The Credit Cycle

Interest-Rates / Credit Crisis 2011 Apr 01, 2011 - 03:37 AM GMTBy: Puru_Saxena

Let’s face it; the availability and cost of credit determine the value of every asset on the planet.

Let’s face it; the availability and cost of credit determine the value of every asset on the planet.

When credit is cheap and plentiful, all assets (with the exception of government bonds) inflate or appreciate in value. Conversely, when credit becomes scarce and expensive, all assets (with the exception of government bonds) deflate or decline in value.

Modern day economists describe this process as the business cycle. However, the truth is that these wild gyrations in the economy and asset prices are symptoms of the credit cycle. When the tide of credit rises, economic activity picks up and the newly created money causes asset prices to rise. On the other hand, when the tide of credit recedes, economic activity comes to a screeching halt and asset prices collapse. This is how the global economy has operated since the beginning of time and those who believe that booms and busts can be eliminated need to get their heads examined.

It is our contention that the cost of credit is the single most important variable and the value of each and every asset is set by the rate of interest.

For instance, when credit is available and the cost of borrowing is low, cash becomes less attractive and the earnings yields of companies become more valuable. As ‘yield hungry’ investors convert their low yielding investment dollars into stocks, companies’ valuations expand. Of course, not all of the investment dollars are converted to stocks, some cash finds a home in other higher yielding assets such as corporate bonds and some of the cash is used to buy hard assets (property, precious metals, wine and collectibles). This widespread conversion of investment dollars into various assets causes a synchronised bull market.

As more and more investment dollars are converted into assets, their prices appreciate, thereby giving birth to the ‘wealth effect’. When investors realise that their assets are appreciating in value, they begin to feel wealthier and embark on a spending spree. This increased aggregate demand for goods and services causes prices to rise within the economy.

When prices start to escalate, inflationary fears emerge and money lenders (bond holders) become worried. For the fear of loss of their purchasing power, they start demanding a higher rate of return on their loans. When that happens, the rate of interest begins to rise and this increase in the borrowing cost causes credit to become tight. As interest rates begin to climb even more, capital flows reverse.

Due to an increase in the ‘risk free’ rate of return available on cash and fixed income securities, investors start liquidating their overvalued assets. After several months of rising interest rates, the yield on cash becomes even more attractive, therefore investment dollars flee from other risky assets in earnest. Make no mistake, it is this higher yield available on cash and the associated liquidation of various assets which turns the economic boom into a bust.

Figure 1 shows the relationship between rising interest rates and economic recessions. As you can see, over the past 40 years, a significant increase in the Fed Funds Rate has almost always caused the US economy to slip into a recession (pink shaded areas on the chart). Moreover, it is notable that these economic recessions have always been accompanied by vicious bear markets in US stocks.

Figure 1: Fed Funds Rate and recessions

Source: www.economagic.com

Now that we have established that economic recessions and stock market declines are caused by the rising cost of credit, we wish to explain how bull markets end.

It is interesting to observe that bull markets (primary uptrends) typically last for several years and higher stock prices are always greeted with euphoric investor sentiment. After all, nothing is more seductive to humans than the lure of easy money.

In the latter stage of a boom, most otherwise rational human beings forget the truism that market risk is directly proportional to the price level. Instead, these investors become mesmerised by the stock market’s recent performance and somehow convince themselves that the prevailing uptrend will continue forever.

At the same time, during the latter stages of a bull market (when interest rates have been increasing for several months), seasoned investors sense something is wrong and they start trimming their exposure to cyclical assets. Unfortunately, during this phase of the credit cycle, most inexperienced investors are acutely unaware that an economic slowdown is around the corner. Accordingly, still captivated by the bull market mentality, they view each sell off in asset prices as a buying opportunity.

Nonetheless, just as night follows day, more and more economic cracks begin to appear and credit begins to contract even more. This is when the market participants recognise the scope of the problem. During this phase of the credit cycle, the majority of investors realise that the economic boom is over and they panic. Consequently, as selling pressure intensifies, an indiscriminate liquidation of assets follows and the bear market is confirmed. As investors register losses and their portfolio valuations shrink, the ‘wealth effect’ reverses and aggregate demand within the economy wanes. Therefore, the bear market causes the real economy to enter a recession and euphoria turns into despair.

