Is it time to Buy Google?

Companies / Google Mar 21, 2011 - 03:56 PM GMTBy: readtheticker

Some time ago I caught Reggie Middleton of BoomBustBlog.com on TV saying he was very bullish on Google (GOOG). The prime reason behind this was Google dominant positioning within the mobile advertising market via it acquisition of Admob (Androids mobile OS). Ok we believe him, but we required GOOG to sell off to let us in at a decent price. We have a sell off, but should we buy.

Source: An Analysis and Valuation of the Success Story Formally Known as Android

Reggie comments was some time ago (Sept 2010), and we have been out to lunch, doesnt really matter as price action will always open the door for a late entries into the bullish trend.

Lets review GOOG for timing.

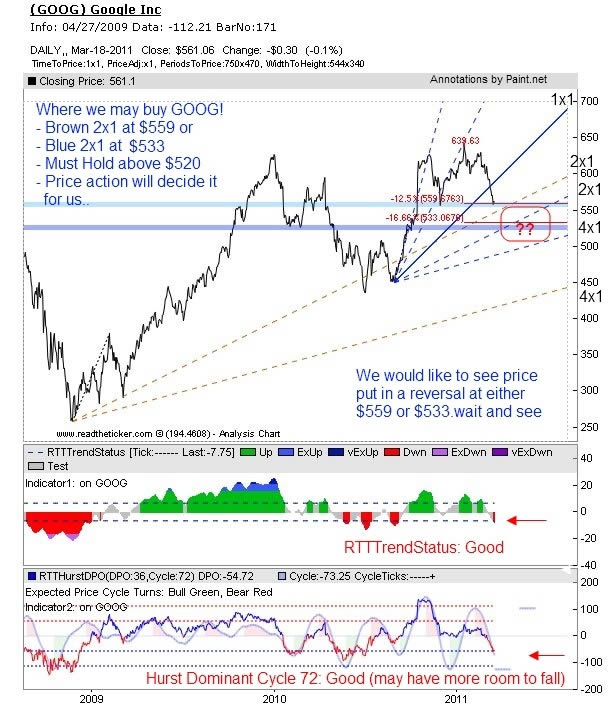

Gann Angles: Price must hold at either the brown or blue 2x1 Gann Angles at either $559 or $533.

Gann Levels: Price has currently pulled back to 12.5% ($559), and it may fall further to 16.66% ($533) which would result in a great setup for to go long.

Support: Support at $559, but even stronger support at $522.

Now this is really exciting both the RTTTrendStatus and Hurst cycle show that the pullback is just normal within a bullish market trend. RTTTrendStatus as not broken the lower -6% dotted line with any significance, not yet anyways, we will monitor it closely. The daily 72 period dominant Hurst cycle suggest that there is more time for prices to fall, so I am not rushing in, I will wait for very strong bullish price action with the Hurst Cycle staring to upswing. We would rather let Mr Market get ahead of us by a few percentage points than be early and wrong.

Of course is timing is not your game and you can afford 20% stops then buying at $559 should not be a problem, otherwise wait for a push down to under $540 before hitting the BUY button. This is all subject to Mr Market reaction to the Libya issues when we open on Monday 21st March.

Our wider market observations is that the March 2011 sell off is not significant (knock on wood), and we expect the SP500 to bounce to recent highs, however we believe Mr Market is losing momentum due to the debate of QE3 is on or off.

Readtheticker

My website: www.readtheticker.com

My blog: http://www.readtheticker.com/Pages/Blog1.aspx

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2011 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.