Stocks Falter, But Fed Policy Favors Bull Market

Stock-Markets / Stock Markets 2011 Mar 21, 2011 - 08:44 AM GMTBy: Money_Morning

Jon D. Markman writes:

Stocks spent the past week in the wash cycle, as bears finally cleaned up to the tune of a loss of 1.5% in the Dow Jones Industrial Average, a loss of 1.9% in the S&P 500, 2.6% in the Nasdaq Composite Index and 1% in the Russell 2000. They rebounded on Thursday and Friday with more of a whimper than a bang, as breadth and volume were a lot weaker than the headline gains in the Dow would lead you to believe.

Jon D. Markman writes:

Stocks spent the past week in the wash cycle, as bears finally cleaned up to the tune of a loss of 1.5% in the Dow Jones Industrial Average, a loss of 1.9% in the S&P 500, 2.6% in the Nasdaq Composite Index and 1% in the Russell 2000. They rebounded on Thursday and Friday with more of a whimper than a bang, as breadth and volume were a lot weaker than the headline gains in the Dow would lead you to believe.

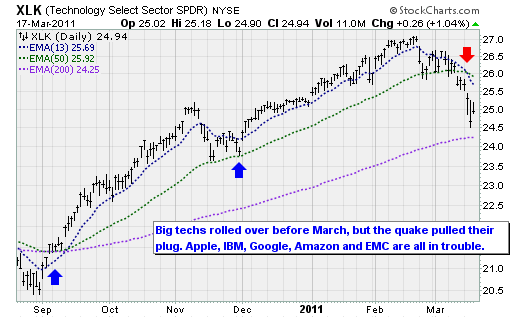

The rally looked more like a response to the extreme short-term oversold market condition than the initiation of a new advance. Buying was more intense on Thursday and Friday on the New York Stock Exchange than anywhere else. But overall volume was actually down by almost a third from Wednesday, the bulls were much more focused on large-cap stocks than the small-caps, and techs were shunned – which is the opposite of what typically occurs in a "risk-on" trading climate.

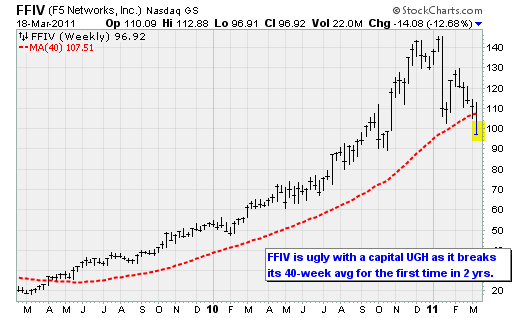

Technology stocks were up a touch as a group, but individually a lot of major stocks in this sector looked absolutely awful. One of the worst of the bunch was fallen angel F5 Networks, Inc. (Nasdaq: FFIV), which broke below its 200-day average for the first time since the bull cycle began in March 2009.

Other techs that traded very poorly over the past week included EMC Corporation (NYSE: EMC); VMware Inc. (NYSE: VMW); salesforce.com inc. (NYSE: CRM); NetApp Inc. (Nasdaq: NTAP); Amazon.com Inc. (Nasdaq: AMZN); and even recent favorites like International Business Machines Corp. (NYSE: IBM) and Apple Inc. (Nasdaq: AAPL). Semiconductors were a bit better, but recent strong plays like Atmel Corp. (Nasdaq: ATML) finished the week 6% lower.

To forecast the course of the first half of the year, you don't need a crystal ball. You just need to keep an eye on the industrial giants, the old favorite techs, and the new favorite oil services and silver stocks, plus possibly the health maintenance organization (HMO) stocks.

If the likes of EMC, FFIV, JDS Uniphase Corporation (Nasdaq: JDSU), Amazon.com and Google Inc. (Nasdaq: GOOG) and regain their poise, then we can look for a chance to pick up a tech fund again. But if they don't gain ground very soon, after having broken a lot of support, then they are likely going to stay down for the count for quite a while -- possibly months.

I did not think tech would be the ones left without a chair this year, but investors appear to think that weak earnings and revenue updates by companies like Texas Instruments Incorporated (NYSE: TXN), Finisar Corporation (Nasdaq: FNSR), F5 Networks -- and, late Thursday, NIKE Inc. (NYSE: NKE) -- are harbingers of tougher times ahead.

Pay attention. No matter how good their business model, or how cheap they seem, or how fundamentally sound they may appear, very few of the major stocks in the tech sector will be spared if investors abandon the group over fears that growth has peaked.

