Unintended Consequences of Central Banks Money Printing, Bubbles in Emerging Markets

Stock-Markets / Liquidity Bubble Mar 26, 2011 - 10:00 AM GMTBy: John_Mauldin

The central banks of the developed world are printing money and are engaged in a very-low-interest-rate regime. What does that mean for emerging markets? It is more than just a dilemma, it is a tri-lemma – they have problems not just coming and going but also sitting still! I am in Zurich tonight after a long day, with a 4:30 AM wake-up call to get back home, but deadlines are deadlines. So, to make this one easier on me as well as hopefully instructive for you, you will get chapter 15 of my new book, Endgame, in which coauthor Jonathan Tepper and I speculate about the future of emerging markets in general and investments in them in particular. We once again are on the New York Times best-seller list this week, by the way (thanks to many of you).

The central banks of the developed world are printing money and are engaged in a very-low-interest-rate regime. What does that mean for emerging markets? It is more than just a dilemma, it is a tri-lemma – they have problems not just coming and going but also sitting still! I am in Zurich tonight after a long day, with a 4:30 AM wake-up call to get back home, but deadlines are deadlines. So, to make this one easier on me as well as hopefully instructive for you, you will get chapter 15 of my new book, Endgame, in which coauthor Jonathan Tepper and I speculate about the future of emerging markets in general and investments in them in particular. We once again are on the New York Times best-seller list this week, by the way (thanks to many of you).

The reviews keep coming in. I have never met Anthony Harrington, but he is clearly a keen and astute analyst, since he has called this book a must-read. Seriously, he homes in on one aspect that I think is critical; and that is the issue of trade deficits and fiscal deficits and how they affect each other. You can read his work at http://www.qfinance.com/blogs/anthony-harrington/2011/03/23/mauldins-end-game-teaches-politicians-the-basics-but-are-they-listening-austerity-measures.

And this week, if you have not yet bought your copy, let me commend you to my friends at Laissez Faire Books. I have been buying books from them for nearly 30 years. They are the best source for Austrian economics and libertarian books, along with the usual offering of investment books current in the market. They have matched the Amazon price for Endgame; but if you are interested, move around their website and pick up a few other things along with my book. http://www.lfb.org/product_info.php?products_id=1014&PromoCode=L401M301

And now, let’s look at emerging markets.

Loose Monetary Policies and Emerging Markets

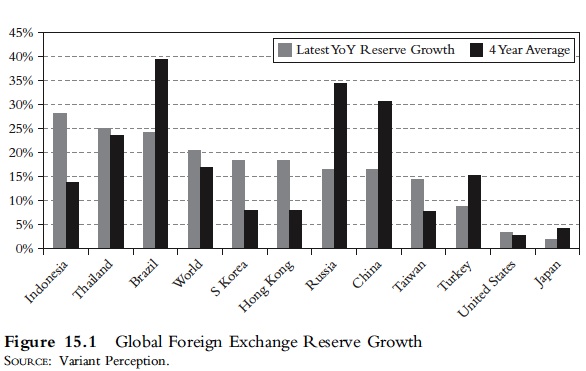

So far we have focused on the United States and other mature, developed economies that have far too much debt. With Japan, the United States, the United Kingdom, and Switzerland at close to zero percent interest rates, it seemed like a good idea to stimulate the economy. However, emerging markets that maintain pegged currencies or that shadow the dollar are essentially reduced to importing excessively loose monetary policies. Reserve growth across many emerging countries has been very strong over the last year. Emerging Asian countries account for almost 50 percent of global foreign exchange reserves. Huge Asian reserve growth since early last year is a result of mimicking loose monetary policies in the developed world to keep their currencies competitive. China has accumulated the most reserves of any emerging market country. This is directly related to its currency peg and its need to recycle the dollars it gets from its exports.

A result of Asian emerging markets’ importing loose monetary policy from developed markets is that domestic inflation rates are rising quickly, as policy rates remain too accommodative. Asian emerging market countries are facing a trilemma: They can fix any two of a pegged exchange rate, free flows of capital, or independence in monetary policy, but not all three. The end result is likely to be higher policy rates and currency appreciation. (See Figure 15.1.)

