ECB Peripheral Divergence and EUR/USD

Currencies / Euro Mar 16, 2011 - 01:32 PM GMTBy: Ashraf_Laidi

The primary reason for the currency's stabilization earlier this year and the subsequent 10% rally from early Jan was the ECB's hawkish rhetoric in the face of rising inflation. 2.4% annual inflation was a sufficiently good reason for the ECB to make a hawkish twist, especially as it underwent the awkward task of having to buy Irish and Portuguese bonds, while preaching monetary discipline and price stability. Bernanke's constant reiterations to maintain QE2 into June did not help the US dollar and neither did the low-volume surge in global equities to fresh 2 ½ year highs.

The primary reason for the currency's stabilization earlier this year and the subsequent 10% rally from early Jan was the ECB's hawkish rhetoric in the face of rising inflation. 2.4% annual inflation was a sufficiently good reason for the ECB to make a hawkish twist, especially as it underwent the awkward task of having to buy Irish and Portuguese bonds, while preaching monetary discipline and price stability. Bernanke's constant reiterations to maintain QE2 into June did not help the US dollar and neither did the low-volume surge in global equities to fresh 2 ½ year highs.

The argument that higher ECB rates would exacerbate rising bond yields in peripheral nations is partly rebutted by the persistent improvement in core-nation macro and business data, including the record-breaking IFO and PMI figures in Eurozone (as a whole) and Germany respectively. And this raises the next question; Will the ECB do one or two rate hikes and stand pat thereafter? The ECB has never started a new rate cycle (hikes or cuts) with 1 or 2 interest rate changes. There may always be room for a first time, but so far the ECB is more likely to bluff its way, as is customary with central banks using rhetoric (rather than action) to manage inflation expectations. Interestingly, 40% of our readers polled find that neither the ECB nor the BoE will raise rates before July.

Peripherals/Yields Puzzle

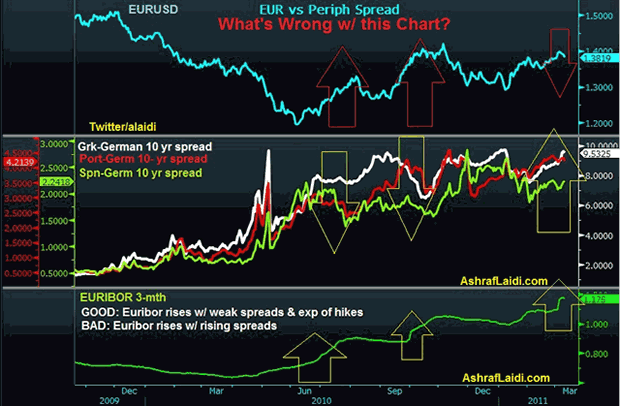

The divergence (contradiction) between rising peripheral Eurozone bond spreads and the rising euro caused many to question the sustainability of the currency's rebound. How could the euro strengthen against all currencies in Jan-Mar despite rebounding bond yields in Greece, Portugal, Ireland and Spain? Something has to give. The chart below shows the previous 2 cases of falling peripheral spreads (indicated by yellow down arrows) coinciding with a rising euro (upper panel) and rising 3-month EURIBOR (bottom panel). In both cases, rising EURIBOR was caused by stabilizing Eurozone fundamentals, explained by diminishing chances of prolonged bond purchases by the ECB. But the chart shows the rare occurrence, whereby a rising euro occurs simultaneously alongside rising peripheral spreads and higher EURIBOR.

The latter is a result of higher market probability of an ECB rate hike. But the contradicting simultaneous increase in EURUSD and peripheral spreads means that something has to give. The latest event-risk developments from the MidEast and Japan have barely caused a dent on the euro's 3-month rally. And as long as major equity indices do not lose more than 6-7% from their year highs and the ECB doesn't depart from its recent hawkish turn, the EURUSD is unlikely to close below $1.36. Moving ahead (beyond Q2 2011), I expect the principal headwind to the Eurozone to emerge from the growth impact of surging oil prices on already subdued growth in Greece, Portugal, Ireland and Spain.

What's next for euro?

Every EURUSD trader must be aware by now of the 3-year trendline resistance (starting from Jul 2008) currently imposing at $1.4250s. The combination of the remaining upside technical potential shown by current prices (1.38-40s) and the ECB's prevailing hawkishness is keeping the pair underpinned above the prelim support at $1.3880s. Thus, traders should expect further consolidation around this +300-pip range into later March until further indications are given by the ECB ahead of the April meeting. The pair will quickly push towards the higher end of the range on any signs of dovishness from the Fed, robust Eurozone data and/orhawkish ECB talk. As long as markets expect the ECB to maintain its hawkish stance, each and every decline in the euro will likely be supported near $1.3880s. From a risk appetite stance, EURUSD pair will have to survive Eurozone event risk (Portugal bailout, Portugal policy impasses by opposition and Irish public opposition to austerity.

USDX Beginning of the Month Pattern?

And just as every FX professional must know of the 3-year trendline resistance in EURUSD, he or she must realize the rising 3-year trendline support in the USD index, extending from the all time low of March 2008 (when gold finally hit an all time high of 1038). Current support stands near 76, which held up last week.

Dollar bulls may take heart in the recent USDX trend of rallying within the first week of the month since November (see chart below). But the duration of such rallies did not last beyond 2 weeks. Notg only must the greenback stabilize in terms of price but also over time and duration. In the event of a weekly close below 76, USDX shall encounter pressure towards the 74.20 low of Nov 2010.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.