Food and Energy Prices Lift U.S. Wholesale Inflation

Economics / Inflation Mar 17, 2011 - 04:06 AM GMTBy: Asha_Bangalore

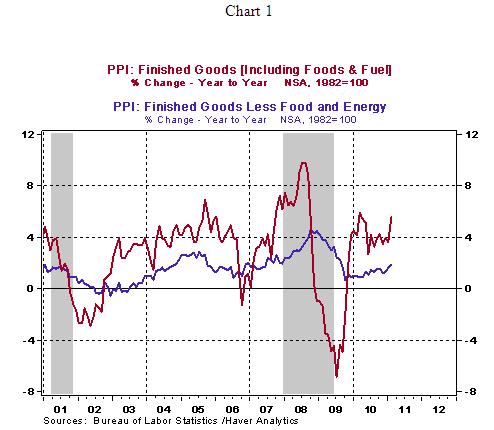

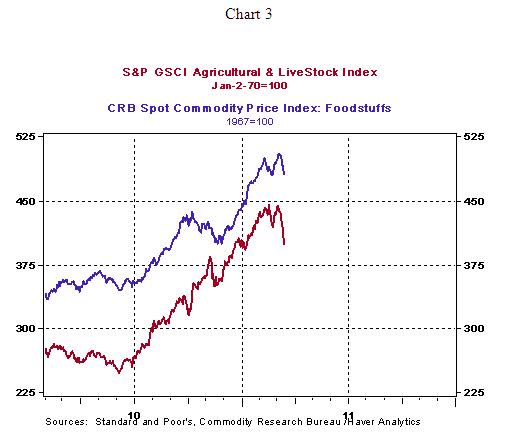

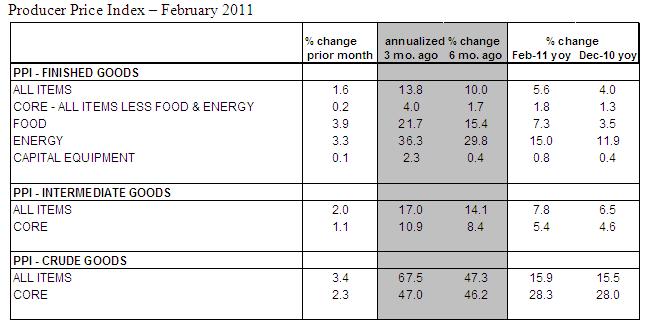

The Producer Price Index (PPI) of Finished Goods rose 1.6% in February following a 0.8% gain in the prior month. A 3.9% increase in food prices and a 3.3% jump in energy prices explain a large part of the increase in the headline number. Higher prices for natural gas (+3.2%), gasoline (+3.7%) and heating oil (+14.6%) contributed for the noticeably higher energy price index. The February increase of food prices (+3.9%) is the largest since November 1974 (+4.2%).

The Producer Price Index (PPI) of Finished Goods rose 1.6% in February following a 0.8% gain in the prior month. A 3.9% increase in food prices and a 3.3% jump in energy prices explain a large part of the increase in the headline number. Higher prices for natural gas (+3.2%), gasoline (+3.7%) and heating oil (+14.6%) contributed for the noticeably higher energy price index. The February increase of food prices (+3.9%) is the largest since November 1974 (+4.2%).

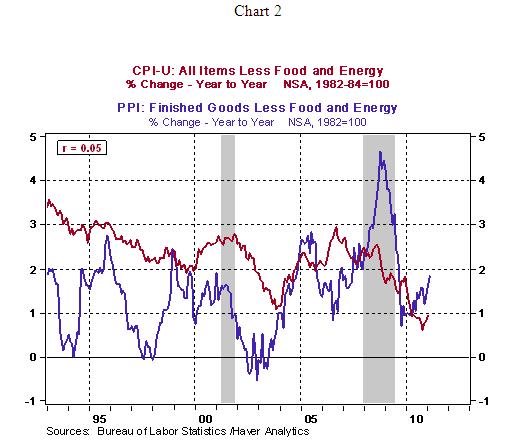

The core PPI, which excludes food and energy, rose 0.2% in February, following gains in the December (+0.2%) and January (+0.5%). The year-to-year increase of the core PPI is 1.9% and it has moved up 3.9% in the last three months. These are not favorable readings. The key is the extent of passthrough to retail prices. In recent years, the passthrough from core wholesale prices to core consumer prices is weak (see Chart 2). Prior to the mid-1980s, there was a stronger positive relationship with wholesale and retail prices.

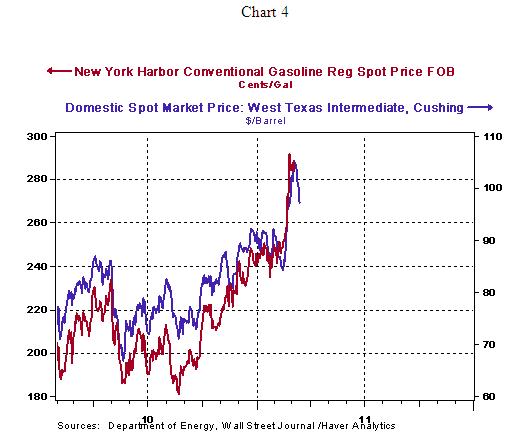

But the fact remains that higher costs of materials have to be accounted for or firms have to experience a reduction in profits. Margin squeeze cannot prevail for too long and higher wage costs also have to be considered. For the present time, the Fed is in a favorable spot with contained growth of wages and retail prices. Also, food prices have dropped in recent days, implying that the increase in food prices during March may not be repeated. The direction of energy prices remain less certain (see Chart 4).

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.