Bubbles in Emerging Markets

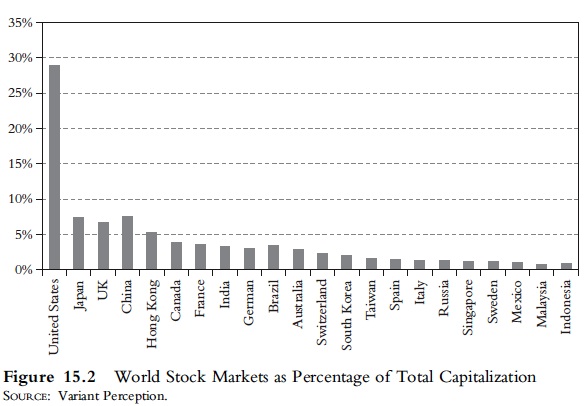

Many emerging markets will double or triple over the next few years. Emerging markets are extremely small as a percentage of total global market capitalization. When investors diversify away from developed markets, it will be like putting a fire hose through a straw. Liquidity from developed markets will overwhelm emerging markets. Part of this is from investors in the developed world wanting to go where the growth is, but part of it is a result of quantitative easing all over the world, especially in the United States. That is why you see emerging markets like Brazil taxing inbound capital flows in an effort to keep their own economies from developing a bubble. (See Figure 15.2.)

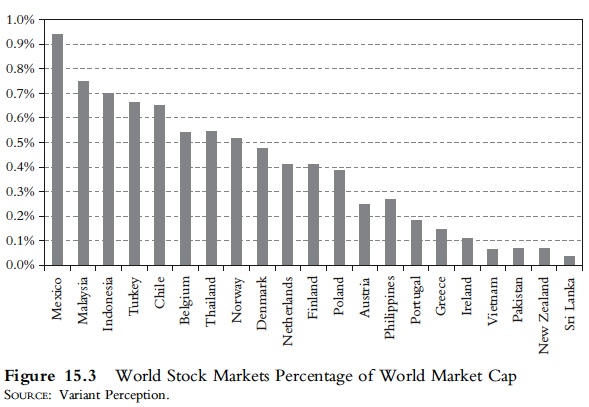

There are good reasons why the United States and the United Kingdom are among the highest capitalizations. In part, this is because a higher percentage of companies are publicly traded in the United States and the United Kingdom, whereas in other countries, many more are privately held, family-owned, or indeed government-run. Individually, almost all emerging markets are less than 0.5 percent of total world capitalization, as Figure 15.3 shows.

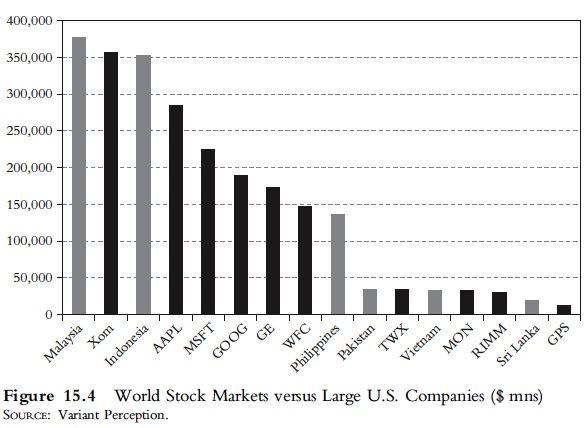

To further emphasize the small size of some emerging equity markets and their potential to grow, in Figure 15.4 we have compared the total market caps of some of these markets alongside the market caps of some well-known blue chip stocks (in millions of $).

Consider the following examples: Microsoft has a bigger market cap than all of Indonesia, General Electric and Wells Fargo have market caps almost double that of all of the Philippines, Monsanto and Time Warner have bigger market caps than all of Vietnam and Pakistan, and GAP Inc’s market cap is almost double that of Sri Lanka’s.

In the reflation trade, a few characteristics drive outperformance in emerging markets:

• Generous liquidity, that is, rapid monetary expansion

• Positive demographics

• Declining real interest rates

• Underleveraged consumer

• Banking sector with low loans-to-GDP ratio

The main countries that satisfy these requirements are Turkey, Malaysia, India, Indonesia, and Brazil.

Local conditions in some emerging market countries will act as a fire starter to excessive liquidity from abroad. In countries like Indonesia, Brazil, and Turkey, due to solid economies, increasing productivity, and thus falling inflation, they are transitioning to lower interest-rate regimes. This often has the consequence of detracting investors from the falling returns on cash and debt products and pulling them toward higher-yielding equities.

Further, large populations and still relatively low levels of GDP per capita give some idea of the scope for expansion in countries like China, India, Indonesia, and Sri Lanka if the prosperity of more developed economies, such as Taiwan and the Czech Republic, is anything to go by.

