Will 1970s-Style Inflation Derail the Stocks Bull Market?

Stock-Markets / Stock Markets 2011 Apr 01, 2011 - 08:33 AM GMTBy: Chris_Ciovacco

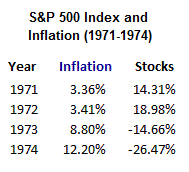

Inflation can adversely affect corporate profits, household discretionary spending, and stock prices. Rising costs for raw materials have a dampening effect on profits. Increasing costs of food and energy begin to account for larger and larger portions of a household’s disposable income. From an investment perspective, when the annual inflation rate jumped significantly between 1971 and 1974, stock market (SPY) returns eventually suffered as shown below.

Inflation can adversely affect corporate profits, household discretionary spending, and stock prices. Rising costs for raw materials have a dampening effect on profits. Increasing costs of food and energy begin to account for larger and larger portions of a household’s disposable income. From an investment perspective, when the annual inflation rate jumped significantly between 1971 and 1974, stock market (SPY) returns eventually suffered as shown below.

With the Fed creating asset inflation via quantitative easing, it is important investors keep their eye on the inflation ball over the next six to eighteen months. Aaron Smith, managing director of Superfund Financial Ltd. and Superfund USA Inc., told Bloomberg:

Coffee, sugar and cocoa prices will rise five- to 10-fold by 2014 because of shortages that will mean consumers getting “swamped” by food-price inflation, according to Superfund Financial.

A lack of farmland and rising costs means growers will fail to keep up with demand.

“There’s a tremendous shortage of food, there’s a tremendous shortage of arable land. Any kind of food products are going to increase.”

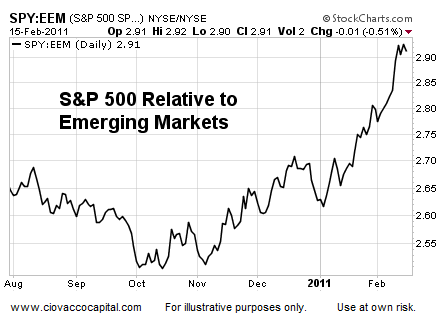

The negative effects of rising food prices are amplified in many emerging countries since food makes up a larger percentage of household spending than in more developed nations, such as the United States. Inflation contributed significantly to the somewhat rare outperformance of U.S. stocks relative to the emerging markets between October 2010 and February 2011 (see below).

Understanding any projection spanning roughly 40 years is subject to significant revisions over time, the figures highlighted by Bloomberg below are still unnerving:

World food production will have to increase by 70 percent by 2050 to meet increasing demand from an expanding global population, projected to rise to 9.1 billion by 2050 from 6.9 billion now, Hiroyuki Konuma, the UN Food and Agriculture Organization’s regional representative in Asia, said in an interview in Bangkok on March 9.

On March 15 we showed the impact of QE2 on asset prices. With food prices rising at rapid rates and oil sitting at almost $107 per barrel, the Fed is caught between the proverbial rock and a hard place. The hard place is the deflationary forces that still exist in the form of excess debt, excess capacity, high unemployment, and strained balance sheets. The rock is the rising threat of inflation. If the Fed bows to inflation, global stock markets will be forced to stand on their own, which did not go well after the Fed closed the books on QE1. QE2 is slated to be wrapped up in June.

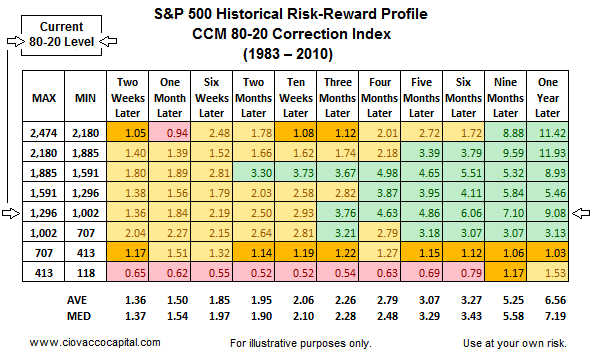

The markets have rebounded impressively off extreme oversold conditions that were present on March 16. While the current advance is somewhat tentative, it remains possible the S&P 500 could march toward 1,400 or 1,440 before inflation or the absence of quantitative easing spooks investors. The CCM 80-20 Correction Index closed Thursday at 1,206, a level that historically corresponds to favorable market outcomes more often than not. The risk-reward ratios of 6.06, 7.10, and 9.08 looking out six, nine, and twelve months respectively are attractive (see table below).

On March 28, we outlined some issues, including the end of QE2, which we continue to believe necessitate a flexible approach to the markets. We are happy to hold our current positions and have been redeploying cash since March 17 into energy (XLE), materials (XLB), commodities (DBC), and mid-caps (IWP). Rationale for favoring these areas of the market was provided on March 21 and March 23.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.