Is Inflation Harmless or Even Good?

Economics / Inflation Apr 04, 2011 - 11:31 AM GMTBy: Robert_Murphy

As Ron Paul's "End the Fed" movement grows, more and more Fed economists are speaking up on behalf of the central bank. In a recent post, David Andolfatto of the St. Louis Fed argues that the systematic debasement of the currency has had a negligible effect on the average American. As we'll see, Andolfatto's evidence is completely irrelevant to the question. The Fed and commercial banks have been ripping off everyone who uses dollars.

As Ron Paul's "End the Fed" movement grows, more and more Fed economists are speaking up on behalf of the central bank. In a recent post, David Andolfatto of the St. Louis Fed argues that the systematic debasement of the currency has had a negligible effect on the average American. As we'll see, Andolfatto's evidence is completely irrelevant to the question. The Fed and commercial banks have been ripping off everyone who uses dollars.

Andolfatto Calls Foul

In setting the stage for his critique, Andolfatto first quotes Ron Paul who wrote in End the Fed (p. 25):

In setting the stage for his critique, Andolfatto first quotes Ron Paul who wrote in End the Fed (p. 25):

One only needs to reflect on the dramatic decline in the value of the dollar that has taken place since the Fed was established in 1913. The goods and services you could buy for $1.00 in 1913 now cost nearly $21.00. Another way to look at this is from the perspective of the purchasing power of the dollar itself. It has fallen to less than $0.05 of its 1913 value. We might say that the government and its banking cartel have together stolen $0.95 of every dollar as they have pursued a relentlessly inflationary policy.

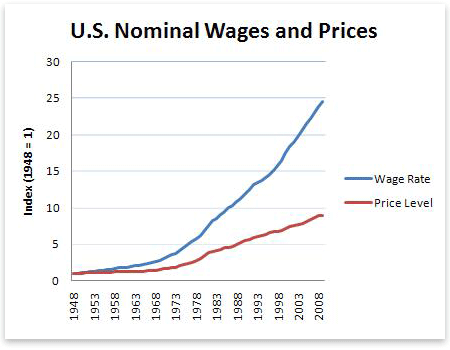

Andolfatto thinks this typical objection to the Fed is spurious. The fact that prices (quoted in dollars) have steadily risen since the founding of the Fed doesn't necessarily mean we're all poorer. Why? Because wages have steadily risen since the founding of the Fed too. To make his point, Andolfatto produces the graph below and then comments:

According to this (publicly available) data, the price-level (CPI) has increased by about a factor of 10 since 1948. But the average nominal wage rate has increased by a factor of 25. …

The figure above implies that the real wage (the nominal wage divided by the price-level) has increased by a factor of 2.5 since 1948. This is undoubtedly a good thing because it implies that labor (the factor we are all endowed with) can produce/purchase more goods and services. More output means an increase in our material living standards. …

Now, an interesting question to ask is how the picture above might have been altered if the price-level had instead remained more or less constant. Judging by the emails I receive, many people evidently believe that the nominal wage path depicted above would have largely remained the same (that is, they apparently see no connection between nominal wages and the price-level). …

I [suggest] there is reason to believe that under an hypothetical regime of price-level stability, the nominal wage rate in the graph above would instead have ended up increasing only by a factor of 2.5 (more or less) — the factor by which real wages actually rose.

Before continuing, let's be clear on Andolfatto's argument: He claims that isolated statistics showing the fall in the purchasing power of the dollar (or what is the same thing, the general rise in the prices of goods and services) don't prove that the average Joe is getting ripped off by inflation. The Fed's injections of new money have led to higher gas and bread prices, yes, but by the same token they've led to higher wages and salaries.

Now if one believes — as most economists do — that money is "neutral" in the long run, then there is no reason to suppose that the relative prices of labor and other items will change just because of more or less money printing. For example, if adding a worker to a factory yields additional output of one DVD set per hour, then basic price theory says that the worker's hourly wage should roughly be able to buy one DVD set. If there has been moderate inflation, and the DVD sells for $25, then the worker's wage rate will be $25. If there has been significant inflation, and the DVD sells for $2,500, then (at least once things settle down) we would expect the worker to get paid $2,500 an hour.

What about Savings?

The immediate response to Andolfatto's position is that he's ignoring the savings of the community. Here's how he handles that objection:

There are many episodes in history where savers have been hurt by an unexpected increase in inflation. I do not wish to defend the actions of any agency responsible for episodes of high and volatile inflation. …

But this is not the regime we currently live in. … [I]nflation has been (relatively) low and stable for over 30 years now. And the Fed is committed to keeping inflation … "low and stable" (implicit inflation target is 2%). The argument that a "careful saver" over the last 30 years "just now" sees the purchasing power of that money destroyed seems implausible to me. Most people do not hold the bulk of their savings in the form of cash. (And if people were holding their savings in the form of Treasury bonds, they would have experienced significant capital gains over the last couple of years with the decline in nominal interest rates.) I think [it's] fair to say that most people, or the people who manage their money, expect inflation. …

So Andolfatto thinks, not only that workers haven't gotten a bum deal from the Fed, but that even retirees should be fine (at least during the last three decades, when price inflation was fairly predictable).

Rather than pinpointing Andolfatto's mistakes, it's easier to analyze a thought experiment.

