China Massive Gold Shortage, Supply and Demand Crunch Looms

Commodities / Gold and Silver 2011 Mar 29, 2011 - 07:36 AM GMTBy: GoldCore

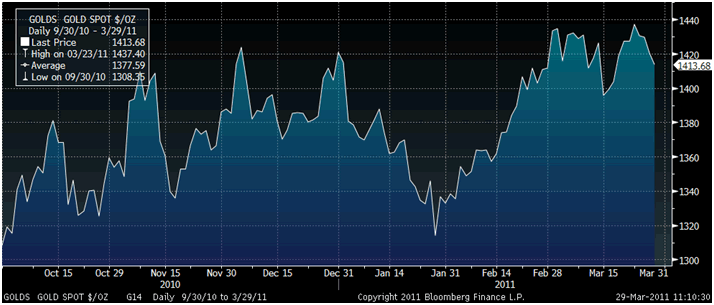

Gold and silver are lower again today with short term momentum traders taking advantage of recent weakness and capping of the gold price at record nominal highs. Options expiry often sees gold and silver prices fall but recover sharply within days of expiry and this is likely to be the pattern again after yesterday's expiration.

Gold and silver are lower again today with short term momentum traders taking advantage of recent weakness and capping of the gold price at record nominal highs. Options expiry often sees gold and silver prices fall but recover sharply within days of expiry and this is likely to be the pattern again after yesterday's expiration.

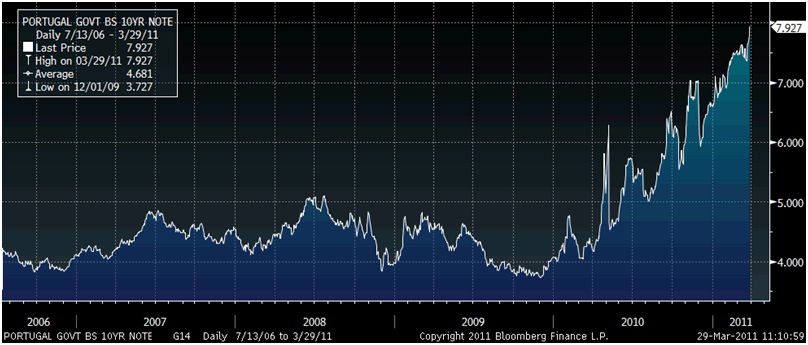

Market participants continue to underestimate the many risks and challenges facing the tentative economic recovery in hugely debt-laden western economies.

Absolutely nothing has changed with regard to the fundamentals of the gold market. The gold bears' most recent prediction of an end to the gold bull market was the non-evidence based, simplistic assertion that the increase in investment demand seen in 2010 and recent years was not sustainable. They asserted that falling investment demand would see liquidations in the bullion market and falling prices.

They are being proved wrong once again. Indeed, safe haven demand looks set to continue and may accelerate due to increased geopolitical instability in oil-producing regions, the effects of the Japanese crisis on the yen and the global economy and the unresolved European sovereign debt crisis.

The scale of the Japanese nuclear crisis has been downplayed from the beginning but the terrible reality of the extent of nuclear contamination of land and sea is gradually coming to light. Nuclear radiation has now been detected across Asia in China, the Koreas and as far away as the Philippines and Vietnam.

Asian households have been buying gold and silver bullion (primarily as a hedge against inflation) in record amounts in recent months and the natural and nuclear disaster in Japan will likely contribute to continuing safe haven demand.

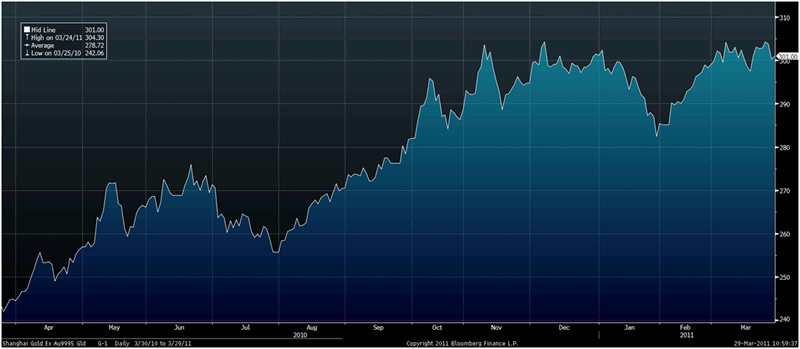

Gold in Chinese Renminbi (per Gram) - Shanghai Gold Exchange – SHGD

Japanese premiums for gold bars remain at 3-year highs as Japan has seen safe haven demand for gold surge in the wake of their crisis. Japan looks set to become a net importer from a net exporter of gold. Indeed, Japanese demand on concerns about their bond market (see news) and currency debasement is another catalyst for gold to reach much higher prices in the coming months and years.

