U.S. Fourth Quarter Real GDP Economic Growth Upward Revision

Economics / US Economy Mar 26, 2011 - 09:28 AM GMTBy: Asha_Bangalore

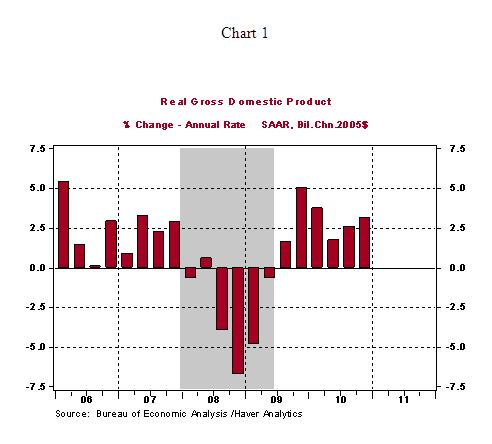

Real GDP of the economy grew at an annual rate of 3.1% in the fourth quarter of 2010, revised up from the prior estimate of a 2.8% increase. The U.S economy grew 2.9% in 2010 after a 2.6% decline in 2009. The outlook for 2011 is for a slightly stronger performance, with most of the growth representing self-sustained economic growth compared with artificial support that has maintained economic momentum in 2010 to a large extent.

Real GDP of the economy grew at an annual rate of 3.1% in the fourth quarter of 2010, revised up from the prior estimate of a 2.8% increase. The U.S economy grew 2.9% in 2010 after a 2.6% decline in 2009. The outlook for 2011 is for a slightly stronger performance, with most of the growth representing self-sustained economic growth compared with artificial support that has maintained economic momentum in 2010 to a large extent.

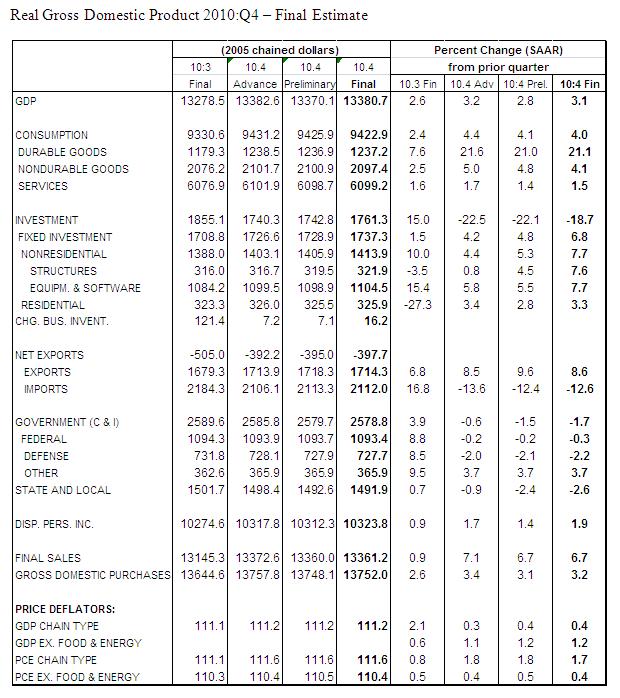

The change in inventories is now estimated at $16.2 billion in the fourth quarter of 2010 versus the earlier estimate of $7.1 billion. This upward revision was the major reason for a stronger GDP headline number. In addition, investment expenditures, inclusive of higher estimates for structures, equipment and software, and the residential expenditures indicate small upward revisions (see below table for details). Consumer spending, exports, and government expenditures show small downward revisions.

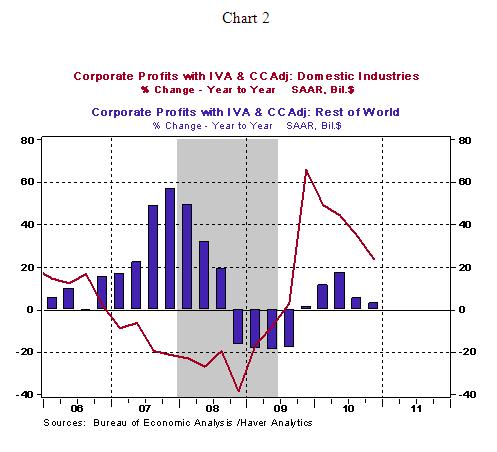

Corporate profits moved up 2.3% in the fourth quarter, putting the year-to-year gain at 18.3%. A large part of the growth was from domestic industries, while the contribution from the rest of the world is meager.

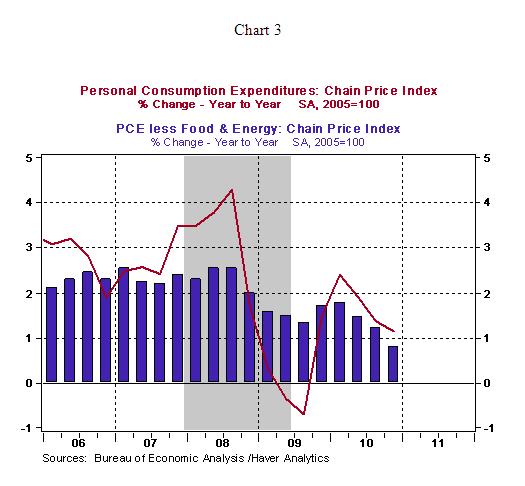

Although these numbers are about 1010, it is noteworthy that inflation measures maintain a benign trend. On a year-to-year basis, the personal consumption price index posted a 1.1% year-to-year increase in the fourth quarter of 2010, while the core personal consumption price index rose only 0.8% from a year ago. These tame inflation numbers do not favor the hawks in the FOMC who are inclined to terminate the QE2 program.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.