options?

The most important question facing the United States today is whether the freedom revolutions sweeping the Middle East will impact the authoritarian regime of Saudi Arabia and the major oil producers surrounding this nation of major oil reserves? The second question is if the government is overthrown, will the new government continue the practice of pricing oil in depreciating dollars rather than consider new options?

The future value of the dollar and the dollar status as the world’s reserve currency depend heavily on the outcome of these two questions. This is why the price of gold could soar and the dollar move dramatically lower when the Saudi Monarchy is overthrown. I fear, the probable American military reaction to this scenario threatens what remains of our republic and may be compared by future historians as comparable in scope to Caesar's march across the Rubicon in Roman history.

"I don't think that what the King is doing now is sufficient to prevent an uprising. Saudi Arabia is a time bomb, but one that is constantly being reset," ~ Jaafar Al Taie, managing director of Manaar Energy Consulting

Today, I’m warning about the risk of a dollar and Treasury bond threat which could make the real estate collapse or 2008 market meltdown mere footnotes in comparison. Today in the Middle East, either by stupidity or design, the Federal Reserve’s perpetuation of the dollar and treasury debt Ponzi schemes is now dependent on the survival of a few dictatorial regimes staying in power in the Persian Gulf while surrounded by spreading freedom revolutions.

This is the most dangerous region in the world and the focal point for conflict between Iran and America, the freedom revolution and authoritarian regimes, Sunni and Shiite, Israel and the Arab world, vast oil resources and the oil needs of the West and China, and where the decision will be made to price oil in depreciating dollars or in other currency alternatives. Of all the conflicts and threats in the region, I believe the question as to whether oil continues to be priced in dollars and the dollar remains the world’s reserve currency for now and the risk of a US dollar and debt collapse are the greatest threats facing America and the West.

The real estate bubble and financial meltdown as well as the new stock market bubble are misdemeanors in criminality compared to the Federal Reserve mistake of allowing our currency and debt to be dependent and held hostage based on the survival of a few corrupt authoritarian leaders in fake nations created by London politicians many years ago.

The Saudi Monarchy Will Fall Sooner Rather Than Later

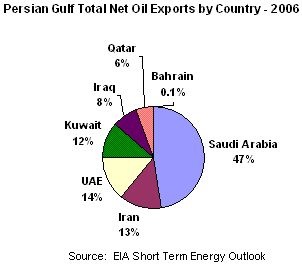

The democracy index published by the Economist Intelligence Unit for 2010 places Libya 158th out of 167 and Saudi Arabia 160th of all nations in terms of an authoritarian government verses a democracy. I fear the oil producing nations of Saudi Arabia, Kuwait, Iraq, Qatar and the U.A.E. could eventually fall to freedom revolutions which have mutated into movements outside the control of the United States. Whether the current radical elements in the revolutionary movements will move to the forefront and possibly take control depends a lot on the current authoritarian regimes reaction to the freedom revolutions in each nation as well as future United States actions to safeguard the future of oil reserves and the dollar.

The fear of these movements sweeping the region is why the Obama Administration postponed actions which could have toppled Gaddafi weeks ago because another perceived victory there would have dramatically increased the growth and blitzkrieg effect of the revolutionary movements thus making them unstoppable and a real threat to first Bahrain and then Saudi Arabia etc. I previously discussed how the Libyan civil war is just a sideshow and deception to buy time and slow down what had been a cake walk by revolutionaries across the Middle East. The real action is in the Persian Gulf and the region is called the Persian Gulf because historically most of the region was under Persian (Iranian) influence.

Washington has successfully in the past chosen stability and tyranny in the region over the Arab people in the streets and now we are going to pay the price through the unintended consequences of our foreign policy in the region. This foreign policy failure when combined with Washington and Federal Reserve economic policies could be a lethal combination for the United States as well as the future of our children and grandchildren.

Our nation may well suffer severe economic consequences, a dollar and debt mini-collapse as well as the risk of a major war in the Persian Gulf region requiring an increasing degree of police state controls at home, the possible return of the draft and even a more authoritarian government in Washington. This is the dark future engineered by the Anglo-American monetary elites, some Washington politicians and the Federal Reserve which have put our currency at such risk.

The United States cannot allow new revolutionary governments outside our control to replace current regimes with political leaders which could threaten the dollar, our national debt and the US economy. If this becomes a risk, I fear the US military could be ordered to intervene and do whatever is necessary to either prop up or install new governments that will still continue to price oil in dollars. Frankly speaking should this situation develop, this may actually be the only way to defend a collapsing fiat dollar regardless of my personal views against military intervention.

The daily news reports continue to show the spread of revolutionary activity across the Middle East now directly impacting Syria, Jordan, Yemen and other nations around the periphery of Saudi Arabia. It appears the new social media driven freedom movements attack both US backed authoritarian regimes and enemies like Libya and Syria. What is often not recognized but apparent is the initial foreign intelligence involvement in the early birth of these revolutionary movements.