Asian demand is especially strong in the increasingly important China. The Chinese strong cultural affinity and love affair with gold (primarily due to a distrust of Chinese paper money) shows no signs of abating. Indeed, it may be accelerating as was seen in the recent figures from the Shanghai Gold Exchange and customs in China and now reports (including from CNTV – the national TV station of the People's Republic of China) of shortages of raw gold or unrefined gold.

China, now the largest producer of gold in the world is seeing its gold mines struggle to cater for surging Chinese demand.

The raw gold trade has been growing by up to 30% per annum and demand has leapt in recent months leading to a developing raw gold shortage in China. The industry in China expects only 27,000 tonnes of raw gold can be delivered this year. That is way below the estimated demand of 50,000 tonnes.

A potential supply shortage of 23,000 tonnes of gold is a large amount of gold in the small gold bullion market which is tiny versus equity, bond and derivative markets. It is infinitesimal when compared to the $4,000 billion a day traded in currency markets.

Indeed, this figure is difficult to fathom given that total above ground gold supply is only some 160,000 tonnes.

Some 'experts' have been calling gold a speculative bubble without establishing the facts since 2007. By discouraging the public from owning gold and discouraging even a small allocation or diversification, they have put their readers and the wider public at risk of further financial loss. A little knowledge is a dangerous thing and uninformed and biased advice will continue to lead to the public becoming impoverished financially.

Gold

Gold is trading at $1,413.20/oz, €1,004.05/oz and £884.08/oz.

Silver

Silver is trading at $36.70/oz, €26.08/oz and £22.96/oz.

Platinum Group Metals

Platinum is trading at $1,738.50/oz, palladium at $736/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- Goldman Says 'Good Time' for Producers to Begin Gold Hedging

Goldman Sachs Group Inc. said it is a "good time" for gold producers to begin "scaled-up" hedging of forward production, particularly for next year and beyond. Gold prices will increase this year and peak in 2012, the bank said today in an e-mailed report.

(Barrons) -- Analysts See Reasons For Gold, Silver To Head Higher This Week

Bob Chapman, editor of the International Forecaster newsletter, is asserting that silver and gold prices are dropping today largely because options are expiring on gold and silver futures contracts.

"That can make the prices go down. If there are a lot of long options and they go below those prices, the banks don't have to pay-off," he said in an interview. "You can almost plan on the attack each month as gold and options contracts come up."

He doesn't see any other major reasons behind the fall-off by spot gold and silver prices on Monday. The SPDR Gold ETF (GLD) is down 0.5% and the iShares Silver Trust ETF (SLV) has slumped some 0.3% so far.

But pressure is also likely coming from potential delays in the restart of auto production in Japan and by some hints of tighter monetary policy, says MF Global's Tom Pawlicki in a note to clients today.

"We still lean positive in gold, but we're unsure about the potential downside given the hawkish comments from Fed's (Charles) Plosser on Friday," he wrote.

The Philadelphia Fed president gave a bullish sermon in New York at the end of last week. "If this forecast is broadly accurate, then monetary policy will have to reverse course in the not-too-distant future and begin to remove the massive amount of accommodation it has supplied to the economy," Plosser said.

But analyst Pawlicki believes gold and silver could move higher later in the week as a rush of new economic data is released, ramping up to Thursday's PMI and Friday's non-farm payrolls and ISM survey.

"The numbers will capture data for March, which may begin to reflect the adverse effects from the March 11th earthquake in Japan," he added. "Potential support will also come from uncertainty tied to European debt and to the Middle East."

(CNBC) -- Silver Is Way Undervalued Compared With Gold

Mother nature, one could say, is the ultimate asset allocator over a long enough time span. Going by that notion, silver is very undervalued versus gold.

Silver is about 16 times as plentiful in the earth's crust as gold, according to John Stephenson, author of the "The Little Book of Commodity Investing."

Yet, the price of gold per ounce currently trades at about 38 times that of silver.

According to the basic laws of supply and demand, especially given that the two metals are quite similar, the price gap between the two metals should be much smaller.

