U.S. Government Evermore Reliant on Foreign Investors to Finance Debt

Interest-Rates / US Bonds Mar 15, 2011 - 10:59 AM GMTBy: Kieran_Osborne

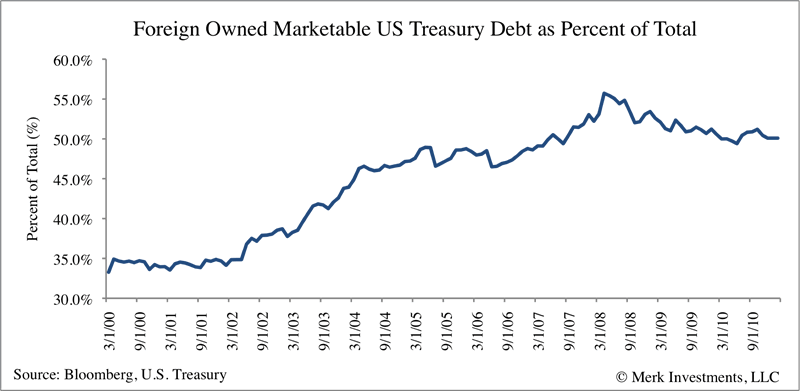

Despite the Fed recently surpassing China as the largest owner of U.S. government debt, the U.S. remains heavily reliant on foreigners to fund the government’s ongoing fiscal largess. Geithner’s Treasury Department has firmly focused new issues at the mid to longer end of the yield curve (since Geithner assumed office, the average length of marketable Treasury debt held publicly has increased by nearly one year). Despite the Treasury taking advantage of the ultra-low interest rate and funding environment, there are substantial refinancing issues over the near term; moreover, many of these maturing issues are foreign owned. Should sovereign fiscal concerns spread to the U.S., in concert with the evermore attractive interest rates offered internationally, refinancing the U.S. debt could become increasingly difficult if foreign investors turn their backs.

Despite the Fed recently surpassing China as the largest owner of U.S. government debt, the U.S. remains heavily reliant on foreigners to fund the government’s ongoing fiscal largess. Geithner’s Treasury Department has firmly focused new issues at the mid to longer end of the yield curve (since Geithner assumed office, the average length of marketable Treasury debt held publicly has increased by nearly one year). Despite the Treasury taking advantage of the ultra-low interest rate and funding environment, there are substantial refinancing issues over the near term; moreover, many of these maturing issues are foreign owned. Should sovereign fiscal concerns spread to the U.S., in concert with the evermore attractive interest rates offered internationally, refinancing the U.S. debt could become increasingly difficult if foreign investors turn their backs.

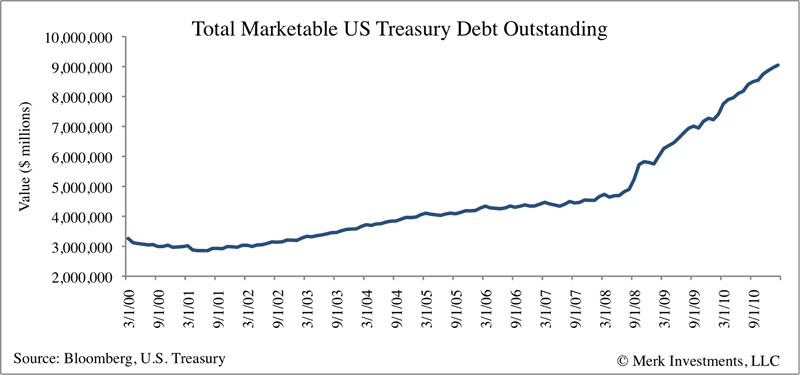

The total outstanding marketable U.S. Treasury debt has expanded considerably recently (total outstanding debt stands at over $14 trillion; marketable debt excludes a substantial portion of intra-governmental holdings). Indeed, through February 28, 2011, total marketable debt increased 22.2% from the year before:

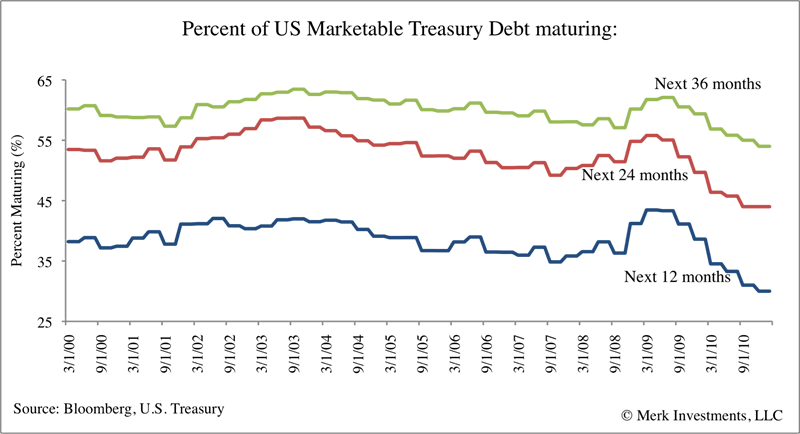

At the same time, much of the new Treasury issuance has been targeted at the middle to long end of the yield curve. The annual change in total marketable Treasury notes (securities issued with maturities of 2 – 10 years) and bonds (securities issued with a maturity of 30 years) through February 28, 2011 was 32.6% and 23.1%, respectively. This trend is evidenced by the decline in the percentage of total marketable debt outstanding that is maturing over the next one, two and three year time periods:

