Russia, U.S. and Indian Wheat Crops Impact on Agri-Food's

Commodities / Agricultural Commodities Apr 01, 2011 - 02:38 AM GMTBy: Ned_W_Schmidt

Has been, it seems, more than a year since any supply bullish/price bearish news on Agri-Foods has come out. Latest news on outlook for Russian and Ukranian wheat was not good (Financial Times, 30 March). World will not know if either nation will be able to export wheat till the second half of 2011. While at the same time, the appraisal of the North American wheat crop, now in the ground, is lackluster due to dry conditions.

Has been, it seems, more than a year since any supply bullish/price bearish news on Agri-Foods has come out. Latest news on outlook for Russian and Ukranian wheat was not good (Financial Times, 30 March). World will not know if either nation will be able to export wheat till the second half of 2011. While at the same time, the appraisal of the North American wheat crop, now in the ground, is lackluster due to dry conditions.

A never-ending flow of supply bearish/price bullish

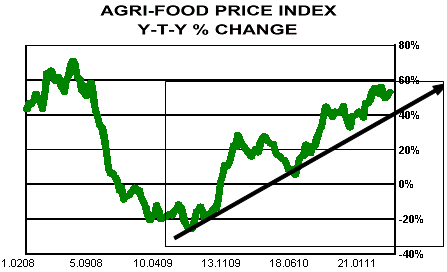

news has pushed up Agr-Food prices to levels on average at or near records experienced. As can be observed in the above chart, our Agri-Food price index is up about 50% from a year ago. The current on year rate of change has approached that experienced in 2008.

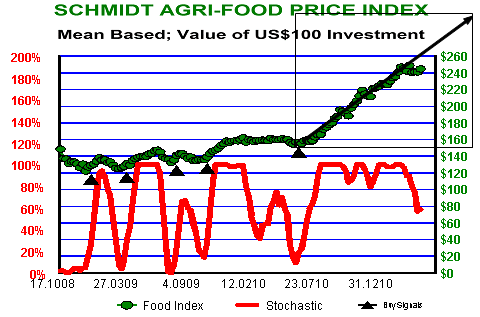

Above chart of the Agri-Food Price Index, and associated stochastic, gives some hint that the strong upward move of the past year may be losing some energy. While the world is not about to experience again a period of Agri-Food bounty, prices in the short-term may have overreached. That latest move of more than 50% in less than 8 months may have been too extreme. Agri-Food Price Index is now in the seventh week of a consolidation, the longest such experience in more than a year. A pause may continue to develop as bear food for the supply bears may be harder to find.

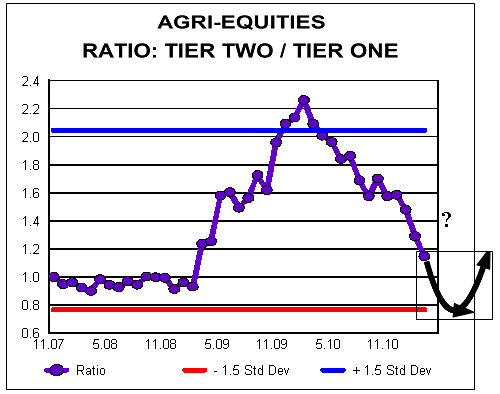

In both the 2008 run and the most recent, stocks of larger, multinational companies, Tier One Agri-Equities, moved in parallel with the action in Agri-Commodity prices. Many investors that cannot, or do not, buy corn and wheat as an investment chose to use those stocks as investment proxies for Agri-Commodities. When the 2008 commodity price run ended, those investment proxies followed Agri-Commodity prices lower.

Attention then turned to those companies closest to heart of that which was, and is, driving demand for Agri-Food commodities, China. Most of those investment proxies derive value from the indirect benefits of China's demand pressure on Agri-Commodities. When that Agri-Food commodity price complex corrected, investors moved into those companies most directly involved in satisfying Chinese Agri-Food demand, Chinese Agri-Equities or what might be referred to as Tier Two Agri-Equities.

In the above chart is plotted the ratio of the Tier Two Agri-Equities, largely Chinese companies, to the Tier One Agri-Equities, large, multinational firms. When that ratio is rising, Tier Two is performing better. As can be observed, for more than a year the Tier One companies have performed exceptionally better than Chinese Agri-Equities. That ratio is now approaching the level from which Tier Two Agri-Equities last showed the beginning of better performance. Given the combined conditions, investors might be advised now to begin researching Chinese Agri-Equities.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.