Does a Weak U.S. Dollar Cause Inflation?

Economics / Inflation Apr 05, 2011 - 09:23 AM GMTBy: Axel_Merk

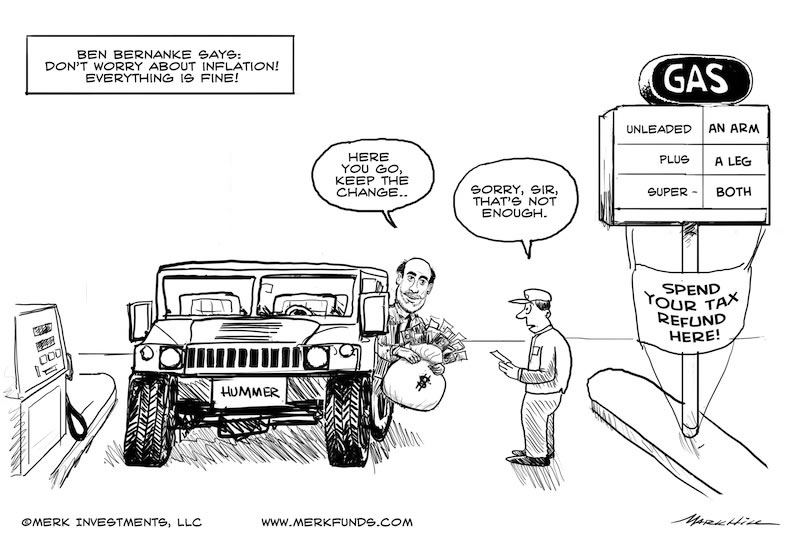

Should investors be concerned that a weaker U.S. dollar causes inflation? The price at the gas pump should be a stark reminder that a weaker dollar may contribute to higher prices. Yet, economists tell us that food and energy inflation does not count. Why do economists have such a baffling sense of logic? Are economists really aliens in disguise, locked up in ivory towers? Let’s shed some light on the logic and why it may not merely be strange, but wrong.

Should investors be concerned that a weaker U.S. dollar causes inflation? The price at the gas pump should be a stark reminder that a weaker dollar may contribute to higher prices. Yet, economists tell us that food and energy inflation does not count. Why do economists have such a baffling sense of logic? Are economists really aliens in disguise, locked up in ivory towers? Let’s shed some light on the logic and why it may not merely be strange, but wrong.

First off, we are talking about the “modern” notion of inflation, rising prices as expressed in the Consumer Price Index (CPI). Historically, inflation had been considered an increase in money supply. Economists have decided to blur the term to have a more “accurate” measure of inflation. When economists embraced what some consider a conspiracy to shortchange retirees entitled to inflation-indexed social security benefits, it may have merely been an attempt by economists to please policy makers, so that their alien identity would not be revealed.

What conspiracy and alien theories have in common is that they imply it’s a question of personnel rather than the system. If there’s one thing we have learned in our discussions with policy makers, including those whose policies we disagree with, it is that they generally work with the best of intentions – as in, “the road to hell is paved with good intentions.”

When Federal Reserve (Fed) Chair Ben Bernanke tells us a weak dollar is not inflationary, he truly means it. And he is right. But possibly also very wrong. As a scholar, his view is based on research conducted at the Fed. “Research” refers to a study of the past, with the argument that the past may be the best we can go by in assessing the future. But given that our current fiat monetary system has only been in place since Nixon removed the last link to the gold standard in 1971, one needs to consider that we have hardly had enough economic cycles to truly understand all levers that drive inflation and the U.S. dollar. In a world inundated with data, economists are eager to find patterns to extrapolate. Not surprisingly, I had to endure presentations by very smart Ph.D.’s in the years leading up to the financial crisis who argued that housing prices would never decline: just look at the data! It never happens, not in the U.S.! The missing piece in the analysis was common sense; but as we all know, it wasn’t just a few that were caught in this trap.

When Federal Reserve (Fed) Chair Ben Bernanke tells us a weak dollar is not inflationary, he truly means it. And he is right. But possibly also very wrong. As a scholar, his view is based on research conducted at the Fed. “Research” refers to a study of the past, with the argument that the past may be the best we can go by in assessing the future. But given that our current fiat monetary system has only been in place since Nixon removed the last link to the gold standard in 1971, one needs to consider that we have hardly had enough economic cycles to truly understand all levers that drive inflation and the U.S. dollar. In a world inundated with data, economists are eager to find patterns to extrapolate. Not surprisingly, I had to endure presentations by very smart Ph.D.’s in the years leading up to the financial crisis who argued that housing prices would never decline: just look at the data! It never happens, not in the U.S.! The missing piece in the analysis was common sense; but as we all know, it wasn’t just a few that were caught in this trap.

