Japan Risk of Nuclear Catastrophe after Explosion Impacts Financial Markets

Commodities / Gold and Silver 2011 Mar 14, 2011 - 06:29 AM GMTBy: GoldCore

The world is still coming to terms with the terrible tragedy in Japan. A second explosion at the Fukushima nuclear reactor overnight and Pentagon reports of radiation being detected 60 miles away from the reactor suggest widening nuclear contamination leading to concerns of a nuclear catastrophe.

The world is still coming to terms with the terrible tragedy in Japan. A second explosion at the Fukushima nuclear reactor overnight and Pentagon reports of radiation being detected 60 miles away from the reactor suggest widening nuclear contamination leading to concerns of a nuclear catastrophe.

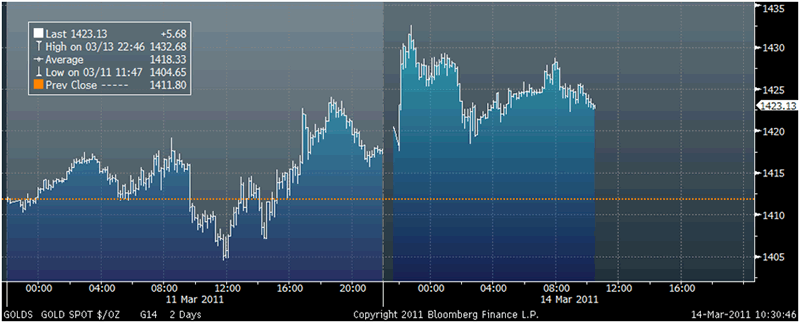

Gold ticked lower momentarily to $1,417.63/oz on the open in Asia prior to rising to over $1,432/oz where determined sellers sold aggressively, sending gold back down to near Friday's closing price on the London AM Fix (see chart). Silver also rose initially prior to determined selling.

Ordinarily, last week's lower silver and gold weekly close would lead to further momentum-driven liquidation but these are no ordinary times.

The catastrophe in Japan is already leading to safe haven demand for gold. Premiums for gold bars in Tokyo rose to their highest level since February. Overnight, gold bars were quoted at a premium of $1 an ounce to the spot London prices in Tokyo, up from zero last week and a discount of 50 cents two weeks ago.

In Japan, panic buying and stocking up with essentials such as food and gasoline has seen shortages developing, prices rising sharply and concerns of inflation. A bullion dealer in Tokyo said that premiums were higher as the Japanese market is a bit tight on gasoline, so there are inflation risks."

Given the European sovereign debt crisis, geopolitical instability in oil producing nations and continuing concerns about the global economy, the devastating megaquake and tsunami could not have come at a worse time both for the indebted Japanese economy and the global economy.

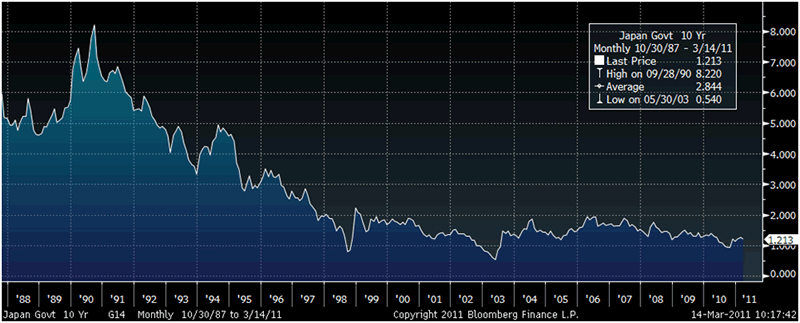

Japan's central bank, the Bank of Japan injected a record 15 trillion yen (US$183 billion) into money markets and eased monetary policy overnight. Japan's 10-year government bond has fallen to 1.21%, see chart above). The Bank of Japan also offered to buy 3 trillion yen (US $36.6 billion) of government bonds from lenders in repurchase agreements starting March 16. It seems likely that the Japanese authorities may have been buying bonds on Friday and today in order to keep interest rates low. The yen is slightly weaker today after Friday's strong rise.

