Stock Market Correction Over?

Stock-Markets / Stock Markets 2011 Mar 11, 2011 - 05:30 AM GMTBy: John_Hampson

In my analysis of March 2nd I suggested the stock market correction should last around 4 weeks (based on cycles and previous corrections) and sufficiently reset overbought or extreme indicators in order for the cyclical bull to continue. Today the correction is 3 weeks old, and we have seen just over 50 points wiped off the S&P500. So is it shortly a buy again?

In my analysis of March 2nd I suggested the stock market correction should last around 4 weeks (based on cycles and previous corrections) and sufficiently reset overbought or extreme indicators in order for the cyclical bull to continue. Today the correction is 3 weeks old, and we have seen just over 50 points wiped off the S&P500. So is it shortly a buy again?

Let's dive in.

--------------------------------------------------------------------------------

1. Investors Intelligence Bullish Sentiment has declined but not yet sufficiently.

Source: Market Harmonics / Investors Intelligence

2. Retail investors continued to pump money into domestic equity funds with inflows of $4.8 billion in the week ended March 9th. This remains a contrarian negative.

3. Most technical indicators are now no longer at overbought levels but nor sufficiently low to flag a buy.

4. Crude Oil remains over $100, following a 20% gain in 2 weeks. Bespoke Investment research reveals that previous such fast strong rises in the oil price resulted in negative average returns for the S&P500 of -2.25% over 1 month and -4.13% over 3 months.

5. Ciovacco's proprietary bull market sustainability index is still flagging a near term stock market correction.

Summarising points 1-5, we should be wary of buying yet. Let's look wider.

--------------------------------------------------------------------------------

6. Copper, which is typically a general bellweather, has formed a head and shoulders pattern, suggestive of further declines.

Source: Stockcharts

7. The US Dollar has also put in a bounce at a critical level. There is a typical historical inverse relationship with stocks.

8. And treasury yields have also just retreated from long term resistance. Such action also typically correlates with stock market pullbacks.

In short, we may need to await fulfilment of these counter moves in copper, dollar and treasuries before stocks can advance again in earnest. However, given the fundamentals and longer term trends in all three of these assets, we may be seeing short lived counter moves, and charting the S&P supports this idea:

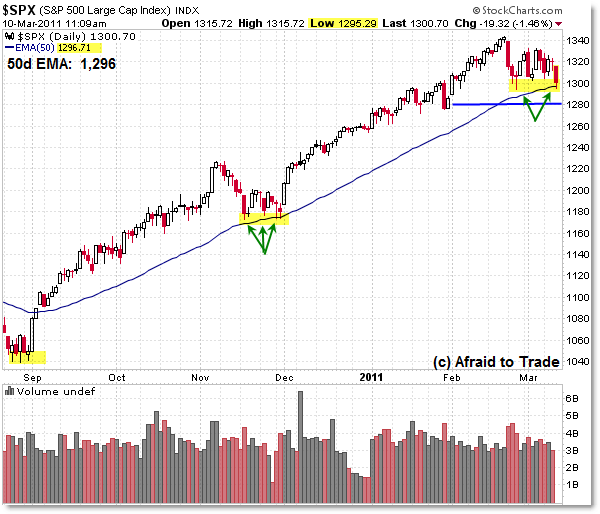

9. The S&P500 is flirting with the 50 day EMA, which previously acted as support, and has made a fairly evenly-weighted ABC-style correction, which would normally be suggestive of an imminent conclusion to the correction.

Source: Afraid To Trade

--------------------------------------------------------------------------------

Now let's look at the underlying cyclical bull market and the case for further advance following this correction.

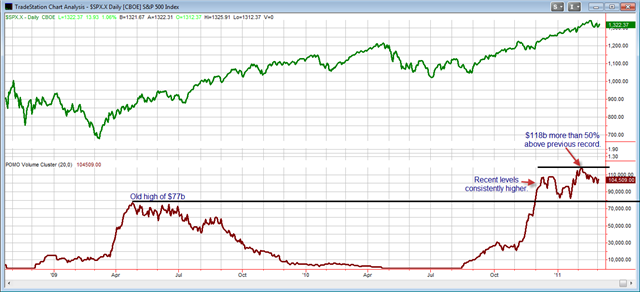

10. QE/Pomo is scheduled to continue to June. I previously analysed the supportive role this plays for the stock market and the chart below reveals the recent record totals deployed. Money supply measures are showing strong growth.

