What the VIX is Saying for the Stock Market...

Stock-Markets / Volatility Mar 12, 2011 - 07:05 AM GMTBy: Marty_Chenard

The VIX is regarded as the Fear Index by many, so you would expect it to be screaming "Fear" after yesterday's market drop, the Libyan and Saudi troubles, and the huge earthquake in Japan.

The VIX is regarded as the Fear Index by many, so you would expect it to be screaming "Fear" after yesterday's market drop, the Libyan and Saudi troubles, and the huge earthquake in Japan.

It isn't ... instead it is showing that the market is acting like it is relatively undaunted by all the above concerns.

So, let's look at two VIX charts today, and discuss what the VIX is saying ...

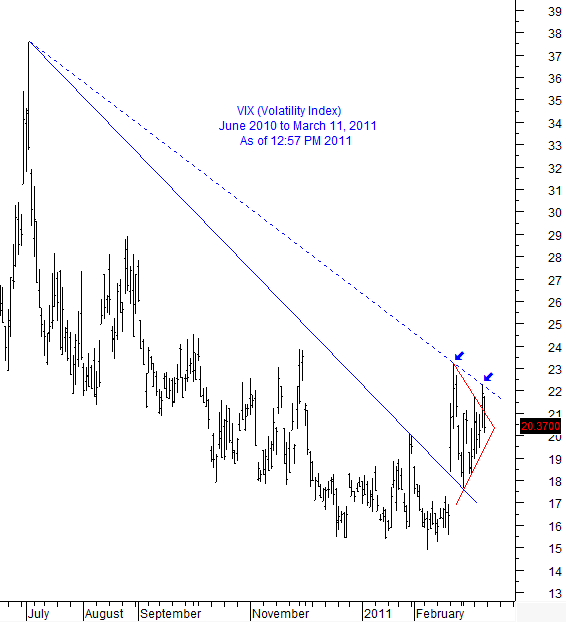

Our first chart shows the VIX from June 2010 to 12:57 PM today. Note that the spike on February 23rd. set the high for a new resistance line from July 2nd. 2010.

After that, the remaining action created a triangular pattern which was a set-up for a VIX breakout.

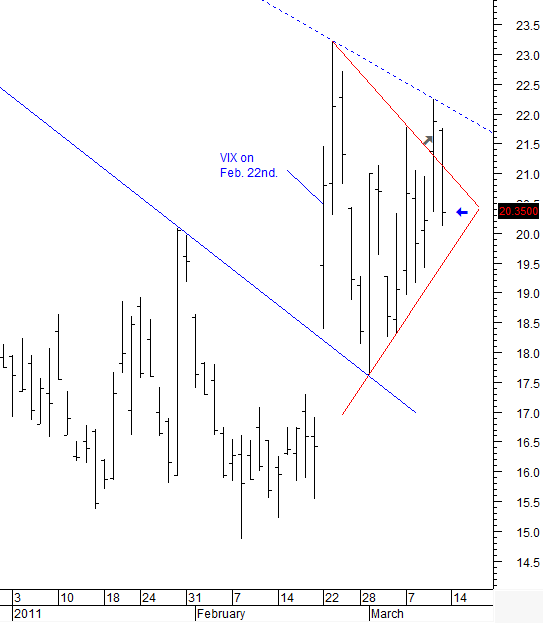

The VIX broke out to the upside on Thursday, but notice what the daily bar did. (See both charts, the second chart is a close up of the action.)

What did it do? Thursday's bar went right up to and touched the 8 1/2 month resistance line and stopped. And then today, the VIX pulled back into the triangular pattern. (See where it was at 12:57 PM in the second chart.)

So, for all the concerns that have plagued the market this week, the VIX is remarkably calm and suggesting that the market may have the gumption to climb a wall of worry. The odds will favor that possibility as long as the VIX remains below the June 2010 to March 11 resistance line.

Friday's 12:57 PM close up chart for the VIX.

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.