Fed FOMC Minutes Show Divisions Over Inflation, QE and Interest Rates

Interest-Rates / US Interest Rates Apr 06, 2011 - 05:04 AM GMTBy: Asha_Bangalore

The main message from the minutes of the March 15 FOMC meeting is that policy making will be contentious as the members of the FOMC hold different opinions about inflation and the need to continue the exceptional financial accommodation that is underway. Although all members agree that the recovery is on a "firmer footing" and the housing sector remains in a slump, their views about inflation were significantly different.

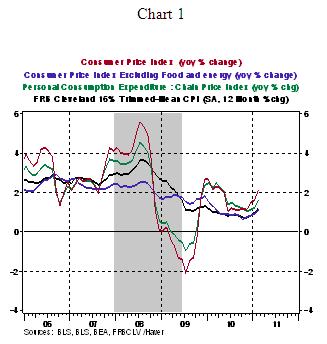

It was noted that higher prices of oil and other commodities had lifted headline inflation but "underlying inflation remained subdued." The stability of inflation expectations was reinforcing the view that the recent increase in commodity prices was only "transitory." Chairman Bernanke reiterated this view on April 4. He also indicated that inflation and inflation expectations need to be watched closely and if the Fed's current projections are incorrect they would have to take appropriate action. As Chart 1 shows, inflation measures appear to have bottomed out in late-2010. But, core inflation remains far from the level associated with the price stability mandate, while higher commodity prices have raised overall inflation measures closer to 2.0%, the "unofficial target."

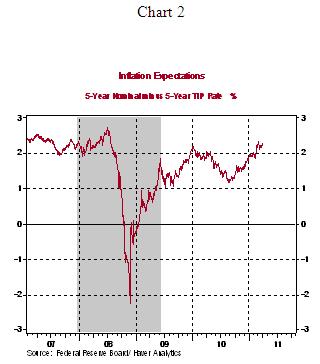

Inflation expectations are contained, for now (see Chart 2). However, there was another view that was discussed at the meeting. Some members "observed that rapidly rising commodity prices posed upside risks to the stability of longer-term inflation expectations, and thus to the outlook for inflation, even as they posed downside risks to the outlook for growth in consumer spending and business investment."

In light of recent developments in the global economy, particularly in North Africa and the Middle East, the FOMC noted that the potential for "disruptions" in oil production implies higher oil prices and "upside risks to inflation" and "downside risks to growth."

A few members of the FOMC also noted that if the public's confidence about the Fed's ability to shrink its balance sheet declines, than it would result in "upward pressure on inflation expectations and so on actual inflation." In order to alleviate this risk, the FOMC is currently working on exit strategies for alternate scenarios. The FOMC was divided about timing of the exit, with a few considering a less-accommodative stance in 2011 and others suggesting that the exceptional policy support should continue beyond 2011.

Differences about the $600 billion asset purchase program were also recorded in the minutes. Several indicated that they did not anticipate making adjustments to this program, while others indicated that "evidence of stronger recovery, or of higher inflation or rising inflation expectations, could make it appropriate to reduce the pace or overall size of the purchase program."

Chairman Bernanke's remarks on April 4 that he sees the recent hikes in energy and commodity prices as "transitory" and the differences of opinion presented in the minutes suggests that the April 26-27 FOMC meeting will include a spirited debate about the near term path of monetary policy.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.