Gold Record High Fuelled by China and Asian Demand

Commodities / Gold and Silver 2011 Mar 28, 2011 - 05:47 AM GMTBy: GoldCore

Gold and silver have fallen in Asian and early European trading, despite global uncertainty leading to weakness in equity and bond markets. Support is likely to come from eurozone debt concerns, geopolitical risk and the deepening nuclear crisis in Japan - the true extent of which remains unacknowledged.

Gold and silver have fallen in Asian and early European trading, despite global uncertainty leading to weakness in equity and bond markets. Support is likely to come from eurozone debt concerns, geopolitical risk and the deepening nuclear crisis in Japan - the true extent of which remains unacknowledged.

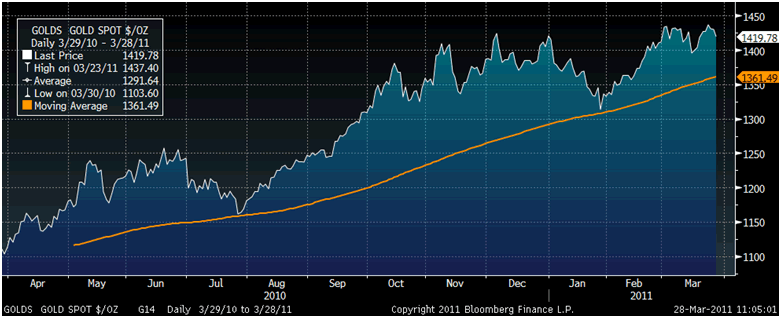

We are seeing yet another period of consolidation with gold trading between $1,300/oz and $1,450/oz since October 2010. While further short term weakness cannot be ruled out, the fundamentals would suggest that after the six-month consolidation, gold could soon take out $1450/oz, and $1500/oz remains a viable near-term target.

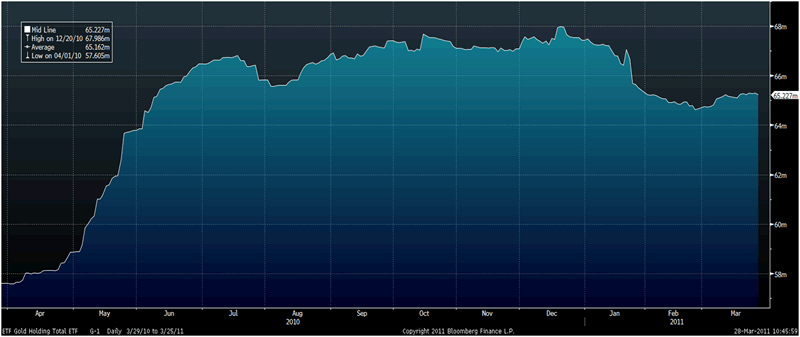

Total Gold ETF Holdings - 1 Year (Daily).

Contrary to popular perception, speculative sentiment remains low with little or no media coverage of gold's record highs, and what coverage there is often negative. Consequently, there is very little public participation or "panic buying" of bullion. The majority of the western public do not know the price of an ounce of gold in dollars, let alone in local currency-terms, which is more important for them.

The lack of speculative fervor is clearly seen in data for the ETF gold holdings (see chart above) and Commitment of Traders (COT) data. Total gold ETF holdings fell in Q1 and are lower than the records seen in December 2010 and at levels seen last June - 9 months ago. This is not indicative of an investment mania.

Real physical demand is driving price rises as is seen in the accepted figures from the World Gold Council and others. Yet, gold ownership remains very small among the investment public in the western world with many estimating that gold accounts for less than 1% of global equity and bond allocations.

Physical demand remains robust, particularly from China and the rest of Asia. This is seen in the healthy premiums for gold bars seen in Asia. Indian demand has lulled somewhat but remains at elevated levels. Gold turnover on the Shanghai Gold Exchange for March to date is 28% higher than February 2011 and indeed 3% higher than March 2010, according to UBS.

Further confirmation that Chinese demand continues to be very robust.

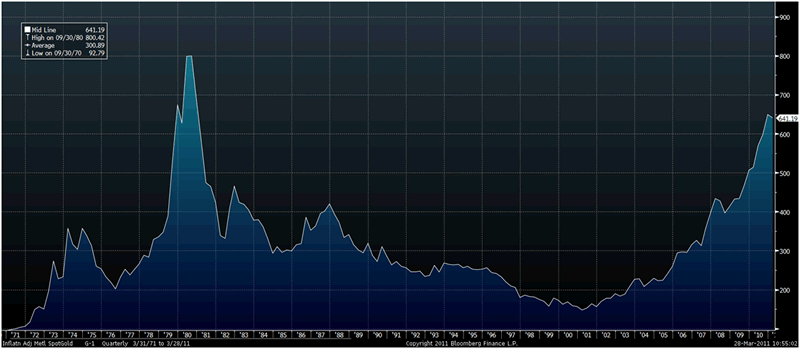

Gold in USD Adjusted for Inflation (Urban consumers price index) - 1971-2011.