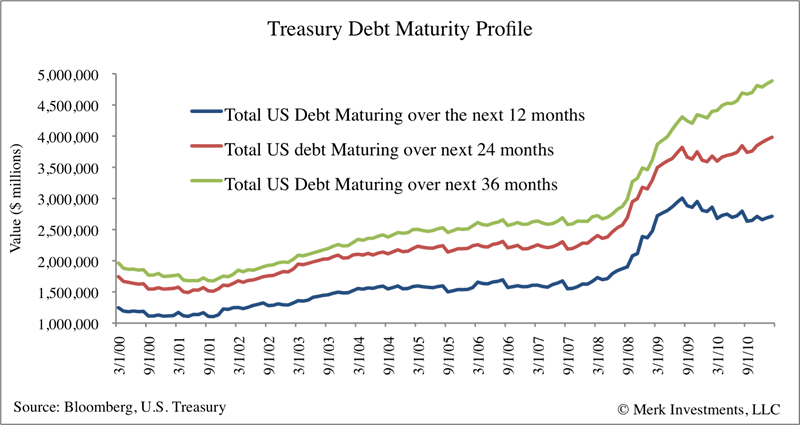

At a glance, the above chart would imply that refinancing pressure may have abated somewhat, but this is not necessarily the case. In fact, total U.S. marketable Treasury debt maturing in the next 12 months has held relatively constant, at historically high levels, while the total debt maturing within two and three years continues to expand.

Simultaneously, the percentage of total US marketable Treasury debt owned by foreigners has been trending upwards, albeit experiencing a moderate drop-off recently.

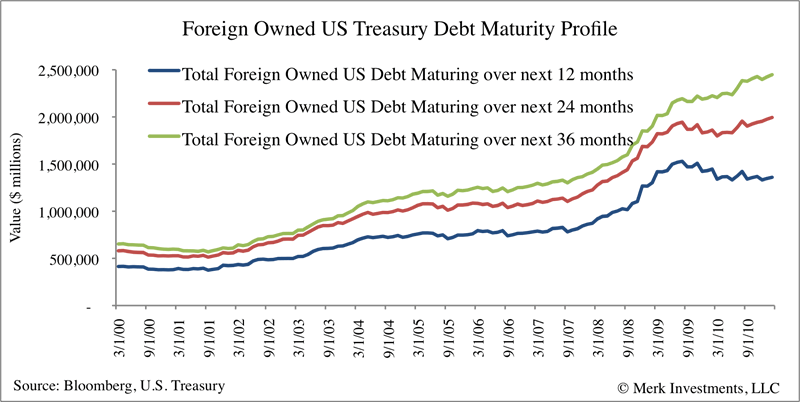

Implying that the overall level of foreign owned US Treasury debt that is maturing in the coming one, two and three years also continues to trend upwards:

To put this in context, over the coming 12 months, the U.S. Treasury must refinance, on average, approximately $5.4 billion dollars in foreign owned debt every single business day. This number doesn’t include any new issuance. Given the U.S. government just posted a record monthly budget gap for February, the substantial fiscal financing requirements aren’t going away anytime soon. Suffice it to say, the US remains highly reliant on foreigners to fund the ongoing elevated levels of government debt and immediate refinancing concerns are apparent, despite recent Treasury issuance targeted at the longer end of the yield curve.

Now consider this: the U.S. fiscal situation has deteriorated significantly; based on numerous metrics of fiscal health, the U.S. is in a relatively worse situation than many of its international peers. Combined with the Fed’s policies of intentionally overvaluing U.S. Treasury securities via quantitative easing policies (as stated above, the Fed is now the largest holder of U.S. government debt; who says the Fed isn’t monetizing the debt?), in the process driving U.S. rates to evermore unattractive levels relative to sovereign debt yields found outside of the U.S. As a result, rational investors may increasingly seek to access less manipulated, more attractive returns in countries that appear much more fiscally sound. We are already seeing this dynamic play out, albeit at the margin. The U.S. dollar weakness is a manifestation of this shift in investor preference. Investors may want to consider positioning themselves accordingly, should these marginal shifts in investor sentiment adjust

We manage the Merk Hard and Asian Currency Funds, no-load mutual funds seeking to protect against a decline in the dollar by investing in baskets of hard and Asian currencies, respectively. To learn more about the Funds, or to subscribe to our free newsletter, please visit www.merkfund.com.

Kieran Osborne

Merk Mutual Funds

Kieran Osborne is Senior Analyst and member of the portfolio management group at Merk Investments; he is an expert on macro trends and currencies and has significant international market experience. Prior to Merk Investments, Mr. Osborne was an equity analyst at Brook Asset Management, where he worked in both the Australian and New Zealand markets. He has also worked in New York for MCM Associates, a U.S. hedge fund.

The Merk Asian Currency Fund invests in a basket of Asian currencies. Asian currencies the Fund may invest in include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund invests in a basket of hard currencies. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a hard or Asian currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfund.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfund.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Tom Ubl

24 Mar 11, 07:24 |

Proud American?

Why did the GSA put 500 companies out of business costing over 5,000 private sector jobs? |