"It basically has the same physical characteristics of gold as a store of value and it also has an industrial kicker," said Stephenson, a portfolio manager for FirstAsset Management in Canada. "For my money, the trade of the decade will be in silver. Gold was the best investment over the last decade, but in the future, silver will be the go-to investment for investors looking to ride out the current storms in the global economy."

Gold has jumped about five-fold in the last decade as investors flocked to the metal. They went there first for safety from two bear markets, but then for an inflation hedge as the Federal Reserve lowered interest rates to zero.

Historically, gold sells for about 30 times the price of silver. Since gold is currently selling at about 38 times, silver is undervalued by about 27 percent and should be closer to $47 an ounce instead of $37.

Of course, gold will always be the more precious metal, not only because of its relative scarcity but because of its cultural significance around the globe.

Indeed, all the focus has been on gold over the last decade. The gold spot market is ten times bigger than the silver market and the SPDR Gold Trust ETF [GLD 138.54 -0.72 (-0.52%) ] has $55 billion in assets, compared to just $13 billion for the iShares Silver Trust [SLV 36.19 -0.20 (-0.55%)] .

"In a world where the amount of paper fiat currency is staggering and increasing as governments from U.S. to Europe keep printing, it may be time to start looking at the poor's man's gold," said Stephenson, who pointed out that while gold has exceeded its record price during the 1980s, silver is still way off the $68 per ounce level it reached during that time.

(Bloomberg) -- Bonds Fall Most Since 2006 as Quake Hits Finances

Japan's benchmark bonds are set for the biggest six-month loss since 2006 as expectations for a reviving economy curbed demand for government debt. The securities pared losses after a March 11 earthquake that was the worst in the nation's history.

The 10-year yield was at 1.225 percent today, up from 0.93 percent on Sept. 30. Prime Minister Naoto Kan said he's considering setting up a reconstruction agency for a cleanup bill the government said may reach 25 trillion yen ($306 billion). The cost of insuring Japan's debt from losses rose this quarter by the most in two years, as investors view Japan as less creditworthy than Panama or Estonia, CMA data show.

Holders of Japanese bonds have lost 1.43 percent since the end of September even after accounting for reinvested interest, Bank of America Merrill Lynch indexes show. They have dropped 0.55 percent this year, while Treasuries have been little changed. Japan will need to boost spending after the magnitude- 9.0 quake and tsunami that struck on March 11 left more than 28,000 people dead or missing and set off the worst nuclear disaster since Chernobyl at the Fukushima Dai-Ichi power plant.

Reconstruction efforts "may lead to a V-shaped economic recovery, push up bond yields in the future and steepen the yield curve," said Tetsuya Miura, chief market analyst in Tokyo at Mizuho Securities Co., a unit of Japan's second-largest banking group. "This view is weighing on bonds."

The increase in yields over the past six months was the biggest since a 45 basis point jump from Dec. 30, 2005, to June 30, 2006.

Yield Curve

Bonds initially rallied after the devastating temblor on March 11 and tsunami that followed, driving yields down to as low as 1.145 percent on March 15. Bonds have fallen since then amid expectations rebuilding after the quake will spur growth.

The difference between 2- and 10-year yields was 102.5 basis points today, compared with 107 basis points on March 10. Two-year yields have fallen 2.5 basis points to 0.20 percent since the day before the tsunami as the Bank of Japan injected 40 trillion yen in successive one-day emergency cash injections from March 14 to March 22.

A yield curve is a chart that plots the yields of bonds of the same quality with different maturities. It steepens when yields on shorter-maturity notes fall, those on longer-dated bonds rise, or both happen simultaneously.

Japanese Economic and Fiscal Policy Minister Kaoru Yosano today signaled the government can't rely on bond sales for spending and needs to push ahead with making changes to its tax and social welfare system.

Default Swaps

The cost of insuring the government's debt from losses with credit-default swaps climbed 28.5 basis points this quarter to 100.5 basis points yesterday, according to CMA. That's the biggest jump since the three months ending March 31, 2009, and compares with 94.2 basis points for Panama and 85.9 for Estonia.

Credit-default swaps pay the buyer face value in exchange for the underlying securities or the cash equivalent should a borrower fail to adhere to its debt agreements. A basis point equals $1,000 annually on a swap protecting $10 million of debt.

Five-year credit-default swaps on Japan's government bonds surged to a two-year high of 117.8 basis points on March 16 as engineers battled to contain the spread of radiation from the Fukushima nuclear plant. Japan's debt is set to reach 210 percent of gross domestic product in 2012, the highest among countries tracked by the Organization for Economic Cooperation and Development.