Record nominal prices are not deterring the Chinese public concerned about surging inflation, partly due to their experience with hyperinflation.

Despite bullish conditions, investors should avoid leverage and taking speculative punts on any one asset class including gold and silver. Attempting to 'time markets' remains the preserve of speculators.

Diversification, including allocations to gold and silver bullion, has never been more important. Real diversification with healthy allocation to gold and silver bullion will be essential to protecting, preserving and growing wealth in the coming years.

Gold

Gold is trading at $1,415.86/oz, €1,007.94/oz and £886.24/oz.

Silver

Silver is trading at $36.62/oz, €26.07/oz and £22.92/oz.

Platinum Group Metals

Platinum is trading at $1,725/oz, palladium at $737/oz and rhodium at $2,350/oz.

News

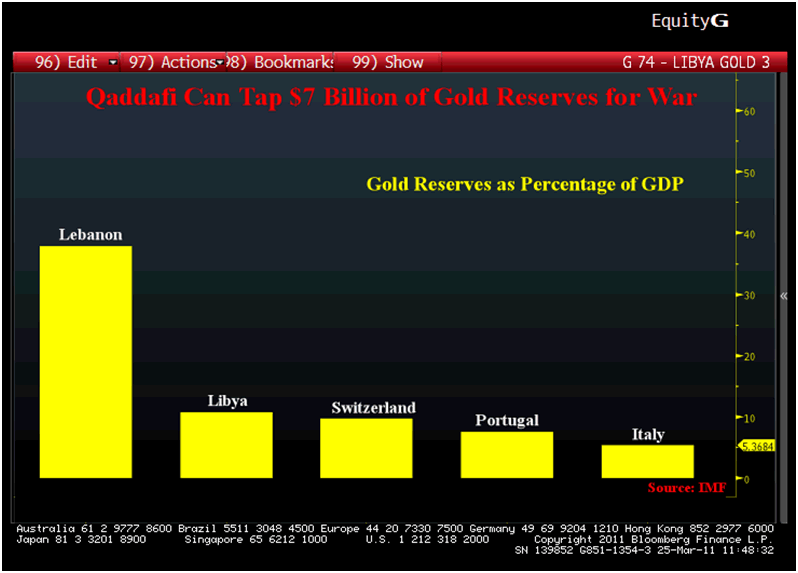

(Bloomberg) -- Libya Can Tap $7 Billion in Gold Reserves for War: Chart of Day

Libyan dictator Muammar Qaddafi can tap gold reserves worth $7 billion, equivalent to a 10th of the size of his country's economy, as he fights a civil war and resists air strikes from a western-led coalition.

The CHART OF THE DAY shows Libya holds more bullion as a proportion of gross domestic product than any country except Lebanon, according to the London-based World Gold Council using January data from the International Monetary Fund. The value of gold is based on the March 25 close of $1,429.74 an ounce.

"He has all that gold? It's probably in the central bank of Libya," said Faraj Najem, a London-based Libyan writer and historian. "He has plenty of cash and if he's got gold, it's even better since he can pay mercenaries in a commodity that is easily exchangeable."

The North African nation is sitting on 143.8 metric tons of gold at a time the price of the precious metal has fluctuated near a record high of $1,448.60 an ounce. Libya is the fourth- biggest holder of gold in the Middle East and Africa.

Qaddafi's access to gold that Alessandro Politi, a former adviser to the Italian Defense Ministry, says is probably kept in domestic vaults will become critical as authorities worldwide step up efforts freeze his assets. The European Union last week extended sanctions against Libya to include asset freezes on oil companies beyond those listed in the March 18 United Nations Security Council resolution that authorized a no-fly zone over the country.

(MarketWatch) -- Gold ticks higher on global uncertainties

Gold futures edged higher in electronic trading during Asian trading hours Monday, as geopolitical unrest in North Africa and the Middle East, as well as the nuclear crisis in Japan, helped drive further buying in the metal.

Gold for April delivery (GCJ11 1,418, -8.00, -0.56%) added 0.2% or 30 cents to $1,426.50 an ounce.

The metal is seen as a less-risky asset and tends to experience stronger interest during periods of uncertainty.

In Libya, anti-government forces gained ground on Sunday, while protests intensified in Syria and Yemen. Read more about turmoil in Libya and Middle East

Meanwhile efforts to contain the nuclear crisis in Japan continued over the weekend, with rising concerns over radiation levels in nearby seawater.

