S&P 500 Remains Overly Bullish

Stock-Markets / Stock Markets 2011 Mar 11, 2011 - 02:14 AM GMTBy: Donald_W_Dony

The recent sell-off of the S&P 500 has brought many investors to question the sustainability of the bull market. Spiking oil prices and the outlook for even high energy costs as demand increases, has resurfaced concerns of another major market decline. However, this outlook is very unlikely given the underlying strength of the index.

Currently over 90% of the stocks within the S&P 500 are trading above their 200-day moving average. This overly bullish level is associated with the same performance as the late 2009 and early 2010 rallies (Chart 1).

Corrections that develop when the vast majority of the stocks within an index are trending up are normally short lived and shallow.

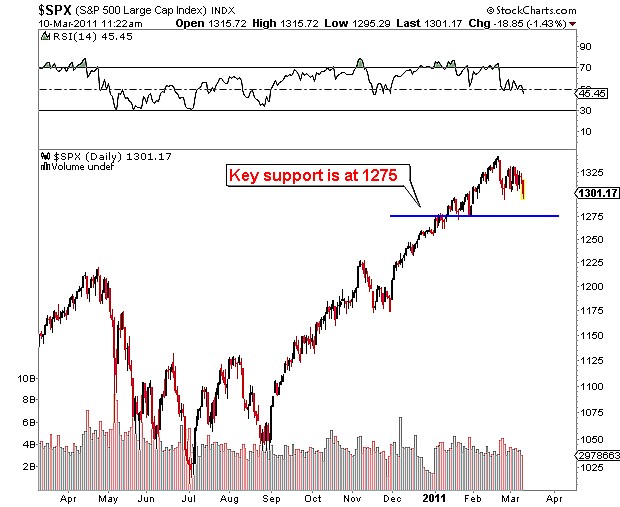

Models point to a probably corrective low occurring by mid-March with solid price support at 1275 (Chart 2).

Moving forward, the S&P 500 is relatively expensive with a P/E of 25. This would suggest somewhat slower growth into Q2.

Bottom line: The current corrective phase of the S&P 500 is likely nearing completion. The pullback is expected to be contained above the 1275 level. The movement into mid-year is anticipated to be more restrained as fundamental valuations, the affects of high oil prices and overhead technical resistance at 1450 take hold.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2011 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.