Regardless of their initial birth as engineered opposition movements by foreign intelligence, as has often been the case since the early 20th century, today these freedom movements have taken on a life of their own. They now threaten not only out of favor authoritarian leaders and enemy regimes but in the case of the United States, the modern day empire which covertly spawned the initial birth of the revolutions today.

Don Tapscott below certainly explains the situation in the region far better than I can and this is what we now face in the Middle East.

The real situation is "Revolution is not happening because of the current systems in place, it is happening despite them," he said. "In the Middle East the old thinking has been support tyrants because they provide stability and keep the oil flowing; the young people are revolting against this very kind of thinking….Technology is enabling revolutions across the Middle East. Young people do not want to be subjects anymore. Until now revolutions have had a leader, technology has changed that," ~ Don Tapscott, the co-author of "Macrowikinomics: Rebooting Business and the World."

The Law of Unintended Consequences

The US should have learned from Iraq and Afghanistan how the law of unintended consequences from aggressive military, political or covert actions in a complex system like the Middle East can often create undesirable outcomes far different from what was hoped. Just as our invasion of Iraq destroyed the major bulwark against Shiite Iran and actually created another Iranian ally. Also our Afghanistan venture destabilized Pakistan, and today the freedom revolutions are slowly surrounding the House of Saud and the major Persian Gulf oil producing and US debt holding nations. We should also remember how our blind backing of the Shah of Iran and his excesses helped bring about the Iranian Revolution of 1979 and the Khomeini led Islamic state and the problems we are dealing with today.

An excellent analogy of the unintended consequences is the long-term result of Germany introducing Lenin and communism to Czarist Russia during World War One. This was successful in the near term to take Russia out of the war and end Germany’s two front war. But the long-term result was a 70 year battle between the communist system and the West which created both the Cold War and contributed to the rise of Hitler in Germany as an alternative against a communist takeover in the 1930’s. Even now, most of the fabricated nations in the Middle East were actually created in London and Paris following the Treaty of Versailles and our oil and dollar controlled foreign policies there are a direct result of fake countries and boundaries created following the First World War almost a century ago.

America’s Weakest Point is the Persian Gulf

"The importance of maneuvering so your enemy is hit in his weakest points." ~ Sun Tzu’s, The Art of War

"The importance of maneuvering so your enemy is hit in his weakest points." ~ Sun Tzu’s, The Art of War

Although the United States is unassailable from a military standpoint in the region, the Washington dollar and Treasury debt are our weakest points and the entire world knows this.

If you have noticed, whenever Saudi Arabia is mentioned, the establishment news coverage is always followed by a comforting statement stressing how the House of Saud will somehow escape the political change in the region. The fall of the Saudi monarchy or serious unrest in the Shiite oil producing region of Saudi Arabia is the "elephant in the room" that no one wants to discuss or write about and why the threat is being ignored and going unaddressed.

The reason is all of the oil produced in the Persian Gulf region outside of Iran is currently priced in US dollars thus allowing the United States and the Federal Reserve to create more dollars at will. 87% of the oil exported out of the Persian Gulf is priced in US dollars and as I explained last week in The Great Anglo-American Gaddafi Deception, the pricing of oil in dollars is a major contributor to maintaining the dollar’s role as the world’s reserve currency.

I believe the Washington Treasury debt and US dollar Ponzi scheme would risk collapse if these five nations mentioned above should threaten or seriously consider pricing oil in gold, Euros, SDR’s or any other currency other than dollars. In addition, Israel wouldn’t survive even with its feared Samson option for more than a few months if the US should lose in the region. Therefore the existence of Israel and the economic survival of the United States, our fiat dollar and the continued rollover of our Treasury debt are very dependent on friendly governments controlled and protected by Washington maintaining power at any price in the Persian Gulf.

Thus our economic future is only guaranteed by fake monarchs and Washington backed puppet regimes staying in power in the region. These are authoritarian regimes and dictatorships because the countries are artificial nations with questionable national boundaries. These nation states only began when needed by the British colonial office almost a century ago in London. In fact, the actual delineation of national borders only started with the first oil concessions in the 1930’s as the United Kingdom needed to map the different oil deposits and this was when the European modern nation state concept was first forced on the region by European powers.

Washington’s Greatest Fear Are the Color Revolutions Sweeping the Middle East

In Libya, the rebels are called the Interim National Council (INC) and apparently run by a former Libyan colonel Khalifa Hifter, who broke with Gaddafi over 20 years ago and has lived a quiet life with no visible means of support only a few miles from CIA headquarters in Langley, Virginia.