Fed Holds Fast

Now a quick word about the Fed, since it was certainly part of the catalyst to help the midweek recovery effort that ultimately failed. Here are notes directly from analysts at Capital Economics to help you understand the central bank's stance:

"Despite the fact that Fed officials now believe the economic recovery is on a "firmer footing" and that surging commodity prices are putting "upward pressure" on headline inflation, it looks like QE2 will be completed as planned."

"The statement issued today does acknowledge the rapid surge in commodity prices. In contrast to the line taken by the ECB, however, the FOMC was careful to stress that it thought the impact on inflation would be "transitory" and that "concerns about global supplies of crude oil" are responsible for the most recent "sharp run-up."

The upshot is that unless inflation expectations or underlying inflation start to rise, the Fed will not be responding by tightening policy any time soon.

"Some would argue that the latest jump in the University of Michigan's measure of households' one-year ahead inflation expectations, to 4.6% in March from 3.4% the month before, is an indication that those expectations are already spiraling out of control. However, expectations climbed even higher in mid-2008, before collapsing again when commodity prices fell back. The Fed was willing to ignore that jump in 2008 and there is no reason to believe that things will be different this time, particularly as the latest surge is more supply-related, whereas the 2008 spike was predominantly demand driven."

"The statement was notably more upbeat about the strength of the economic recovery, in particular acknowledging that "conditions in the labor market appear to be improving gradually."

Previously, the Fed had always stressed the recovery had been insufficient to generate any significant improvement in the labor market.

Here's the bottom line: Investors are not out of the woods. The Fed is on investors' side, and that is a huge plus for the long-term. It will be very hard for bears to make permanent mischief with the Fed ready to defend its entrenched position focused on industrial and employment growth. In the short term, however, the path of least resistance is still lower unless investors are dazzled by the U.N. airstrikes on Libya in the same way that they adored "shock and awe" at the start of the Iraq war in 2003.

Caterpillar and Lubrizol

Very few stocks in the Dow Jones Industrials finished the week higher, but Number 1 on the list was Caterpillar Inc. (NYSE: CAT). CAT is the go-to stock for people who want to bet on a global recovery. This week the buying had more to do with its bulldozers and heavy-duty diesel engines being in high demand for the reconstruction of the northern coast of Japan. Shares rose 5% over the week and are now a whisker from an all-time high.

Elsewhere, big integrated energy companies like Chevron Corporation (NYSE: CVX) and ExxonMobil Corporation (NYSE: XOM) enjoyed positive sessions as crude oil prices recovered amid renewed tensions in the Persian Gulf in addition to the struggle in Libya, particularly in the tiny but important island emirate of Bahrain.

While crude oil has been flat in the past few days due to expectations of a decline in demand in Japan, a rise in the possibility of turmoil in Saudi Arabia will send it right back up toward the $120 per barrel area and beyond.

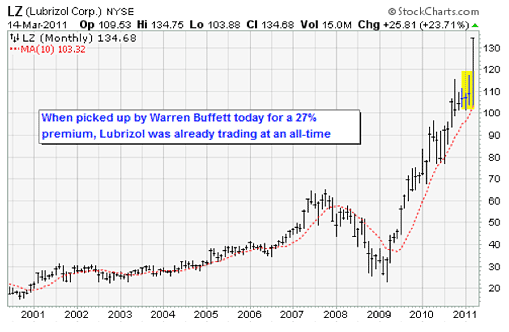

Otherwise in the past week the big news was an announcement that Warren Buffett had decided to grease the skids of his conglomerate by buying Lubrizol Corporation (NYSE: LZ) for $9.7 billion in cash.

I have been talking about how cheap the market is, and the Buffett-Lubrizol deal is a perfect example. Lubrizol was already at an all-time high, and yet one of the greatest value investors of all time considered it to be such a bargain that he paid cash -- and a 27% premium to boot. I suppose he'll be sorry he did not wait a day, when he could have had it at least 3% cheaper.

Of course Buffet is not alone in potentially being regretful this week. Tuesday Pimco chief Bill Gross, the so-called bond king, made a splash in the media about having sold all of his trove of Treasury bonds. Bonds were soaring a few days later due to the troubles overseas.

The Week Ahead

March 21: Existing home sales.

March 22: ICSC-Goldman chain store sales, Redbook chain store sales, FHFA House Price Index, API crude inventories.

March 23: MBA Mortgage Purchase Applications, New Home Sales, DOE Crude Inventories.

March 24: Initial Jobless Claims, Continuing Claims, Durable Orders, Bloomberg Consumer Comfort, EIA Natural Gas Inventories.

March 25: GDP (second revision), GDP Deflator, Michigan Consumer Sentiment.

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source : http://moneymorning.com/2011/03/21/stocks-falter-but-fed-policy-favors-bull-market/

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.