We Love Silver But We Respect The Trends - Be Careful

Commodities / Gold and Silver 2011 Mar 18, 2011 - 07:41 AM GMT We believe in investing in long term bull market trends. To illustrate this point consider the following. In theory, with only two trades and two and a half long term trends, an individual could have turned only $10,000 into more than $47.6 million dollars.

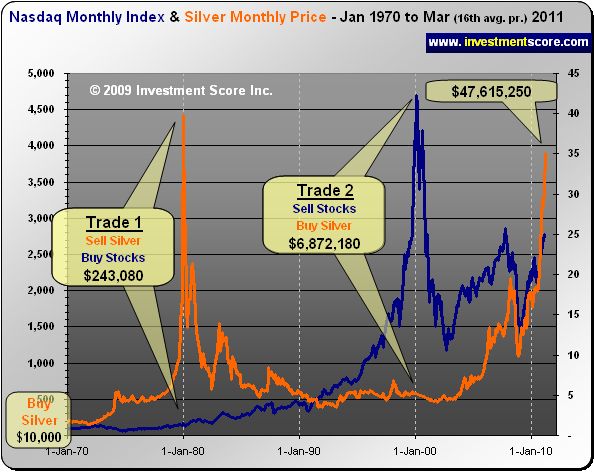

We believe in investing in long term bull market trends. To illustrate this point consider the following. In theory, with only two trades and two and a half long term trends, an individual could have turned only $10,000 into more than $47.6 million dollars.

The above chart helps illustrate the power of identifying a long term trend when it comes to building wealth. However, the following arguments could be made in regards to the above chart.

- The chart does not consider taxes paid or other investing fees.

- Hindsight is 20/20. We can't expect to pick the perfect day to trade.

- We don't all have 30 years to invest.

Let us address these comments individually:

-

The chart does not consider taxes paid or other investing fees. The simple illustration above does not consider some costs such as taxes paid or trading costs, but it also does not consider the benefits of dividends from stocks or mining equities within a mutual fund. To clearly illustrate our point we wanted to keep the math very simple and easy to understand so we left out external considerations that both increase and decrease the end number.

-

Hindsight is 20/20. We can't expect to pick the perfect day to trade. The above chart uses monthly price data and the profit would be larger if we had picked the perfect intra-month day to trade. Additionally we recognize that we cannot pick the ideal day, week or month to trade all of our capital from one investment to another. However, it may be reasonable to attempt to "dollar-cost-average" into positions over time near a perceived bottom, and "dollar-cost-average" out of a position near a perceived top. We do not expect perfect results but instead we try to locate multi decade bull markets and avoid multi decade bear markets.

-

We don't all have 30 years to invest. This is a valid statement as many individuals may not live long enough to invest for 30 years. However, the above chart was meant to illustrate the power of the mega trends so we only used a modest initial investment of $10,000. Over a lifetime, investors will most likely invest more capital than $10,000, and that would increase their profit potential within a shorter period of time. Additionally, we try to identify intermediate term moves within the long term trends to help us identify lower risk entry and exit points within the mega trend. Our goal here is to maximize our profit potential from the major trend.

Basically, in the above chart we are trying to illustrate the power of identifying long term trends, investing in the bull markets, and avoiding the bear markets. In our opinion short term trading is a very difficult and time consuming skill to master. At the same time the indefinite "buy and hold" strategy concerns us as investors ride multi decade long term bear markets.

Instead of trying to guess what will happen day to day and moment to moment, we want to identify the major bull market trend in the markets. When we backup and look at the large macro moves, the smaller fluctuations seem rather trivial. Imagine if you could build significant wealth and spend more time focusing on your career, relaxing and enjoying your family. Imagine if you simplified your investment decisions instead of spending many hours of your day in front of a computer screen making various short term decisions.

So how about now? Commodities are doing great! Silver is up to about $36 from a low of around $4 in the early 2000's. You can't lose by putting your money in commodities right? Wrong. Although we think precious metals are eventually going much higher we are careful not to forget about the intermediate down turns that all markets go through.

We get nervous when investing in one asset class or another gets "too easy." Silver, gold and commodities in general have been "spiking" in price. Most people would agree that government money printing can only cause precious metals to rise further. In our opinion, this seems too obvious to be right from an intermediate term perspective. Additionally, the media has been focusing ever more attention on precious metals as they climb to new highs. In recent months we have seen three different instances of characters on reality TV shows "hunting for precious metals". We are aware of at least one reality TV show solely based on gold mining. Where was the media attention on precious metals in the 90's or early 2000's, when they were hitting lows? In our opinion, the time to buy any investment is when it is out of the spotlight and on "sale".

We suggest that when the market appears to be too obvious and too easy to predict because it continues to advance in one direction, it often means that a turn in the opposite direction is nearing.

Are we long term bullish on precious metals and commodities? You bet. In fact, we are probably more bullish than most. However, in the excitement of the current bull market move we are preparing for the new trend that will arrive sooner or later.

At investmentscore.com we look at investments relative to various markets in order to gain a unique perspective to their “Value” instead of their “Price”. We believe it is a common mistake for investors to be misguided by “price movement” instead of by true value. At the end of the day understanding “Value” is where wealth can be created and stored as “Price” can be greatly distorted by the constant fluctuations of currencies. To learn more about our strategies and to sign up for our free newsletter please visit us at www.investmentscore.com.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.