Yemen close to transition of power

Protesters in Yemen are angry at the president's offer to stand down but only with a dignified departure. Video courtesy of Reuters.

"The demand for gold is currently very robust amid the various crises," analysts at Commerzbank said in a research note.

European debt worries were also supporting prices, the analysts said.

"The situation in Portugal is escalating: Rating agency Standards and Poor's has downgraded the country's credit rating by two notches, making it more likely now that Portugal will have to claim financial aid. The price of gold should climb further accordingly," the analysts said.

Silver (SIK11 3,682, -22.90, -0.62%) tracked gold higher, with the May contract gaining 14 cents, or 0.4%, to $37.19 an ounce.

Meanwhile, May copper (HGK11 434.25, -7.65, -1.73%) was weaker, down 1.0% or 4 cents to $4.38 a pound.

Sister metals platinum and palladium were also trading lower, with palladium (PAM11 745.00, -5.40, -0.72%) for June delivery off by $5.40 or 0.8%, to $745.00 an ounce, while April platinum (PLJ11 1,733, -12.80, -0.73%) fell $7.70 or 0.4% to $1,737.90 an ounce.

(Bloomberg) -- Gold Declines on Rally to Record Price, Signs of Improving Economy in U.S.

Gold declined for a third day in London as some investors sold the metal after its rally to a record and on signs the U.S. economy is improving. Silver, platinum and palladium also fell.

The U.S. economy grew at a 3.1 percent annual rate in the fourth quarter, revised up from a 2.8 percent estimate issued last month, data showed March 25. Gold reached a record $1,447.82 an ounce on March 24 as fighting in Libya, the Japanese nuclear crisis and concerns about European debt boosted demand for a protection of wealth.

"The U.S. numbers have not been all that awful," said Afshin Nabavi, a senior vice president at bullion refiner MKS Finance SA in Geneva. "The market has had a huge move up and the higher we go up, the more chance of a bigger correction."

Immediate-delivery bullion fell $11.77, or 0.8 percent, to $1,417.97 an ounce by 9:49 a.m. in London. Prices are little changed this quarter after gaining the previous nine quarters. Gold for June delivery was 0.6 percent lower at $1,419.40 an ounce on the Comex in New York.

Consumer spending in the U.S. probably accelerated in February as the labor market improved, economists said before a report today. Policy makers should review whether to complete a second round of quantitative-easing purchases because of strong U.S. economic data, St. Louis Federal Reserve Bank President James Bullard said March 26.

The North Atlantic Treaty Organization said yesterday it has taken command of all military operations to ensure the safety of Libyan civilians against forces loyal to leader Muammar Qaddafi. Rebel forces advanced westward with support from NATO air strikes targeting Sirte, the hometown of the country's leader.

Containing Radiation

A meltdown of nuclear fuel may have contributed to the highest radiation readings so far at Japan's crippled Fukushima Dai-Ichi power plant. Preventing the most-contaminated water from leaking into the ground or air is key to efforts to contain the spread of radiation beyond the facility, damaged after the March 11 earthquake and tsunami.

"The strong U.S. economic data provided some investors with a good excuse to take profits after gold hit a record," said Hwang Il Doo, a senior trader at Korea Exchange Bank Futures Co. in Seoul. "Bullion can soon resume the rally since there are many uncertainties lingering around the market: the euro zone debt problems and the Middle East unrest as well as the fallout from the Japanese earthquake."

Silver Slides

Silver for immediate delivery dropped 1.6 percent to $36.745 an ounce. It reached $38.165 on March 24, the highest level since February 1980, the year the metal reached a record $50.35 in New York. Prices are up 19 percent this year, heading for a ninth straight quarterly advance, the best run of gains since at least 1950.

Silver held in exchange-traded products rose 194.68 metric tons to 15,382 tons on March 25, the highest level since at least February 2010, data compiled by Bloomberg from four providers show. An ounce of gold bought as little as 37.94 ounces of silver last week, the least since 1983, data compiled by Bloomberg show.

Palladium was down 1.4 percent at $740.25 an ounce, taking its quarterly loss to 7.7 percent. Platinum fell 1.3 percent to $1,728.35 an ounce. Prices are down 2.4 percent this quarter.

(Bloomberg) -- Templeton Asset's Mobius Says Gold Will Continue to Go Up

Gold prices will continue to go up, Mark Mobius, executive chairman of Templeton Asset Management Ltd.'s Emerging Markets Group, told reporters today in Mumbai. Mobius likes oil, copper, platinum, coal and nickel, he said.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.