India’s Stock Market BSE Sensex Index Heading to New Highs

Stock-Markets / India Mar 27, 2011 - 10:16 AM GMTBy: Tony_Caldaro

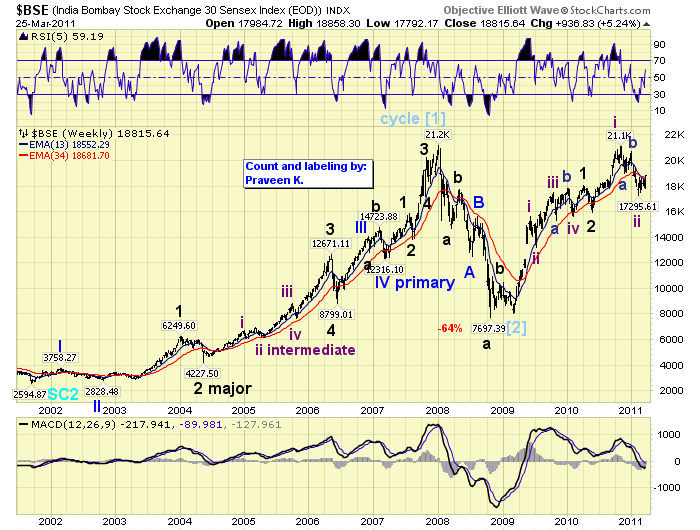

Nothing has changed longer term. India’s Sensex entered a multi-decade Cycle wave [3] in the spring of 2009. The current multi-year bull market is only Primary wave I of this Cycle wave, and we’re still expecting the Sensex to reach 34,000 during this bull market.

Nothing has changed longer term. India’s Sensex entered a multi-decade Cycle wave [3] in the spring of 2009. The current multi-year bull market is only Primary wave I of this Cycle wave, and we’re still expecting the Sensex to reach 34,000 during this bull market.

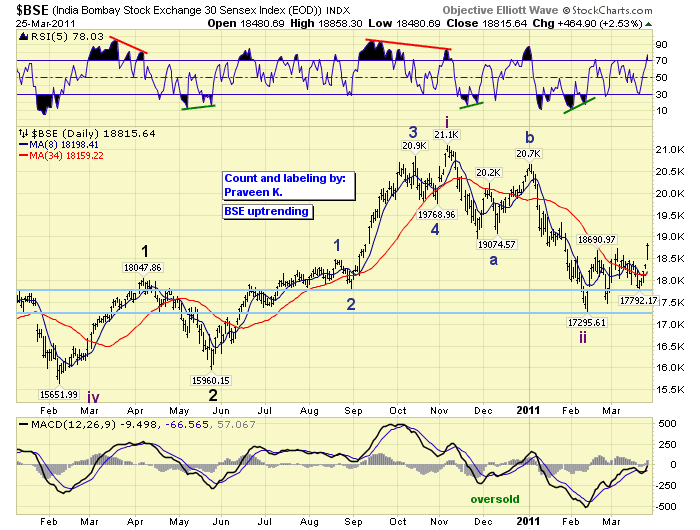

In the last report we anticipated a new uptrend coming off the Nov10 low. The uptrend did unfold, but it was only a B wave rally in a more complex (Nov10-Feb11) ABC correction. This correction was very important for the bull market wave count of the Sensex. Corrections often define wave structures in bull markets. As a result of this correction we updated our bull market wave count from a series of wave one’s to completed Major waves 1 and 2 in the spring of 2010. Major wave 3 began in May10 at BSE 15,960.

During Major wave 1 there were five Intermediate waves as noted on the weekly chart. Intermediate wave two was simple, but Intermediate wave four was an irregular complex correction alternating with Intermediate wave two. Major wave 3 completed Int. wave one in Nov10 at BSE 21,100 and recently just completed a complex Int. wave two at BSE 17,300. With a confirmed Int. wave three now underway, we can anticipate a breakout to all time new highs in the weeks/months ahead. Then a simple Int. wave four a few months down the road before an Int. wave five pushes the Sensex to even higher new highs to complete Major wave 3 of this five Major wave bull market.

Fibonacci relationships suggest this uptrend should top in a few months between BSE 22,400 (Int. iii = Int. i) and 25,600 (Int. iii = 1.618 Int. i).

This is an update to our previous post: http://caldaro.wordpress.com/2010/12/01/indias-sensex/.

You can track the Sensex along with us by scrolling down page 7 using the following link: : http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.