Credit Crunch Grows From a $2bn to a Trillion Dollar Problem!

Stock-Markets / Credit Crunch Nov 10, 2007 - 12:48 PM GMT

We seem to be entering a new phase of the credit crunch. The markets are finally catching on that the attempts at minimizing the losses at the banks are not working as the smoke clears and the real losses are becoming more apparent. Bill Gross, the chief investment officer at Pacific Investment Management, Inc. and the manager of the largest bond portfolio in the world recently stated that the sub-prime and alt-a problem exceeds $1 trillion and that he expects to see some $250 billion in defaults.

We seem to be entering a new phase of the credit crunch. The markets are finally catching on that the attempts at minimizing the losses at the banks are not working as the smoke clears and the real losses are becoming more apparent. Bill Gross, the chief investment officer at Pacific Investment Management, Inc. and the manager of the largest bond portfolio in the world recently stated that the sub-prime and alt-a problem exceeds $1 trillion and that he expects to see some $250 billion in defaults.

Gee whiz, Bill. Welcome to the party! Some of my readers may recall that I pointed out the magnitude of the problem in my July 20 th newsletter . By some quirk of fate, that day marked the summer top of the market, as the witch's brew of toxic waste started boiling over. By the way, the page that appeared on the Federal Reserve website in July announcing $1.231 trillion of collateralized debt obligations suddenly appearing on the balance sheets of the major banks, is no longer available .

Instead, we have the Federal Reserve's Maturity Distribution of Outstanding Commercial Paper website that shows the weekly amounts of maturing asset-backed commercial paper increasing from $218.3 billion last week to $237.8 billion this week. This is the hot potato that no one wants, but won't go away.

Yesterday, Fed Chairman, Ben Bernanke gave his testimony to the Joint Economic Committee of the U.S. Congress. In his speech, he claims that the economy has grown reasonably well. However, he does not see the rate of growth sustainable in the near term. In summary, he suggests that inflation will continue to be a problem with a slowing economy. Odds have recently increased that the Fed may do yet another interest rate cut. Will it help the consumers or the markets? A look at the performance of the economy or the markets in 2001-2002 suggests that further rate cuts may not stem the slide in the economy nor in the markets.

Japan joins the bears…

Last week I suggested the corrective rally was over and the next bearish phase was to begin for the Japanese Nikkei Index. Last night's loss gave the Nikkei a 7% loss for the week. This is the lowest closing price on the index since last August. It is fair to say that the Nikkei is heading even lower as it embarks on its longest and strongest decline since 2002.

Last week I suggested the corrective rally was over and the next bearish phase was to begin for the Japanese Nikkei Index. Last night's loss gave the Nikkei a 7% loss for the week. This is the lowest closing price on the index since last August. It is fair to say that the Nikkei is heading even lower as it embarks on its longest and strongest decline since 2002.

Shanghai 's slide blamed on U.S. Trading…

…but China 's officials can shoulder some of the blame, too. The fact is, their centralized government controls almost every phase of the economy. Their planners have been concerned about inflation for some time, so they raised the price of fuel by 10% last week. As much as the central planners want to keep their markets isolated , they will have to adjust to the fact that the markets are becoming more connected to the world.

…but China 's officials can shoulder some of the blame, too. The fact is, their centralized government controls almost every phase of the economy. Their planners have been concerned about inflation for some time, so they raised the price of fuel by 10% last week. As much as the central planners want to keep their markets isolated , they will have to adjust to the fact that the markets are becoming more connected to the world.

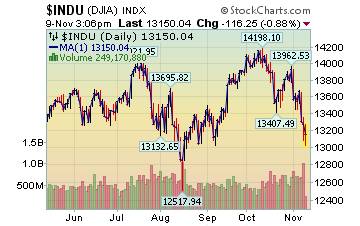

A born-again bull is now jittery .

Richard Russell of Dow Theory Letters is a belated born-again bull on the stock market. But now he seems really jittery. He wrote Wednesday night: "Transports broke below their Aug. 16 support today but Industrials closed 455 points above their own Aug. 16 critical low of 12,845.78. If Industrials close below that figure, the great primary trend of the market will have turned down, and according to the Dow Theory we'll be in a primary bear market." That's big stuff, folks!

Richard Russell of Dow Theory Letters is a belated born-again bull on the stock market. But now he seems really jittery. He wrote Wednesday night: "Transports broke below their Aug. 16 support today but Industrials closed 455 points above their own Aug. 16 critical low of 12,845.78. If Industrials close below that figure, the great primary trend of the market will have turned down, and according to the Dow Theory we'll be in a primary bear market." That's big stuff, folks!

It's the economy, stupid.

Consumer sentiment has now reached a low not seen since March 2003, just prior to our invasion of Iraq . There is a lot to worry about and that is showing in the rally in Treasury bonds. The rise in bonds and the fall in interest rates is a recession signal. What it is telegraphing is that investors are seeking the safest of havens for what may happen next. The only problem is that we've already had a strong run in bonds.