The Counterfeiter

Suppose Andolfatto's next-door neighbor tinkers with his color printer and comes up with the ability to print counterfeit $100 bills that are indistinguishable from the currency produced by the Treasury. (For those who haven't seen the Bureau of Engraving and Printing website's actual address, it's a hoot.)

In the first year, the man produces $1 million in counterfeit cash, and he uses it to buy jewelry, clothes, new cars, and other items with a total market value of $1 million. Now, how should the rest of us feel about this little operation?

Most people (except Walter Block) instinctively recoil at such selfish, antisocial behavior: the guy counterfeiting money in his basement is basically stealing from the rest of us. He is obtaining valuable goods and services even though he hasn't produced anything in exchange. He can't even argue that he's providing a valuable monetary asset, because he's merely fraudulently piggybacking on a system that he had nothing to do with. If merchants understood that the cash in his wallet came from his color printer, they wouldn't accept them in trade.

Now, in this scenario, what of Andolfatto's defenses of the Fed? For example, will the counterfeiter cause workers to suffer permanently lower "real" wages, i.e., paychecks adjusted for the new prices?

Not at all. If the counterfeiter restricts his activities to a one-shot burst of $1 million, then eventually all other prices in the economy will adjust to the new quantity of money. Prices in general will be higher, and that includes the price of labor (i.e., wages and salaries). Someone who had to work for a week in order to earn the money to pay the landlord probably still has to do the same; it's just that the numbers will be a little bit higher than they otherwise would have been.

So have I just proven that the counterfeiter didn't really hurt the community at all? No, of course he did. He really is driving around a new Ferrari, and he really does have a fancy new wardrobe. His printing up of $1 million didn't create new resources to facilitate the production of those goods; he merely redistributed them away from everyone else. The rest of the community is precisely that much poorer — even if we ignore the secondary disturbances caused by his injection of money.

What about Andolfatto's point concerning expectations? Is our hypothetical counterfeiter ripping people off because they don't expect the price hikes?

Again, no. Suppose the counterfeiter is an avid reader of Andolfatto's blog, and so to assuage his conscience he always sends an anonymous tip to various Fed economists the month before he begins a new injection of counterfeit money. In this way, the community can brace for the rising prices that will inevitably follow. In this revised scenario, is the public now fully immune to the counterfeiter's scheme?

Of course not. If the community expects another $1 million, prices might rise ever so slightly, even before the counterfeiter gets to the stores. But he still has a fresh $1 million in (nonrecognizable) counterfeit money on him. He can still use it to buy valuable goods and services, which thereby reduces the amount left for everybody else.

There is simply no getting around this basic fact. Over time, as the counterfeiter jets around the world, eating fancy meals and buying expensive jewelry, he is siphoning off potential consumption (or accumulating wealth) from everybody else. The fact that wages rise as well as other prices, and that investors can begin to anticipate the price hikes and invest accordingly, doesn't negate this simple conclusion.

Where Did Andolfatto Go Wrong?

There are at least two major things that Andolfatto overlooked in his analysis. In the first place, it's not true that every worker's nominal income would rise in proportion to the prices of the things the worker wants to buy. For a fanciful example, suppose our counterfeiter buys up all the known Mickey Mantle rookie cards on the planet. This will push up their market price, as the last remaining holdouts insist on top dollar.

Once things settle down, the final price of a Mickey Mantle rookie card will be much higher than the general increase in wages (and other prices). So somebody who had intended on using his Christmas bonus to buy one of the cards is now out of luck. Yes, his Christmas bonus will be bigger than before, but not enough to complete his intended transaction.

Here's a more serious example: if the counterfeiter buys real estate in New York, Los Angeles, and Chicago, he will push up land prices and rental rates in those markets more than he will, say, the price of eggs. People who live and work in those cities will thereby be hurt; their salaries won't rise to completely offset the jump in the cost of living.

The second major omission from Andolfatto's post is the inflation coming from fractional-reserve banking. Andolfatto looks at the "seigniorage" earned by the Treasury from the Fed's issuance of new fiat money, and concludes that it's "small potatoes" (his words). But that's because he's only focusing on the direct income to the Treasury remitted by the Fed on its excess interest income. (I explain that whole shady process in "The Fed as Giant Counterfeiter.")

Andolfatto is ignoring the commercial banks, which (typically) generate far more inflation than the Fed. Every time a commercial bank grants a new loan that is not backed up 100 percent by reserves, it is "creating money out of thin air" the same way Bernanke does when he buys toxic assets. (I explain the balance-sheet mechanics of fractional-reserve banking from a Rothbardian perspective in my video lecture, "The Theory of Central Banking.")

It's true, the more competitive the banking sector, the more these gains from fractional-reserve lending would be shared with the bank's customers. For example, fractional-reserve banks can afford to pay interest on checking accounts, which would probably not happen under 100 percent reserves.

Even so, if one subscribes to the Rothbardian view that the Fed is a cartelization device installed by the big bankers to enrich themselves, then we see the weakness of Andolfatto's defense. The general public is being bilked far more than just the "seigniorage revenue" would indicate.

Conclusion

The general public's distrust of big bankers and the Federal Reserve is grounded in fact. Inflation really does make most of us poorer. Although there are some nuances to the argument, it is valid to point to the drop in the dollar's purchasing power since 1913 as an indication of the magnitude of the theft.

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2011 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.