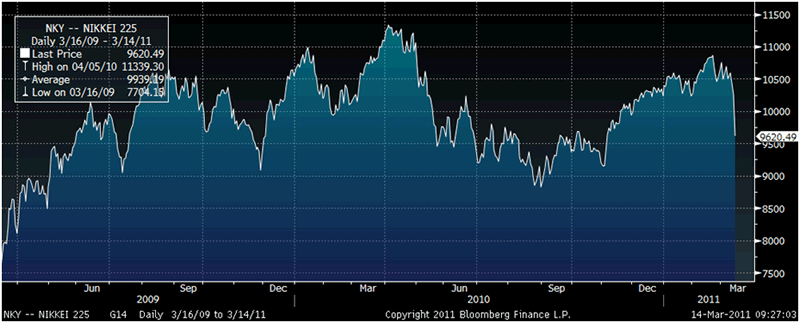

The Nikkei fell 6.18% overnight but there were encouraging signs from other Asian markets which were resilient. The Hang Seng, CSI 300 and Kospi all eking out small gains and European indices are mixed.

Gold

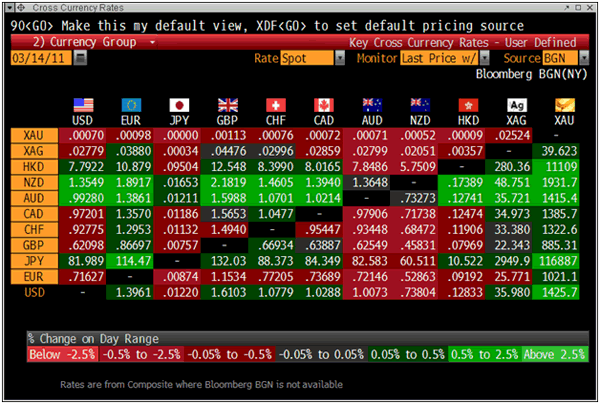

Gold is trading at $1,425.65/oz, €1,021.17/oz and £885.17/oz.

Silver

Silver is trading at $35.97/oz, €25.75/oz and £22.32/oz.

Platinum Group Metals

Platinum is trading at $1,757.50/oz, palladium at $753 .00/oz and rhodium at $2,350/oz.

News

(Dow Jones via Wall Street Journal) -- PRECIOUS METALS: Gold Up On Nuclear Fears; Platinum Slumps

Gold was higher in Asia Monday as the ongoing nuclear emergency in Japan fueled safe-haven buying, and economic uncertainty resulting from Friday's earthquake and tsunami.

The benchmark Nikkei equity index slumped 6.2% after local media reported an explosion at the No. 3 nuclear reactor building at Tokyo Electric Power Co.'s (9501.TO) Daiichi plant in Fukushima prefecture, following a similar blast at its No. 1 reactor over the weekend.

"We keep getting news dissipating from Japan saying it's all under control, but until we get more certainty there will still be the safety in gold," said Darren Heathcote, head of trading at Investec in Sydney.

At 0800 GMT, spot gold was at $1,427.50 a troy ounce, up $7.90 since Friday's New York close, although it was well off an intraday high of $1,432.60/oz hit in opening trades.

Tokyo Commodity Exchange February 2012 gold was at Y3,771/gram, down Y22, as the yen strengthened.

Political unrest in Bahrain, where protesters and police clashed over the weekend, is a potential further source of support for gold, but failed to provide the market an extra boost Monday as fears of lower crude supply from the Middle East were outweighed by concerns Japan's oil demand will fall, sending oil prices lower.

Europe also provided a minor headwind, as currency markets bid the euro higher after euro-zone leaders agreed to expand the their bailout capacity to EUR500 billion, reassuring credit markets over sovereign debt issues, at least temporarily.

Gold in euros was at EUR1,023/oz, steady from Friday's close.

Spot silver was tracking gold at $36.08/oz, up 18 cents, while platinum group metals, which are heavily reliant on demand for auto catalysts, a component used in vehicle exhaust systems, were being hit hard by production shutdowns at Japanese auto makers.

Nissan Motor Co. (7201.TO), Honda Motor Co. (7267.TO) and Toyota Motor Corp. (7203.TO) said they will suspend operations at nearly all their domestic plants in the aftermath of the quake.

Spot platinum was at $1,747/oz, down $30, while spot palladium, which is more reliant on Chinese demand, was $3 lower at $754/oz.

(Bloomberg) -- Silver Will Rise to $50 on Demand, Supply Drop, Hightower Says

Silver prices will rise to $50 an ounce before the end of this year on increased global demand and declining inventories of the metal, said David Hightower, president of the Hightower Report in Chicago.