The reason Bernanke is right is because in the past, indeed, a weaker dollar has not necessarily been inflationary. Most notably, the U.S. dollar index almost halved between February and December of 1987. The CPI, however, increased by a “mere” 4.4%. The main reason why, historically, a weaker dollar may not have been particularly inflationary, is that foreign exporters tended to absorb what amounts to a higher cost of doing business in a weak dollar environment. Because of competition, foreign exporters tend to be limited to two choices: reduce margins as exporting to the U.S. becomes less profitable, or stop selling into the U.S. market if it is no longer profitable.

There are numerous ways to manage currency risk: they include hedging in the forward currency markets, but also include moving production to lower cost countries or to the country where the customer is located. Lower cost countries tend to be the preferred destination for low-end consumer goods: Vietnam has seen a lot of investment as the cost of doing business in China has risen. However, for more value-added goods, producing closer to the consumer often makes sense: Toyota and BMW are two of the higher profile examples that have built plants inside the U.S. Active management of foreign exchange rates can buffer many risks, leading to a mitigated impact on consumer prices. Having said that, the management of foreign exchange risk can be an art as much as a science, and mistakes are made. Chinese businesses love fixed exchange rates because it is one less item to worry about; conducting business in a world with free floating exchange rates is a skill learned over time, a key reason why Chinese policy makers are rather slow to allow the yuan to appreciate.

Bernanke may also be very wrong. That’s because he may under-estimate just how far foreign exporters have been pushed in recent years, as the U.S. may be pursuing an ever weaker dollar. As U.S. manufacturing has eroded over the years, foreign exporters may have another option at hand: passing the higher cost of exporting to the U.S. onto U.S. importers. In an economist’s mind, that should not happen easily. We beg to differ and point to the spring of 2008 as evidence. At the time, import prices were soaring, reaching annual increases of over 20% year over year; and it was not all driven by oil prices moving well above $100 a barrel. Chinese exporters were starting to raise prices; and guess what: there was no U.S. manufacturing to fill the void, those higher prices had to be accepted.

Said differently: many Chinese businesses have had an implicit export subsidy because of the yuan’s quasi-peg to the U.S. dollar. While many of these operations may go out of business should the yuan appreciate, the quasi-peg has also created a fiercely competitive export environment, as there are more competitors than would otherwise be the case in an environment with free floating exchange rates. As a result, international companies that know how to operate profitably in China today are some of the most sophisticated in the world. Think of the South Korean electronics giant LG: after learning how to compete in China, the company started selling more aggressively in the U.S.; nowadays, you can get appliances, cell phones, TVs by LG. Conversely, WalMart has a very tough time competing in China and has left the South Korean and German markets; low retail margins imposed by fierce competition make it difficult for WalMart to compete in these markets with its bloated corporate overhead.

The Financial Times writes, “Li & Fung, a Hong Kong-based consumer goods sourcing and logistics company, warned that a new era in sourcing with higher prices has begun, as manufacturers pass on the rising costs of raw materials and Chinese labor to customers.” Walmart and Gap in the U.S. are amongst Li & Fung’s customers. While the firm has increasingly moved production to cheaper Asian countries, the firm continues to engage in acquisition in China, making China more, rather than less relevant in the sourcing business. In fact, last week Wal-Mart CEO Bill Simon cautioned "We're seeing cost increases starting to come through at a pretty rapid rate. Inflation is going to be serious."

U.S. policy makers have to be careful about what they wish for. As the U.S. dollar may weaken further, foreign exporters may indeed be able to pass on higher prices. In 2008, the U.S. was “bailed out” by a financial crisis, causing pricing pressures to ease once again. With policy makers instigating a “growth at any cost” approach yet again, we may not be so lucky this time around.

Of course, American consumers may react by buying fewer of the gadgets they didn’t need in the first place. Policy makers would unlikely be satisfied with such a reaction. Not only has Bernanke called for inflation to be higher, but he has argued that the economy needs to grow by at least at 2.5% a year, just to keep unemployment from rising. Any consumer slowdown may be countered with more money printing or other monetary or fiscal initiatives. There is a real risk we may be getting more than we are bargaining for.

Ensure you sign up for our newsletter to stay informed as these dynamics unfold. We manage the Merk Absolute Return Currency Fund, the Merk Asian Currency Fund, and the Merk Hard Currency Fund; transparent no-load currency mutual funds that do not typically employ leverage. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.