Stock Market Trends Impacted by Social Moods

Stock-Markets / Stock Markets 2011 Mar 12, 2011 - 07:01 AM GMTBy: EWI

We can now add the recent uprisings in North Africa and the Middle East to the category of life imitating art -- specifically, music lyrics. Those who lived through the 1980s might be forgiven for hearing an unbidden snatch of music run through their heads as they watched first Hosni Mubarak and now Moammar Gadhafi try to hold onto power -- "Should I Stay or Should I Go" by The Clash. In Libya, where Gadhafi has used air strikes and ground forces against the rebels, The Clash's other huge hit from 1981, "Rock the Casbah," describes the current situation so well it's almost eerie:

We can now add the recent uprisings in North Africa and the Middle East to the category of life imitating art -- specifically, music lyrics. Those who lived through the 1980s might be forgiven for hearing an unbidden snatch of music run through their heads as they watched first Hosni Mubarak and now Moammar Gadhafi try to hold onto power -- "Should I Stay or Should I Go" by The Clash. In Libya, where Gadhafi has used air strikes and ground forces against the rebels, The Clash's other huge hit from 1981, "Rock the Casbah," describes the current situation so well it's almost eerie:

The king called up his jet fighters He said you better earn your pay Drop your bombs between the minarets Down the Casbah way

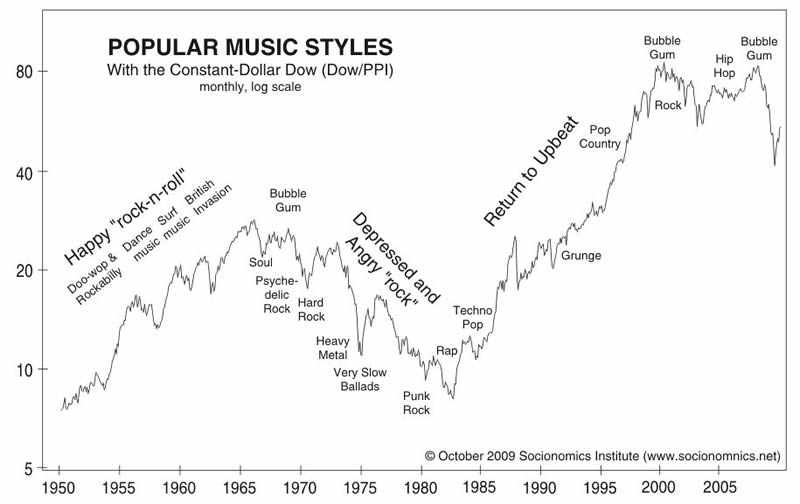

Punk rock played by bands like The Clash, X, The Ramones, and the Sex Pistols had that in-your-face, defy-authority attitude that crashed onto the scene in Great Britain and the United States in the '70s and '80s. It's interesting that the lyrics can still ring true 30 years later, but even more trenchant is how the prevailing mood is reflected by the music of the times, as seen in this chart that Robert Prechter included in a talk he gave last year.

Popular culture reflects social mood, and the stock market reflects that same social mood. That's why we get loud, angry music when people are unhappy with their situation; they want to sell stocks. We get light, poppy, bubblegum music when they feel happy and content; they want to buy stocks. In a USA Today article about music and social moods in November 2009, reporter Matt Frantz made clear the connection that Elliott Wave International has been writing about for years:

The idea linking culture to stock prices is surprisingly simple: The population essentially goes through mass mood swings that determine not only the types of music we listen to and movies we watch, but also if we want to buy or sell stocks. These emotional booms and busts are followed by corresponding swings on Wall Street.