Record gold prices will shift consumer demand to jewelry made from the cheaper silver, especially in India, Hightower said today at a R.J. O'Brien & Associates LLC client conference in Chicago. Investors also will boost purchases of silver to hedge against inflation, he said.

May silver in New York has more than doubled in the past year to $35.935 an ounce yesterday. Silver inventories held in warehouses for delivery against New York futures fell last week to the lowest since August 2006.

"We should see silver demand increase and we will reach my $50 objective this year," Hightower said. "Silver production is not keeping up with demand."

Hightower also said natural gas prices may double by the end of the 2011 and could triple by the middle of 2012 on reduced production. Natural gas prices are just above the cost of production, and producers will reduce output as the discount to crude oil boosts demand, he said.

(Bloomberg) -- Gold Advances for a Second Day on Turmoil in Libya, Japanese Earthquake

Gold advanced for a second day as investors sought shelter from the aftermath of Japan's strongest earthquake on record and intensifying violence in Libya. Platinum and palladium fell on concern that demand may drop after the quake forced some carmakers to halt output.

Immediate-delivery gold climbed as much as 1.1 percent to $1,432.68 an ounce before trading at $1,427.22 at 3:27 p.m. in Singapore. The metal advanced to an all-time high of $1,444.95 on March 7. The April-delivery contract in New York gained 0.2 percent to $1,424.60 an ounce.

"With the recent and ongoing political events in the Middle East and Africa, combined with the devastation in Japan, I believe gold will remain at the forefront of most sensible investors' minds," said Gavin Wendt, an analyst at MineLife Pty Ltd. "Gold will hit further record highs this week."

Japan was struck by a 8.9-magnitude temblor, triggering a tsunami that engulfed the northern coast on March 11. Local media has said the death toll may top 10,000. Workers today battled to prevent a nuclear meltdown after a second hydrogen explosion rocked the Fukushima atomic plant north of Tokyo.

Unrest In North Africa and the Middle East, which has toppled leaders of Tunisia and Egypt, has reached Saudi Arabia's neighbors Yemen, Oman and Bahrain. In Libya, Muammar Qaddafi is fighting rebels seeking to end his rule.

Ten of 16 traders, investors and analysts surveyed by Bloomberg said bullion will rise this week. Four predicted lower prices and two were neutral. Gold rallied 30 percent last year on the prospect of rising inflation and currency debasement.

Sell Assets

Efforts to rebuild Japan may weaken the dollar, helping to bolster demand for gold, as financial institutions sell assets to raise money, said Ong Yi Ling, Singapore-based analyst with Phillip Futures Pte Ltd.

"Japanese insurance companies may start selling dollar- denominated assets to raise disaster claims," Ong said. "This could contribute to a weaker dollar and greater demand for gold as a currency alternative."

(Bloomberg) -- Japan's Government Bond Trading to Start at 8:40 a.m. in Tokyo

Japan Bond Trading Co. will start transactions at its regular opening time of 8:40 a.m. in Tokyo.

The country's largest interdealer debt broker halted trading at 2:49 p.m. in Tokyo on March 11 after an earthquake struck off the nation's northern coast and forced some of its customers to evacuate.

(Bloomberg) -- Vietnam May Only Allow the Sale of Gold Bullion, VnExpress Says

Vietnam may limit gold bullion trade to just sales of the bars to the central bank, online newswire VnExpress reported today, citing an unidentified source.

The proposal is part of a draft decree on gold bullion trading that the central bank is working on, the report said.

Under the proposal, the State Bank of Vietnam will buy back gold bullion from businesses and individuals or appoint some agencies to do so, VnExpress said. The price at which the central bank buys the gold bullion will be determined by the international price, according to the report.

(Bloomberg) -- UBS Increases One-Month Gold Forecast to $1,450 From $1,375

UBS AG raised its one-month gold forecast to $1,450 an ounce, from a previous estimate of $1,375. The bank's three-month forecast was unchanged at $1,400, it said today in an e-mailed report.

(FT Fund Management) -- Gold's Role in Pension Funds Under Scrutiny

But it is not necessary to believe in the more conspiratorial theories to see the attractions of gold. After such a long bull run, the risk of a significant gold price correction cannot be ignored, but supportive supply and demand fundamentals, diversification attributes and inflation hedging potential suggest there is a place for gold in investment portfolios.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.