In this scenario, liquidity is likely to remain well above the norm for some time, and China will be little different from the other emerging markets:

Small markets + Ample liquidity + Investor risk appetite

+ Historically low interest rates = Bubblelike conditions

Chinese equity, property, and other asset markets will benefit hugely. China differs from many other emerging markets because it has tight capital controls that keep a lid on overseas speculation. If these controls were relaxed, however, and the currency allowed to freely fluctuate, then all bets are off as to the effect on Chinese markets. This would be no different from Japan in the 1980s, when the capital accounts were opened up and the yen was allowed to float. Indeed, many if not all of the bubbles that have occurred since the Dutch Tulip Mania in the seventeenth century have been precipitated by a combination of financial liberalization and innovation.

There is always a bull market somewhere. If you go back to the 1970s in terms of loose monetary policies and excessive government debt, does that mean that we’ll see a repeat of a decade in the doldrums for U.S. and European stock markets? Possibly, but it should not matter to a global macro investor. Again, there are always bull markets somewhere.

Figure 15.5 shows that from 1970 to 1985, if you had invested $1 in the United States, you would have $2 by 1985. If you had invested in Japan, you would have made $6 over the same period, and if you had invested in Hong Kong, you would have made more than $8. Emerging markets will be the big winners of the loose monetary policies around the world. Just as the Fed’s loose monetary policy after the Internet bubble burst created the housing bubble, the Fed’s money printing will inflate emerging markets.

The surplus liquidity isn’t likely to ignite an inflationary boom in the U.S. economy if consumers refuse to borrow and spend. But that liquidity has to go somewhere, and emerging markets look like the most likely destination. Emerging markets and commodities took the first hits in the credit implosion because they were viewed as warrants (longterm call options) on global growth.

As history shows, the leading sector of the previous bull market typically is not the leader of a new bull market. The emerging markets look like they are the new global leaders. Emerging economies account for 43.7 percent of global output and, according to the IMF, will account for 70 percent of the world’s growth going forward, yet they represent only 10.9 percent of global stock market capitalization. China by itself makes up 15 percent of the global economy but less than 2 percent of market cap, while the United States provides 21 percent of output but 43.4 percent of market cap.

Most investors weight the American and European markets too heavily. This is partly due to home bias in investing, but it is really more like a drunk searching for his keys under the lamppost. He searches there not because he is likely to find his keys but because there is light. In the same way, most investors in emerging markets do not look for the right data and merely decide to either take risk and invest or reduce risk and withdraw funds. Their investments into emerging markets are unsystematic.

Most investors buy or sell emerging markets indiscriminately based on their willingness to take on further risk or shed risk. Figure 15.6 shows the extremely high correlation between the VIX Index, global equity volatility, and the U.S. dollar versus South African rand exchange rate (USDZAR). You can’t make up charts like this.

During the emerging markets rally in 2006 and 2007, almost all markets traded in line with the others. Figure 15.7 shows that for much of 2006, the Indian Sensex and the Mexican Bolsa Index had a 96 percent correlation, even though their economies could not have been more different. (File under the “investors are lemmings” category.)

Emerging markets could easily be the next bubble. However, they don’t even need to be the next bubble or the next big thing for investors to profit from them. As recessions ended in the United States and Europe in 1992 and 2003 and central banks kept liquidity flowing freely, almost all emerging markets rallied indiscriminately.

Loose liquidity and undervalued emerging market currencies are leading toward excess foreign exchange reserve accumulation and loose credit conditions. Underleveraged emerging markets with higher velocity will continue to benefit from the accommodative monetary policies of a developed world beset with high debt and low monetary velocity. Continued reserve accumulation can lead to inflationary pressure, overinvestment, complications in the management of monetary policy, misallocation of domestic banks’ lending, and asset bubbles.

Difficult Choices

We have written about the difficult choices developed countries will face as they deal with the hangover from too much debt. Emerging market countries face the flip side of the same problem. They are, for the most part, underleveraged and have higher monetary velocity, yet they are importing the loose money policies from the United States and Europe.

What can emerging markets do to try to reduce inflows of hot money and prevent bubbles? There are a number of tools available to policy makers of liquidity-receiving economies in response to excess global liquidity and large capital inflows. As the IMF has pointed out, emerging markets can allow a more flexible exchange rate policy. They can accumulate reserves (using sterilized or unsterilized intervention as appropriate). They can reduce interest rates if the inflation outlook permits, and they can tighten fiscal policy when the overall macroeconomic policy stance is too loose. All of these involve difficult tradeoffs where the costs and benefits are not obvious.