Remember, the rebel forces were initially at the gates of Tripoli, when any kind of military or even diplomatic action would have overthrown Gaddafi but now once again they have been pushed back and cornered in Benghazi for the second time in several weeks after the use of air power.

Certainly the rebels have sadly been reduced to "dogs of war" and held on a leash by the US and allied elites in order to continue the sideshow action for entertainment and nightly news coverage as the new freedom revolutionaries are taught that victory can only be achieved by working within the confines of the Anglo-American paradigm.

What Will China Do? China can manipulate the foreign policy of the United States in the same way the United States forced the United Kingdom to withdraw its forces back during the Suez crisis. This was in 1956 when the UK, France and Israel invaded Egypt to take control over the Suez Canal. Washington threatened to dump the US Government's Sterling Bond holdings if Great Britain didn’t withdraw troops and the invasion ended.

What Will Iran Do? – They are masters at thinking long-term and I do not believe they will take any action to provoke a wounded beast like the Washington Empire. Iran has not invaded another nation in hundreds of years while you well know America’s sordid track record of aggression, drone attacks, aerial bombing and military occupation. Why should they? Their intelligence services were behind the fake weapons of mass destruction evidence in Iraq and they provoked the Bush Administration into invading Iran and toppling their major opponent in the Middle East. They will just sit back and let us do ourselves in.

What Should Americans Do?

- First, we need to audit and eliminate the Federal Reserve which is the vehicle the monetary elites use to enslave our nation and most of the rest of the world.

- Second, follow the real news on the Middle East with alternative news sites and email letters like LewRockwell.com, The Daily Bell and the Swiss Mountain Vision newsletter for which I’m also a contributing editor.

- Third, get as much of your wealth as possible legally and following all of the new reporting requirements out of the threatened fiat dollar currently being destroyed by Washington and the Federal Reserve. Consider other investments, currencies and real estate denominated in the Euro, Swiss franc etc. as well as gold and natural resource stocks. None of your wealth will be safe inside the United States if the dollar status as the reserve currency is compromised by the fall of Saudi Arabia and other friendly governments selling oil for dollars in the region.

- Store large amounts of gold outside the US in protected and safe jurisdictions in Europe, Australia and Switzerland in secure storage programs like Global Gold located in Switzerland.

- Finally oppose all future military activities in the Middle East as the unintended long-term consequences of US control in the region have historically far outweighed any near-term military gain advocated by the Neocons or profits for a few elite controlled financial institutions and international corporations.

If the Saudi Monarchy and other Persian Gulf dictators are overthrown by the current revolutionary movements, the debate will be shifted from should we go to war and occupy the region and restore stability (which actually means they continue to rollover treasury debt and price oil in dollars) to like the trial runs of 9/11 and the Fed induced meltdown, do we choose military action or risk economic and dollar collapse. Both Congress and the American people showed their preference for stability at any price including war and loss of liberties. Therefore I fear our conditioned response is already assured.

In the final analysis, the monetary elites are probably correct that their continued survival and parasitic control over much of the West can only be assured by full occupation of the oil resources of the region rather than depending on the former strategy of authoritarian regimes now shown to be weak and subject to powerful freedom movements.

Although all efforts will be made to stay outside the Moslem Holy cities of Mecca and Medina, a new foreign occupation of the Middle East although cloaked in some UN, NATO or Arab organization agreement will still be seen by the people in the street as another crusade for oil and against the Moslem world. This will be magnified if the US and their former colonial masters also utilize the forces of Israel in this repeat version of the 1956 Suez Crisis and takeover of the Suez Canal.

This kind of action although maybe necessary for the survival of the dollar and oil supplies could begin the end of the West as we know it. But then again, maybe that is the goal of the Anglo-American elites moving toward global governance and control by a few wealthy and powerful families? Maybe they can only succeed in their goals of one world government if they world they govern has become so desperate, poverty stricken and tired of permanent war that we will accept any limitation on our wealth and liberties to just survive.

After all, in the end, most people will sacrifice freedom and liberty for stability. It worked for the Soviet Union, Nazi Germany and since the end of World War Two in the Middle East. Why would this not work in Europe and America?

I guess Benjamin Franklin was right."They who can give up essential liberty to obtain a little temporary safety, deserve neither liberty nor safety." We did this after the 9/11 attack, and we again allowed this to happen after the Federal Reserve created bubble and financial meltdown in 2008. I fear if history is any guide, America and the West will follow the same course of action again in the Middle East but this time straight to the slaughter house of perpetual war and the risk of economic poverty at home.

Ron Holland [send him mail], a retirement consultant, works in Zurich and is a co-editor of the Swiss Mountain Vision Newsletter. He is the author of the special report, "Get Ready To Escape the Obama Retirement Trap" and you can email him for the complete report.

© 2011 Copyright LewRockwell.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.