It is noteworthy that this slowdown in economic activity prompts companies to reduce their work force, thereby compounding the problem. This increase in unemployment further reduces aggregate demand and so it goes.

During this phase of the credit cycle, the supply of credit overwhelms the demand for new debt. Consequently, the cost of credit declines and bondholders have to settle for a lower rate of interest on their loans.

As the recession spreads through the real economy, the public demands a solution from the politicians. Accordingly, during the depth of the recession, governments usually unleash bold measures to revive economic activity. Under normal circumstances, the central banks cut interest rates aggressively and the government offers tax breaks. However, if these steps are not sufficient to assist the economy, governments unleash stimulus and central banks resort to quantitative easing (euphemism for creating new money out of thin air).

During the bottom of the credit cycle, ‘end of the world’ fears are widespread, prominent bears are treated as prophets and most investors are convinced that another boom will never return.

Fortunately, economic busts do not last forever and at some point, cheap interest rates start to weave their magic. It is noteworthy that during severe economic recessions, the yield curve (difference between short and long term interest rates) is very steep, therefore the financial institutions are able to repair their balance sheets. Furthermore, the low yield offered by cash (once again) prompts investors to convert their temporarily powerful investment dollars into under priced assets. Thus, capital starts to flow out of cash and government bonds and a fresh credit cycle is underway.

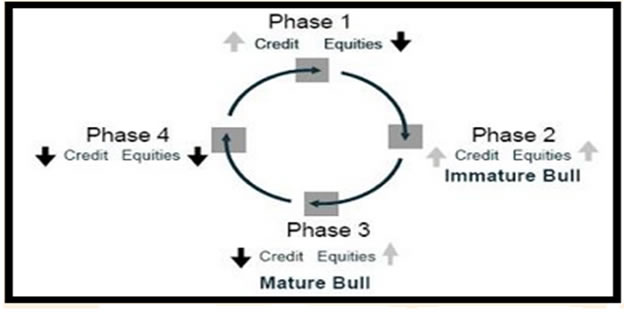

Figure 2 captures the causal relationship between credit and equities. As you will note, during the depth of a bear market and recession (Phase 1), credit begins to expand while stock prices are still struggling. Thereafter, in the next phase of the credit cycle (Phase 2), both credit and stock prices rise in tandem. This is the early phase of the bull market and during this period, most investors are still sceptical. Usually, this phase of the credit cycle lasts for several months and during this period, interest rates begin to gradually creep higher. During the next stage of the cycle (Phase 3), interest rates have risen significantly and credit begins to contract. However, despite hostile credit conditions, stock prices (fuelled by momentum and rampant speculation) continue to appreciate. Finally, in Phase 4 of the credit cycle (recognition phase), investors finally throw in the towel and stock prices collapse in tandem with credit.

Figure 2: The effect of the credit cycle

Source: Citi

Turning to the present situation, it is our belief that we are in the ‘immature bull’ phase of the cycle. Today, credit is expanding, yield curves are steep in many nations and retail investors are still nervous about the stock market. Furthermore, if our assessment is correct, the ‘mature bull’ phase is still several months away and the next bear market will probably arrive in 2-3 years.

It goes without saying that we do not possess a crystal ball but we suspect that the primary uptrend will only end when significantly higher interest rates usher in the next credit contraction. Accordingly, we are staying fully invested in our growth producing assets (energy, precious metals, developing stock markets in Asia and US multinationals).

As and when the credit conditions deteriorate (higher interest rates and inversion of the yield curve), we will lock in our bull market gains and reposition our clients’ capital to benefit from the next recession. Although we are almost certain that our timing will not be perfect, but by repositioning our portfolios before the onset of the next recession, at least we will be able to retain our bull market gains over the full credit cycle.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2011 Puru Saxena Limited. All rights reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.