Stock Market Bulls Get Benefit of Doubt, Though End of QE2 Concerning

Stock-Markets / Stock Markets 2011 Mar 29, 2011 - 07:41 AM GMTBy: Chris_Ciovacco

James Bullard, President of the Fed’s St. Louis Bank, is speaking in Prague today. According to Bloomberg:

He said four areas in particular are raising “macroeconomic uncertainty.” These included turmoil in the Middle East and north Africa, the natural disaster in Japan, “the U.S. fiscal situation and the possibility of a government shutdown,” and Europe’s sovereign debt crisis.

Chairman Ben S. Bernanke has given no indication the central bank will deviate from its plan to buy bonds through June to spur economic growth and reduce 8.9 percent unemployment.

Since QE2 is due to end in June and given the “macroeconomic uncertainty” mentioned by Mr. Bullard, we continue to believe flexibility is required (see post) relative to the market’s current advance. The monthly employment report will be released this Friday at 8:30 a.m. EDT - another reason to remain open-mined about both bullish and bearish outcomes.

As of Monday’s close the S&P 500 Index has checked off 94% of the boxes on the what-you-would-expect-to-see-at-the-end-of-a-correction list. False turns are the exception, rather than the rule, so we will continue to give the bull market the benefit of the doubt until we see evidence to the contrary.

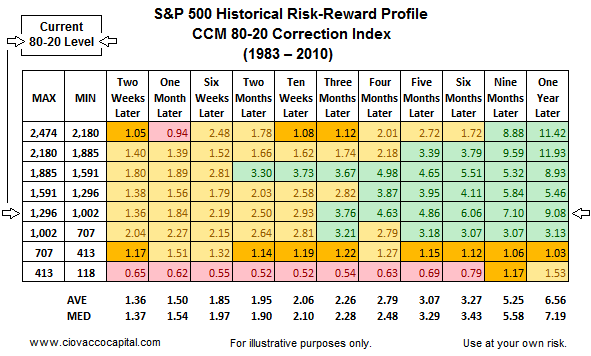

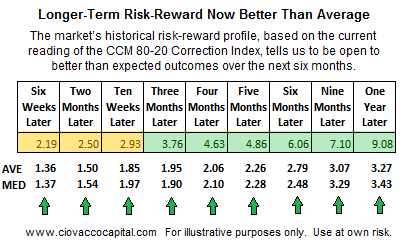

The CCM 80-20 Correction Index closed Monday at 1,167. As shown via the table below, this 80-20 level corresponds to favorable risk-reward outcomes from a historical perspective.

A risk-reward ratio of 1.00 represents a situation where the upside and downside for a given market are equal. Higher risk-reward ratios are more favorable. The table below takes a closer look at the S&P 500’s current profile. The ratios near the bottom of the table show the average and median risk-reward ratios – the current ratios are shown in the colored boxes above. If we look out six weeks to a year, the market’s current risk-reward profile from an historical perspective is very favorable.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.