Reflections on the PPI and the Commodity Bubble

Commodities / Commodities Trading Mar 19, 2011 - 06:12 AM GMTBy: Mike_Shedlock

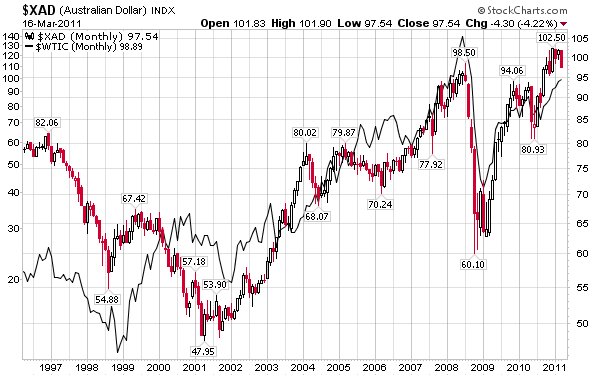

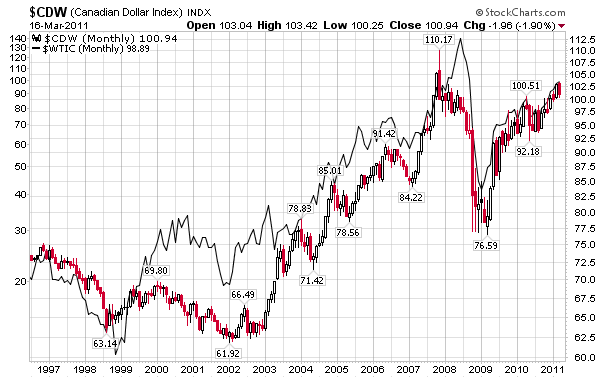

Here is a pair of interesting charts showing the correlation between the Canadian and Australian dollar vs. the price of West Texas Intermediate crude.

Here is a pair of interesting charts showing the correlation between the Canadian and Australian dollar vs. the price of West Texas Intermediate crude.

Australian Dollar vs. Crude

Canadian Dollar vs. Crude

Both the Australian and Canadian dollars have a strong correlation with crude going all the way back to 1997. Should the correlation continue to hold, and there is no reason to believe it won't, then if the price of crude drops, the Loonie and the Australian dollar will both likely drop as well.

Reflections on the PPI

Earlier today someone told me via email that my "silence on the PPI and CPI was deafening".

Actually I have seldom directly commented on the CPI or PPI recently even when the CPI was low.

However, I have commented on commodity prices on many occasions expressing the viewpoint "those looking for inflation can find it in China and India where credit is running rampant".

Commodity prices are set at the margin and China is overheating. When China cools (and it will in my opinion), commodity prices will drop.

Commodity Bubble

People are entitled to believe what they want, but I will side with John Hussman who thinks commodities are in a bubble.

From Hussman Anatomy of a Bubble

In the stock market, I believe that there is indeed a "bubble" component in current prices, but it is not nearly as large as we observed in the approach to the 2000 peak, nor as extreme as we observed on the approach to the 2007 peak. My hope is that investors have learned something. That's not entirely clear, but we'll be as flexible as we can while also being mindful of the risks.

While my view is that bubble components can come and go in the markets, they sometimes become so large and well-defined that they take on a very distinct profile. Such bubbles included the advance to the 2000 stock market peak, the housing bubble, the advance in oil prices to their peak in 2008, the advance in the Nikkei in the late 1980's, and other clearly parabolic advances.

On that note, it's clear to me that we're seeing classic bubbles in a variety of commodities. It is very unlikely that this is simply due to global demand growth. Even with an exhaustible resource, it is a well-known economic result (Hotelling's rule) that the optimal extraction rule is one where the price rises at a rate not much different from the interest rate. What we've seen lately is commodity hoarding, predictably resulting from negative real interest rates provoked by the Fed's policy of quantitative easing.

Fortunately for the world's poor, the speculative dynamic that has created a massive surge in commodity prices appears very close to running its course, as we see very similar "microdynamics" in agricultural commodities as we saw with oil in 2008. That's not to say that we have a good idea of precisely how high prices will move over the short term. The blowoff phase of a bubble tends to be steep, but so short-lived that it affords little opportunity to exit. As prices advance in an uncorrected parabola, the one-sided nature of the speculation typically gives way to a frantic effort of speculators to exit simultaneously. Crashes are always a reflection of illiquidity in two-sided trading - the inability of sellers to find eager buyers at nearby prices.

On the subject of commodities, it's a natural question whether gold falls into the same category as agricultural commodities. After all, gold and other hard assets have an important role as an alternative to money to store value, and it appears clear that the world is monetizing in a way that is unlikely to be fully reversed even if policy makers wish to do so down the road.

In my view, it's not clear that gold is in a bubble here, but it will be important to watch for the earmarks of a classic bubble. Below, I've plotted the price of gold against a "canonical" log-periodic bubble. Already, we're seeing some behavior that is characteristic of a bubble-type advance. A Sornette-type analysis generates a finite-time singularity as early as April, but there are other fits that are consistent with a more sustained advance. If we observe a virtually uncorrected advance toward about 1500 in the next several weeks, the steep and uncorrected advance would imply an increasing hazard probability.My response to the above was Anatomy of Bubbles; Negative Returns for a Decade Revisited; Is Gold in a Bubble?

I agree with Hussman about the bubble in commodities not only because of the speculation angle but also because of unsustainable growth in China. When China stalls, it will likely take commodities and the commodity producing countries down with it, notably Australia and Canada.

Finally, gold is acting more like a currency than a natural-resource commodity (because that is what it is). It may or may not be immune to a commodity-related selloff, and much depends on the actions of central banks down the road.

Those who insist on a direct quote regarding the recent PPI report, here it is: "Commodities are in a bubble and the PPI is reflective of that bubble."

Of course bubbles can always get bigger. Oil hit $140 in 2008. Perhaps it does again in 2011, but barring a major disruption in Saudi Arabia or Iran, I rather doubt it.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.