"The same social elements driving the stock market are driving the gyrations on the dance floor," says Matt Lampert, research fellow at the Socionomics Institute, a think tank associated with well-known market researcher Robert Prechter, who first advanced the idea in the 1980s. [USA Today, 11/17/09]

In the talk he gave to a gathering of futurists in Boston, Prechter explained how the music people listen to relates to social mood and the stock market:

When the trend is up, they tend to listen to happier stuff (see chart). Back in the 1950s and ‘60s, you had doo-wop music, rockabilly, dance music, surf music, British invasion — mostly upbeat, happy material. As the value of stocks fell from the 1960s into the early 1980s, you had psychedelic music, hard rock, heavy metal, very slow ballads in the mid-1970s, and finally punk rock in the late ’70s. There was more negative-themed music. [excerpt from Robert Prechter’s speech to the World Future Society's annual conference, 7/10/10]

Which brings us right back to punk rock. Although there's lots of upbeat music in the air now, we can assume that after this current bear market rally, we will hear angrier music on the airwaves as the market turns down. It might be a good time, then, to pay attention to what the markets were doing the last time punk rock blasted the airwaves. Here's an excerpt from "Popular Culture and the Stock Market," which is the first chapter of Prechter's Pioneering Studies in Socionomics.

The most extreme musical development of the mid-1970s was the emergence of punk rock. The lyrics of these bands' compositions, as pointed out by Tom Landess, associate editor of The Southern Partisan, resemble T.S. Eliot's classic poem "The Waste Land," which was written during the 'teens, when the last Cycle wave IV correction was in force (a time when the worldwide negative mood allowed the communists to take power in Russia). The attendant music was as anti-.musical. (i.e., non-melodic, relying on one or two chords and two or three melody notes, screaming vocals, no vocal harmony, dissonance and noise), as were Bartok's compositions from the 1930s.

It wasn't just that the performers of punk rock would suffer a heart attack if called upon to change chords or sing more than two notes on the musical scale, it was that they made it a point to be non-musical minimalists and to create ugliness, as artists. The early punk rockers from England and Canada conveyed an even more threatening image than did the heavy metal bands because they abandoned all the trappings of theatre and presented their message as reality, preaching violence and anarchy while brandishing swastikas.

Their names (Johnny Rotten, Sid Vicious, Nazi Dog, The Damned, The Viletones, etc.) and their song titles and lyrics ("Anarchy in the U.K.," "Auschwitz Jerk," "The Blitzkrieg Bop," "You say you've solved all our problems? You're the problem! You're the problem!" and "There's no future! no future! no future!") were reactionary lashings out at the stultifying welfare statism of England and their doom to life on the dole, similar to the Nazis backlash answer to a situation of unrest in 1920s and 1930s Germany.

Actually, of course, it didn't matter what conditions were attacked. The most negative mood since the 1930s (as implied by stock market action) required release, period. These bands took bad-natured sentiment to the same extreme that the pop groups of the mid-1960s had taken good-natured sentiment. The public at that time felt joy, benevolence, fearlessness and love, and they demanded it on the airwaves. The public in the late 1970s felt misery, anger, fear and hate, and they got exactly what they wanted to hear. (Luckily, the hate that punk rockers. reflected was not institutionalized, but then, this was only a Cycle wave low, not a Supercycle wave low as in 1932.)

In summary, an "I feel good and I love you" sentiment in music paralleled a bull market in stocks, while an amorphous, euphoric "Oh, wow, I feel great and I love everybody" sentiment (such as in the late '60s) was a major sell signal for mood and therefore for stocks. Conversely, an "I'm depressed and I hate you" sentiment in music reflected a bear market, while an amorphous tortured "Aargh! I'm in agony and I hate everybody" sentiment (such as in the late '70s) was a major buy signal.

Popular Culture and the Stock Market. Read more about musical relationships to social mood and the markets in this 40-page-plus free report from Elliott Wave International, called Popular Culture and the Stock Market. All you have to do to read it is sign up to become a member of Club EWI, no strings attached. Find out more about this free report here.

This article was syndicated by Elliott Wave International and was originally published under the headline How Punk Rock and Pop Music Relate to Social Mood and the Markets. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.