Issuance Forecast

Japanese bonds gained for two days after the March 11 temblor as the disaster caused investors to seek the relative safety of government debt. The 10-year yield dropped as low as 1.145 percent on March 15 before climbing again.

"There was a flight to quality from stocks because production by Japanese companies will stagnate in the coming quarter," affecting earnings, said Ayako Sera, who helps oversee about $330 billion as a strategist in Tokyo at Sumitomo Trust & Banking Co. "We now have to expect additional bond issuance" of as much as 10 trillion yen, which will push up bond yields.

Ten-year yields may fall to 1.10 percent by mid-year before increasing toward 1.50 percent by Dec. 31, Sera said.

A tax increase to finance earthquake reconstruction may be unavoidable considering the nation's huge debt, two Japanese ruling party officials said, and two-thirds of the public agree the measure may be necessary.

'Dangerous' Situation

"We can't avoid raising taxes as the great earthquake may worsen an already dangerous fiscal situation," Ikkou Nakatsuka, deputy chairman of the tax committee of the ruling Democratic Party of Japan, said in an interview. Vice Finance Minister Fumihiko Igarashi said the government may scrap its plan to lower the corporate tax rate, a move the head of the nation's largest business lobby said he would support.

A tax increase may help to push back the possibility of a future fiscal crisis with public debt already about twice the size of the $5 trillion economy. Some 67.5 percent of the public support higher taxes to fund reconstruction after the earthquake, according to an opinion poll released by Kyodo News.

"Tax hikes would certainly be on the table considering Japan's massive debt burden," said Masamichi Adachi, senior economist at JPMorgan Chase & Co.

The yen has depreciated since the Group of Seven agreed to coordinate intervention to weaken the currency on March 18, saying in a statement that member nations would "provide any cooperation" with Japan. The yen was at 81.71 per dollar today from a post-World War II high of 76.25 on March 17.

Three-month euroyen Tibor, a benchmark for corporate lending, has been at 0.33615 percent since March 16, when it climbed from the 0.33538 percent level where it had been since November.

(Bloomberg) -- Commodity Gains May Exceed Forecast on Japan, Goldman Says

Commodities may rise more than estimated in the coming year because of tensions in the Middle East and Japan's earthquake and subsequent nuclear disaster, Goldman Sachs Group Inc. said.

While the bank still predicts a 14.3 percent gain for the S&P GSCI Enhanced Commodity Index in the period, risk to the forecast is "substantially skewed to the upside," analysts including London-based Jeffrey Currie said in a report today. Energy is at "increasing risk" of outperforming industrial metals, and gold and agriculture have "further upside risk," they said.

"Unfolding events in the Middle East/North Africa and Japan have dramatically reshaped the risk profile across commodities," the analysts said. "In particular, ongoing physical disruptions to Libyan oil supply and increased Japanese hydrocarbon demand to compensate for nuclear outages have begun to further tighten global oil balances."

The S&P GSCI index has added 11 percent this year after gaining 12 percent in 2010. Cotton is up 37 percent this year, Brent crude oil has advanced 21 percent, silver is up 18 percent and tin has increased 16 percent.

Growth Concern

Goldman Sachs in February cut its forecast for 12-month returns on the S&P GSCI index from 18.6 percent as unrest in the Middle East and North Africa raised concern that global growth might slow.

Energy will return 15 percent in 12 months, while industrial metals may return 21 percent and precious metals will appreciate 13 percent, today's report shows. Gold will increase this year and peak in 2012, the bank said.

Goldman Sachs said it's "closely" watching developments in copper demand given the disaster in Japan and turbulence in the Middle East and North Africa. Rising energy prices may curb global growth and prompt monetary tightening, which would erode demand for industrial metals, the bank said.

Events in Japan "will likely soften metals balances given the hit to Japanese manufacturing capacity and the broader negative impact on global industry stemming from Japan's importance as a global parts supplier," Goldman Sachs said.

While a return of Chinese buyers and higher energy prices will probably support metals for now, "further upside is likely limited from current levels," the analysts said.

(CNTV) Video: Raw Gold Shortage in China

Raw gold trade has been growing by up to 30%. Experts expect only 27,000 tonnes of raw gold can be delivered. That is way below the estimated demand of 50,000 tonnes.

The video can be seen on our home page (click here).

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.