Consumer sentiment has now reached a low not seen since March 2003, just prior to our invasion of Iraq . There is a lot to worry about and that is showing in the rally in Treasury bonds. The rise in bonds and the fall in interest rates is a recession signal. What it is telegraphing is that investors are seeking the safest of havens for what may happen next. The only problem is that we've already had a strong run in bonds.

When leverage is your enemy.

For most families, their home is their most important asset. A fall in home prices affects many more households than a drop in stock prices. “Leverage” is an important, but poorly understood concept for homeowners. We have been talking about “leveraged loans” that have been getting banks into trouble. Now we should discuss “leveraged homes” and the problems they may bring. In a rising housing market, leverage is considered your friend. However, in a declining housing market, leverage may be deadly.

For most families, their home is their most important asset. A fall in home prices affects many more households than a drop in stock prices. “Leverage” is an important, but poorly understood concept for homeowners. We have been talking about “leveraged loans” that have been getting banks into trouble. Now we should discuss “leveraged homes” and the problems they may bring. In a rising housing market, leverage is considered your friend. However, in a declining housing market, leverage may be deadly.

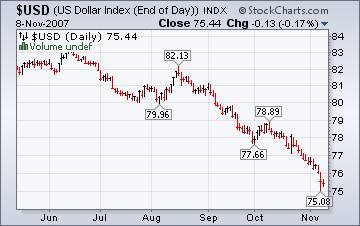

A silver lining on the dollar?

The U.S. trade deficit narrowed in September, thanks mainly to the declining U.S. Dollar. The surprisingly strong boost in the balance of trade prompted economists to increase their estimates of economic growth in the last quarter. The abrupt fall in the dollar has made U.S. goods more competitive against virtually every other currency, while increasing the cost of imported goods by nearly 1.8% last month. Is it time to start to “buy American?”

The U.S. trade deficit narrowed in September, thanks mainly to the declining U.S. Dollar. The surprisingly strong boost in the balance of trade prompted economists to increase their estimates of economic growth in the last quarter. The abrupt fall in the dollar has made U.S. goods more competitive against virtually every other currency, while increasing the cost of imported goods by nearly 1.8% last month. Is it time to start to “buy American?”

Gold investors should be happy.

The headline reads, “ Gold ends lower, but gains $26 for the week .” "There are some emerging signs of fatigue in this very aggressive and long-lasting of rallies, but the jury remains out as to the depth and speed of a potential correction."

The headline reads, “ Gold ends lower, but gains $26 for the week .” "There are some emerging signs of fatigue in this very aggressive and long-lasting of rallies, but the jury remains out as to the depth and speed of a potential correction."

The fly in the ointment is that precious metal stocks closed down for the week. Mind you, the decline was only .48%, but any decline at all is a sharp contrast to the bullion's performance and is considered a non-confirmation of the rally in gold. Time to step back and see what happens.

Message to Congress, “Don't just sit there!”

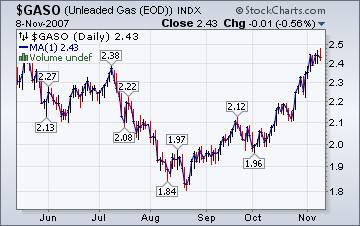

When the price of gasoline went over $3.00 per gallon in 2005, congress quickly raised a hue and cry about “price gouging” and pointed fingers at the oil companies. Today there is a better understanding of the economics of oil and there is no movement among lawmakers to point blame at our energy companies, especially after several major oil companies reported a loss in their most recent quarterly earnings.

When the price of gasoline went over $3.00 per gallon in 2005, congress quickly raised a hue and cry about “price gouging” and pointed fingers at the oil companies. Today there is a better understanding of the economics of oil and there is no movement among lawmakers to point blame at our energy companies, especially after several major oil companies reported a loss in their most recent quarterly earnings.

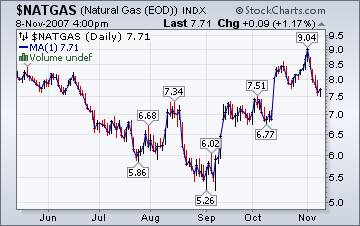

Natural gas prices may lead the way down for other sources of energy.

The relative abundance of natural gas has had a dramatic effect on prices in the last week. The unseasonably mild temperatures lower usage helped stage a comeback for natural gas, says the EIA Natural Gas Weekly Update . This allowed the level of gas in storage to grow, according to the Houston Chronicle .

The relative abundance of natural gas has had a dramatic effect on prices in the last week. The unseasonably mild temperatures lower usage helped stage a comeback for natural gas, says the EIA Natural Gas Weekly Update . This allowed the level of gas in storage to grow, according to the Houston Chronicle .

Things really are more serious…

Michael Nystrom has really outdone himself again, when he quotes John Kenneth Galbraith's The Great Crash of 1929 . If you have been recently reassured that “The worst is behind us,” consider how the banking crisis has grown from $2 billion to $20 billion to $1 trillion since August. Is the problem really behind us? Please take the time to read the linked article . I also recommend reading the book, which I own. It pays to be informed.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.