The bottom line is that governments around the world need to be alert and make difficult choices to deal with a world excess liquidity. From an investor’s point of view, we would enjoy the current ride in emerging markets but recognize that they are high beta to the U.S. economy and stock markets. The next time the United States goes into recession—and there will be a next time—it is likely that emerging markets will suffer significant losses. So, emerging markets are a trade and not a long-term investment.

That being said, at the bottom of the next U.S. recession, we think emerging market countries could see their economies and stock markets finally decouple from the United States, and at that point, they could become the trade of the decade. We suggest that investors use the time to find specific stocks and not just country ETFs, or find someone who can do that work for you. Fortunes can be made if you do your homework.

Snowbird, New York, Portland, and La Jolla

Let me remind you that my conference in La Jolla is filling up and the registration deadline is looming. As I said last week, at my Strategic Investment Conference, the first two questions that each speaker will get at the end of their presentation will be, first, “What will happen when QE2 goes away?” and second, “Under what conditions will the Fed launch QE3?”

I will pose them to Martin Barnes, Marc Faber, Louis-Vincent Gave, Paul McCulley, David Rosenberg, and Gary Shilling – and John Paulson has agreed to speak as well! They will be joined by Neil Howe (The Fourth Turning, and demographics guru) and George Friedman of Stratfor, as well as your humble analyst and Altegris partner Jon Sundt. I mean, really, is there a conference anywhere this year that has a line-up that powerful?

The conference is April 28-30 in La Jolla. It is filling up fast. You can register at https://hedge-fund-conference.com/2011/invitation.aspx?ref=mauldin. Sadly, it is for accredited investors only, but I will report back to you the answers from the speakers to those questions.

As noted at the outset, I am in Zurich tonight. The weather in Europe this week has been fantastic, some of the best I have ever had. London, Malta, Milan, Zug, Zurich – just brilliant. I had dinner outside with Massimo Lattman on Lake Zurich tonight. A very successful entrepreneur and manager, he had such great stories and insights to share, on a gorgeous night. You live for moments like that.

Saturday I am off to Snowbird, Utah, for my partner at SMG Steve Blumenthal’s 50th birthday party, then on to New York on Sunday for meetings and media to help promote the book. I will detail the schedule next week.

I will also be providing the keynote address for the West Coast-based investment advisory firm of Arnerich Massena at their 2011 Investment Symposium, on April 11-12, in Newberg, Oregon, outside of Portland.

OK, don’t tell my kids about this next bit. (When we travel together, I am a bit of a stickler about schedules. Moving seven kids and their families with kids can get to be a logistical issue. Dad can get on their case if they don’t move fast enough.

So, last night I was with Niels Jensen on the train from Milan to Zug, our destination a quaint little “village” in Switzerland near Zurich. Lots of fund managers are moving there for tax reasons, lifestyle, etc. It was late and I was writing away on the train, deep in my creative throes, charmed with an idea for a new research report I am writing. Niels said, “John, you might want to pack up. We are getting close.” I looked at my watch and thought I had five minutes, so I kept typing away. Creative juices and all, you know? You’ve got to give the Muse her lead.

However, we pulled into the station sooner than I expected. I started packing up quickly, but there were a lot of wires and stuff. Spilled the last of the Prosecco on my coat (is that maybe why I thought I was creative?). I ran to the door, only to have it close and lock, and watched Niels, standing with my luggage on the platform, waving goodbye as the train pulled out! Nothing to do but feel like an idiot and travel on to Zurich, then take the next train back (this one with local stops) to Zug. I got to the small hotel. No one was at the desk or would answer the phone. Not knowing what to do, I looked around and saw there was a key on the counter. Next to it was a note reading, “Mr. Mauldin, your luggage is in your room. Have a good night.” Anywhere else this is an invitation to free luggage. In Zug, I guess, this is how they take care of latecomers.

The next day, as we are back at the train station, heading for Zurich, this gentleman walks up and asks, “Are you John Mauldin? I have this new econometric model I’ve been wanting to show you.” So, on the train to Zurich I looked at feedback mechanisms and how they can be used to analyze markets. Actually quite intriguing. It is a small damn world, but a really fun one.

It is time to hit the send button. The wake-up call will come way too soon. But, there is a party going on underneath my hotel room window. They are singing songs from the ’60s and ’70s here in the Old Town in Zurich. Maybe just one drink and then bed. Have a great week! Auf wiedersehen!

Your loving Switzerland analyst,

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Ben

29 Mar 11, 09:54 |

YOU SAID DEFLATION

This author said we would be in massive deflation 2 years ago. He is clueless like prechter. |