Source: Quantifiable Edges Blogspot

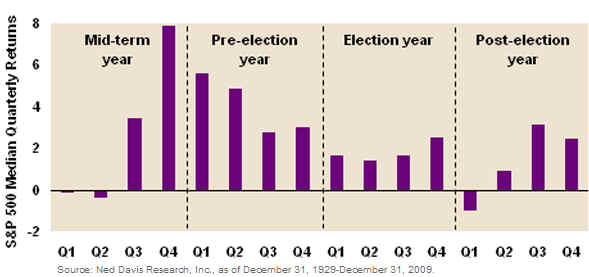

11. The Presidential Cycle sweetspot for equities persists this year, particularly into June also. We are currently in Q1 of the pre-election year, shortly entering Q2 in the chart below:

Source: Tradersnarrative.com

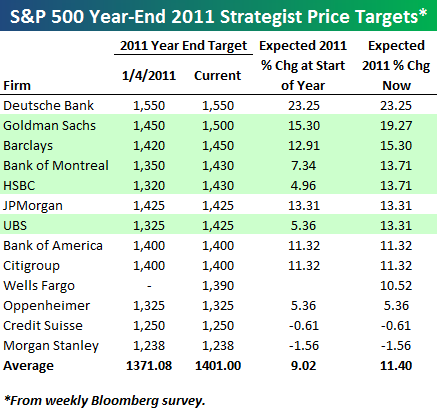

12. Investment banks have recently upped their targets for year end 2011, looking for an average 10% gains from current levels.

Source: Bespoke Investment

13. ECRI leading indicators are still positive and trending higher:

Source: Dshort.com

14. We still fall short on historical guidelines for cyclical bull endings, namely:

Inflation over 4%

10 year treasury yields over 6%

Stock market topping process accompanied by weakening breadth

Yield curve abnormal

Overtightening of interest rates

Indeed, picking out "stock market topping process", I previously noted that similar bulls from history topped in a range process lasting weeks to months during which market action was confused but internals and the environment for stocks weakened and flags were raised. The 50 point decline in the S&P that we have seen in 3 weeks so far has the hallmarks of a correction rather than a topping process, but it could yet feasibly become part of a topping process if it were to move back up in to the topping range but not exceed the highs. Either way, a move up should follow current action and we will have time to see internals and the evironment weakening, if that were the case.

So are there any such concerns yet?

--------------------------------------------------------------------------------

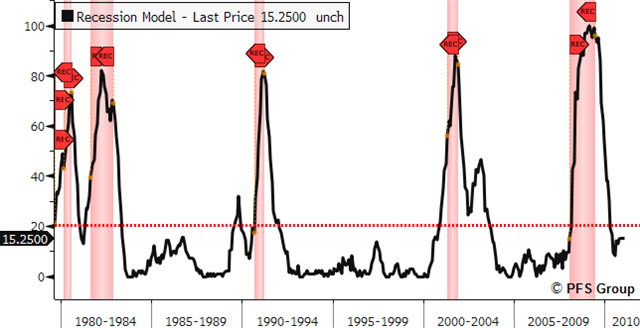

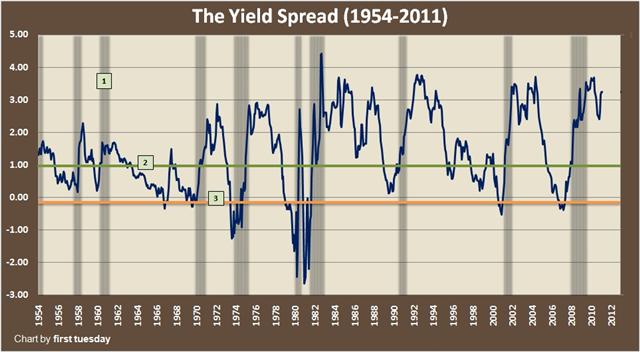

15. Chris Puplava's recession prediction model has increased a little, and looks to be trending towards warning levels. However, the yield spread recession predictor shows now such concerns:

Source: Chris Puplava

Source: First Tuesday

16. The Bloomberg Financial Conditions index has slipped to neutral and is to be watched for breaking into negative territory:

Source: Bloomberg

In short, there are two watch items but no current red flags.

--------------------------------------------------------------------------------

In summary, the stock market correction has not yet adequately reset overbought and overly-bullish measures, and action in other assets suggests more time may be required. Looking at historical corrections and cycles, another week of corrective activity would be typical and may provide fulfilment on both. The second half of March may therefore provide a buying opportunity. The cyclical bull still looks in good health to continue, with no current warning flags, so I still want to be exposed to the long side. April is a seasonally strong month for stocks and US earnings season gets underway again 11th April, with earnings and revenues still surprising to the upside in the last quarter. With QE/Pomo and Presidential cycle tailwinds into mid-year, I expect stocks can revisit the highs in quarter 2.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation.

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Diane

11 Mar 11, 10:50 |

Great article

Hello John, This is a very thoughtful article and I have found it very helpful. You obviously put a lot of thought into your analysis. Many thanks, Diane :) |